TOKEN METRICS WATCHLIST

We scored many projects this week. Here are a few you should know about:

- ALEX

- PYTH Network

- MASQ

- exaBITS

- 0xAnon

Please remember that some of these projects must still be subjected to our code review process. Still, we want to call them out here for preliminarily catching our eye based on our fundamental analysis process.

ALEX -64.58%

Website | Twitter

Website | Twitter

Sector – DeFi Infrastructure

Status – Active

TVL – $14M

ALEX is spearheading the development of a DeFi platform targeting next-generation Bitcoin users and developers. ALEX uses Stacks technology to create DeFi primitives that facilitate trading, lending, borrowing, and token issuance, leveraging Bitcoin as the settlement layer and Stacks as the smart contract layer.

Ecosystem

The platform’s suite of DeFi tools offers an array of diverse functionalities. BRC20 Inscriptions streamline deploying, minting, and securely transferring BRC20 tokens, ensuring efficient management. ALEX’s hybrid Launchpad presents a lottery-based approach for project token launches, merging off-chain and on-chain models to optimize the user experience. Additionally, its bridging capabilities facilitate seamless token transfers across EVM, Bitcoin, and Stacks, bolstering interoperability.

ALEX’s trading solutions encompass Automated Market Making (AMM) and an order book. Drawing inspiration from Balancer V2, the AMM feature enables users to trade tokens, provide liquidity, and execute various strategies. The Orderbook ensures rapid trade confirmations secured by Bitcoin, leveraging a hybrid on-chain/off-chain design for commitment and settlement. ALEX’s partnerships with industry leaders and major indexers strengthen decentralized consensus in BRC20 indexing. The Bitcoin Oracle establishes a tamper-proof, censorship-resistant indexing oracle for meta-protocols on Bitcoin, leveraging Stacks’ L2 attributes for decentralized consensus. Operating under a federated model, it relies on a consortium of off-chain indexers to validate and submit the latest meta-protocol transactions to the on-chain smart contract authored by ALEX, ensuring validator accountability.

Team

Investors

Token

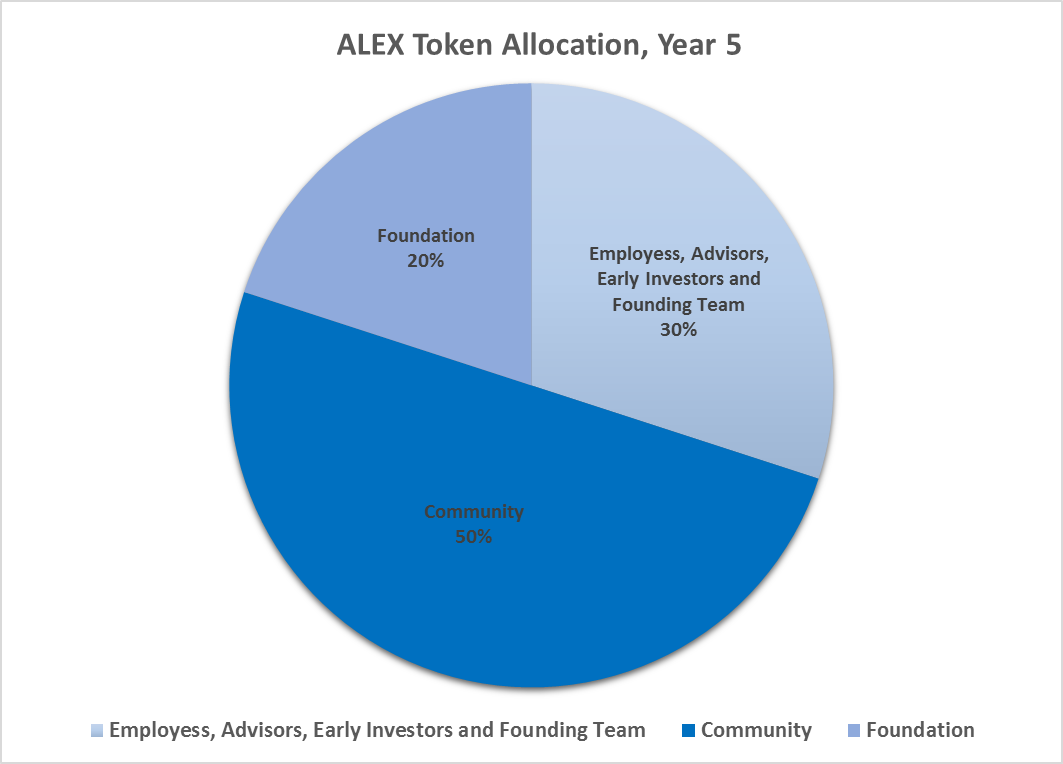

$ALEX is the native token of the ALEX platform. It has a maximum supply of 1 billion tokens.

The fundamental purpose of $ALEX revolves around incentivizing participants engaged in platform activities, notably liquidity provision on our decentralized exchange (DEX) and staking. The emission of $ALEX tokens is designed to sustainably encourage adoption and ongoing involvement, fostering a vibrant community of users and strategic partners.

Regarding staking, individuals can voluntarily lock up $ALEX tokens or Liquidity Tokens for a specific duration to earn an additional $ALEX as a reward. Fifty percent of the initial token supply is earmarked for staking purposes, enabling participants to accrue $ALEX through this mechanism.

Moreover, $ALEX plays a pivotal role in governance within the ALEX ecosystem. Holders of $ALEX tokens possess voting rights, which extend to various critical decisions

Where can you buy $ALEX?

$ALEX can be brought from exchanges like ALEX lab, MEXC and Gate.io.

PYTH Network -64.58%

Website | Twitter

Website | Twitter

Sector – Oracle

Status – Active

The Pyth Network functions as an oracle, opening access to previously exclusive financial markets data and rendering it accessible for DeFi applications and the broader public. Its primary aim is to democratize access to all asset prices globally across various blockchains, empowering data owners and users. Pyth provides pricing data for various assets, including cryptocurrencies, foreign exchange, equities, and commodities.

Pyth’s unique value proposition lies in its ability to provide reliable and accurate pricing data across multiple blockchains, offering secure price aggregation and an EMA feature for more precise price tracking. The combination of Solana technology, cross-chain capabilities, and the Oracle Program ensures its functionality and resilience in volatile market conditions.

How PYTH Works

Pyth represents a protocol enabling market participants to publish pricing data on-chain for broader utilization. The protocol operates through an interaction involving three distinct entities:

- Data providers are responsible for submitting pricing information to Pyth’s oracle program. This approach involves multiple data providers contributing to each price feed, enhancing the accuracy and resilience of the system.

- Pyth’s on-chain oracle program, integrated within Pythnet, consolidates the data submitted by providers to generate a singular aggregate price along with a confidence interval.

- Applications access the price data generated by the oracle program. Notably, Pyth enables users to fetch prices onto the blockchain as necessary, thereby making these prices accessible to the public within that particular chain’s ecosystem.

Token

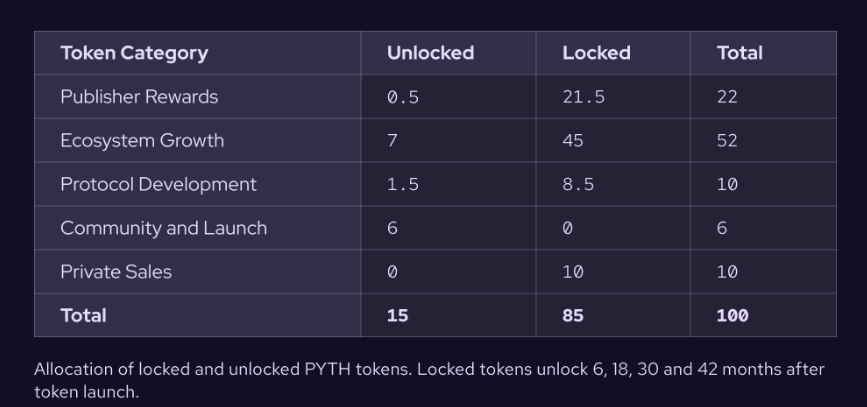

PYTH is the native token of the platform. It is used for rewards, governance, and participation in the PYTH network.

Regarding Publisher Rewards, these allocations are dedicated to incentivizing publishers responsible for disseminating price data across the Pyth Protocol. Reserved tokens are allocated for various reward mechanisms and grant programs to encourage publishers to furnish accurate and timely price information consistently.

PYTH has a maximum supply of 10 billion.

MASQ- 64.58%

Website | Twitter

Sector – Privacy

Status – Not yet launched

MASQ Network encompasses a dMeshVPN, a browser, a web3 Store, a protocol, and an earning ecosystem designed to provide anonymity and privacy within the Web3 environment. Its software suite delivers a private web3 browsing experience constructed on a peer-to-peer mesh network infrastructure. Users gain access to content that might otherwise be geographically restricted or subject to censorship in their region. They can freely explore their preferred websites and dApps while also having the opportunity to earn cryptocurrency by contributing to the peer network.

As the network expands, it enhances the potency and robustness of the browsing experience. This growth translates into a more resilient and potent browsing environment, fostering borderless internet freedom for all users across the globe.

Features

- MASQ is designed to offer users an authentic web3 browsing experience, delivering a comprehensive digital interface.

- The MASQ Network, upon its activation, aims to reach a level of resilience where it remains immune to shutdown. It is structured to resist control or censorship by significant entities or governmental bodies, ensuring users’ access to the unrestricted internet.

- Users can leverage the MASQ Network’s functionalities while evading detection by oppressive regimes—an issue commonly encountered with VPNs and Tor.

- It establishes an uncensored platform enabling journalists to communicate and exchange content without constraints.

- As a foundational network layer, MASQ facilitates the development of other decentralized applications (dApps) and communication protocols within an integrated ecosystem.

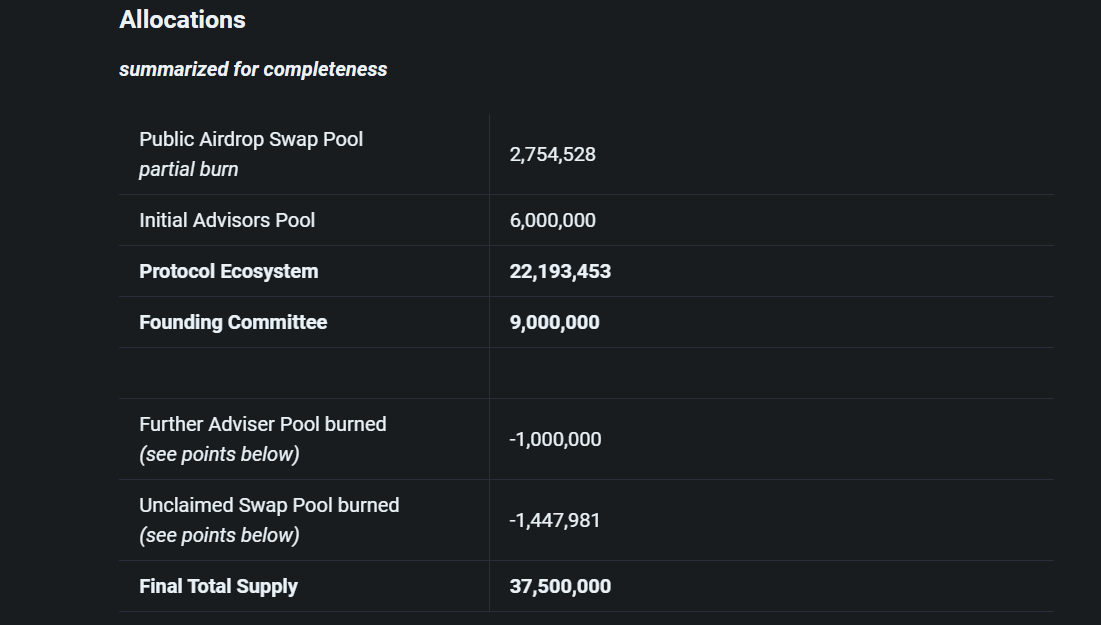

Token

The $MASQ token, limited to 37.5 million, drives Masq’s network by incentivizing users to share bandwidth. It facilitates secure, trustless data transfer between peers. Users earn $MASQ tokens for sharing bandwidth (as serving Nodes) with those requesting data (consuming Nodes). This token is a defense against attacks and grants early access to the MASQ Browser app during its beta stages, encouraging community involvement and testing.

Where can you buy the token?

You can buy $MASQ from Uniswap V3(Ethereum), Quickswap and Sushiswap.

exaBITS -64.58%

Website | Twitter

Sector – Artificial Intelligence

Status – Not yet launched.

exaBITS operates as a decentralized infrastructure designed for AI and computationally intensive applications. It empowers users by allowing them to contribute to the exaBITS infrastructure and train their distinct AI models.

The platform takes pride in enabling users to offer distributed GPU services, data storage, and expertise to AI communities without reliance on a central authority or intermediary. Participants leverage their web3 identities, such as blockchain wallet addresses or Decentralized Identities (DIDs), to engage in the marketplace and provide services to the AI ecosystem.

Users gain access to various AI-related services and resources through their marketplace, encompassing computing services, data storage, and Model as a Service (MaaS). This setup promotes fairness, efficiency, and performance within the realm of AI, facilitating the expansion and development of the AI ecosystem.

Computing-Oriented Network Architecture (CONA)- CONA represents a novel network architecture centered around computing and deeply integrating AI, Blockchain, Data, and Security components. Its core aim is to enhance the retrieval of computing power and access to intelligence services by offering robust support for persistence, availability, and authentication within a more cohesive architectural framework.

The primary objective is to furnish social-level services that enable global access and immediate availability. CONA seeks to amalgamate ubiquitous computing power, network infrastructure, and artificial intelligence to deliver seamless, widespread services globally.

Team

0xAnon – 62.50%

Website | Twitter

Website | Twitter

Sector – Decentralized Finance(DeFi)/ Bot

Status – Not yet launched.

0xAnon is a complete privacy trading and liquidity leasing solutions. At its core, 0xAnon embodies the principles of decentralization and smart contract integration. Leveraging decentralization, the platform fortifies itself against censorship, ensuring resilience, global accessibility, and immutability.

User privacy is a pivotal focus for 0xAnon, emphasizing the protection of user data and transaction confidentiality. It prioritizes users’ complete control over their personal information. This commitment to privacy entails rigorous security measures and protocols, effectively mitigating potential threats and vulnerabilities within the platform.

Features

Dex aggregator- Their privacy-focused DEX aggregator serves as a utility, allowing users to access multiple decentralized exchanges (DEXs) via a unified platform. This platform integrates advanced privacy and security enhancements, leveraging the inherent security and privacy features of DEXs, known for their decentralized and secure trading environments. Moreover, 0xAnon offers users the capability to scrutinize token contract transactions. It provides warnings to users in case of suspicions about a contract before initiating a transaction.

Leasing facility – The platform’s Liquidity Leasing solution enables deployers to borrow liquidity from the protocol’s Treasury. Functioning as a coin launcher platform, 0xAnon aids deployers in token creation and liquidity borrowing from the Treasury to establish a liquidity pool on Uniswap. A portion of the revenue from liquidity leasing is distributed to 0xAnon token holders as incentives.

This distinctive feature optimizes the utilization of 0xAnon’s treasury liquidity, ensuring a consistent income stream while delivering benefits to token holders.

0xAnon Bot – The 0xAnon Bot transcends the typical Telegram bot by offering a comprehensive toolset to streamline the cryptocurrency experience. With a robust suite of features, it empowers users to seize control of their digital assets with unparalleled ease. The bot facilitates the creation of secure wallets, enabling secure storage, management, and seamless transactions with various cryptocurrencies. Its private transaction capability ensures the confidentiality of financial activities, safeguarding sensitive data during transactions. Furthermore, the liquidity leasing feature allows users to generate passive income by participating in liquidity pools.