Market Update

PAX Gold: Daily

Past performance is not indicative of future returns.

Gold is top of mind these days. Geopolitical troubles and the Bank of England’s bailout of UK pension funds point to a need for a safe-haven asset. PAXG seems to have bottomed after DXY (Dollar Index) topped. That said, it’s not a bull market until you can buy a dip and make money. The Williams oscillator in PAXG shows a big move is coming. If PAXG can take out 1732, the big move could be up. 1732 is important because that is where the give-up trade to the downside began. If PAXG can not take out 1732, then any rally might have to be after CPI on October 13.

S&P Futures: Daily

Past performance is not indicative of future returns.

S&P (ES1) reached a downside target of 3726 and bounced. At the time the low was made, people were as bearish as they were in 2008. The bounce off 3726 may imply an intermediate-term bottom. Said differently, risk assets may enjoy a robust rally during the month of October.

Brent Crude Oil Futures: Daily

Past performance is not indicative of future returns.

Oil is rallying. Brent crude hit a big technical inflection point and has bounced. The oil rally is likely the cause of the anemic price action in crypto. The oil rally is likely a seasonal phenomenon (Source: @spiralcal), and the rally may have run its course. If the oil stalls, that could favor bitcoin.

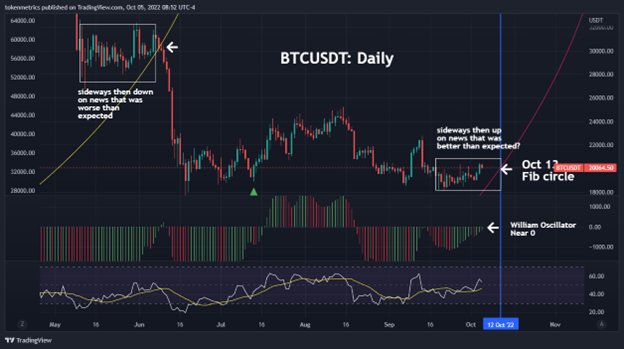

Bitcoin Daily Chart

Past performance is not indicative of future returns.

Even though bitcoin is going sideways, there is still a lot to discuss. The current range seems similar to the range that preceded the last downtrend. In that case, the Williams oscillator reached zero, BTC moved through a Fib circle level, and then a sharp downtrend began. In the current case, bitcoin is moving toward a Fib circle level. If BTC stays near 20k, bitcoin should reach another Fib circle structure on October 12. That is one day before the next CPI report. Also of note is that the Williams Oscillator is headed for zero. This development could indicate another big move could unfold. It may be wise to be open to the idea that the next big move could up.

ETHBTC: Daily Chart

Past performance is not indicative of future returns.

ETH continues to underperform BTC. The ETHBTC charts hints that it could continue until ETHBTC hits the 62% retracement of its merge-up move. That level is .063.

Bottom Line

If oil stops rallying, we see upside potential in gold, growth stocks, and bitcoin. 49% of Millennials sold their risk assets during 2022 (source: @dimit). This development creates a scenario where investors may pile back in for fear of missing out. Also, don’t forget that BTC is sitting on support in the form of the 2017 high.