TOKEN METRICS WATCHLIST

We scored many projects this week.

Please remember that some of these projects still need our code review process. Still, we want to call them out here because they preliminarily caught our eye based on our fundamental analysis process.

Phala Network- 64.58%

Website | X(Twitter)

Website | X(Twitter)Sector – Artificial Intelligence

Status – Not yet launched

Phala Network is a decentralized execution layer that is purpose-built to integrate artificial intelligence with blockchain technology. It seeks to enhance and streamline user experiences within the Web3 ecosystem by enabling direct interactions between AI and blockchains. This integration facilitates the creation of intelligent, autonomous agents capable of securely and efficiently executing complex tasks. Phala Network’s AI Execution Layer bridges the divide between AI and blockchain, allowing AI agents to undertake tasks that would traditionally require manual operations across multiple decentralized applications (dApps) and blockchains.

Features

- AI Execution Layer: Phala Network serves as the execution layer for Web3 AI, enabling AI agents to understand and interact with blockchains securely.

- AI Agent Contract: A framework to build smart contract-centric AI agents that can autonomously execute tasks on the blockchain.

- Multi-proof System: Ensures tamper-proof and unstoppable AI operations integrated with smart contracts.

- Decentralized and Private: Utilizes TEE (Trusted Execution Environment) network for privacy-preserving and transparent operations.

- Incentivized and Powerful: Developers can monetize their AI agents through tokenomics and leverage powerful programming environments like JavaScript and WASM.

Token

$PHA, the native token of the Phala blockchain, serves multiple vital functions. Holders can use $PHA to receive rewards as workers providing computational power, running AI Agent Contracts, participating in governance as DAO members, stake or delegating for network security, and engaging in governance activities. The max supply of $PHA is 1 billion.

Where can you buy the token?

$PHA can be brought from exchanges like **Binance, Kraken, OKX, Kucoin, Uniswap** etc.

KIP-62.50%

Website | X(Twitter)

Website | X(Twitter)Sector – Artificial Intelligence

Status – Active

The KIP Protocol is an open-source Web3 framework designed to facilitate creating, managing, and monetizing decentralized knowledge assets for AI applications, thereby initiating KnowledgeFi. The protocol empowers AI value creators by enabling them to connect their expertise—whether in data production, model training, app design, or other areas—and benefit from transparent accounting and revenue sharing.

The primary objective of the KIP Protocol is not to produce specific models, data, or applications but to support their development through a diverse ecosystem of partners. This approach prevents the establishment of monopolies and provides users with the freedom to choose between suppliers. As a result, users can leverage their purchasing power to influence the evolution of AI and data protection standards while promoting faster and more efficient model and app development.

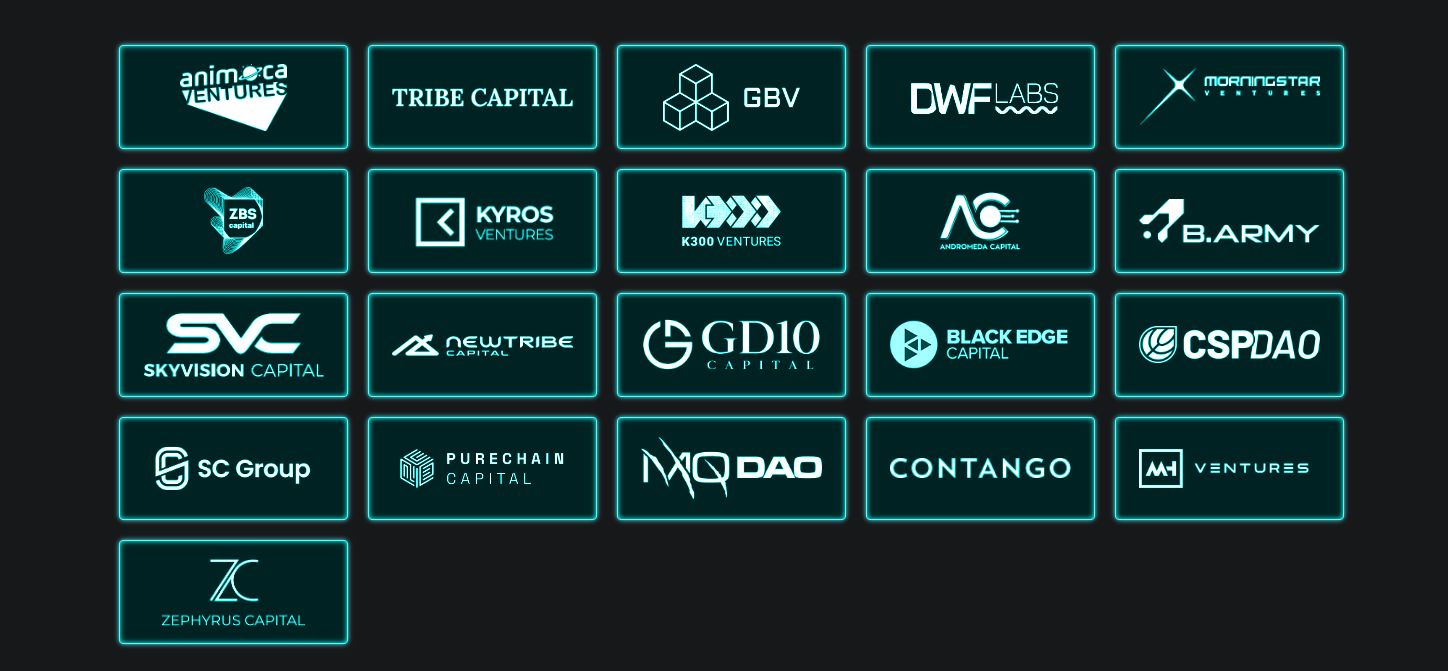

Investors

Token

The $KIP token serves as the driving force behind the KIP Protocol, powering the entire ecosystem. Within this ecosystem, $KIP tokens are the transaction currency for utilizing AI applications and knowledge assets. Additionally, $KIP token holders play a crucial role in shaping the direction of the KIP Protocol through decentralized governance.

Velvet Capital-62.50%

Website | X(Twitter)

Website | X(Twitter)Sector – DeFi

Status – Active

Velvet Capital is a decentralized finance (DeFi) asset management protocol that enables users and institutions to create diversified financial products, such as tokenized funds, portfolios, yield farming strategies, and other structured products. The platform offers a range of features, including automated tokenization, flexible custody options, superior access to on-chain liquidity, smart yield farming, permissioning capabilities, seamless integration, reporting, and white-label portal, and cross-chain functionality.Any individual, professional fund manager or entity can create a vault on Velvet.

Features

- Automated Tokenization: Velvet Capital utilizes smart contracts to tokenize every fund or strategy deployed on-chain. This allows fund managers and investors to mint or burn tokens representing the underlying assets, ensuring these tokens are always fully backed.

- Flexible Custody Options: The platform provides various custody options for underlying assets, including non-custodial smart contract vaults, multi-signature vaults, and multi-party computation (MPC) solutions. This flexibility caters to different regulatory requirements, client needs, and internal policies.

- Superior Access to On-Chain Liquidity: Velvet Capital integrates with major on-chain liquidity providers, such as automated market makers (AMMs) and aggregators. This ensures optimal trade execution and additional “just in time” liquidity for larger trades through partnerships with top market participants.

- Smart Yield Farming: The platform integrates with leading DeFi protocols to earn additional yield through lending, staking, or providing liquidity. Its architecture allows for automated yield harvesting, optimization, and auto-compounding of rewards.

- Permissioning Capabilities: Velvet Capital offers optional functionality to whitelist wallets, restrict transfers, and limit the assets and protocols used. This ensures only authorized users can access the strategies and comply with KYC/KYB requirements.

- Cross-Chain Functionality: Velvet Capital aims to provide robust tools for users to capture opportunities across multiple DeFi ecosystems, enabling expansion across different chains.

Investors

Token

Velvet Capital’s native token is $VLVT. These tokens’ emissions are conducted in $VLVT and are designed to encourage growth by offering additional rewards to Vault managers and investors through a referral program. Stakeholders can stake their tokens to receive $veVLVT, which grants them voting rights within the Velvet DAO. This includes voting on the allocation of $VLVT emissions across various vaults. Fund managers can also set up incentives or “bribes” to motivate token holders to vote in favor of their vaults, thereby securing higher rewards.

Zero1 Labs- 62.50%

Website | X(Twitter)

Website | X(Twitter)Sector – Artificial Intelligence

Status – Not yet launched

Zero1 Labs is pioneering the future of Artificial Intelligence (AI) with its decentralized ecosystem focused on robust data governance. Through a comprehensive suite of DeAI tools and applications, Zero1 Labs provides a secure, modular platform for streamlined AI development. Their mission is to simplify AI development while ensuring user data remains under their control, creating a user-friendly AI tool suite. Additionally, Zero1 Labs is dedicated to building a resilient DeAI ecosystem through its innovative programs.

Keymaker – Keymaker offers a comprehensive open platform tailored for open-source DeAI developers. It includes a versatile DeAI toolset, a Zapier-like API to streamline workflows, and a dApp Store for launching applications. Developers can leverage the Zero Economic Framework, benefiting every time their application is used. It’s a new Home for DeAI Applications.

Zero Construct Program – The Zero Construct Program is designed to create a new economic framework for open-source AI developers. It accelerates DeAI app development from conception to launch, harnessing the power of the Zero1 Flywheel. The Zero Economic Framework aims to revolutionize the funding and development of decentralized Artificial Intelligence (DeAI) projects. This framework proposes an inclusive environment for open-source developers to deploy their dApps and earn $DEAI tokens.

Cypher – Cypher is designed for data governance and ownership and is tailored for AI and large language model-driven applications. Operating as a distinct blockchain, it facilitates decentralized AI applications.

Token

$DEAI is the native token of the Zero1 ecosystem, serving multiple critical functions. Within Cypher, it operates as a gas token and is essential for validators. It also acts as a reward mechanism for DeAI developers using Keymaker, granting tokens when their dApps are utilized. Additionally, token stakers receive numerous benefits, including early access to projects incubated through the Zero Construct Program (ZCP), airdrops from ecosystem projects, and staking returns. The token has a deflationary nature.

Where can you buy the token?

The token can be bought through Uniswap V3(Ethereum), CoinEx, and Bitmart.

Wildforest- 60.42%

Website | X(Twitter)

Sector – Gaming

Status – Active

Wild Forest offers a thrilling experience with fast-paced PvP battles, making it essential for strategy enthusiasts. The game combines tactical challenges within battles with strategic depth through card-collecting and deck-building, ensuring an engaging gaming experience. Wild Forest is free to play, allowing all players to earn rewards by competing in seasonal leaderboards while experiencing RTS games’ pure, classic excitement. Players can expedite their progress or access exclusive features through available in-app purchases. The game is developed on the Ronin chain.

Players are continually involved in collecting cards, refining their decks, and experimenting with diverse combinations to gain an advantage in battles. Every battle in Wild Forest is driven by units and spells, each represented by a unique card. To ensure that every player starts on an equal footing, a set of default cards is provided upon account creation. While these cards are integral to gameplay, they differ from in-game NFT cards as they cannot be traded, upgraded, or sold.

Traction – Wild Forest has been gaining significant traction, with over 50,000 downloads to date. The NFT sales have been highly successful, and the game boasts a robust and vibrant community.

Investors