Executive Summary

BounceBit is an innovative platform dedicated to Bitcoin restaking, enabling users to earn additional rewards by restaking their Bitcoin holdings. Distinct from traditional staking platforms, BounceBit exclusively focuses on Bitcoin restaking, offering specialized solutions for Bitcoin holders. With a mission to redefine Bitcoin’s value, BounceBit is developing an infrastructure grounded in the belief that Bitcoin should primarily be asset-driven at the infrastructure level.

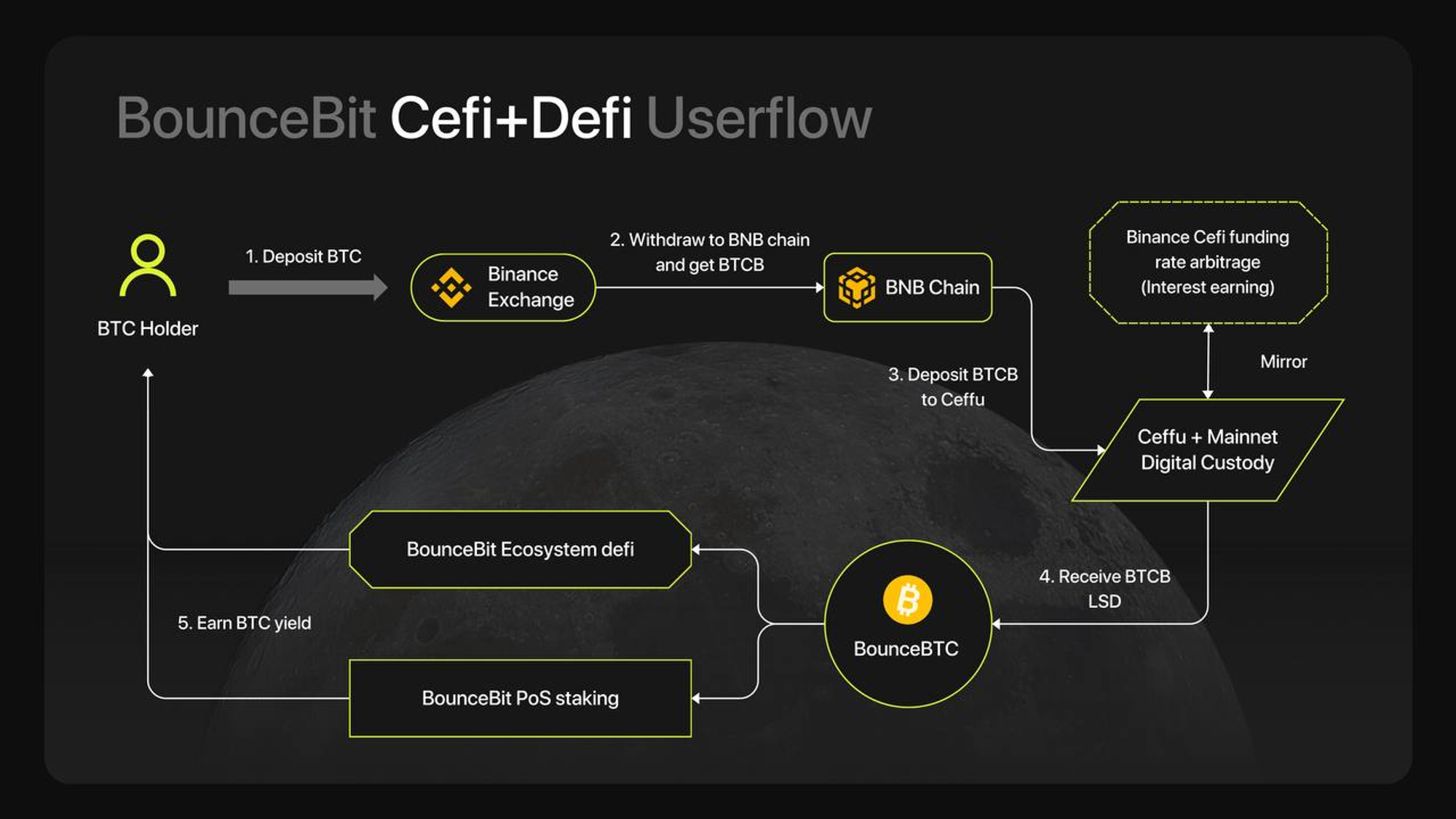

BounceBit is a project utilizing centralized and decentralized finance frameworks to establish a BTC restaking network. Through BounceBit, Bitcoin (BTC) holders can earn yields across various networks. Additionally, the project offers full compatibility with the Ethereum Virtual Machine, facilitated by its native token, BB. For those unfamiliar, BounceBit is a layer-1 project that merges Bitcoin’s security with the Proof-of-Stake (PoS) consensus mechanism. This dual system allows users to bridge assets and engage with restaking products on the network.

About the Project

Vision – By providing CeDeFi opportunities with Bitcoin’s security and Ethereum Virtual Machine (EVM) compatibility, also to enhance Bitcoin utility.

Problem – BTC holders undoubtedly face the challenge of their assets being underutilized, as Bitcoin currently lacks utility. The absence of a smart contract platform within Bitcoin’s ecosystem limits the overall development of decentralized applications (dApps). BounceBit addresses this issue by working to provide a smart contract platform, thereby enhancing Bitcoin’s utility and fostering the development of dApps.

Solution – BounceBit aims to develop a comprehensive infrastructure to explore restaking across various Bitcoin types, including sidechains, oracles, bridges, virtual machines, and data availability layers. As a platform focused on Bitcoin restaking, BounceBit enables users to earn additional rewards by restaking their Bitcoin holdings.

It offers diverse reward opportunities, such as premium yield generation through funding rate arbitrage, node operation rewards, and a blend of centralized (CeFi) and decentralized finance (DeFi) yields. BounceBit’s CeDeFi dual approach allows users to earn attractive returns while maintaining liquidity through Liquid Custody tokens. Its compatibility with the Ethereum Virtual Machine (EVM) ensures seamless migration for developers, leveraging Ethereum’s security and ecosystem.

Features

- More Yield for Bitcoin Holders – Restaking offers Bitcoin holders increased utility and additional passive income streams by leveraging their assets across multiple services or platforms. It enhances capital efficiency, like Ethereum, allowing holders to maximize returns without extra capital investment. Additionally, restaking bolsters the security of the Bitcoin ecosystem by contributing to the security of other networks or decentralized applications. BounceBit’s approach, which integrates CeFi and DeFi frameworks, unlocks more excellent utility for Bitcoin assets, enabling holders to earn yields across multiple networks. This transforms Bitcoin from a mere store of value into a versatile asset that supports various financial services and applications.

- CeDeFi Infrastructure – BounceBit is compatible with the Ethereum Virtual Machine (EVM), enabling smart contract execution and extensive development opportunities. Its integration of decentralized finance (DeFi) and centralized finance (CeFi) seamlessly merges traditional finance with blockchain technology, offering a wide range of financial instruments and services. Partnering with regulated financial institutions, BounceBit provides asset custody, fiat currency exchange, and credit services. This collaboration ensures effective liquidity management, faster transactions, higher capacity, and enhanced security for user assets. The BounceBit chain, the dual-token PoS Layer 1 secured by BTC and $BB, leverage Bitcoin’s security with full EVM compatibility.

- Proof of Stake – BounceBit employs a unique Proof of Stake (PoS) consensus mechanism that enhances network security, energy efficiency, and scalability. In this PoS system, node operators must stake tokens, such as $BB or $BBTC, to participate in the consensus process and verify transactions. Using two token types for staking and validation, BounceBit increases participant diversity and flexibility. Token holders can vote to elect trusted nodes as network validators, promoting decentralization and distributing power more evenly across the network. Validators participating in PoS staking receive transaction fees and newly generated tokens as rewards, incentivizing participation and further securing the network.

- Liquid Staking Derivates – Users begin by selecting the asset they wish to stake, such as BB or BBTC. Once the assets are locked, they receive corresponding liquid staking derivatives (LSD), such as stBB or stBBTC. BounceBit’s LSD flexible staking mechanism is an innovative feature that allows users to stake cryptocurrencies without sacrificing asset liquidity. This is particularly beneficial for users who want to earn income from their crypto holdings without locking up their assets. LSD addresses the issue of asset illiquidity in traditional staking methods by creating a derivative that represents the staked asset.

Market Analysis

Blockchain technology has witnessed remarkable growth since its inception. It is currently valued at $2.6T, and optimistic projections indicate continued expansion. The largest cryptocurrency, Bitcoin, boasts a market capitalization of $1.3T. Recent developments, such as increased governmental acceptance and the SEC’s approval of a Bitcoin ETF, are expected to drive demand for Bitcoin further.

BounceBit is introducing utility to major cryptocurrencies, presenting significant market potential. The platform offers yield for Bitcoin and leads innovation in the Bitcoin ecosystem. By combining the security of Bitcoin with Ethereum-like features, BounceBit is creating a new realm of opportunities. It expands the utility of the pioneering cryptocurrency while introducing a token economic model that emphasizes scalability, security, and inclusiveness. Additionally, Babylon is another project operating in the Bitcoin restacking ecosystem.

Token

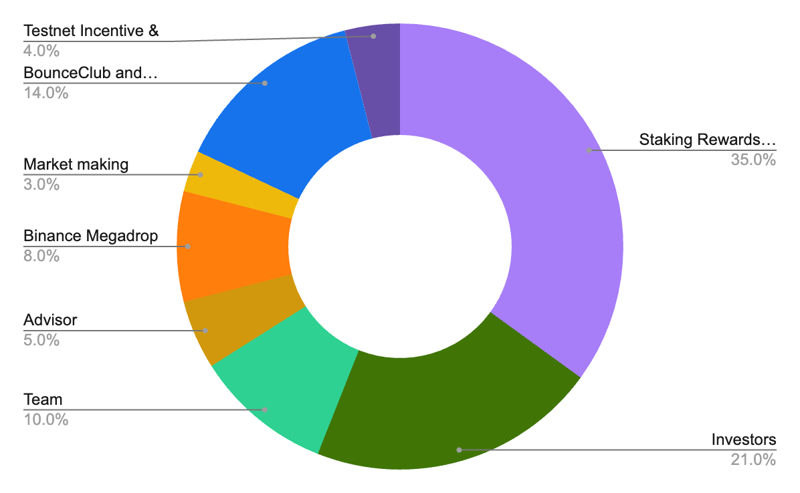

BounceBit’s dual-token system is a fundamental design feature that enhances network security, provides flexible staking mechanisms, and encourages user participation in governance. The $BB token, the platform’s native governance token, serves several key purposes. Firstly, $BB token holders can participate in governance decisions, influencing the platform’s development direction and key parameter adjustments. Secondly, $BB tokens can be staked to support network operations, with stakers receiving transaction fees and other incentives. Staking $BB tokens also contributes to network security, preventing double spending and other attacks. This design incentivizes holders to engage actively in platform maintenance and governance, ensuring its healthy development and long-term success. the distribution of $BB token can be seen in the above picture.

$BBTC, on the other hand, is a token pegged to the value of Bitcoin, primarily used to promote wider adoption of Bitcoin on the BounceBit platform. $BBTC increases Bitcoin’s liquidity and usability by allowing users to convert their Bitcoin to $BBTC and participate in various staking and investment opportunities, such as DeFi projects, on the BounceBit platform. Additionally, $BBTC can be freely transferred between blockchains, expanding Bitcoin’s circulation and utility in the broader blockchain ecosystem. By converting Bitcoin to $BBTC, users can maintain Bitcoin’s value while earning additional income through staking, addressing the challenges of lower liquidity and limited application scenarios for Bitcoin on its native chain.

Traction

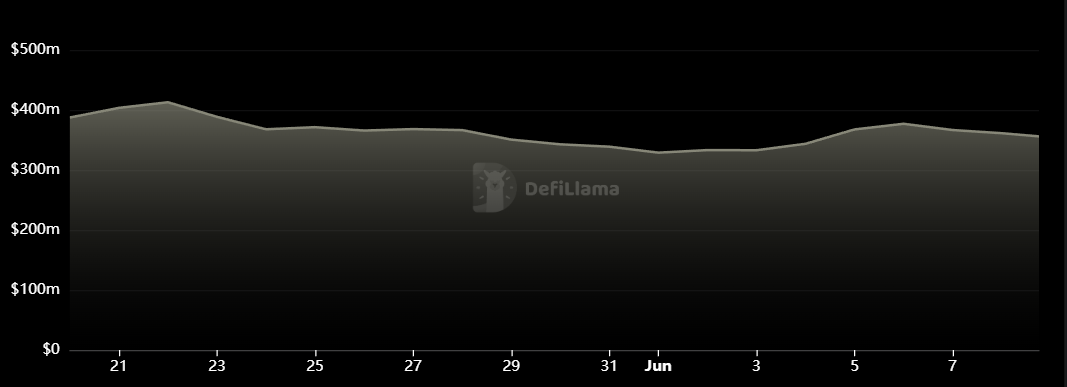

BounceBit has amassed $357 million in staked assets, indicating significant adoption and growing demand for its protocol. This milestone reflects the platform’s ability to attract users seeking innovative staking and yield-generation solutions. In addition to its financial success, BounceBit has cultivated a strong community on Twitter and Discord, demonstrating a robust and engaged presence within the crypto community. Bouncebit has a $1.6B FDV valuation, showcasing its growth and the project’s size.

Investors

Conclusion

BounceBit’s innovative approach introduces a new use case for the industry, representing a significant advancement in integrating Bitcoin with the Proof-of-Stake economy. Bouncebit’s innovative approach presents a promising solution to the scalability challenges of Bitcoin and other blockchain networks. Extending Bitcoin’s security to Proof-of-Stake (PoS) chains offers more opportunities through its CeDefi options. It was one of the first projects to offer more utility to Bitcoin. BounceBit has achieved great Total Value Locked (TVL) and holds a significant valuation above $1 billion, making the project noteworthy.

| Fundamental Analysis | |||||

| Assessment | |||||

| Problem | Significant, long-term problem | 3 | |||

| Solution | Distinct, defensible solution | 3 | |||

| Market Size | Massive market with high growth rates, or untapped niche with high potential | 4 | |||

| Competitors | Emerging market with few strong competitors | 3 | |||

| Unique Value Proposition | Clear differentiation and value for customers | 3 | |||

| Current Traction | High traction, strong user growth and retention | 4 | |||

| Unit Economics | Positive unit economics, with plans for further improvement | 3 | |||

| Tokenomics | Basic token strategy, potential for improvement | 2 | |||

| Product Roadmap | Unclear or unrealistic product roadmap | 1 | |||

| Business Model | Proven business model with clear path to profitability | 3 | |||

| Go-to-Market Strategy | Solid GTM strategy, clear target market and channels | 3 | |||

| Regulatory Risks | Minimal regulatory risk, strong mitigation and adaptability | 4 | |||

| Total | 75.00% | ||||