Executive Summary

Across is a cross-chain bridge designed for Layer 2 solutions (L2s) and rollups, utilizing UMA’s optimistic oracle for security. The platform emphasizes capital efficiency through several key features, including a single liquidity pool, a competitive landscape of relayers, and a fee model that eliminates slippage. The Across protocol represents an innovative approach to bridging and integrating an optimistic oracle, bonded relayers, and single-sided liquidity pools. This combination enables decentralized instant transactions from rollup chains to the Ethereum mainnet.

How does it works?

The Across Protocol prioritizes capital efficiency, employing a single liquidity pool, a competitive relayer landscape, and a no-slippage fee model. This emphasis on efficiency is central to their cross-chain bridge philosophy. The protocol achieves this efficiency through several strategies. Firstly, it operates on a single liquidity pool model, simplifying liquidity management and enhancing overall efficiency. Additionally, Across Protocol employs an interest rate fee model, which reduces user costs while increasing yield for liquidity providers. This model incentivizes participation in the liquidity pool, contributing to its overall robustness.

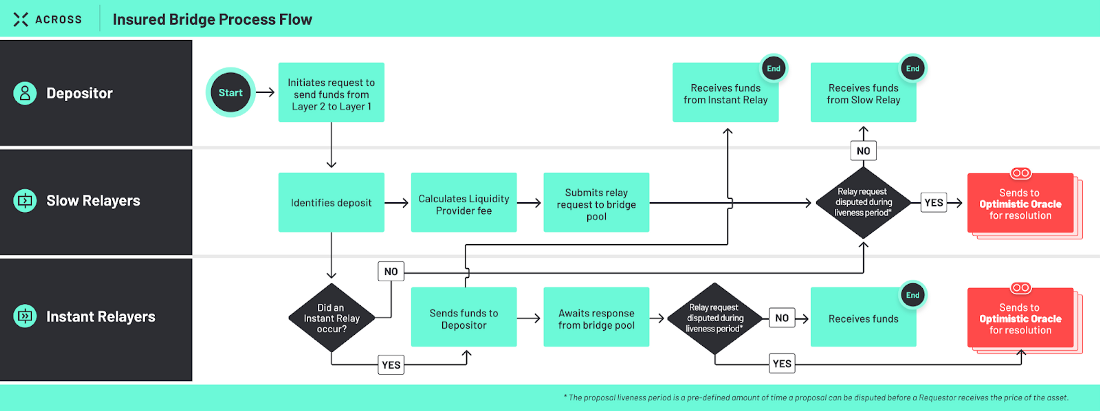

Across Protocol utilizes a Spoke Pool concept to facilitate fund transfers between chains. Users deposit funds into a Spoke Pool on one chain, specifying their desired destination and the fee they are willing to pay. Relayers then verify and process these deposits, immediately providing funds to the user on the target chain. Once the relay is complete, proof of the transaction is submitted to the optimistic oracle (OO) for verification. Upon successful verification, the relayer is reimbursed from the Hub Pool, a single liquidity pool on the Ethereum mainnet. Liquidity providers to this pool also earn a fee per transfer, incentivizing their participation. The movement of funds between L2 Spoke Pools and the L1 Hub Pool and the reimbursement of relayers follows the rules outlined in UMIP-157. These rules ensure the integrity and security of fund transfers within the Across Protocol ecosystem.

Market Analysis

In the evolution of blockchain technology, there has been remarkable and exponential growth, resulting in a current valuation of $1.6 trillion, with optimistic forecasts anticipating continued expansion. Despite this success, the market faces a notable challenge in achieving interoperability, as existing protocols pose potential complications. The cryptocurrency industry is undergoing rapid expansion, witnessing the creation of new blockchains and layers daily, each tailored for specific use cases such as enhancing speed and flexibility and reducing transaction costs for applications spanning DeFi, gaming, social platforms, and more. While this innovation is exciting, it introduces a degree of fragmentation in the industry, creating challenges for users. Tasks like setting, switching networks, and bridging between blockchains and layers are complex, expensive, and often time-consuming.

Across Protocol offers a comprehensive suite of solutions for the blockchain industry’s challenges. Its Optimized Cross-Chain Bridge facilitates seamless transactions across Layer 2 (L2) solutions and rollups, leveraging UMA’s optimistic oracle for enhanced security. Secondly, the platform promotes Capital Efficiency by utilizing a single liquidity pool for all transactions, thereby reducing user costs and maximizing yields for liquidity providers (LPs). Thirdly, its Permissionless Relayer Ecosystem enables third-party relayers to compete for speed in fulfilling transfer requests, ensuring fast transaction completions while bearing their financial risks. Additionally, Across implements an Innovative Fee Model based on the utilization of assets in its liquidity pool, resulting in more consistent pricing. Lastly, the platform incorporates Liquidity and Reward Mechanisms, where LPs earn fees from transfers via LP tokens. Users can participate in referral and reward-locking programs to encourage long-term engagement.

Key Features

The Across Protocol boasts a range of key features that distinguish it within the blockchain space:

- Safety: The safety of Across is underpinned by its robust, optimistic design, which ensures that even in scenarios with high participation rates, the system can quickly and effectively identify and rectify false claims with the input of just one honest participant.

- Speed: Besides its current speed of under 2 minutes per bridging transaction, Across is actively developing capabilities for next-block bridging, aiming to enhance cross-chain transactions’ speed and efficiency.

- Growth: The Across ecosystem is not just growing in size but also in its scope of opportunities. Participants can engage with the platform in various ways, including providing liquidity, participating in governance decisions, and contributing to developing new features and functionalities. This open and inclusive approach allows individuals to actively shape the future of decentralized finance (DeFi) and cross-chain interoperability.

- Capital Efficiency: Moreover, the concept of capital efficiency is deeply ingrained in Across’s design philosophy. By optimizing capital deployment and minimizing idle funds, the protocol seeks to reduce costs and enhance overall liquidity, making it an attractive option for users seeking efficient and cost-effective cross-chain transactions.

- Innovative Fee Model: Across employs an interest rate fee model based on the utilization of assets in its liquidity pool, leading to more consistent pricing.

- Liquidity and Reward Mechanisms: Liquidity providers receive LP tokens, earning fees from transfers. Users can earn rewards through referral programs and a reward-locking program encouraging long-term participation.

Token

The $ACX token is pivotal in governing the Across Protocol operations and managing the DAO treasury. Operating as an ERC-20 token facilitates decentralized ownership and control over the protocol’s functionalities. Token holders wield governance authority over the Across Protocol through the ACX token, ensuring decision-making power resides in their hands.

Beyond governance, $ACX is an incentive mechanism for liquidity providers and participants engaging in the Across Referral Link program. This incentivization structure encourages active participation and contribution within the ecosystem.

The maximum supply of $ACX is capped at 1 billion tokens, setting a definitive limit on the total available tokens within the system.

Traction

Across supports a variety of blockchain networks, including Ethereum mainnet, Arbitrum, Boba, Optimism, and Polygon. The platform has gained notable traction, amassing over 3 million transactions and facilitating a total volume of $5.1 billion. According to Defilama, Across boasts a total value locked (TVL) of $101 million, indicating a strong level of adoption and highlighting its promising future.

Investors

Conclusion

Across Protocol is actively addressing a significant challenge in the cryptocurrency space. It introduces a novel bridging method that combines an optimistic oracle, bonded relayers, and single-sided liquidity pools to enable decentralized instant transactions from Rollup chains to Ethereum Mainnet. With its adoption and focus on user-centric features, Across Protocol emerges as a promising project in the blockchain ecosystem.

| Fundamental Analysis | |||||

| Assessment | |||||

| Problem | Moderate, somewhat persistent problem | 2 | |||

| Solution | Distinct, defensible solution | 3 | |||

| Market Size | Large market, significant growth potential | 3 | |||

| Competitors | High competition, but room for differentiation | 2 | |||

| Unique Value Proposition | Clear differentiation and value for customers | 3 | |||

| Current Traction | High traction, strong user growth and retention | 4 | |||

| Unit Economics | Positive unit economics, with plans for further improvement | 3 | |||

| Tokenomics | Solid token strategy, aligns with user incentives | 3 | |||

| Product Roadmap | Unclear or unrealistic product roadmap | 1 | |||

| Business Model | Proven business model with clear path to profitability | 3 | |||

| Go-to-Market Strategy | Basic GTM strategy, lacks detail or differentiation | 2 | |||

| Regulatory Risks | Minimal regulatory risk, strong mitigation and adaptability | 4 | |||

| Total | 68.75% | ||||