Executive Summary

EigenLayer represents a pioneering protocol established on the Ethereum network, introducing the concept of ‘restaking’. This innovative framework enables Ethereum stakers to redeploy their staked ETH or Liquid Staking Tokens (LSTs) across various applications, fortifying the network’s crypto economic security. By facilitating pooled security, EigenLayer effectively diminishes the capital expenses for stakers while reinforcing confidence across diverse services. Noteworthy features include customizable decentralization choices, distinctive slashing mechanisms tailored for each service, and operator delegation, granting stakers the ability to delegate operations while actively contributing to the network’s security.

How EigenLayer Works

Cryptoeconomic security has been a persistent challenge in Web3 development, from Bitcoin’s early days to recent Ethereum upgrades. Fragmented security, especially on Ethereum, poses a significant hurdle. Middleware and non-EVM applications build their trust networks, leading to inefficiencies in cost and time.

EigenLayer addresses these issues with the restaking primitive. Users staking $ETH can repurpose locked funds to enhance security for other Ethereum applications. This mechanism creates an opt-in middle layer, granting EigenLayer enforcement rights over staked $ETH. Notably, EigenLayer introduces additional slashing conditions beyond the consensus layer, supporting extensible security for emerging projects like bridges and data layers.

EigenLayer deploys restaked $ETH to various applications, using slashing conditions to encourage honest behavior. This design enables staked $ETH to provide validation services beyond Ethereum itself.

EigenLayer has developed two distinct restaking mechanisms:

- Native Restaking: This involves directing the withdrawal credentials of previously staked Ethereum (ETH) to EigenLayer’s smart contracts.

- Liquid Restaking: This mechanism entails the transfer of liquid staking derivatives into EigenLayer’s smart contracts. Applicable to tokens such as stETH, rETH, cbETH, and LsETH, this method offers a flexible approach to restaking within the EigenLayer ecosystem.

Features

Custom Decentralization: In anticipation of exponential growth among native ETH restakers, EigenLayer offers a customizable approach to decentralization. Native stakers can opt-in to secure services prioritizing high decentralization, restricting participation to native stakers only. Examples of services emphasizing decentralization include those supporting censorship resistance through multilateral ordering, secret sharing, and MPC across multiple nodes. To enhance opt-in rates from native Ethereum stakers, services valuing decentralization should maintain lightweight off-chain software container requirements, minimizing the infrastructure demands on participating stakers.

Custom Slashing: EigenLayer ensures cryptoeconomic security through diverse slashing mechanisms imposing a substantial cost on corruption. Each service deploys a slashing contract detailing the terms and conditions of slashing. By choosing to restake with a specific service, stakers acknowledge the risk of potential slashing by the rules outlined in the slashing contract. Opted-in restakers receive additional rewards on their staked ETH, while participating validators generate extra revenue from the services benefiting from their validation operations. EigenLayer employs the service’s slashing contract to verify malicious behavior during disputes, subsequently slashing the offending staker.

Operator Delegation: In the realm of EigenLayer, potential participants, or stakers, may harbor an interest in the platform but may choose to abstain from managing the intricacies of software containers for services independently. EigenLayer accommodates such preferences by introducing a mechanism for stakers to delegate operational responsibilities to operators who commit to running validated service software modules on their behalf. When opting for delegation, stakers consider key criteria, including evaluating the operator’s trustworthiness through due diligence to avoid potential slashing of assets in the event of unfulfilled obligations. Additionally, delegation decisions may be influenced by the allure of maximum rewards offered by specific operators and the alignment of services with personal interests, risk assessments, or reward preferences. For those inclined towards a trust-minimized approach, EigenLayer ensures flexibility by allowing stakers to act as their operators during the delegation process.

Market Analysis

Ethereum’s notable transition from a proof-of-work to a proof-of-stake consensus mechanism has significantly altered the paradigm of transaction verification on the network. This evolution dictates that validators assume verification responsibilities, supplanting proof-of-work miners. The accessibility for anyone to become a validator by staking 32 ETH in the network and subsequently earning staking rewards has transformed Ethereum staking into a viable income-generating opportunity. However, a notable caveat arises, as individuals must stake their ETH for an extended duration, resulting in illiquidity.

Addressing this concern, a groundbreaking concept of Liquid Staking Derivatives (LSD) emerged, offering a unique solution. LSDs empower users to maintain ownership of their staked assets while concurrently receiving tradable tokens reflective of the value of their staked position. By injecting liquidity into staked assets, users can actively participate in trading, lending, or leverage their staked assets for diverse purposes, all while contributing to the security and governance of the underlying blockchain network. Utilizing liquid staking derivatives enables users to optimize their yield potential, engaging in other decentralized finance (DeFi) activities, such as yield farming or providing liquidity, fostering dual participation to maximize returns and explore additional income streams. Notably, the current market valuation of LSD stands at $28B, according to Coingecko.

EigenLayer takes a pioneering step by introducing a novel concept of restaking, allowing individuals who have already staked their Ethereum (ETH) or Liquid Staking Tokens to double down by restaking these assets. This innovative approach enables them to contribute additional security measures to emerging decentralized services on Ethereum, simultaneously earning extra rewards. EigenLayer’s strategy proves mutually beneficial, enhancing the security infrastructure across Ethereum services without necessitating stakers to infuse additional capital. This proves particularly advantageous for new decentralized applications (dapps) on Ethereum, as they can seamlessly integrate with EigenLayer, leveraging the existing pool of stakers instead of embarking on a trust-building process from scratch. This approach effectively eliminates fragmentation, fostering a more unified and secure ecosystem.

EigenDA

EigenDA is a secure, high-throughput, and decentralized data availability (DA) service strategically constructed atop the Ethereum network, utilizing the innovative EigenLayer restaking primitive. Conceived and developed by EigenLabs, EigenDA represents the inaugural actively validated service (AVS) set to launch within the EigenLayer framework. Through this platform, restakers can delegate their stake to node operators responsible for executing validation tasks specific to EigenDA, receiving service payments in return. Moreover, rollups within the EigenLayer ecosystem can seamlessly submit data to EigenDA, capitalizing on reduced transaction costs, elevated transaction throughput, and enhanced secure composability. EigenDA’s security and throughput mechanisms are designed to scale horizontally with the cumulative restake amount and the number of operators opting into servicing the protocol. This forward-looking initiative positions EigenDA as a pivotal component within the EigenLayer ecosystem, promising increased efficiency and security for its users.

Adoption

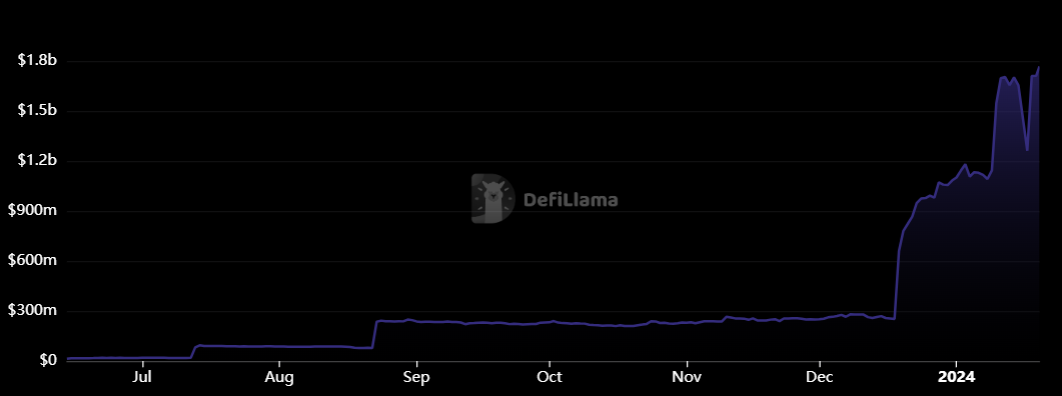

EigenLayer, characterized by its pioneering concept and compelling use case, has garnered substantial adoption within the blockchain community. The platform boasts a significant Total Value Locked (TVL) of $1.75 billion, indicating remarkable user interest and engagement. As the adoption continues to grow, EigenLayer stands as a testament to the success of its innovative approach in the blockchain landscape.

Benefits of EigenLayer

- Enhanced Protocol Security: EigenLayer enhances protocol security by incentivizing ETH stakers to participate, tapping into Ethereum’s robust security layer and expanding access to a diverse set of validators.

- Unparalleled Flexibility: Protocols on EigenLayer enjoy autonomy, retaining control over architecture elements like consensus mechanisms and slashing conditions, tailoring their structures to specific needs for a dynamic ecosystem.

- Optimized Capital Efficiency: EigenLayer boosts capital efficiency by allowing stakers to restake ETH across multiple protocols, aligning with market trends favoring liquid staking derivatives. This approach maximizes returns and diversification opportunities in the DeFi landscape.

Investors

Eigenlayer has esteemed investors like Blockchain Capital, Polychain Capital, Ethereal Ventures, Electric Capital, Polychain Capital, Hack VC, Finality Capital, Coinbase Ventures and more.

Team

Sreeram Kannan assumes the role of founder and CEO at Eigenlayer. Alongside this position, he holds the title of associate professor at the University of Washington and serves as the head of the UW Blockchain Lab. The initial team members of EigenLayer emerged from this esteemed academic laboratory, fostering a strong foundation for the project. The EigenLayer team boasts extensive expertise.

Conclusion

EigenLayer envisions the establishment of a restaking marketplace, fostering a dynamic environment where protocols can purchase pooled security from validators, while validators can reciprocally sell pooled security to protocols. Distinguished as one of the noteworthy protocols developed recently, EigenLayer’s architecture stands out for its ability to benefit diverse stakeholders. Developers engaged in protocol development now enjoy unprecedented access to limitless innovation possibilities, while market participants can effectively deploy their capital to secure additional rewards. This multifaceted approach enhances the potential for developers and market participants and contributes to the overall robustness of the blockchain landscape. The improved security and innovation introduced by EigenLayer are anticipated to be pivotal factors driving increased user engagement within the ecosystem.

| Fundamental Analysis | |||||

| Assessment | |||||

| Problem | Significant, long-term problem | 3 | |||

| Solution | Distinct, defensible solution | 3 | |||

| Market Size | Large market, significant growth potential | 3 | |||

| Competitors | Uncontested market space, first-mover advantage | 4 | |||

| Unique Value Proposition | Clear differentiation and value for customers | 3 | |||

| Current Traction | High traction, strong user growth and retention | 4 | |||

| Unit Economics | Positive unit economics, with plans for further improvement | 3 | |||

| Tokenomics | No clear token strategy or poorly conceived strategy | 1 | |||

| Product Roadmap | Unclear or unrealistic product roadmap | 1 | |||

| Business Model | Proven business model with clear path to profitability | 3 | |||

| Go-to-Market Strategy | Basic GTM strategy, lacks detail or differentiation | 2 | |||

| Regulatory Risks | Minimal regulatory risk, strong mitigation and adaptability | 4 | |||

| Total | 70.83% | ||||