TOKEN METRICS WATCHLIST

Every week, Token Metrics highlights emerging opportunities across the blockchain industry, covering everything from infrastructure innovations to decentralized platforms. While some of these projects are still pending our thorough code review process, we are excited to highlight them due to their initial promising potential, as identified through our fundamental analysis.

Allora Network- 62.50%

Website | X(Ex-Twitter)

Sector – Artificial Intelligence(AI)

Status – Testnet

Allora is an open-source, decentralized marketplace that integrates artificial intelligence (AI), machine learning (ML), and blockchain technology to facilitate the seamless exchange of valuable insights. These insights include predictions, sentiment analysis, and the outcomes of both supervised and unsupervised learning. By harnessing decentralized AI and ML, Allora enables users to generate, evaluate, and monetize high-quality predictions directly on-chain. The network is organized around key participants, such as workers, reputers, and validators, who uphold the system’s integrity through a well-crafted incentive mechanism. Allora’s consensus process not only guarantees the accuracy and reliability of the information exchanged but also rewards participants based on their contributions and performance.

Features

- Decentralized Machine Intelligence: Allora uses a decentralized AI framework, distributing inference tasks across a network of participants. This collective approach yields more accurate results than any single model.

- Context-Aware Inference Synthesis: Allora’s AI agents predict each other’s model performance in real-time, enhancing the accuracy of the network’s predictions.

- Self-Improving Mechanism: The network continually improves as AI agents learn from each other, leading to a compounding increase in overall intelligence.

- Open and Transparent Participation: Allora is open to anyone with data or algorithms, promoting transparency and broad access to advanced AI capabilities.

- Privacy and Security: The decentralized structure ensures data privacy and security, allowing participation without compromising confidentiality.

- Cross-Domain Applicability: Allora’s versatile design supports applications across various sectors, including finance, healthcare, and environmental science.

Investor

Token

The Allora Network uses a Pay-What-You-Want (PWYW) model, giving token holders the flexibility to choose their fees for inferences, promoting inclusivity and accessibility. ALLO tokens can be used to purchase inferences, create or participate in topics, and pay registration fees for workers and reputers. They are also essential for staking and delegating within the network, with participants earning rewards in ALLO tokens for their contributions. This system ensures active participation while maintaining the network’s integrity.

Vana – 60.42%

Website | X(Ex-Twitter)

Sector – Artificial Intelligence (AI)

Status – Testnet

Vana is a decentralized network designed for private, user-owned data, with the goal of enabling AI that is both user-owned and governed. Users have full ownership and control over the AI models they contribute to, allowing them to govern and profit from these models. Developers, in turn, gain access to cross-platform data that drives the creation of personalized applications and the training of advanced AI models. Vana introduces a groundbreaking approach to data ownership and AI, transforming data into a liquid asset and empowering users to control, govern, and earn from AI models built on their data.

Features

- User-Owned Data Treasury: A system where users collectively own, govern, and benefit from the AI models trained on their data, sharing in the value generated.

- User-Owned Foundation Models: Vana enables users to collaboratively train and own foundational AI models, shifting control away from centralized entities.

- Data Liquidity Pools (DLPs): Vana incentivizes and validates data contributions, making them available for AI training while ensuring privacy is maintained.

- Decentralized Ledger (Connectome): A transparent system that tracks and verifies all data transactions within the ecosystem, supporting cross-DLP data utilization and ensuring accountability.

Investors

Vana has secured up to $20 million in funding, with Paradigm and Polychain being one of the key investors.

Gravity- 58.33%

Website | X(Ex-Twitter)

Website | X(Ex-Twitter)Sector – Layer 1/Intenets/Cross-Chain

Status – Active

FDV – $487M

Gravity is a Layer-1 blockchain designed to drive mass adoption and support an omnichain future by enabling efficient, scalable, and secure cross-chain interactions. It employs advanced technologies such as Zero-Knowledge Proofs (ZKPs), a staking-powered architecture, and a state-of-the-art consensus mechanism to deliver high performance, robust security, and cost-effective transactions. By simplifying blockchain interactions, Gravity ensures a seamless and user-friendly experience for both users and developers. Serving as an omnichain settlement layer, Gravity facilitates intent-based, cross-chain transactions and gas abstraction, allowing developers to build applications that interact across multiple blockchains without dealing with underlying complexities.

Features

- Omnichain Smart Contract Platform: Gravity is an omnichain smart contract platform that manages interactions across multiple blockchains. Its cross-chain settlement protocol simplifies these interactions, providing an intuitive user experience by abstracting technical complexities.

- Advanced Technologies: The platform leverages advanced technologies, including Zero-Knowledge Proofs (ZKPs) for efficient and secure transaction verification, and a staking-powered architecture supported by the G token.

- EVM Compatibility: Gravity’s full compatibility with the Ethereum Virtual Machine (EVM) allows easy deployment and interaction with smart contracts, facilitating the transition of Ethereum-based applications.

- Cross-Chain Transactions and Gas Abstraction: Gravity enables cross-chain transactions and uses a gas abstraction mechanism to simplify multi-chain interactions, eliminating the need for token bridging.

- High-Performance Execution: The Reth execution layer and Jolteon consensus algorithm provide high performance and fast finality, supporting scalable, high-throughput applications.

- Secure Proof-of-Stake Mechanism: Gravity’s PoS framework, supported by G token staking and restaking, ensures network security and decentralization by incentivizing broad participation.

Token

$G is the native utility token for both the Gravity and Galxe ecosystems. It functions as the gas token for Gravity transactions and will soon support network security through staking. G drives governance, incentivizes growth, and facilitates payments across both ecosystems. As the native token of the Gravity Alpha Mainnet, $G will enhance its applications beyond existing $GAL utilities. Key functions include staking for governance participation and network security, with additional rewards from Galxe applications. $G also powers all on-chain transactions on Gravity Chain and is used for payments within the Galxe ecosystem, covering fees for applications like Galxe Quest, Galxe Passport, and Galxe Score.

Where can you buy the token?

You can buy the token from exchanges like Gate.io and Binance.

Bracket Labs- 58.33%

Website | X(Ex-Twitter)

Website | X(Ex-Twitter)Sector – Liquid Staking/Restaking

Status – Not yet launched

TVL – $4.3M

Bracket is developing a platform tailored for Liquid Staked DeFi, aimed at optimizing the use of Liquid Staked Tokens (LSTs) and Liquid Restaking Tokens (LRTs). This platform allows users to utilize these block reward-accruing assets as high-quality collateral in decentralized finance. At the core of Bracket’s innovation is the $brktETH token, a non-rebasing asset supported by a composite of LSTs and LRTs. This token functions as fungible, capital-efficient collateral within the Bracket ecosystem. The platform is designed to enhance the adoption and utility of assets like $stETH, $eETH, and $rETH. Bracket offers a range of features, including passive and active strategies, margin lending, and collateral management, to make LSTs and LRTs more accessible and functional in the DeFi space.

Features

Fungibility of LSTs: Bracket addresses the issue of non-fungibility in Liquid Staked Tokens (LSTs) by introducing $brktETH, a token that aggregates various LSTs and Liquid Restaking Tokens (LRTs). This enables users to employ a single, fungible token in DeFi, simplifying interactions compared to managing multiple distinct LSTs.

Collateral Efficiency: $brktETH enhances capital efficiency by consolidating LSTs and LRTs into a unified collateral pool. This approach minimizes complexity and reduces liquidity fragmentation within DeFi protocols.

Passive and Active Strategies: Bracket offers a range of opportunities, including passive earning through block rewards and active strategies like margin lending, all within a single platform. This versatility enables users to optimize returns according to their risk preferences.

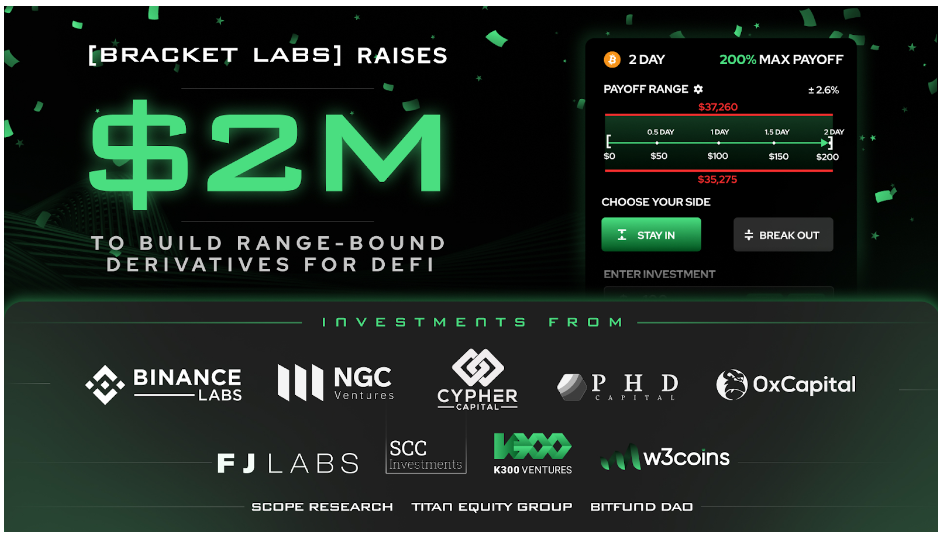

Investors

Lombard- 54.17%

Website | X(Ex-Twitter)

Website | X(Ex-Twitter)Sector – Bitcoin Staking

Status – Not yet active

Lombard is a project dedicated to integrating Bitcoin into the decentralized finance (DeFi) ecosystem, unlocking its full potential. The core offering, LBTC, is a yield-bearing, cross-chain liquid Bitcoin token backed 1:1 by native BTC. LBTC preserves Bitcoin’s role as a store of value while enabling it to participate in earning, staking, trading, and other DeFi activities across multiple blockchains. Lombard’s innovation lies in establishing a universal standard for Bitcoin in DeFi, avoiding liquidity fragmentation and expanding market opportunities. In collaboration with Babylon, Lombard facilitates Bitcoin staking, providing PoS networks with Bitcoin-backed security while allowing BTC holders to earn yields. Built on this foundation, LBTC offers liquidity and cross-chain compatibility, positioning it as a versatile asset within the DeFi ecosystem.

Features

- Universal Bitcoin Standard in DeFi: LBTC provides a liquid, yield-bearing version of Bitcoin that can be utilized across various blockchains, avoiding the liquidity fragmentation often seen with wrapped tokens or Layer 2 solutions.

- Cross-Chain Compatibility: LBTC is designed for seamless movement across major blockchain ecosystems, enabling users to tap into Bitcoin’s value within a wide array of DeFi protocols and applications.

- Yield Generation: LBTC holders can benefit from multiple layers of yields, including native yields through Babylon staking, Lombard Points, and rewards from participating in DeFi protocols.

- Security through Consortium: The Security Consortium ensures that LBTC remains secure and is supported by a coalition of leading industry players, mitigating the risks associated with centralized wrapped tokens or unsecured bridges.

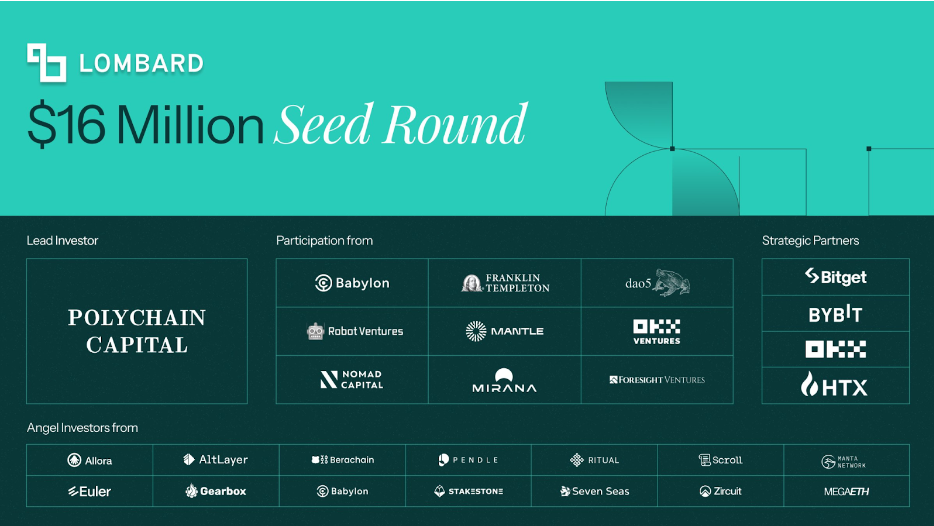

Investors