We scored many projects this week. Please remember that some of these projects still need our code review process. Still, we want to call them out here because they preliminarily caught our eye based on our fundamental analysis process.

Usual – 75.24%

Website | X(Twitter)

Sector – RWA/DeFi

Status – Active

Usual is a decentralized protocol aggregating real-world assets (RWAs) into a stablecoin named $USD0, bridging traditional finance and DeFi. It is a stablecoin issuer that redistributes ownership and governance through the $USUAL token. The total value locked (TVL) on the protocol is $1.57B, and the total users on the platform are 88,300.

The protocol aggregates yield generated by the collateral backing its stablecoin into the protocol’s treasury. Rather than redistributing this yield directly as cash flow, the value is retained within the protocol, enhancing the intrinsic worth of the governance token ($USUAL).

Features

- Revenue Sharing: The Protocol redistributes its revenue to token holders, aligning incentives with its growth and usage.

- Decentralized Governance: A governance model where token holders can influence decisions, ensuring community-driven development and transparency.

- Integration with DeFi: USD0 integrates with various DeFi protocols, enhancing liquidity provision and investment opportunities within the broader DeFi ecosystem.

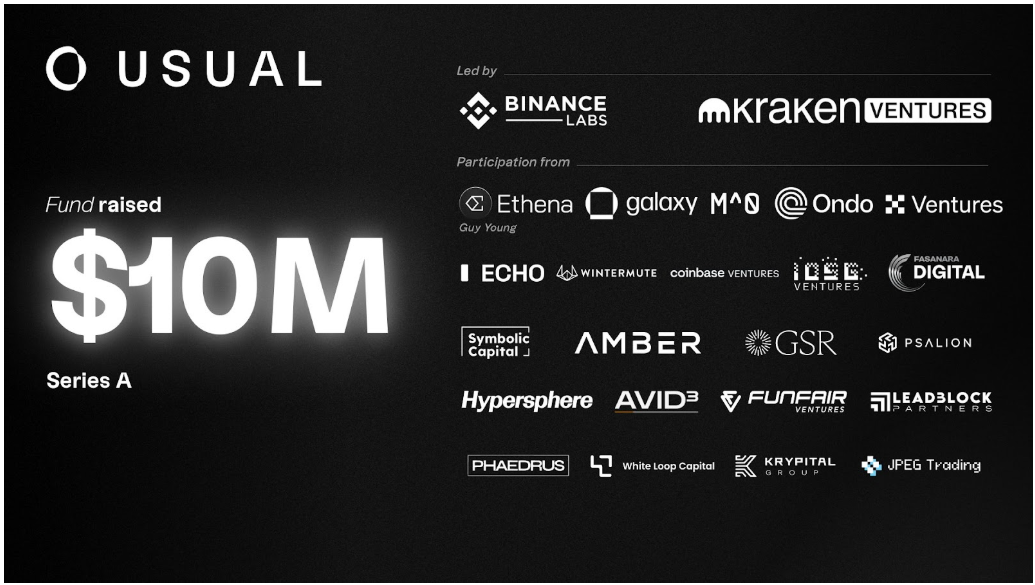

Investors

Token

The protocol has three tokens, USD0 for stability, USD0++ for growth, and $USUAL for real governance with revenue-sharing, all working together to power Usual’s future.

- USD0: The first RWA stablecoin that aggregates various US Treasury Bill tokens.

- USD0++: A liquid staking version of USD0, acting like a savings account for Real-World Assets with a 4-year lock-up. It offers rewards while remaining transferable.

- USUAL: USUAL fuels USD0’s adoption and rewards active users, aligning incentives with contributors to power the protocol’s growth.

$USUAL token grants users ownership and decision-making power over the protocol, its treasury, and future revenues, aligning incentives and fostering sustainable growth.

Where can you buy the token?

You can buy $USUAL on centralized exchanges such as Binance, Gate.io, Bitget, MEXC, KuCoin, and BingX.

Kaito AI – 71.43%

Website | X(Twitter)

Sector – InfoFi/AI

Status – Active

Kaito is an AI-powered search engine designed for the crypto and Web3 community. It aims to aggregate and make various blockchain-related content searchable from multiple platforms. It indexes thousands of premium Web3 sources that are currently not readily available via Google.

Kaito extensively leverages LLM to transform how users engage with information on and around the blockchain. Their goal is to democratize access to information within the cryptocurrency and Web3 ecosystem. The platform invites users to YAPP (to share expertise on different topics) to get rewarded.

Features

- MetaSearch: Search any ticker, topic, or trend for instant insights in seconds across thousands of premium Web3 sources.

- Sentiment Tracking: Provides insights into the factors affecting large sentiment changes over time and interprets complex sentiment data with AI-powered analytics.

- Smart Alerts: Smart Alerts for any project, topic, keyword, event, sentiment change, etc.

- Dashboard & Feeds: Customized watchlists for tokens, projects, or topics allow you to track the latest news, governance proposals, discussions, sentiment changes, upcoming catalysts, and events.

- Token Mindshare: Monitors and benchmarks project mindshare changes over time.

- Narrative Mindshare: Track narrative rotations to understand the momentum and identify upcoming narratives.

- Catalyst Calendar: Track events and catalysts for 2000+ tokens across crypto in real-time, from product launches, tokenomics changes, unlocks, TGE, governance votes, and much more.

- Audio Library: Access podcasts conference transcripts with TLDR summaries.

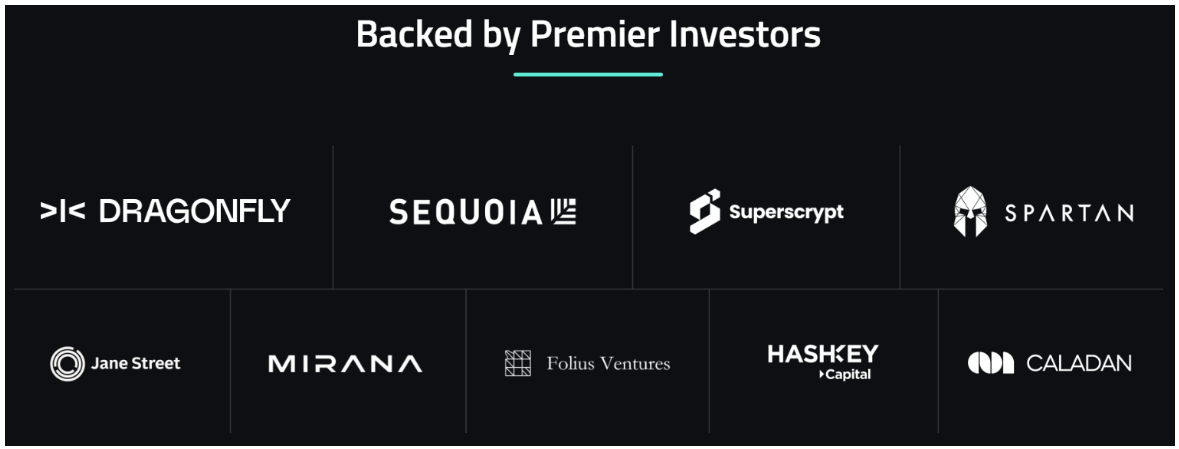

Investors

Vertical AI – 70.48%

Website | X(Twitter)

Sector – AI Marketplace

Status – Active

Vertical AI provides a platform where users can create, fine-tune, and monetize industry-specific AI models without coding, harnessing decentralized GPU resources. The platform aims to democratize AI model creation and usage, making AI accessible across various industries.

By removing technical and financial barriers, Vertical aims to empower users to create and customize AI models with no-code studio for industry-specific challenges and generate revenue from your models by listing them on the marketplace.

Features

- Decentralized AI Development: Users can leverage a network of GPUs to train and run AI models, enhancing scalability and reducing costs.

- No-Code AI Model Creation: The platform simplifies AI development, making it accessible to those without technical expertise in machine learning or coding.

- Marketplace for AI Models: Users can test, share, and monetize their AI models, fostering a community-driven ecosystem of industry-specific AI solutions.

Token

$VERTAI is the native token of the ecosystem. Token holders can earn a share of up to 20% of the platform’s profits, including revenue from marketplace transactions, subscription payments, and query cost margins.

By burning $VERTAI, users can unlock premium features such as advanced fine-tuning tools, priority listings, and enhanced analytics. Top-tier $VERTAI holders gain access to an exclusive Whale Chat, offering perks like early feature access, priority support, and influence over platform decisions.

Where can you buy the token?

You can buy $VERTAI on the decentralized exchange Uniswap.

Abstract – 69.52%

Website | X(Twitter)

Sector – Layer 2

Status – Testnet

Abstract is an Ethereum Layer 2 network built using the Zk Stack. It is designed to provide a seamless, consumer-centric blockchain experience, focusing on simplifying user onboarding and enhancing app discoverability. The platform aims to bring the next generation of crypto users on-chain, focusing on usability and accessibility.

Abstract has garnered attention for its user-friendly approach and partnerships with established players like Pyth Network for real-time market data integration. The key innovation is its account abstraction technology, which eliminates the need for traditional wallet setups like seed phrases, thus enhancing user experience by simplifying blockchain interactions.

Features

- Account Abstraction: The platform’s core technology allows for transactions without the complexities of managing keys, making blockchain interactions as straightforward as using traditional apps.

- Session Keys: It enables users to grant temporary app access for automatic transaction approval, enhancing user experience by reducing interaction friction.

Investors

Abstract Chain is backed by Animoca Brands, Founders Fund, Fenbushi Capital, 1k(x), EVG, and Selini.

Hyperbolic – 69.52%

Website | X(Twitter)

Sector – AI/GPU

Status – Active

Hyperbolic is a decentralized platform offering affordable AI computing resources. It specifically focuses on GPU access and inference services for developers and researchers. The platform aims to democratize AI by providing global innovators with open-access, scalable, and cost-effective computational resources.

Hyperbolic leverages blockchain for trustless, decentralized GPU compute access and introduces Proof of Sampling (PoSP) for verifiable AI services, enhancing security and scalability. The team has engaged over 40,000 developers through its GPU compute platform, indicating significant market adoption.

Their live beta version of the GPU marketplace allows for the renting and supplying GPUs. Hyperbolic’s AgentKit, also live now, enables AI agents to autonomously manage their compute resources.

Features

- Decentralized GPU Network: This technology utilizes a global network of underutilized GPUs to provide cost-effective computing power, reducing the financial barriers to AI development.

- Verifiable AI Inference: Through PoSP, Hyperbolic ensures that AI services are performed honestly and can be verified, contributing to trust in AI computation outcomes.

- AI Agent Autonomy: With AgentKit, AI agents can independently manage their computational needs, promoting efficiency and reducing reliance on human oversight.

Investors

Hyperbolic raised a $7M Seed round in July 2024, led by Polychain Capital and Faction, with participation from Chapter One, LongHash Ventures, Bankless Ventures, Santiago R. Santos, and others.

Subsequently, they raised a $12M Series A round in December 2024, led by Polychain Capital and Variant. Other investors were IOSG Ventures, Wintermute, GSR, Chapter One, Alumni Ventures, etc.