TOKEN METRICS WATCHLIST

We scored many projects this week. Here are a few you should know about.

Please remember that some of these projects still need our code review process. Still, we want to call them out here because they preliminarily caught our eye based on our fundamental analysis process.

Open Eden – 64.58%

Website | X(Twitter)

Sector – RWAs

Status – Active

TVL – $121.5M

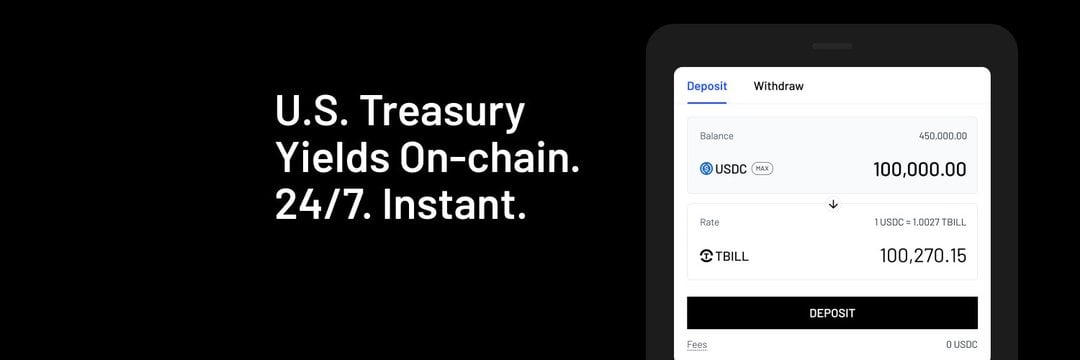

OpenEden has introduced the first smart contract vault providing 24/7 access to U.S. Treasury Bills (T-Bills), allowing stablecoin holders to mint TBILL tokens through the OpenEden TBILL Vault and earn the U.S. risk-free rate. OpenEden is the first tokenized real-world asset (RWA) issuer to achieve an “A” rating from Moody’s. Since its launch in early 2023, OpenEden has become the largest issuer of tokenized U.S. Treasuries across Asia and Europe.

Compliance: The TBILL token issuer operates as a professional fund, established under the British Virgin Islands Securities and Investment Business Act 2010, and is managed by a regulated fund management company based in Singapore.

Transparency: All token subscription, issuance, and redemption processes are executed on-chain, with independent proof-of-reserves and attestations ensuring maximum transparency.

DeFi Integration: TBILL tokens offer 24/7 access to U.S. Treasuries, unrestricted by U.S. trading hours. Built on the ERC-20 standard, the tokens enable DeFi projects to integrate seamlessly while offering continuous minting and redemption through smart contracts.

Investors

Kana Labs- 60.42%

Website | X(Twitter)

Sector – DeFi

Status – Active

Kana Labs is a blockchain infrastructure and tooling company focused on simplifying the complexities of the DeFi and GameFi sectors. They offer an all-in-one Web3 Middleware SDK, which includes cross-chain bridging solutions and liquidity aggregators. This provides developers and users with streamlined access to decentralized finance and gaming ecosystems. Kana Labs addresses key challenges such as user-friendly navigation, fragmented liquidity across multiple chains, and cross-chain communication inefficiencies.

Kana AMM Swap Aggregator: Built on Kana Labs’ Web3 Middleware, also known as the Aggregator SDK, this platform consolidates multiple liquidity sources (DEXs and liquidity aggregators) and cross-chain bridges under one system. Using a smart routing algorithm, it integrates nine different blockchains, including EVM and non-EVM networks.

Kana Trade: Kana Trade is a fully decentralized, on-chain order book trading platform developed by Kana Labs. It simplifies the complex navigation often associated with decentralized trading, while addressing common limitations in the current trading environment, enabling users to fully harness the potential of blockchain-powered trading.

Paymaster: Paymaster technology enables decentralized applications (dApps) and third-party entities to sponsor gas fees for transactions executed on their platforms. This allows businesses and entities to allocate funds to cover gas fees through a separate account, facilitating smooth and cost-free transactions for their users.

Web3 Middleware (Aggregator SDK): The Aggregator SDK is a toolkit built on a multi-chain foundational layer, comprising three core components: multiple liquidity sources (DEXs and liquidity aggregators), a bridge and messaging protocol aggregator, and a smart routing algorithm.

Investors

Token

Kana Labs will introduce its native token, $KANA, to facilitate fee payments across the platform. Token holders can earn revenue by staking $KANA, while also benefiting from a 50% discount on platform fees. Additionally, users can participate in exclusive promotions, including token and NFT campaigns, which provide access to unique NFT passes and identities. $KANA tokens will also serve as rewards across various products Kana Labs offers. The total supply of $KANA is capped at 300,000,000 tokens, ensuring a finite issuance within the ecosystem.

Zyfi- 60.42%

Website | X(Twitter)

Sector – Gas Abstraction

Status – Active

Zyfi offers a Paymaster-as-a-Service solution that simplifies gas fee management for decentralized applications (dApps) within the zkSync ecosystem. It allows users to pay transaction fees using any ERC-20 token or enables dApps to sponsor transaction costs. Powered by an API that abstracts technical complexities, Zyfi integrates with a wide range of dApps to deliver gasless transactions and a seamless user experience. By leveraging zkSync’s native account abstraction, Zyfi facilitates gasless transactions directly from Externally Owned Accounts (EOAs), making the platform more user-friendly and boosting adoption.

Zyfi has processed over 1.5 million paymaster transactions and is integrated with more than 30 dApps across zkSync chains, serving a variety of sectors. These include PancakeSwap (DEX), ZeroLend (Supply & Borrow), SyncSwap (DEX), Gravita (CDP), Increment Fi (Perpetual), and zkMarkets (NFT marketplace), with many more partnerships in development.

Features

Flexible sponsorship model – which provides dApps with full control over the sponsorship level for each transaction. This flexibility allows dApps to implement any sponsorship model they choose, without the need for smart contract modifications.

Supports any token – Additionally, support for any token is available, enabling users to pay gas fees with any token of their choice. By leveraging an off-chain price feed, Zyfi natively supports all tokens traded on zkSync, ensuring a seamless experience for users.

Intent-Based API – The Intent-Based API is another notable feature of Zyfi. It functions as a solver within the Intent landscape, focusing on achieving the user’s desired outcome in a streamlined and efficient manner.

Investors

Sophon- 58.33%

Website | X(Twitter)

Sector – Layer 2

Status – Not yet launched

Sophon is an entertainment-centric ecosystem built as a modular rollup utilizing zkSync’s ZK Stack technology. Designed as a ZK chain, Sophon is optimized for high-throughput applications such as artificial intelligence and gaming. The platform fosters connections between developers and users through strategic partnerships with ecosystems like zkSync, Beam, Zentry, and Aethir. By leveraging the ZK Stack, Sophon aims to position itself as a leader in the entertainment and blockchain industries, capitalizing on one of the most advanced and future-proof Ethereum Layer-2 technologies available. Node operators can engage with a blockchain network specifically designed to drive innovation in entertainment and blockchain, creating a decentralized, efficient, and user-focused environment. Sophon is founded on the belief that the future of blockchain lies in creating ecosystems that resonate with users on a deeper, more cultural level. By discreetly embedding crypto rails into the platform’s framework, users can access blockchain’s benefits without facing its typical technical barriers. This approach allows the chain’s power to effortlessly enrich the user experience.

Sophon Guardians form the foundation of the Sophon network’s operational infrastructure. Guardianship is tied to the rights to operate a Sophon Node, initially granted through memberships associated with nodes purchased during the node sale. As a Guardian, individuals can either operate a Sophon Node themselves or delegate their membership to other operators managing nodes on their behalf.

Investors

Sophon’s investors include notable entities such as Binance Labs, The Spartan Group, Seven X Ventures, Maven 11, HTX Ventures, OKX Ventures, and Paper VC.

Stake Stone-58.33%

Website | X(Twitter)

Sector – Staking/DeFi

Status – Active

StakeStone is a next-generation omnichain liquidity infrastructure that introduces liquid assets, STONE and SBTC, representing ETH and BTC respectively, powered by a dynamic staking network. Designed with a highly scalable architecture, StakeStone supports major staking pools and is preparing for future restaking capabilities. The platform creates a multi-chain liquidity market centered around STONE assets, offering users diverse applications and enhanced yield opportunities.

StakeStone is developing an omnichain liquidity distribution network and market tailored for the application layer. The platform aims to establish STONE as the standard for omnichain liquidity assets while advancing its use cases across multiple chains. This approach not only helps Layer 2 solutions attract liquidity but also offers users a range of earning opportunities.

By wrapping ETH staking and potential rewards from blue-chip restaking into STONE, the platform distributes these benefits across the application layers of various ecosystems. This positions STONE as a unified standard, enhancing the efficiency of users, chains, and the overall ecosystem—similar to how a unified currency can provide advantages to all stakeholders involved.

Key Features:

- Transparency: StakeStone employs a non-custodial model, ensuring full visibility of underlying assets and returns, similar to MakerDAO’s governance approach.

- Omnichain Accessibility: STONE and its price feed are accessible across multiple chains, facilitating smooth transactions and consistent pricing.

- Adaptability: Compatible with various consensus mechanisms, StakeStone’s modular architecture allows for flexible yield strategies and maximized returns.

- Optimization: The platform’s decentralized portfolio strategy reallocates liquidity efficiently, allowing STONE holders to switch underlying portfolios and enhance yields.

- Consistency: StakeStone maintains token stability through its modular design, ensuring that changes to smart contracts or underlying assets do not affect the circulating STONE supply. This approach supports a wide range of use cases, including DeFi, IDOs, payments, and collateral on centralized exchanges.

Investors

StakeStone’s investors include notable entities such as Binance Labs and Outlier Ventures.