Thesis

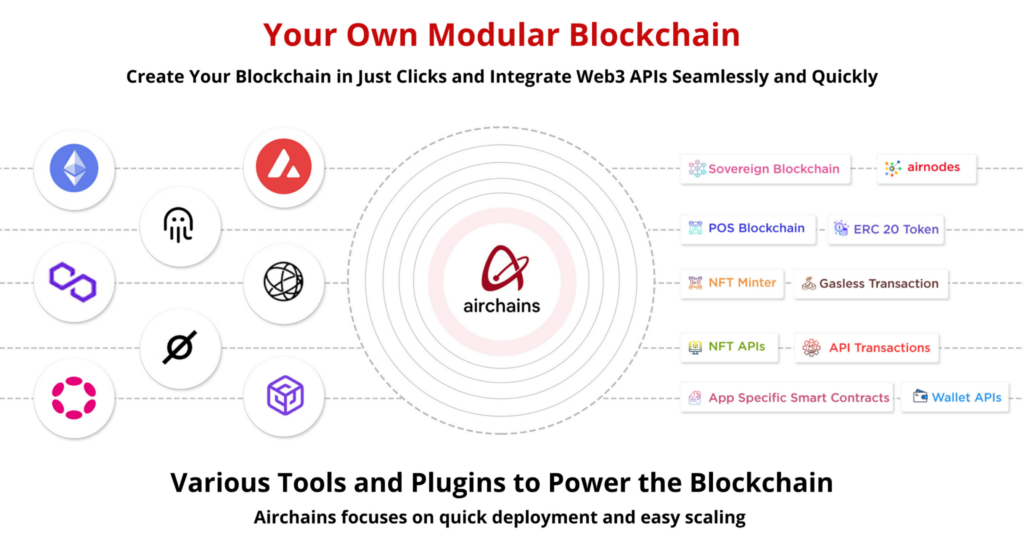

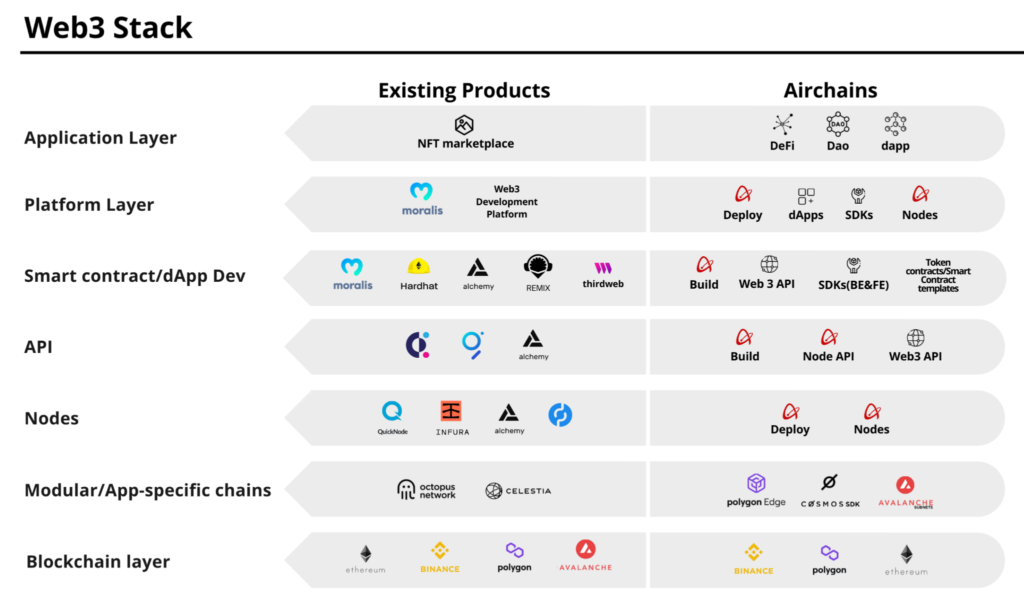

Airchains is a middleware platform allowing businesses and developers to quickly and efficiently deploy modular blockchains and launch applications on top of it. Engineers from the Indian blockchain firm Retcons Technology developed the service after discovering modular blockchains’ power. Airchains’ thesis is that public chains are too slow and costly to handle the demands of enterprises with 1 million or more monthly active users. Therefore they need a solution to develop their chains. Airchains allows clients to deploy chains using Cosmos SDK or Polygon Edge and plans to expand to Polkadot, Avalanche, Celestia, and Octopus Network.

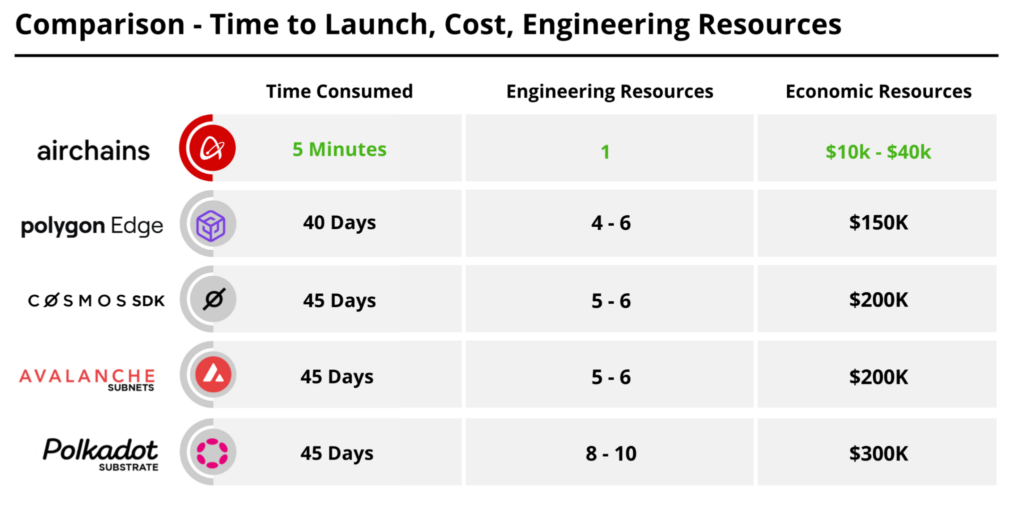

Using Airchains, developers can launch a modular blockchain in a fraction of the time and cost required to set up a sidechain on Polygon Edge or an application-specific chain on Cosmos SDK. Five chains have been deployed as of this writing, generating $65,000 MRR at a monthly burn rate of $25,000-30,000.

Airchains has three product offerings:

Deploy: A service for launching PoS/PoA chains

Nodes: offering remote-node access, a large network of multichain RPCs, and validators access

Build: Offers a full suite of tools for developers looking to launch smart contracts and applications on the newly deployed blockchain.

The team is raising $3.3M at a $16.5M pre-money valuation. At this valuation, we are bullish on Airchains, because it’s cash-flow positive, has a strong use case, is a live product, and is positioned well to compete against competitors.

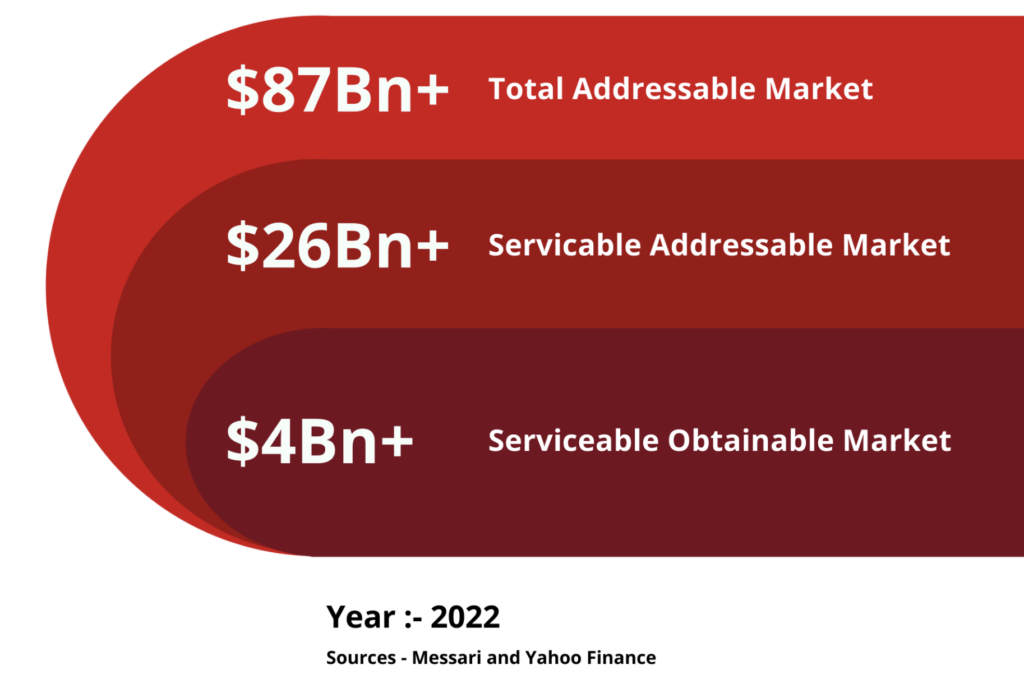

The market for modular blockchains is expected to grow to 41.5% YoY to an $87.7 billion market by 2026. Airchains’ team sees this as their total addressable market and its serviceable obtainable market at around $4 billion or ~22% of TAM. Cosmos Tendermint derivatives are collectively valued at around $50 billion. Cosmos and Polygon are valued at $3.5 and $7.6 billion, respectively.

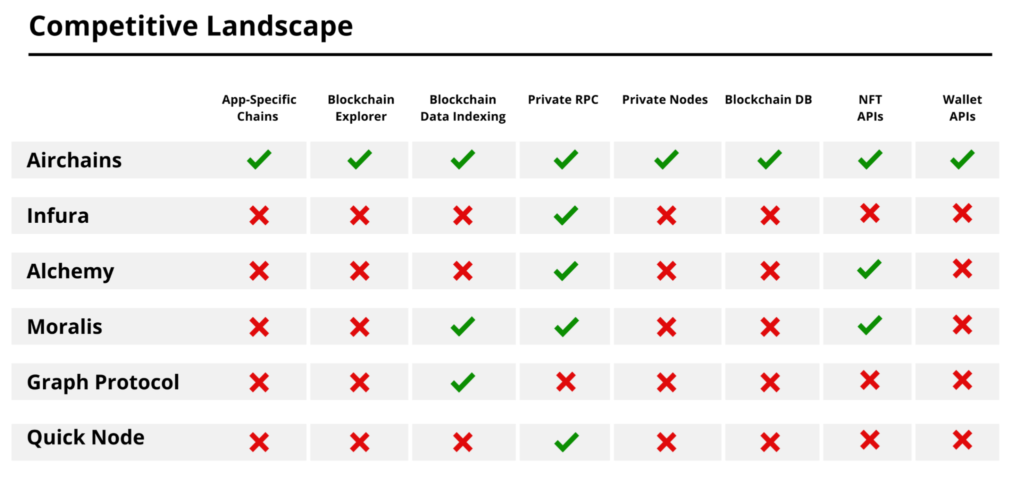

Airchains told us that their closest competitors were Moralis, Alchemy, and Quicknode; they were most recently valued at $215M, $10B, and $700M, respectively.

Assumption

The team has not fully fleshed out its plans for launching a token, stating that they “were not in a hurry” to launch their token. The assumption is that when the token is released, it will have good tokenomics and accrue value as Airchains gains users and revenue from clients using their products. Additionally, we must assume that public chains continue to be too congested for large enterprises and communities to use – requiring that they launch their modular blockchains.

Risk

The number one risk in Airchains is the lack of information regarding the token. Bad tokenomics can ruin good products. Joining the project as an investor before the token launch can allow us to ensure incentives are aligned with the firm, investors, and Airchains users.

Airchains’ team consists mainly of recent graduates. They all worked at Retcons Technology; however, this is a small firm with little publicly available information about its successes/failures. Except for the CEO and advisors, all of the team had just finished college.

Another risk is convincing developers modular blockchains are provably secure and not centralized through the same cloud hosting providers like Amazon Web Services (AWS).

Potential

An investment in Airchains will compound as the company continues to expand its user base and revenues. If the token is designed correctly to accrue value as Airchains generate more revenue, the token price should compound proportionately to the revenue generated.

Based on our competitive landscape analysis, we project that Airchains has a floor of $200M and a ceiling of over $2B. Setting our expectations for a 10 to 100x return on investment in Airchains.

Summary

We saw similarities between this project and the team and Polygon (MATIC) when we met them back in 2018. A very young team with a great product with initial traction, going after a large use case with a reasonable valuation.

Disclosure: Token Metrics Ventures is an investor in Airchains.