Executive Summary

BEVM (Bitcoin Layer-2 Network) is an innovative platform combining the robustness of Bitcoin with the flexibility of Ethereum’s Virtual Machine (EVM). It leverages the Substrate framework for compatibility with EVM, offering seamless integration with Ethereum’s API and Substrate’s API. This duality allows Ethereum’s tooling and account systems, including MetaMask, to be utilized on the BEVM network.

BEVM employs the same account system as Ethereum, and your mnemonic phrase and private key are interchangeable with your Ethereum account.

About the Project

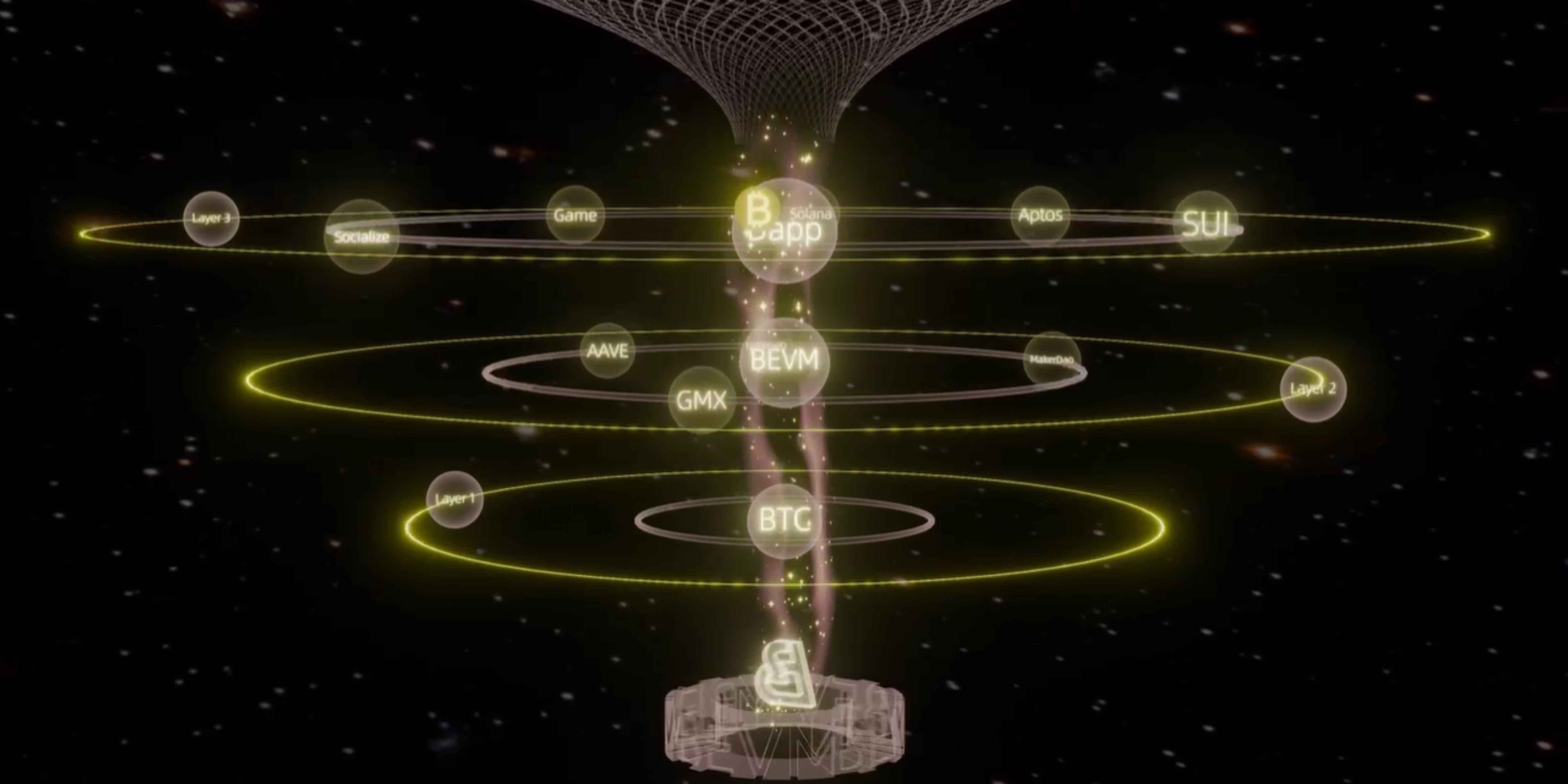

Vision: They aim to build the first fully decentralized EVM-compatible Bitcoin L2 that uses BTC as Gas and allows all DApps running in the Ethereum ecosystem to operate on Bitcoin L2.

Problem: BTC commands nearly 50% of the cryptocurrency market share, yet Bitcoin has lacked a mature Layer 2 (L2) solution since its inception. As a result, most Bitcoin holders cannot interact with cutting-edge decentralized applications (DApps).

Solution: Following key technological upgrades such as Segwit and Taproot, along with the popularity of the Ordinals protocol and BRC20 tokens, BEVM was introduced, a fully decentralized, EVM-compatible Bitcoin Layer 2 solution using Bitcoin as its gas.

Features

- Transaction Fee Structure: BEVM implements a unique fee structure comprising initial gas, real gas, and refund gas, paid in BTC.

- Smart Contract Deployment: The BEVM Canary TestNet allows developers to deploy and test decentralized applications (dApps) using familiar tools like Solidity, MetaMask, and Remix.

- Custodial Modes: ChainX, part of the BEVM ecosystem, offers multi-signature and threshold signature custody schemes for secure cross-chain asset management.

- X-Lightning Network: An implementation of the Lightning Network Protocol, enhancing transaction efficiency and security.

- Dapp Development Support: ChainX supports various virtual machines and execution environments, such as WebAssembly (Wasm) and EVM, fostering a vibrant dApp development ecosystem.

- ComingChat Integration: Aiming to build a social metaverse, ComingChat supports ChainX wallet and promotes interoperability within the Web 3.0 space.

Investors

Market Analysis

Bitcoin’s dominance in the cryptocurrency market is undeniable. However, its limited scalability has been a persistent challenge. Enter Bitcoin Layer 2 (L2) networks – a rapidly evolving market with the potential to unlock Bitcoin’s true potential.

According to Coingecko, the total combined market capitalization of Bitcoin L2s is only $3.15 billion. This is just 12% of the total L2 market capitalization of $24.5 billion, which Ethereum L2s currently dominate. The demand for L2s is destined to increase as the scalability issues of Bitcoin and Ethereum are still far from resolved.

L2s solve crucial scalability and functionality issues that have limited Bitcoin’s growth. By enabling faster transactions, lower fees, and DeFi applications, L2s can significantly increase the utility and value of the Bitcoin network. This translates to potential growth for L2-related tokens and projects.

Investing in promising L2 projects early can offer significant returns as the market matures and adoption increases. Early backers of successful L2 solutions can benefit from token appreciation and potential network effects.

Traction

The BEVM core team comes from ChainX, the first chain based on Substrate. ChainX has served almost 100,000 on-chain BTCs and has been running for 5 years.

BEVM is a secondary derivative based on ChainX. The EVM-compatible Bitcoin L2 currently boasts 98,714 accounts and has processed over 6 million transactions. According to DeFi Llama, the total locked value (TVL) on BEVM is $884,385. Therefore, considering the current growth stats, BEVM adoption is expected to grow significantly in the coming months.

Conclusion

BEVM sounds like an exciting project. It combines the strengths of Bitcoin and Ethereum to address scalability challenges and unlock new possibilities in the cryptocurrency space. Its integration with Ethereum’s ecosystem and tools like MetaMask could make it more accessible to developers and users familiar with Ethereum, potentially accelerating adoption.

Investing in promising Bitcoin Layer 2 projects early on could indeed yield significant returns. It is one of the most rapidly growing ecosystems, with the total locked value constantly increasing in the existing projects.

| Fundamental Analysis | |||||

| Assessment | |||||

| Problem | Significant, long-term problem | 3 | |||

| Solution | Distinct, defensible solution | 3 | |||

| Market Size | Large market, significant growth potential | 3 | |||

| Competitors | Emerging market with few strong competitors | 3 | |||

| Unique Value Proposition | Clear differentiation and value for customers | 3 | |||

| Current Traction | Early traction, user engagement starting to grow | 2 | |||

| Unit Economics | Positive unit economics, with plans for further improvement | 3 | |||

| Tokenomics | No clear token strategy or poorly conceived strategy | 1 | |||

| Product Roadmap | Unclear or unrealistic product roadmap | 1 | |||

| Business Model | Proven business model with clear path to profitability | 3 | |||

| Go-to-Market Strategy | Basic GTM strategy, lacks detail or differentiation | 2 | |||

| Regulatory Risks | Minimal regulatory risk, strong mitigation and adaptability | 4 | |||

| Total | 64.58% | ||||