TOKEN METRICS WATCHLIST

We scored many projects this week. Here are a few you should know about:

- Clanker

- Initia

- Fluent

- Paradex Network

- Bankr

Please remember that some of these projects still need our code review process. Still, we want to call them out here because they preliminarily caught our eye based on our fundamental analysis process.

Clanker- 70.42%

Sector – Token Launchpad

Status – Active

FDV – $64M

Clanker is an AI-powered token creation bot designed to simplify the deployment of cryptocurrency tokens on the Base blockchain. By leveraging Clanker, users can create and launch tokens with minimal technical expertise. The bot operates within the decentralized social network Farcaster and its applications, including Warpcast and Supercast, providing seamless access to token creation tools.

Clanker streamlines the process through a user-friendly mechanism—users simply tag Clanker on supported platforms, provide token details, and the bot automates the rest. This accessibility broadens participation in token creation, particularly for individuals and projects exploring decentralized finance (DeFi). Clanker’s AI-driven automation eliminates the need for manual smart contract development, handling all technical complexities to ensure a smooth deployment experience. Operating on Ethereum’s Base network, Clanker benefits from Ethereum’s security and scalability, offering a reliable infrastructure for token issuance. By integrating advanced AI with blockchain technology, Clanker makes token creation more efficient, secure, and accessible to a wider audience.

A key feature that distinguishes Clanker from other blockchain platforms is its fee-sharing model, which redistributes 40% of transaction fees to users who actively contribute to the network. This approach enhances user engagement and fosters a more inclusive ecosystem. Additionally, Clanker provides multiple interfaces for token deployment, allowing users to launch tokens through various platforms, including Clankfun, Bolide, Productclank, Nativedots, A0xbot, Streamm, and Glanker. This flexibility ensures accessibility and customization, catering to a diverse range of token creation needs.

Token

Currently, the $TOKENBOT(Clanker Token) serves primarily as a tradable representational asset within the ecosystem, without specific utility functions such as governance or staking. However, its locked liquidity enhances stability and security for traders, reinforcing its role within the financial structure of the Clanker ecosystem. While its utility is limited, the token remains a key component of the platform’s trading environment.

Where to buy the Token?

You can buy the token on Bitget, Uniswap and MEXC.

Initia- 69.72%

Sector – L1

Status – Testnet Live

Initia is a network designed for interwoven optimistic rollups, integrating a foundational Layer 1 blockchain with Layer 2 infrastructure to create a cohesive ecosystem of modular networks. By controlling the entire technology stack, Initia aligns the economic interests of users, developers, Layer 2 app-chains, and the Layer 1 chain itself through built-in chain-level mechanisms.

As an orchestration layer, the Initia Layer 1 coordinates security, liquidity, routing, and interoperability across its network of rollups through the VM-Agnostic Optimistic Rollup framework, known as the OPinit Stack. This framework, supported by fraud proofs and rollback capabilities, enables the secure scaling of CosmosSDK-based rollups in environments such as EVM, MoveVM, and WasmVM, while utilizing Celestia’s Data Availability (DA) layer.

Additionally, Initia introduces Enshrined Liquidity, a mechanism where INIT tokens—either individually or in pairs—are staked with validators to establish a liquidity hub within the Layer 1 chain. This approach enhances security, increases liquidity, and functions as an inter-Layer 2 router, enabling seamless token transfers across rollups. Initia provides developers with the flexibility to build using Solidity, Move, or CosmWasm while seamlessly integrating with the CosmosSDK. The network offers a comprehensive suite of built-in functionalities, including native USDC support, enshrined oracles, instant bridging, cross-chain interoperability via IBC, fiat on-ramps, decentralized sequencers, DAO tools, and InitiaScan. Additionally, it enables secure signing for both EVM and Cosmos wallets, streamlining the development and deployment of decentralized applications.

Investors

Initia has completed multiple funding rounds. In October 2023, the project secured $1 million in a pre-seed round led by YZi Labs. This was followed by a $7.5 million seed round in February 2024, with participation from Delphi Ventures, Hack VC, Nascent, Big Brain Holdings, Figment Capital, a_Capital, and other investors. In September 2024, Initia raised $14 million in a Series A round, backed by Theory VC, Delphi Ventures, Hack VC, Bryan Pellegrino, Zaki Manian, Michael Egorov, and additional investors. These investments have strengthened Initia’s ability to advance its technology and expand its ecosystem.

Fluent-69.05%

Sector – Infra

Status – Devnet Live

Fluent is the first blended execution network, integrating a zero-knowledge virtual machine (zkVM), a Layer-2 network, and a comprehensive development framework designed for building diverse blockchain applications on Ethereum. Fluent distinguishes itself by enabling the simulation of multiple virtual machine (VM) execution environments (EEs), allowing real-time composability of smart contracts across different VMs—including the Ethereum Virtual Machine (EVM), the Solana Virtual Machine (SVM), and WebAssembly (Wasm). This capability extends to contracts written in various programming languages, such as Solidity and Rust, all operating within a shared state execution environment.

The network supports atomic composability between applications running on different VMs, enabling the creation of “blended” applications that integrate smart contracts from multiple environments. These cross-VM interactions occur seamlessly, in real-time, and with atomic execution, ensuring reliability and efficiency. Blended execution enables applications from different virtual machines (VMs) to interact seamlessly on the same blockchain without wallet switching or friction. By sharing a unified blockchain state, smart contracts, programming languages, and tools designed for distinct VMs can communicate effortlessly. This allows real-time, atomic composability across traditionally isolated environments, enabling developers to build cohesive applications without compatibility concerns. Additionally, existing apps benefit from shared network effects and pooled liquidity, enhancing efficiency and scalability.

Investors

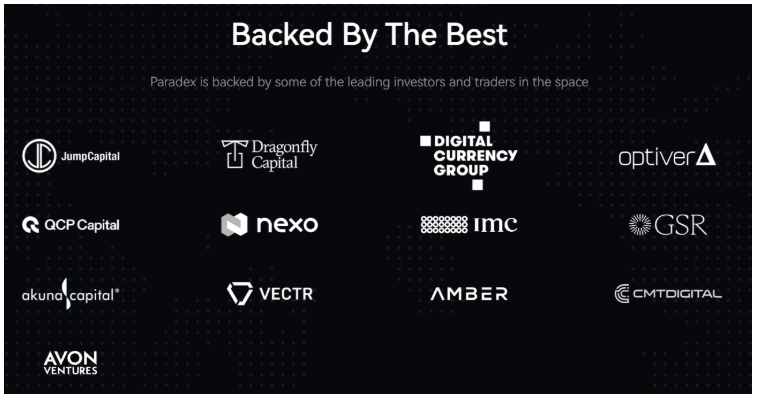

Paradex Network- 68.10%

Sector – Derivatives

Status – Active

Paradex is a high-performance crypto derivatives exchange built on a StarkNet appchain, designed to deliver deep liquidity, low fees, and fast execution. As an advanced perpetual decentralized exchange (DEX), it is engineered for Open Finance, offering a comprehensive ecosystem that includes battle-tested DEX, next-generation asset management vaults, lending pools, and more. Powered by StarkNet and Pyth, Paradex prioritizes self-custodial, on-chain risk management to enhance market trust and improve risk assessment in the crypto exchange landscape. Its fully on-chain risk engine, optimized for capital efficiency, ensures that the complex business logic behind derivatives trading is validated on Layer 2, reinforcing security and transparency.

Paradex Chain- is a general-purpose smart contract platform built on the SN Stack and powered by CairoVM. It shares state with Paradex Exchange, creating a fully composable, high-throughput execution environment that allows on-chain applications to interact seamlessly with the platform’s deep liquidity infrastructure.

Paradex Vaults- are smart contract-based asset pools within the DeFi ecosystem, enabling investors to deposit collateral—currently limited to USDC—in exchange for Vault Tokens representing their share of the pool. These assets are managed by Vault Operators, who implement trading strategies, with a current focus on perpetual futures, to generate returns for depositors.

Investors

Token

$DIME serves as the native token of Paradex, with future utility expected to include payment for trading fees, fee discounts, staking rewards, liquidity mining incentives, and governance participation. Further details regarding its functionality will be disclosed at a later stage.

Currently, Paradex operates a points-based engagement system known as Xperience Points (XP), which is designed as a universal metric to measure and reward user participation. XP is not merely a numerical value but a structured system that incentivizes all forms of contributions to the Paradex ecosystem. Previously, XP allocations were transparently categorized with explicitly assigned weights.

Bankr

Sector – AI Agents

Status – Active

Bankr is an AI-powered trading companion facilitating buying, selling, swapping, and executing transactions through simple commands directed to @bankrbot on X or Farcaster. It enables users to launch Clanker tokens directly on X and transfer tokens to profiles without leaving the social feed. As the second most popular Clanker token, Bankr replaces the complexity of traditional transaction processes with an intuitive AI-driven experience, acting as both an executor and a guide in decentralized finance. To deploy a token using Bankr, users must hold 5 million $BNKR in their Bankr trading wallet. They can then tag @Bankrbot on X, provide the desired token name and symbol, and initiate deployment seamlessly.

While Bankr thrives in social trading environments, it also provides a private trading terminal, enabling traders to create and automate custom strategies. Users can set predefined commands, such as instructing Bankr to “Buy $TICKER and sell if it rises by 5%”, allowing the AI to monitor the market continuously and execute trades at optimal moments. Whether optimizing short-term gains or managing long-term investment strategies, Bankr ensures precise and timely execution without the need for constant market oversight.

Recent Rise – Recently, Bankr gained significant traction when a user prompted Grok to suggest a token name and leveraged Bankr to deploy it through Clanker. This resulted in the creation of the DRB token(went to $30M+ FDV), driving increased attention and engagement with the platform.

Token

Bankr has its own native token, $BNKR, which was launched using Clanker. The platform reinvests transaction fees into $BNKR, creating a flywheel effect that strengthens the community and enhances user benefits. As part of its strategic growth plan, Bankr aims to stabilize and increase the market capitalization of $BNKR by allocating a portion of its 0.8% transaction fees toward purchasing the token. These acquired tokens will be held in the $BNKR treasury, reinforcing long-term value and sustainability within the ecosystem.

Where can you buy the token?

You can buy the token from Aerodome Finance, Lbank and Uniswap