Executive Summary

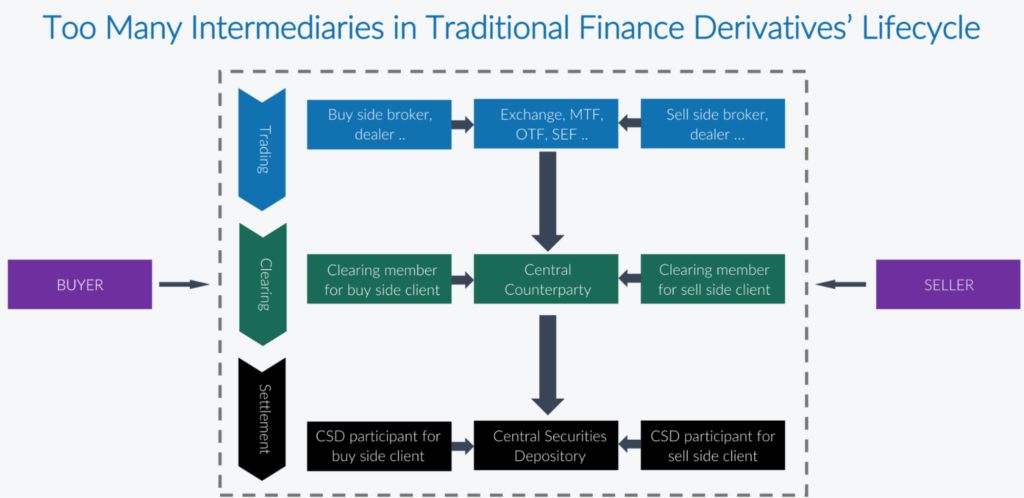

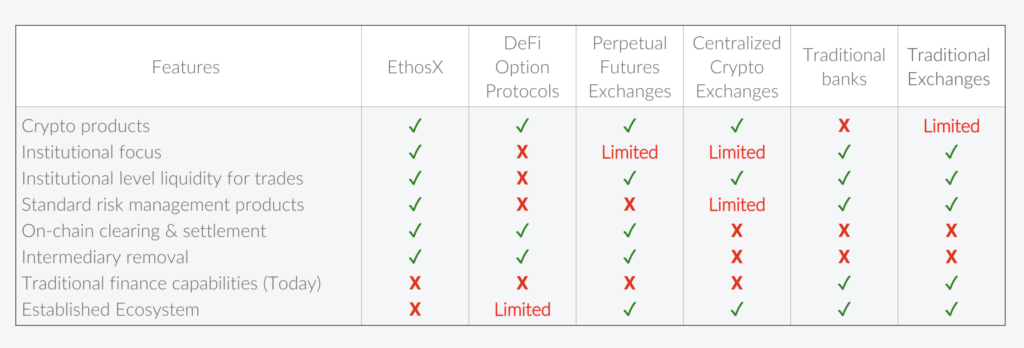

EthosX is a blockchain-based platform for automated and non-custodial clearing and settlement of financial derivatives. It offers customizable crypto options, and access to liquidity, and has an experienced team. EthosX serves both institutional and retail clients and generates revenue from trading fees and yield farming. Its native token is used for transaction fees, staking rewards, and governance voting. EthosX is secure, user-friendly, and has a fast and reliable trading engine. It has potential as a major player in the crypto derivatives market. The platform also offers on-chain over-the-counter derivatives trading, starting with crypto options, and the entire post-trade process is non-custodial and automated. Collateral deposited for derivative trade can earn an additional yield on defi protocols. More derivatives types are coming soon.

Company Overview

EthosX is building a blockchain-based decentralized infrastructure for clearing and settling financial derivatives in both crypto and traditional finance sectors. The platform offers customizable vanilla and exotic crypto options and has integrated with Liquidity while negotiating with leading lending protocols like MakerDao, Aave, and Venus.

The founders of EthosX have relevant market experience in options and derivatives, technical proficiency, and established partnerships. Key team members include experienced professionals from the fields of finance, technology, and blockchain development. EthosX aims to serve both institutional and retail clients and secure liquidity from prominent hedge funds and market makers.

Market Analysis

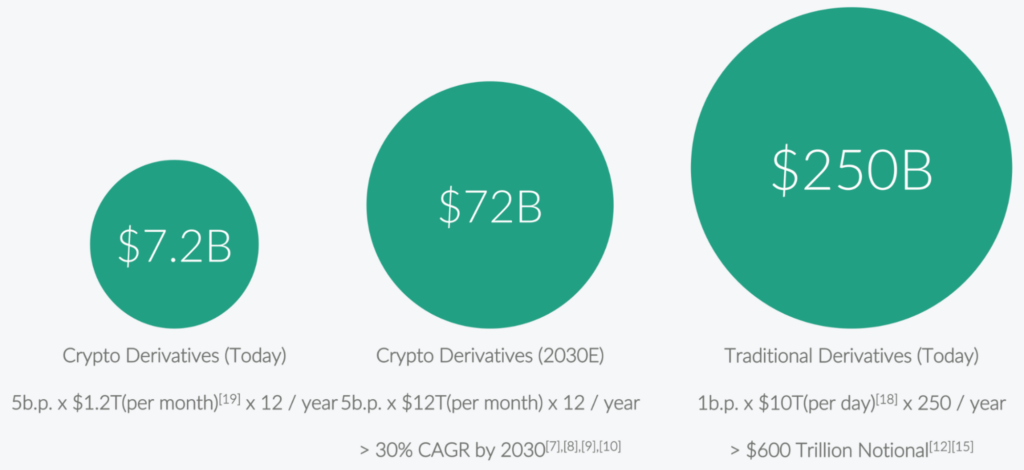

The crypto sector has been growing rapidly, and it is estimated that it represents only about 3% of the total derivatives market. However, there is great potential for growth in the crypto derivatives market in the coming years, with experts predicting that it could expand tenfold by 2030. This growth is expected to be driven by increasing demand from both retail and institutional investors who are looking to diversify their portfolios and take advantage of the opportunities offered by crypto derivatives. EthosX aims to capture a significant market share from centralized rivals like Deribit and Bybit, as well as decentralized competitors such as Ribbon Finance, Dopex, and Lyra.

Product/Platform

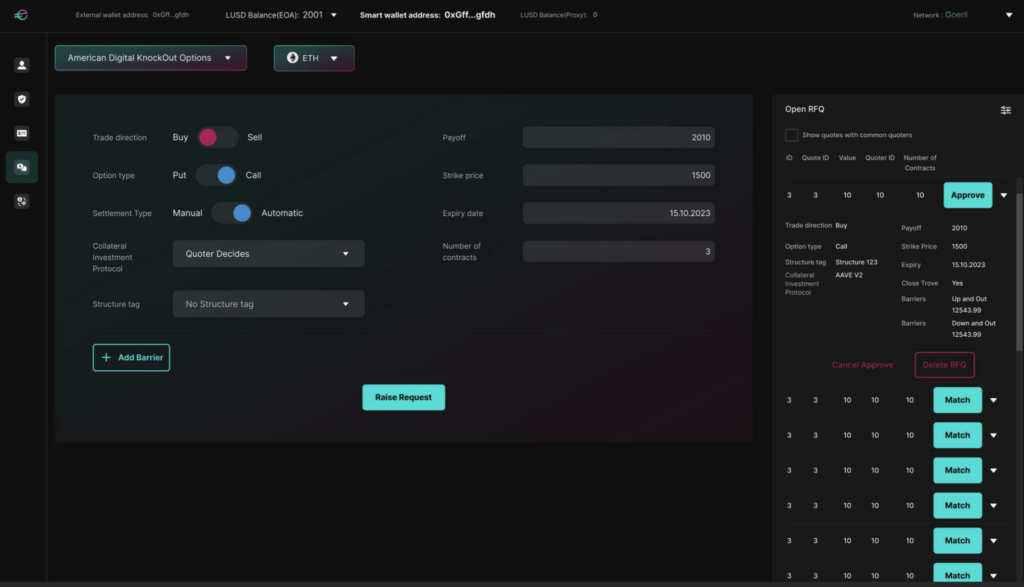

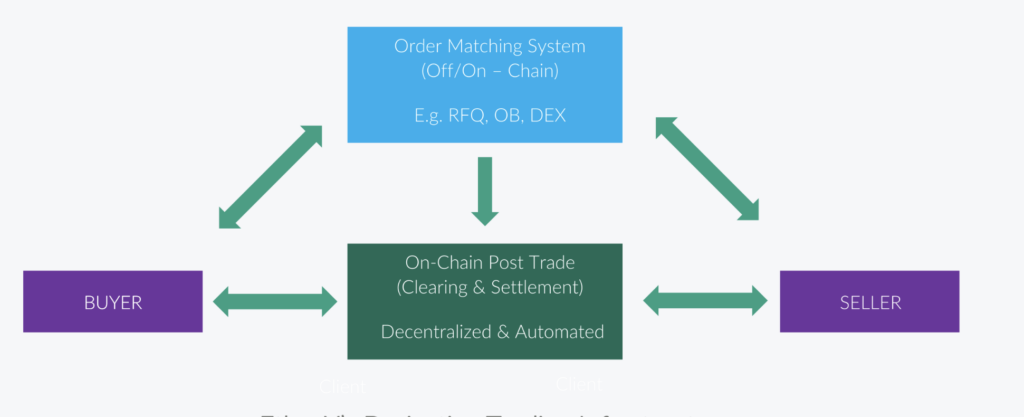

EthosX is a platform that offers a wide range of services to its users, including customizable crypto options and full control over assets. It leverages an over-the-counter on-chain put option strategy for extra security and provides users with a variety of tradable derivatives to manage risk. EthosX also integrates with lending protocols to provide put-option insurance. Overall, EthosX is a comprehensive and secure platform for crypto investors and traders.

Business Model

EthosX is a blockchain-based decentralized platform that offers automated and non-custodial clearing and settlement of financial derivatives. Its revenue model depends on trading fees, which are designed to be competitive with other decentralized exchanges, making it an attractive option for users. To attract a diverse range of clients, EthosX has developed a customer acquisition strategy that includes targeted marketing campaigns, educational content, and strategic partnerships. By offering educational content, the platform aims to attract new users who may be unfamiliar with decentralized finance and provide them with the resources they need to make informed investment decisions.

EthosX also partners with MakerDao, Aave, and Venus, among others, to give users access to a wider range of liquidity options. These partnerships not only increase the platform’s visibility but also give users more opportunities to borrow and lend various assets. The platform is committed to expanding its network of partners to provide the best possible service to its users. Additionally, EthosX offers incentives to its users, such as no trading fees for the first 3 months, rebates on gas usage, and revenue sharing for top market makers.

Tokenomics

The native token of EthosX is still in roadmap but will have multiple use cases, Aside from being used for transaction fees, it will also provide staking rewards for investors, and will be utilized for governance voting. In terms of token distribution, there will be allocations for different purposes such as team members, investors, ecosystem development, and community incentives. With EthosX’s innovative governance model, token holders will be given the power to vote on different proposals that will influence the platform’s development and direction. This ensures that the platform is shaped according to the needs and preferences of the community. By giving token holders the ability to influence the platform’s development, EthosX is able to build a strong and engaged community that is committed to the platform’s success.

Risk Assessment

EthosX faces challenges in the DeFi and derivatives trading space, including competition, regulatory compliance, security breaches, user experience, and liquidity. To address these challenges, EthosX is focusing on innovation, regulatory compliance, security audits, user education, and engagement with liquidity providers and market makers.

Conclusion

EthosX is a blockchain-based platform that offers customizable crypto options and access to liquidity. It aims to transform the way institutional and retail investors trade cryptocurrency, and generate revenue from trading fees and yield farming. EthosX is well-positioned to capture a significant market share and generate substantial profits in the competitive crypto derivatives market.