TOKEN METRICS WATCHLIST

Every week, Token Metrics highlights emerging opportunities across the blockchain industry, covering everything from infrastructure innovations to decentralized platforms. While some of these projects are still pending our thorough code review process, we are excited to highlight them due to their initial promising potential, as identified through our fundamental analysis.

Character X – 60.42%

Website | X(Twitter)

Website | X(Twitter)Sector – Social

Status – Active

CharacterX aims to be infrastructure that bridges Web2 and Web3 for AI, enabling seamless interaction, on-chain governance, and trading of AI assets across entire ecosystems. Initially, CharacterX was a platform where users could create and interact with AI characters. It has since evolved into a Web3 trading platform, allowing users to leverage the SDID protocol to transform their Web2 AI characters into Web3 AI assets and trade their asset keys. Looking ahead, CharacterX plans to expand the SDID protocol to encompass the entire AI ecosystem, empowering everyone to convert their AI characters into AI assets.

CharacterX 3.0 will elevate the platform into a comprehensive AI social ecosystem, introducing new features designed to enhance user interactions and experiences. These include AI Clubs, which are community-driven decentralized organizations that promote collaborative development and governance around each AI character. The Telegram Mini App offers a lightweight version of CharacterX, facilitating seamless AI interactions within Telegram and serving as a hub for AI partnerships. The Initial SDID Network will connect users and characters, laying the groundwork for future ecosystem value. Additionally, the AI Quest Platform introduces interactive challenges and missions, incorporating gamification and rewards to enrich the user experience.

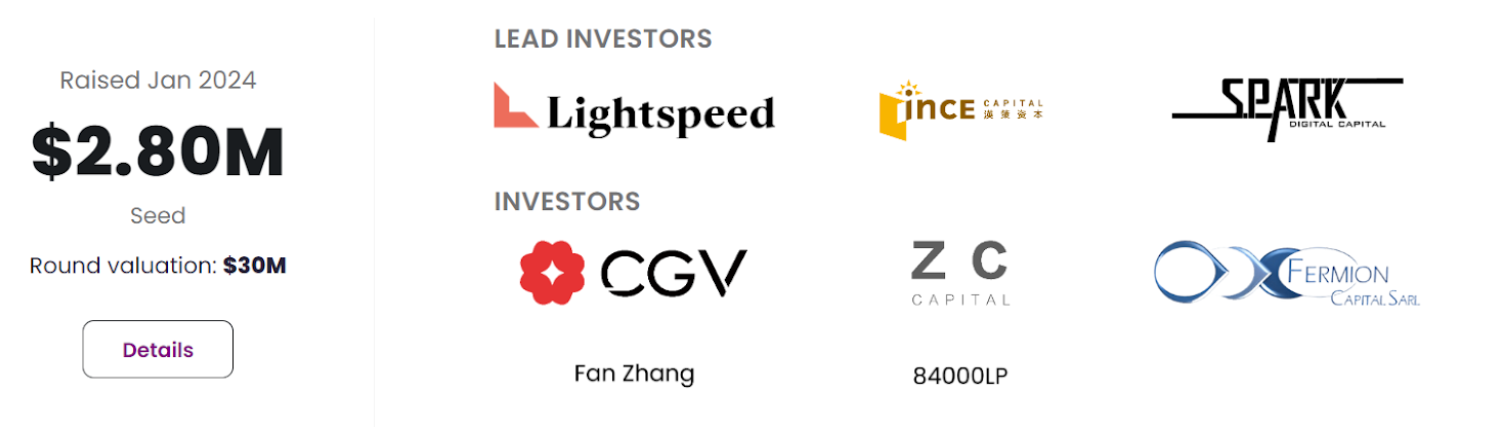

Investors

Token

$CAI – is integral to the CharacterX ecosystem, functioning as a reward mechanism during official seasons to enhance diverse gameplay and scenarios. It will also serve as the exclusive credential for future CharacterX token airdrops, with Pre-Season CXT being converted into corresponding NFT credentials for use in upcoming airdrop standards. CAI production scenarios include tasks within Mini Apps, AI interactions, $CAI staking pools, and shared revenue opportunities for creators. On the consumption side, CAI can be used to purchase creator Keys, participate in staking, upgrade characters, exchange for whitelists or tokens from partner projects, and enter cash or gift card lotteries.

The CharacterX Coin ($CXC) – is the platform’s integrated virtual currency, designed to grant access to specific features. It plays a crucial role in the incentive system by facilitating ongoing interactions with virtual friends, which in turn helps users earn CharacterX Governance Token Points (CAI)

Hedgemony- 60.42%

Website | X(Twitter)

Sector – DeFi

Status – Testnet

Hedgemony serves as an intent-centric execution layer native to Monad, offering comprehensive functionality for on-chain trading, hedging, and portfolio automation. It supports single and multi-asset swap routing, provides direct access to a network of yield opportunities, and enables seamless interaction with automated capabilities through its Strategy library and builder interface. By aligning user intentions with boundless possibilities, Hedgemony allows strategies of varying complexity to be executed with a single click. Whether users are seeking basic swap routes, reallocating entire portfolios to maximize yield, or designing intricate strategies, Hedgemony equips them to stay ahead of market volatility and avoid potential pitfalls.

Features

Efficiency, Economy, and Security – Hedgemony delivers efficiency, economy, and security, providing a versatile, intuitive platform for critical trading moments. Built on Monad’s advanced infrastructure, it settles complex transactions with near-instant finality, minimal costs, and no reliance on centralized capital pools.

Close Study – Hedgemony features a robust account abstraction framework, ensuring self-custody and controlling overactive positions. Upon opening a position, users receive an individual contract account with trading and delegation privileges, reducing token approval friction while allowing customization.

Hyper active Capital – When a position is activated, Hedgemony offers a curated selection of DeFi options, enabling users to explore simple and complex strategies. From yield-bearing opportunities to advanced lending, borrowing, and perpetual futures, the platform supports precise control over hedging and trading activities.

Story Protocol- 58.33%

Website | X(Twitter)

Sector – Layer 1

Status – Testnet

Story represents a groundbreaking platform for intellectual property (IP) on the blockchain, designed to facilitate the next generation of AI, DeFi, and consumer applications. The Story Protocol is a Web3 technology aimed at revolutionizing storytelling by providing creators with the tools to build expansive narrative universes and imaginative worlds based on open-source principles. It enables the creation, governance, and licensing of IP on the blockchain, fostering an ecosystem of modular story components that can be remixed and combined in innovative ways. By transforming IP into “IP Legos”—modular and programmable assets—Story Protocol allows for the licensing, management, and monetization of these assets through smart contracts on the blockchain.

Features

Tokenize the World’s IP – Tokenizing IP represents a significant opportunity, as IP is one of the world’s most valuable and versatile assets. By onboarding tokenized IP, creators gain the ability to exchange, expand, and distribute their creative works more effectively.

Monetize IP in the Age of AI – In the era of AI, Story empowers creators to maintain control over their IP rather than ceding power to platforms or algorithms. It enables creators to define the economic terms for AI usage of their IP, allowing both creators and their communities to benefit from AI advancements.

Programmable IP for Remixing and Expansion – The Story Protocol also supports programmable IP, enabling developers and creators to extend their IP across various mediums and platforms. A fully on-chain IP graph ensures that IP remains portable and composable, enhancing its usability across different applications.

Investors

Gravity- 58.33%

Website | X(Twitter)

Sector – Layer 1

Status – Alpha Mainnet

FDV – $453M

Gravity is a Layer-1 blockchain built by Galxe. It is designed to support mass adoption and an omnichain future by enabling efficient and secure cross-chain interactions. It employs Zero-Knowledge Proofs (ZKPs), a staking-powered architecture, and a robust consensus mechanism to ensure high-performance and cost-effective transactions. By abstracting blockchain complexities, Gravity provides a seamless, user-friendly experience for users and developers, facilitating intent-based cross-chain transactions and gas abstraction. This architecture simplifies the development of applications that interact with multiple blockchains, reducing the complexity for developers.

- Omnichain Smart Contract Platform – Gravity is an omnichain smart contract platform that facilitates interactions across multiple blockchains. It functions as a settlement layer for cross-chain intents, simplifying complexities and ensuring an intuitive user experience.

- EVM Compatibility – Gravity is EVM-compatible, allowing seamless integration and migration of Ethereum-based applications, which simplifies development and accelerates adoption.

- Cross-Chain Transactions and Gas Abstraction – Gravity enables cross-chain transactions with gas abstraction, reducing the need for users to bridge tokens and streamlining multi-chain interactions.

- Advanced technologies – Gravity employs advanced technologies to enhance security, efficiency, and performance. It uses Zero-Knowledge Proofs (ZKPs) for secure transaction verification and a staking-powered architecture with the G token, along with protocols like Babylon and EigenLayer, to strengthen security and decentralization.

- High-Performance Execution – Gravity’s integration of the Reth execution layer and Jolteon consensus mechanism delivers high performance and scalability, supporting mass adoption.

- Canonical Bridge for Asset Transfer – Gravity’s canonical bridge connects to Ethereum, enabling secure asset transfers through an optimistic roll-up mechanism with a 7-day withdrawal challenge period.

Token

The $G token is the native utility token of Gravity, powering both the Gravity and Galxe ecosystems. It serves as the gas token for transactions, secures the network through staking, and plays a crucial role in governance. $G incentivizes growth, facilitates payments, and allows stakers to participate in governance, access exclusive rewards, and benefits within the Galxe ecosystem. Governance of the G DAO is led by $G token holders, ensuring a transparent and decentralized framework. As the gas token of Gravity Chain, $G is used for all on-chain transactions.

Where can you buy the token?

$G can be bought through exchanges like Gate.io, Binance, and Uniswap.

Kwil – 54%

Website | X(Twitter)

Sector – Decentralized Database

Status – Testnet

Kwil is a framework that transforms traditional relational databases into independent, Byzantine Fault Tolerant (BFT) networks. By integrating a practical Byzantine Fault Tolerant (pBFT) layer atop existing database engines, Kwil enhances the security and decentralization of data stores. Each Kwil network operates on its blockchain, which can be configured as either a permissionless Proof-of-Stake (PoS) system or a permission Proof-of-Authority (PoA) system, offering projects substantial flexibility in managing their networks. This allows applications and products to have complete control over the operation, location, and management of nodes within their blockchain.

Features

Permissionless Database: Kwil enables decentralized applications (dApps) to manage relational databases without centralized intermediaries, using SQL-based storage and Postgres to ensure deterministic execution and consensus.

Configurable Network: Each Kwil network operates on its blockchain, which is customizable as either Proof-of-Stake (PoS) or Proof-of-Authority (PoA). This allows developers to control node operations and network administration.

Data Integration: The platform seamlessly integrates data with assets on other blockchains, opening new opportunities for user incentivization and innovative business models.

Decentralized Asset Control: Kwil embeds access control directly into the blockchain, giving developers precise control over data permissions and enhancing security and governance.

Kiwi Network: A Kwil Network is a sovereign blockchain designed for decentralized database management. Its networks are composed of nodes that efficiently handle CRUD operations.

Extension: Developers can customize Kwil Networks using extensions—modular components written in Go that enable advanced features like cryptographic signatures, external library integration, and custom governance rules.

Investors