Executive Summary

GRVT is an innovative hybrid exchange (HEX) that uses advanced technology (zk-powered volition) to separate the exchange and custody functions. This is backed by a central system that matches orders and processes transactions using blockchain and smart contracts for managing trading margins. This ensures that users don’t have to worry about risks from others involved and always maintain complete control over their assets.

Company/Project Overview

Their objective is to reshape the financial landscape through the innovative application of blockchain technology, enabling individuals to exercise absolute authority over their financial resources at their convenience. Positioned at the crossroads of established financial practices and blockchain innovation, they are dedicated to crafting a state-of-the-art digital asset platform of the future. This platform empowers users with the capacity to securely own, transfer, and trade their assets while maintaining their privacy.

Their groundbreaking hybrid exchange (HEX) employs zk-powered volition technology to distinctively bifurcate exchange and custody functionalities. Supported by a central order matching engine, inherent blockchain settlements, and dynamic margin management driven by smart contracts, their trading framework eradicates counterparty vulnerabilities. This approach empowers users with relentless control over the safekeeping of their assets.

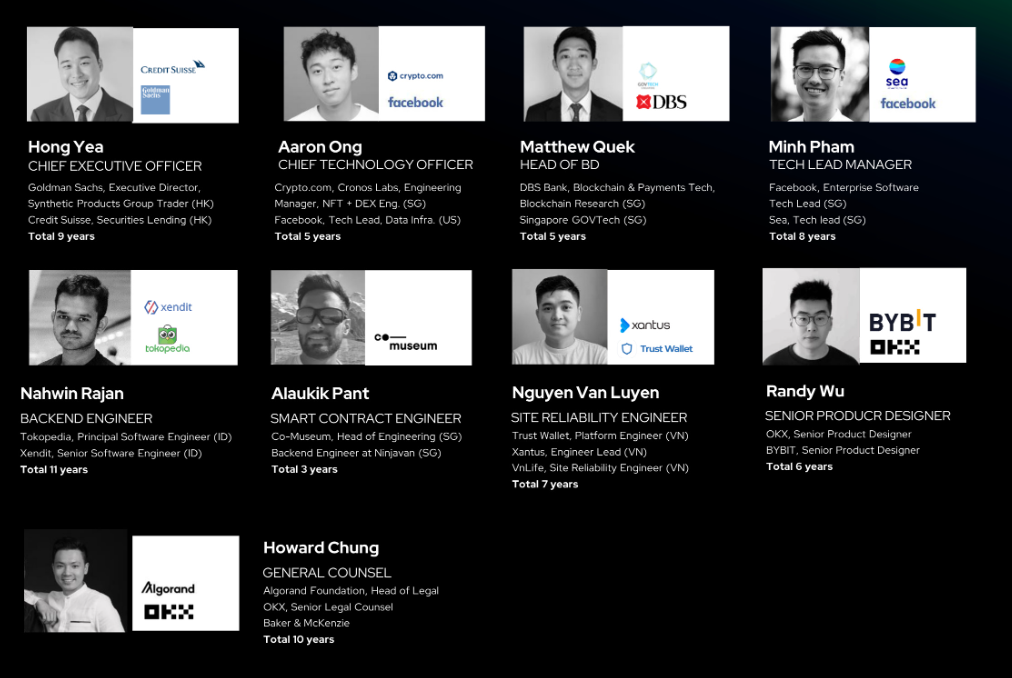

The team consists of seasoned professionals, each bringing a wealth of robust experiences from their tenure with esteemed organizations such as Facebook, DBS, Goldman Sachs, DBS, Bybit, OKX, and crypto.com. The diverse expertise of the team strengthens the project.

Market Analysis

As of the latest data available in March 2023, cryptocurrency derivatives maintain their prominent position within the market, commanding a substantial 74.8% share of the overall trading volume in the cryptocurrency sector, which stands at $2.95 trillion. Projections indicate a sustained upward trajectory for this market, driven by the escalating adoption of decentralized finance (DeFi) practices.

In this landscape, the potential for growth of the GRVT platform emerges as substantial. Nonetheless, it is essential to acknowledge the formidable competition of well-established entities in this sector. What sets GRVT apart is its distinctive positioning as a hybrid exchange, combining elements of both Centralized Finance (CeFi) and Decentralized Finance (DeFi). This innovative approach empowers users with a secure framework for ownership, seamless transfer, and efficient trading of their assets, all while safeguarding their privacy.

Product/Platform

GRVT acts as a bridge, melding the advantages of the CeFi and DeFi realms. On the one hand, it furnishes a centralized trading platform boasting swift throughput, efficient order book trading, and an intuitive interface. On the other, it embraces DeFi attributes through self-custody and blockchain assurance for secure and trustless trading, distinctly segregating settlement and trading functions. This fusion optimally amalgamates CeFi’s strengths with DeFi’s merits, delivering users an uninterrupted and inventive trading journey.

GRVT’s array encompasses a comprehensive range of derivative products: perpetual contracts, options, and derivatives combo structures. Furthermore, anticipated expansion in 2024 will contain structured products and spot trading, broadening horizons for users across diverse asset classes.

GRVT offers the following advanced features –

Self-Custody Trading – Users can take charge of their trading with self-custody and on-chain margin management, leveraging smart contracts in partnership with zkSync to eliminate counterparty risk.

Confidential Trading – Users can protect their trading advantages using validium technology, deploying zero-knowledge proofs for complete trade confidentiality.

Capital Efficiency – Maximize capital utilization through their leading margin model, featuring portfolio margining, cross margining, and intermarket hedging.

Lightning Fast Orderbook – Trade swiftly with their central limit order book, offering 600,000 TPS order book matching and under 2-millisecond latency.

RFQ Block Trading – Receive personalized quotes for multi-leg derivatives combinations through their RFQ Block Trade feature.

KYC & AML Compliance – Ensures safety with KYC & AML process, verifying all customers and wallets.

Multilevel Security – User funds are safeguarded by a security system that includes password checks, two-factor authentication, wallet private vital controls, and smart contract oversight.

Business Model

GRVT will charge a small percentage of settlement and clearing fees from the users, depending on their trade volume. Additionally, during instances of liquidation, the platform will institute a liquidation fee set at 2.5%.

They have an effective go-to-market strategy, where they will incentivize individuals and communities to market for them. Participants will be offered a trading revenue share of up to 20% for each individual they successfully refer to as a reciprocal arrangement for their efforts.

Starkware plays a pivotal role as an investor and technological collaborator for GRVT. Together, they are actively engaged in the joint design of options and futures within the StarkEX framework and facilitating on-chain confidential trading through validium technology.

GRVT has entered a strategic partnership with zkSync, positioning itself as a prominent exchange within the zkSync ecosystem. This partnership underscores GRVT’s commitment to staying at the forefront of blockchain innovation and providing its users with the most advanced and secure trading solutions available in the market.

GRVT has raised money from Matrix Ventures, Delphi Digital, ABCDE, Susquehanna International Group(SIG), Hack VC, Folius Ventures, Starkware, Kronos, 500 Global, and Metalpha.

Tokenomics

Details about their token will be disclosed at a later time.

Risk Assessment

Operating within the dynamic and competitive DeFi market, GRVT finds itself in the company of well-established participants. This prevailing landscape can influence the trajectory of the project and its avenues for growth. New regulations in the DeFi space could also pose as a roadblock. GRVT faces challenges in DeFi and derivatives trading, including tough competition, unclear rules, security concerns, user experience, and encouraging trading.

Conclusion

GRVT is at the crossroads of traditional finance and blockchain, creating a modern digital asset platform. This empowers users to own, transfer, and trade their assets privately. Their groundbreaking hybrid exchange (HEX) stands out. It separates exchange and custody functions using innovative ZK-powered technology. With a central order matching engine, blockchain settlements, and smart contract margin management, their setup removes risk and gives users complete control over their assets.