TOKEN METRICS WATCHLIST

This week, we’ve unearthed several promising ventures that have the potential to stand out in the crowded landscape. While we’re still in the process of conducting thorough code reviews, these projects have already captured our attention through our rigorous fundamental analysis. Stay tuned as we delve deeper, but for now, here’s a sneak peek into the gems we’ve discovered.

Radiant Capital – 66.67%

Website | X(Twitter)

Website | X(Twitter)Sector – Lending/Borrowing

Status – Active

FDV – $141M

Radiant Capital is a secure and efficient DeFi protocol that facilitates seamless interest earning and asset borrowing across multiple blockchains. Its robust security, validated by top-tier audits, and emphasis on community governance ensure reliability. Radiant V2 enhances cross-chain functionality, effectively addressing user needs.

Radiant V2 is a significant upgrade to the platform, improving cross-chain functionality and user interaction. The transition from the ERC-20 RDNT token to the LayerZero Omnichain Fungible Token (OFT) format enhances cross-chain fee sharing and provides native control over bridging contracts. In collaboration with LayerZero and Stargate, this development accelerates the rollout on additional blockchain networks.

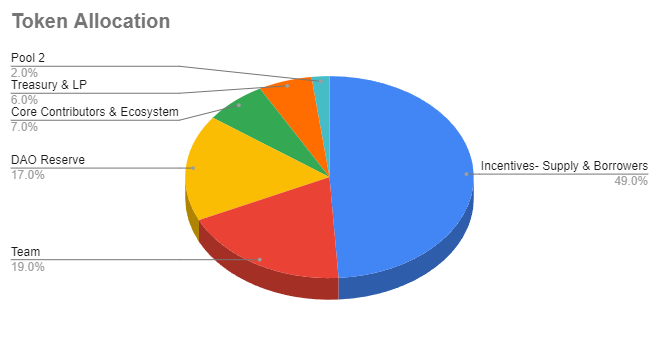

Radiant Capital’s native utility token, $RDNT, incentivizes users to act as dynamic liquidity providers (dLP). Users lock LP tokens to activate RDNT emissions on their deposits or borrows and share in platform fees collected in blue-chip assets. Liquidity mining involves claiming $RDNT emissions, which can be instantly converted into locked dLP tokens or vested for three months.

Investors

Binance Labs, FJ Labs, Iconium (Specialized Finance), and Saxon have invested in Radiant Capital.

Token

$RDNT is the native token of the Radiant Network. RDNT emissions incentivize ecosystem participants to contribute to the platform as dynamic liquidity providers (dLPs). Only users with locked dLP (liquidity tokens) are eligible for RDNT emissions on deposits or borrows. Additionally, these users receive a share of the platform’s fees. They are also part of the Radiant DAO, which ensures that community members dictate the decisions and ultimately shape the vision of the Radiant ecosystem.

Where can you buy the token?

You can buy $RDNT from exchanges like Binance, Bitunix and Gate.io.

Apeiron – 64.58%

Website | X(Twitter)

Website | X(Twitter)Sector – Gaming

Status – Active

FDV – $604M

In the game Apeiron, players assume the role of godlings who reside in enigmatic regions of the planet known as EDENs. Each godling is represented by a Spirit Core that governs an Avatar, capable of harnessing various planetary powers. These powers are symbolized by four elemental forces: Water, Earth, Air, and Fire. As newly emerged divine entities, godlings are introduced to the game and take command of a planet inhabited by endearing creatures called Doods. These small, adorable beings revere the godlings, seeking their guidance and benevolence for an improved existence.

Apeiron offers four game modes: In the God-Game Simulation, players, known as godlings, perform Miracles for their Doods, influencing their planet’s alignment, and can breed planets to create Pure Planets with special powers or initiate an Armageddon to start a superior planetary cycle, gaining benefits like Soul Gems and deeper dungeon access. In PvE Battle mode, set in the Dirac Dungeons Dimension, players fight and recruit or rescue Dood Apostles, earning ANIMA tokens and Relic NFTs through dynamic dungeon explorations. PvP Battle mode occurs in the Galactic Arena, where players compete in tournaments for top leaderboard positions and in-game tokens. Lastly, the Guild vs. Guild Alliance mode allows players to collaborate to advance the Apeiron universe’s story, engaging in seasonally Avatar and Raid Boss battles that unlock new content. Initially, The game was built on Polygon, but then it migrated to the Ronin blockchain.

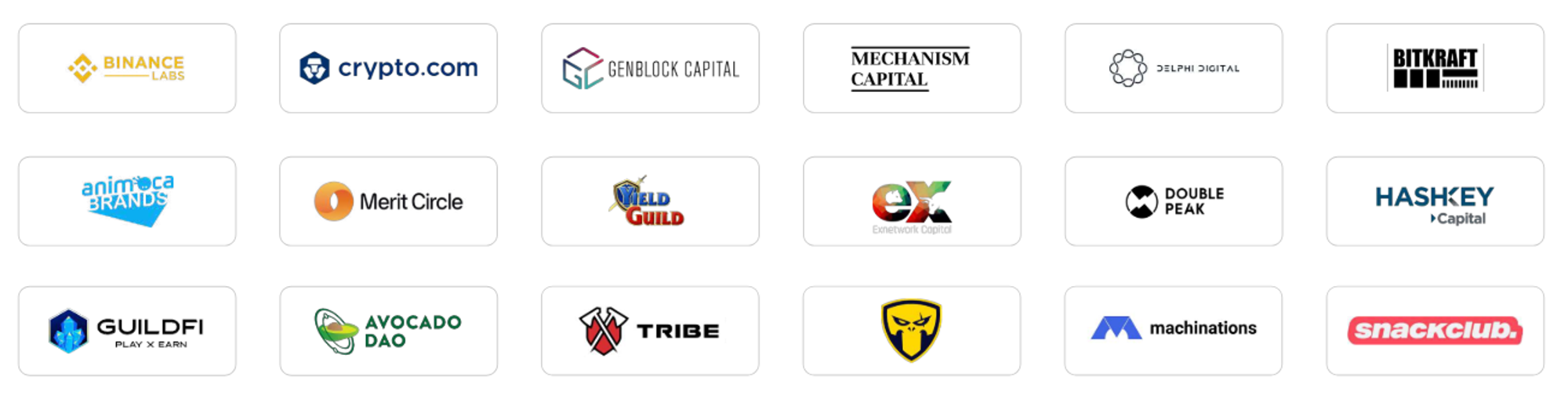

Investors

Token

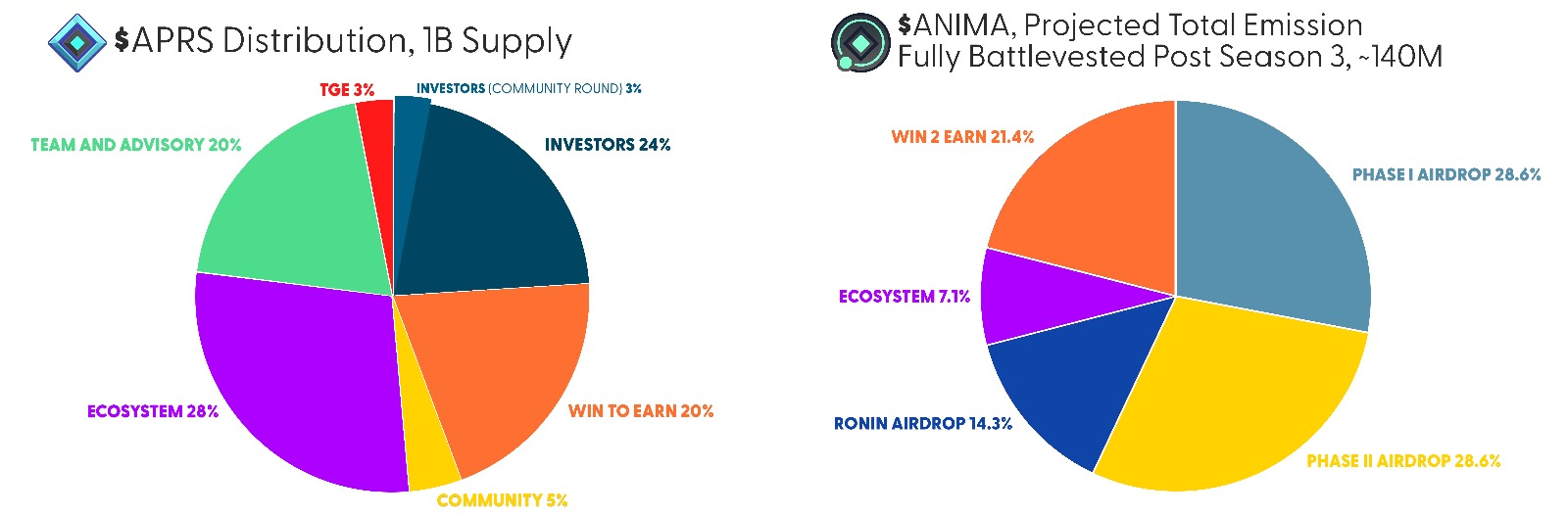

Apeiron’s ecosystem comprises three tokens: Aperios (APRS), Anima (ANIMA), and Ringularity (RNGU).

Aperios ($APRS) – $APRS serves as the governance token, allowing players to stake, participate in governance through a decentralized autonomous organization (DAO), and earn yields. Its in-game currency version is Aperium.

Anima ($ANIMA) – $ANIMA is a play-to-earn incentive token with various utilities, such as providing revival chances in dungeons. Its in-game counterpart, Animus, is non-tradeable but can be a discount currency for $ANIMA, rewarding players throughout gameplay.

Ringularity (RNGU) – $RNGU is a unique multiplayer token that grants access to exclusive sales for limited in-game items on the Apeiron marketplace

Where can you buy the token?

You can buy $APRS from exchanges like BingX, Bybit, and Gate.io.

Heroes of Mavia- 64.58%

Website | X(Twitter)

Website | X(Twitter)Sector – Gaming

Status – Active

FDV – $549M

Heroes of Mavia is an online multiplayer blockchain-based strategy game where players use their bases and armies to battle others, competing for real cryptocurrency in a play-to-earn format. The game is set on the island of Mavia, where players focus on constructing and enhancing their armies and engaging in battles using resources obtained from attacking other bases.

Players can earn the in-game crypto asset, Ruby, by winning battles and contests on a fantasy-themed island. Ruby is a unique play-to-earn asset that cannot be traded outside the game, reducing the risk of price manipulation and ensuring the platform’s sustainability. Mavia also includes tradeable crypto assets and NFTs, although these are not required to play the game, removing barriers to participation for gamers without cryptocurrency knowledge or ownership.

Heroes of Mavia stands out by offering players a range of in-game items as NFTs, making them unique and tradeable. Key NFTs include Land, Hero, and Statue, each serving a distinct purpose and possessing its value. These NFTs can be upgraded over time, enhancing their worth.

Investors

Token

Heroes of Mavia features three distinct currencies within its ecosystem, each serving a unique purpose.

Ruby – Ruby is the cornerstone of the in-game economy, earned through battles, achievements, and daily challenges.

Sapphire – Sapphire is the premium in-game currency, obtainable through in-app purchases, and a versatile tool for enhancing strategic gameplay.

$MAVIA – The platform’s primary cryptocurrency is the $MAVIA token, which plays a key role in governance. $MAVIA holders can vote on changes and the platform’s future direction via the Mavia DAO. Additionally, $MAVIA can be used to trade Legendary NFTs on the Mavia Ruby marketplace. Players can earn MAVIA by winning tournaments and participating in special events. $MAVIA is a supply-capped token with a maximum total supply of 250 million.

Where can you buy the token?

$MAVIA can be brought from exchanges like Bitget, Bybit, and Gate.io.

Sanctum -64.58%

Website | X(Twitter)

Website | X(Twitter)Sector – Liquid Staking

Status – Active

Sanctum is Solana’s pioneering stability protocol designed to enhance liquidity depth and stability across the entire Solana DeFi ecosystem. It is a groundbreaking development for Solana’s liquid staking ecosystem, acting as a unified liquidity layer for various Solana-based liquid staking token (LST) providers. The Sanctum Infinity platform on Solana is engineered to revolutionize the LST ecosystem by supporting a broad range of LSTs within a single liquidity pool (LP). Sanctum also lets users create their own LST tokens.

Sanctum has developed a router that enables instant buying, selling, and trading of any Solana LST with minimal slippage. This includes both well-established tokens like mSOL and jitoSOL, as well as lesser-known ones such as pathSOL and alphaSOL. This functionality eliminates the need to manually liquid-stake native SOL with an LST provider; users can swap cryptocurrencies like SOL and USDC for the LST they wish to hold.

- Sanctum serves as a centralized access point for a diverse range of LSTs offered by different validators, streamlining the process by eliminating the need to navigate multiple platforms.

- Sanctum aggregates liquidity across various LST pools, providing deeper liquidity for users and resulting in tighter spreads when buying or selling LSTs.

- Sanctum offers a user-friendly interface for staking SOL, converting SOL to LSTs and vice versa, and managing LST holdings.

- Sanctum promotes innovation within the Solana ecosystem by offering customizable LST functionalities. Projects can leverage LSTs for unique purposes, such as integrating them with NFTs or creating subscription services.

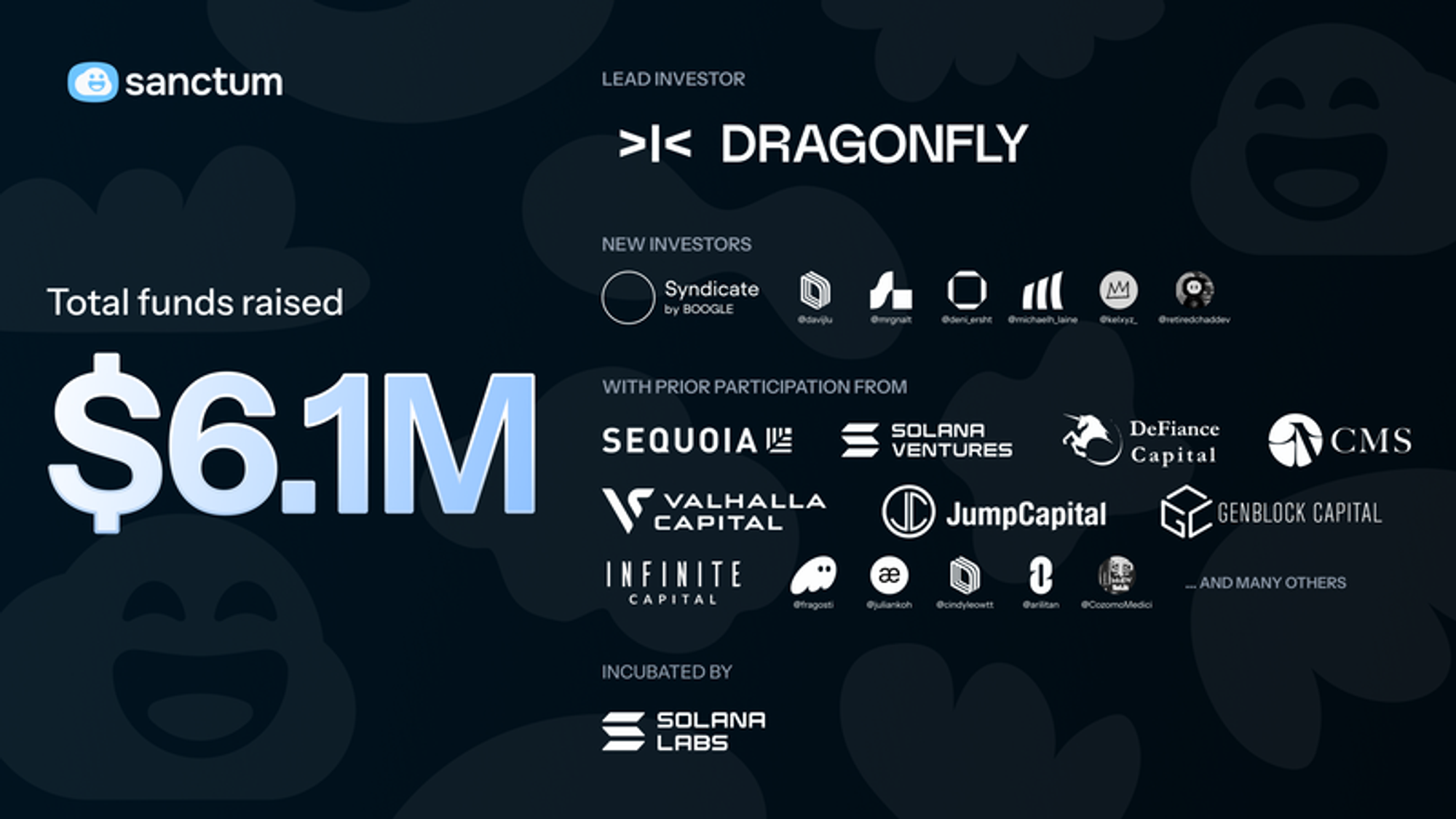

Investor

Token

Sanctum is currently developing its tokenomics framework, which will ensurewhich will ensure that the tokens hold significant value and have ample use cases within its ecosystem.

Vara Network- 60.42%

Website | X(Twitter)

Website | X(Twitter)Sector – Layer 1

Status – Active

FDV – $461M

Vara Network is a decentralized layer-1 blockchain constructed on the Gear Protocol, a Substrate-based programming platform. Gear Protocol underpins Vara Network, delivering a fast, scalable, and non-fork upgradable environment ideal for next-generation gaming, financial applications, and other use cases. Vara Network distinguishes itself with low transaction costs, robust security through a Nominated Proof-of-Stake (NPoS) consensus mechanism, and a community-driven governance model utilizing the OpenGov framework. The network is designed to be developer-friendly, facilitating the creation of decentralized applications (dApps) without the need to develop an entirely new blockchain.

Features

- Fast and Scalable: Vara Network is optimized for low-latency applications, offering a swift and efficient platform for gaming, financial transactions, and other high-demand use cases. Its architecture ensures the network can handle a high volume of transactions without compromising performance.

- Low Transaction Costs: Transactions on Vara are designed to be cost-effective, making it an attractive option for dApp developers and users. This cost efficiency encourages broader adoption and usage, particularly for microtransactions and high-frequency trading.

- NPoS Consensus: Vara’s Nominated Proof-of-Stake mechanism enhances decentralization and security by incentivizing both validators and nominators. This system ensures network integrity and fosters a collaborative environment where stakeholders are actively engaged in maintaining the blockchain.

- Community Governance: Utilizing the OpenGov framework, $VARA token holders can actively participate in network governance and influence updates and modifications. This democratic approach empowers the community to shape the network’s future, ensuring it evolves according to its users’ needs and preferences.

- Developer-Friendly Environment: Built on Gear Protocol, Vara supports WebAssembly (Wasm), allowing developers to write smart contracts in familiar languages, bridging the gap between Web2 and Web3. This compatibility reduces the learning curve for developers transitioning to blockchain technology and accelerates the development of innovative dApps.

Investors

Token

$VARA tokens are integral to the operation of the Vara Network, serving essential functions such as transaction fees, staking for network security, and governance. Every transaction and interaction with smart contracts on the network requires VARA tokens. This includes developers deploying smart contracts, who can also pre-fund their contracts with gas for future execution using Gas Pools. This enables the innovative feature of self-executing smart contracts on Vara Network. In the consensus model of the Vara Network, $VARA tokens are crucial as token holders contribute to network security by staking their tokens in exchange for a portion of the block rewards. The incentives within the Vara Network are carefully designed to promote continued participant engagement and support decentralization.

Inflation – Regarding inflation, the network operates on an inflation model with a decreasing rate. The maximum inflation rate for the first year is 6.00%, gradually decreasing to 3-4% by the fourth year. Vara Network doesn’t have a maximum supply.

Where can you buy the token?

You can buy $VARA from Coinbase Exchange.