TOKEN METRICS WATCHLIST

We scored many projects this week.

Please remember that some of these projects still need our code review process. Still, we want to call them out here because they preliminarily caught our eye based on our fundamental analysis process.

Parallel Finance- 66.67%

Website | X(Twitter)

Website | X(Twitter)Sector – Layer2/DeFi

Status – Active

Parallel Network is an advanced Layer 2 scaling solution for Ethereum that leverages Arbitrum’s Nitro stack. It significantly enhances Ethereum’s scalability by providing cheaper and faster transactions while maintaining full EVM compatibility. This ensures that existing Ethereum dApps and smart contracts can seamlessly operate on a Parallel Network without any modifications, benefiting from improved transaction speeds and reduced costs.

Parallel has introduced an innovative solution to address liquidity fragmentation, known as Omni-Chain Restaking L2. This solution allows users to deposit assets from any blockchain into the protocol, aggregating them into unified liquidity pools spanning multiple chains. This aggregated liquidity enables users to participate in lending, borrowing, and staking activities across different networks.

Parallel Finance is creating a comprehensive platform for decentralized finance (De-Fi), offering services such as wallets, staking, crowd loans, cross-chain bridges, automated market maker, yield farming, and more. Unlike most De-Fi platforms, Parallel Finance leverages its large team to offer a diverse range of services simultaneously.

Multi-chain Wallet – Parallel Finance is developing a non-custodial multi-chain wallet to enhance user access to the De-Fi space. This wallet will enable users to secure, manage, and grow their assets using Parallel Finance’s suite of De-Fi solutions.

Liquid Staking – Parallel Finance offers Liquid Staking, a unique form of staking where users receive a derivative token called sDOT when they lock up an asset. This keeps users liquid and allows the derivative to be used across dApps like the original asset.

Money Market – Parallel Finance’s money market supports yield farming, lending, and borrowing. Integrated with other dApp suite products, users can maximize asset utility and leverage across various services.

Automated Market Maker (AMM) – Parallel Finance’s Automated Market Maker, Dynamic Swap, enables non-custodial, autonomous trading without intermediaries. Users can access this feature without creating an account or undergoing KYC procedures. The AMM uses a liquidity protocol similar to Uniswap V2, allowing users to provide liquidity and value equivalent to the underlying DOT/KSM tokens.

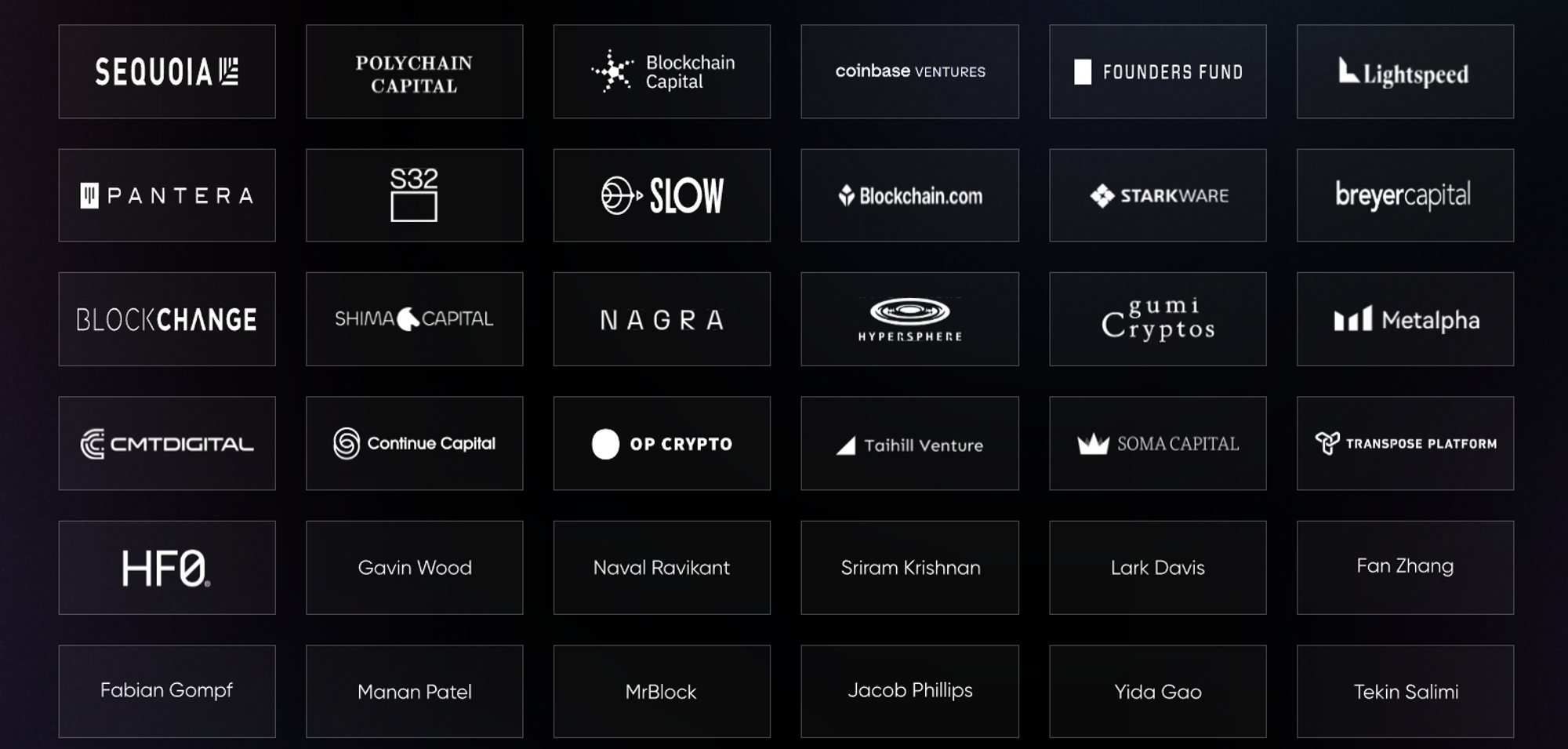

Investors

Token

Parallel Finance’s native token, $PARA, plays a central role in the ecosystem and is distributed among core actors and partners. In addition to serving as the platform’s native token, $PARA has several key functions within the ecosystem. Firstly, PARA holders are granted the right to participate in protocol governance, allowing them to vote on management and administrative decisions within Parallel Finance. Additionally, $PARA is utilized to pay for network fees on the platform, including transactions such as staking, lending, borrowing, crowd loans, trading, and other essential functions. Moreover, $PARA serves as a means to incentivize collators and validators, crucial mechanisms within the network. These incentives help ensure the network’s security and integrity.

Blade of God X- 66.67%

Website | X(Twitter)

Website | X(Twitter)Sector – Gaming

Status – Not yet launched

Blade of God X, an anticipated Action-RPG, takes inspiration from the rich and dark lore of Nordic mythology. This game blends traditional role-playing elements with unique gameplay. Their vision is to reshape the interaction between humans, the digital realm, and AI through gaming. Blade of God X constructs a world that spans the four-dimensional space of spatial and temporal civilizations across the nine realms.

Void Labs, a leading name in the gaming industry, is the driving force behind Blade of God X. The game will be on PC and mobile platforms, pioneering cross-platform play. Their Web 2 games (‘Blade of God I’ and ‘Blade of God II’) have collectively surpassed 6 million downloads. They are leveraging their strong presence and brand in the Web 2 world to make a significant mark in the Web 3 gaming domain. They have built a strong community, and their NFT sales have been successful, making this a promising project.

AI Gaming – Void Labs is developing an ecosystem that transforms human engagement with AI and the digital world. They are trying to revolutionize the gaming world by inculcating AI into it. More on this front will be revealed later.

Investors

Ora- 62.50%

Website | X(Twitter)

Website | X(Twitter)Sector – Artificial Intelligence

Status – Active

Ora provides a verifiable oracle protocol that brings AI and complex computations on-chain. It is designed to be programmable, permissionless, and censorship-resistant, enabling users to create their own AI oracles. ORA’s Verifiable Oracle Protocol represents a significant advancement in enabling trustless on-chain AI and complex computations. It harnesses the capabilities of opML (Optimistic Machine Learning). This cutting-edge solution allows AI-generated results to be cryptographically verified using Optimistic Proofs.

Features

Onchain AI engine: ORA currently supports Stable Diffusion and LlaMA models, with plans to expand support to other models in the future. This feature allows developers to directly integrate AI capabilities into their smart contracts, enhancing their functionality and efficiency.

Onchain AI Oracle (OAO): This component of ORA enables developers to augment their smart contracts with AI capabilities. Node operators can run AI Oracle nodes to execute and secure computations with verifiable proofs, providing a comprehensive infrastructure that combines AI capability and automation.

World Supercomputer: ORA introduces the concept of a World Supercomputer, which consists of peer-to-peer networks connected by a secure data bus. This innovative approach enables scalable and decentralized AI computations across networks, promoting greater efficiency and collaboration.

Verification – zkML leverages Zero-Knowledge proofs to validate machine learning inference results on-chain, protecting confidential data and model parameters during training and inference. opML enhances transparency and trust in machine learning by enabling on-chain verification of AI computations. By integrating zkML for privacy and opML for efficiency, the zk+opML hybrid model is explicitly tailored for on-chain AI applications. Additionally, ai/fi combines AI and DeFi, replacing computationally intensive parts of DeFi protocols with AI to significantly improve efficiency.

Token

OpenLM, the open-source LLM model, will be tokenized into $OLM and integrated with ORA’s Onchain AI Oracle (OAO) to generate revenue for $OLM holders. Part of the revenue from OAO and other sources will be allocated to a revenue-sharing pool for $OLM tokens, allowing token holders to claim their share every 90 days after a snapshot. Additionally, a portion of the revenue will be allocated to a burning pool for $OLM tokens, providing a buyback mechanism. This burning mechanism will help maintain the “floor price” of OpenLM tokens.

Where can you buy the token?

You can buy $OLM from exchanges like BitMart, BingX, and BingX.

Astella Finance- 62.50%

Website | X(Twitter)

Website | X(Twitter)Sector – DeFi

Status – Not yet launched

Astella is a pioneering DeFi platform that leverages Options Quant Theory to address two major challenges in decentralized finance: Impermanent Loss Protection and democratizing DeFi Options Trading. Astella combines innovative quant algorithms with the best practices of traditional finance (TradFi) and decentralized finance (DeFi), offering industry-first products.

Products

Dual Investment: Astella’s on-chain Dual Investment product, known as the “Uniswap of Options” and the “Robinhood of DeFi,” guarantees 30-80% sustainable APRs through options quant models. It simplifies limit order spot trading and liquidity staking, making it more user-friendly with single-asset trading.

Impermanent Loss Protection: Astella’s Quant-Based Impermanent Loss Protection provides a sustainable, delta-neutral, high-return solution for yield farming. It offers 1.5-3x the returns of a typical DEX while minimizing impermanent loss. This innovative product ushers in the next growth phase for the DEX market, allowing users to earn high yields without transaction fees.

Investors

Token

Astella employs a deflationary model to ensure supply and price stability through mint and burn mechanisms based on TVL and quant models. These mechanisms consistently support the token’s value. The $ASTLA token incentivizes buyers and holders through various utilities, including staking, boosting rewards (veASTLA), and governance. Astella also innovatively distributes platform profits to quantitatively buy back and burn tokens, reinforcing the deflationary model. This approach continuously enhances $ASTLA’s buying power, driving long-term price appreciation.

Aizel- 60.42%

Website | X(Twitter)

Website | X(Twitter)Sector – Artificial Intelligence

Status – Not yet launched

Aizel is an on-chain verifiable AI inference network that enhances blockchains with trustless AI capabilities. It ensures the persistence and production of machine learning model inferences in a decentralized and trustless manner. Aizel attests to these inferences through an advanced remote attestation system integrating Multi-Party Computation (MPC) and Trusted Execution Environments (TEEs). It is the only protocol leveraging these features. This technology modularizes verifiable inference abilities for all blockchain networks and any decentralized application (dApp) operating on them.

Aizel is the infrastructure capable of executing trustless large language models (LLMs) and producing trustless inferences. This verifiable inference ability is modularized to integrate all blockchain networks and any dApp built on them. It delivers trustless AI with Web2-Level Speed and Cost.

Aizel is tackling a major problem in the AI space and demonstrates significant growth potential. By building on the Peaq network, Aizel aims to introduce verifiable intelligence to the heart of DePIN. This integration will unlock secure, private, and verifiable AI co-processing for DePINs on Peaq.