Executive Summary

Babylon recently introduced a Bitcoin Staking Protocol designed to harness Bitcoin’s capabilities in bolstering decentralized economies. The protocol’s objective is to enable the staking of the 21 million bitcoins, providing holders with a secure avenue to generate yields from their dormant bitcoins.

Using a self-custodial approach, bitcoin holders can lock their bitcoins to acquire the privilege of validating Proof-of-Stake (PoS) chains, thereby earning yields in exchange. Babylon’s protocol is characterized by its rapid, non-restrictive, and scalable restacking features, ensuring that Bitcoin stakes benefit from maximum liquidity and yields.

About the Project

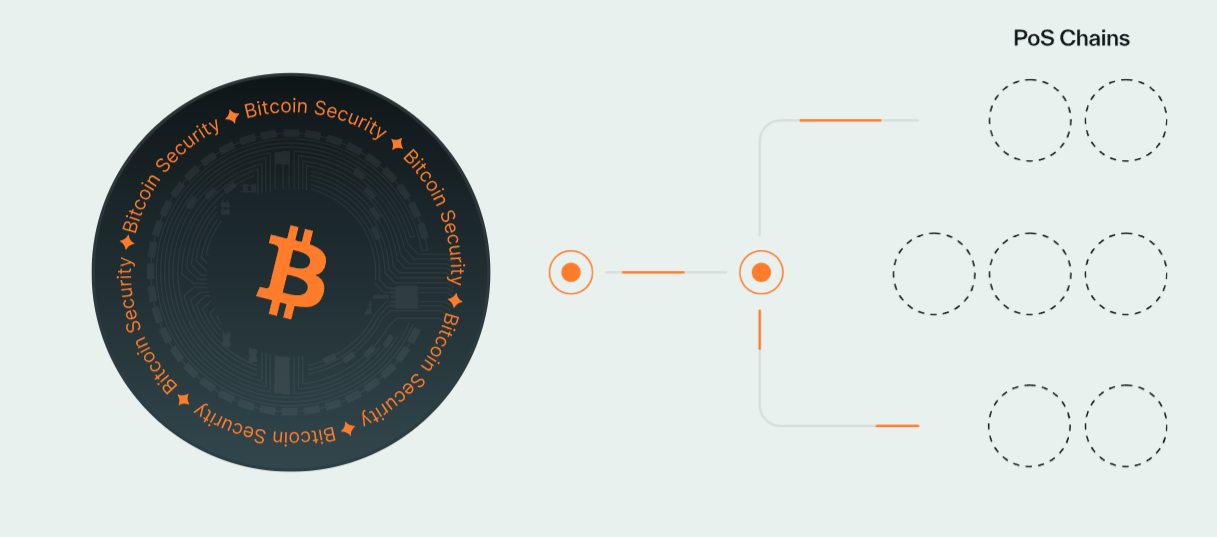

Vision – Making Bitcoin a trusted security backbone for PoS chains, delivering yields for Bitcoin holders while fostering an integrated, secure, decentralized economy.

Problem – Despite Bitcoin’s market capitalization exceeding $1T, its potential has been underutilized due to challenges such as the absence of smart contracts and scalability issues. Bitcoin holders cannot derive significant utility from their holdings beyond price appreciation despite it being the most secure chain. In contrast, many chains incur substantial expenses to establish validators and secure the chain, limiting their growth potential.

Solution—Babylon’s approach does not involve adding new layers or constructing new ecosystems atop Bitcoin. Instead, it leverages the security of the Bitcoin chain. It extends it to various proof-of-stake (PoS) chains such as Cosmos, Binance Smart Chain, Polkadot, Polygon, and other blockchains with robust, interoperable ecosystems. Babylon aims to scale Bitcoin’s security to fortify the decentralized world. By utilizing Bitcoin’s three core components—its timestamping service, block space, and asset value—Babylon can extend Bitcoin’s security to all these PoS chains, fostering more robust and united ecosystems. This approach addresses both issues: chains can harness Bitcoin’s security while holders can generate better returns.

Features

- Fast Unbonding and Scalable Restaking – Babylon’s Bitcoin Staking Protocol introduces several key features to enhance the staking experience for Bitcoin holders and secure decentralized economies. One of its primary features is fast, unbinding, and scalable restaking, ensuring that Bitcoin holders can access maximal liquidity and yields. This feature simplifies the process of unlocking the potential of idle bitcoins.

- Modular Design – Another notable feature of Babylon’s protocol is its modular design, which enables compatibility with various Proof-of-Stake (PoS) chains. This modular approach is a plug-in solution for enhanced security, making it easier for different blockchain networks to integrate with Babylon’s protocol seamlessly.

- Bitcoin Security Sharing Protocols – Babylon implements innovative security-sharing protocols to enhance Bitcoin’s security capabilities. The Bitcoin Timestamping Protocol provides succinct and verifiable data timestamps, strengthening integrity and security, particularly against long-range attacks. The Bitcoin Staking Protocol allows Bitcoin to offer economic security to decentralized systems through trustless staking, enabling PoS chains and decentralized applications (dApps) to opt-in for Bitcoin-backed security. Lastly, the Bitcoin Data Availability Protocol ensures data availability on the Bitcoin network, further enhancing security and reliability across the ecosystem.

- Trustless – Babylon employs cutting-edge cryptographic technologies such as the extract one-time signature (EOTS) to convert slashable PoS attacks into spendable Bitcoin UTXOs for burning. This method allows Bitcoin holders to stake their bitcoins and participate in PoS security by locking them on the Bitcoin network. No third party is involved, and the bitcoins remain secure if the staker does not attack the PoS chains.

Market Analysis

Blockchain technology has witnessed remarkable growth since its inception. It is currently valued at $2.6T, and optimistic projections indicate continued expansion. The largest cryptocurrency globally boasts a market capitalization of $1.3T. Recent developments, such as increased governmental acceptance and the SEC’s approval of a Bitcoin ETF, are expected to drive demand for Bitcoin further.

Babylon targets the entire Bitcoin market with a novel staking mechanism, offering a compelling use case for Bitcoin holders and PoS chains. This represents a significant market opportunity. Babylon is a pioneer in this concept, distinguishing itself from another protocol, BounceBit, which also offers Bitcoin staking but includes a centralized element. It is a competitor and has a TVL of $700M.

Traction

The Babylon testnet is currently operational and experiencing a notable increase in users As part of its Phase 1 program, the project has attracted 430,000 whitelisted wallets. Furthermore, Babylon has established partnerships with several prominent networks, including Osmosis, Akash Network, Injective, Sei, and others, underscoring the project’s robust presence and potential.

Babylon Team

Established in 2022 by Stanford Professor David Tse and Dr. Fisher Yu, Babylon boasts a leadership team comprising consensus protocol researchers and seasoned Layer-1 engineers. Supported by an advisory board that includes industry luminaries like Sunny Aggarwal (Co-Founder of Osmosis Lab) and Sreeram Kannan (Founder of EigenLayer), Babylon is backed by a formidable team.

Conclusion

Babylon’s innovative approach introduces a new use case for the industry, representing a significant advancement in integrating Bitcoin with the Proof-of-Stake economy. Babylon’s innovative approach presents a promising solution to the scalability challenges of Bitcoin and other blockchain networks. By extending Bitcoin’s security to Proof-of-Stake (PoS) chains, Babylon is fostering a more robust and efficient ecosystem capable of facilitating faster and more secure transactions. This integration enhances Bitcoin’s utility and contributes to the overall development and resilience of the blockchain industry.

| Fundamental Analysis | |||||

| Assessment | |||||

| Problem | Significant, long-term problem | 3 | |||

| Solution | Groundbreaking, highly defensible solution | 4 | |||

| Market Size | Massive market with high growth rates, or untapped niche with high potential | 4 | |||

| Competitors | Uncontested market space, first-mover advantage | 4 | |||

| Unique Value Proposition | Highly innovative, unique value driving significant customer advantage | 4 | |||

| Current Traction | Solid traction, user engagement and retention growing | 3 | |||

| Unit Economics | Positive unit economics, with plans for further improvement | 3 | |||

| Tokenomics | No clear token strategy or poorly conceived strategy | 1 | |||

| Product Roadmap | Unclear or unrealistic product roadmap | 1 | |||

| Business Model | Proven business model with clear path to profitability | 3 | |||

| Go-to-Market Strategy | Solid GTM strategy, clear target market and channels | 3 | |||

| Regulatory Risks | Minimal regulatory risk, strong mitigation and adaptability | 4 | |||

| Total | 77.08% | ||||