TOKEN METRICS WATCHLIST

We scored many projects this week. Here are a few you should know about:

- ApolloX

- NOYA.ai

- Scallop

Please keep in mind that some of these projects have not yet been subjected to our code review process, but we want to call them out here for preliminarily catching our eye based on our fundamental analysis process.

ApolloX- 64.58% (Website – Twitter)

APX is a leading decentralized exchange for crypto derivatives on the BNB Chain. It offers order book trading across various blockchains (BNB Chain, Ethereum, Arbitrum, zkSync) and on-chain perpetual contracts (BNB Chain, Arbitrum). APX empowers traders and stakers with opportunities for up to 500x leverage, competitive fees, and market-leading slippage rates.

Why we like it

ApolloX provides a versatile trading experience with two key options: V1 order book perp or V2 on-chain perp, offering a wide range of assets. ApolloX prioritizes minimal slippage, ensuring tight spreads, deep liquidity for V1’s order book, and a mere 0.01% slippage for V2 on-chain perps. ApolloX employs an innovative transaction model that combines off-chain transaction matching with on-chain fund settlement and custody, ensuring high transaction performance and user fund safety. It offers access to over 75 markets with leverage of up to 200x and competitive fees (0.02% maker and 0.07% taker).

On the other hand, APX V2 On-Chain Perp relies on a fully on-chain liquidity model, providing transparent trades with minimal slippage. All V2 trades are executed against the ALP pool, optimizing capital efficiency. V2 uses a dual Oracle system (Binance Oracle and Chainlink) for precise pricing. It offers access to over 25 markets, leverage of up to 200x, low fees, and trading rewards, including 750x leverage with zero slippage and no open position fees under Degen Mode.

Investors

The Team

Token Utility

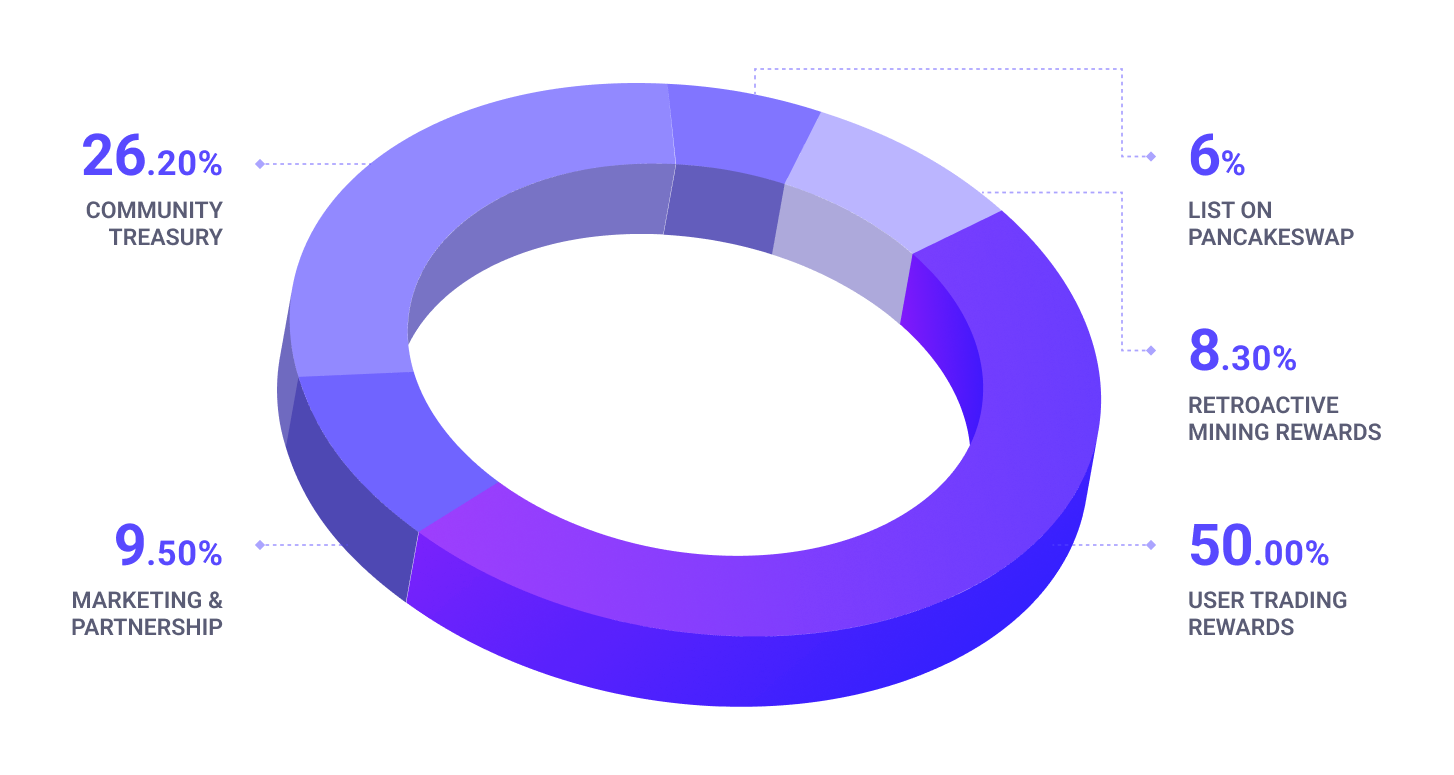

$APX token is the primary utility token of ApolloX. $APX is used as V1 trading fees can be staked to obtain V1 trading discounts and to enhance V2 trading rewards. Staking $APX in the DAO allows users to earn an additional $APX. The token is subject to burning.

ALP is the ApolloX platform’s liquidity provider token comprising a pool of assets. Users can become liquidity providers using any specified assets to buy ALP. Users can stake ALP and earn from platform fees and staking rewards.

Where can you buy the token

$APX can be brought from centralized and decentralized exchanges like PancakeSwap (V2), Gate.io, MEXC etc.

NOYA.ai- 64.58% (Website – Twitter)

NOYA.ai is an innovative Omnichain Yield Aggregator that leverages artificial intelligence (AI) to forecast and enhance yield outcomes, effectively addressing fees, slippage, and rewards concerns. Users can embrace the DeFi transformation introduced by NOYA through its cutting-edge, proactive, and self-improving AI framework. Our sophisticated model is meticulously designed to optimize your yield farming endeavors by striking the right balance between maximizing rewards and minimizing potential risks and fees.

Why we like it

At the core of our platform lies a self-learning and predictive AI model. This dynamic system intelligently allocates liquidity across multiple blockchain networks, assets, and protocols. This approach simplifies the intricate task of yield prediction, enabling the intelligent identification and capitalization of high-yield opportunities across a diverse range of blockchain networks, protocols, and assets. In doing so, it ensures sustainable growth within the ever-evolving landscape of decentralized finance (DeFi). Secondly, they prioritize efficiency through seamless bridging and asset swapping.

NOYA has established strategic partnerships with leading Dex and Bridge aggregators, ensuring swift and cost-effective asset swapping and bridging. This optimization leads to enhanced returns while concurrently reducing associated costs. They prioritize the safety and security of your assets. Unlike many platforms, they do not hold your funds. Instead, their solution gives you complete control over your investments. NOYA’s implementation of ZKML technology stands as an achievement, enabling on-chain verification of private and predictive yield AI models. This capability fosters a trustless and verifiable environment for executing DeFi strategies

Investors

No Investors found for NOYA.ai.

The Team

NOYA.ai was founded by Omar El Daouk and Hadi Esnaashari, who bring their knowledge and skills to the project. The Noya team is further strengthened by a group of highly skilled and experienced professionals who collectively contribute to the success and development of the platform.

Token Utility

The details about the token will be revealed later.

Where can you buy the token

NOYA.ai doesn’t have a token yet.

Scallop (Website – Twitter)

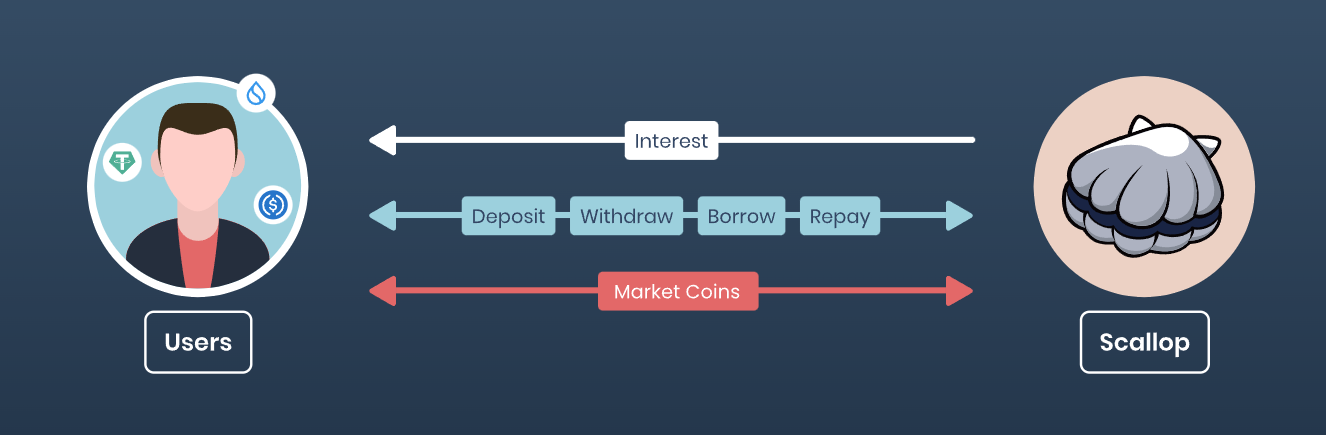

Scallop is a next-generation money market platform that combines institutional-grade quality, enhanced composability, and robust security. Scallop offers a unified platform that covers a broad spectrum of DeFi services, including lending, borrowing, trading, flash loans, swaps, and bridges. This all-in-one approach simplifies DeFi interactions for users, allowing them to access various financial tools seamlessly.

Scallop is a next-generation money market platform that combines institutional-grade quality, enhanced composability, and robust security. Scallop offers a unified platform that covers a broad spectrum of DeFi services, including lending, borrowing, trading, flash loans, swaps, and bridges. This all-in-one approach simplifies DeFi interactions for users, allowing them to access various financial tools seamlessly.

Why we like it

Scallop’s lending-borrowing technology is based on a well-optimized model inspired by Compound V3, Euler, and Solend V2. It includes features such as the Trilinear Interest Rate Model, Dynamic Parameters, Collateral/Borrow Weights, Protected Collateral Vault, Borrow/Outflow/Collateralization Limits, Delayed Model Change, and Soft Liquidation. These features are designed to improve scalability, stability, and user protection. Users who supply assets to Scallop lending pools receive sCoin tokens representing their deposits. sCoins have two essential functions. Firstly, the value of sCoin increases over time due to earned interest on the deposits. Secondly, the exchange rate between sCoin and the underlying assets also increases as interest is added to the assets. Scallop uses a multi-oracle consensus algorithm to obtain price feeds from multiple sources.

Components such as Pyth, Switchboard, and Supra Oracles provide essential price feeds for assessing account health and liquidation. The use of Time-Weighted Average Price (TWAP) oracles enhances security. The platform also implements a soft liquidation mechanism to protect lenders and borrowers, preventing significant losses and promoting a more stable DeFi environment. Scallop can potentially be the leading lending-borrowing platform in the Sui ecosystem.

Investors

The Team

Kriss is the founder of Scallop and is accompanied by a team with backgrounds in cybersecurity, Web2 fintech, DeFi, algorithm contests, quantitative trading, and venture capital (VC).

Token Utility

$SCA is a functional multi-utility token that will be used as a medium of exchange between participants on Scallop in a decentralized manner. Holders of $SCA can propose and vote on governance proposals to determine Scallop’s future features, modifications, and parameters. The voting weight is calculated based on the proportion of tokens staked. The token has a maximum supply of 250 million.

Where can you buy the token

The token has yet to be made available to trade.