TOKEN METRICS WATCHLIST

We scored many projects this week. Here are a few you should know about:

- Contentos

- Airchains

- Connext

- Equation

- Circuit Trade

Please remember that some of these projects must still be subjected to our code review process. Still, we want to call them out here for preliminarily catching our eye based on our fundamental analysis process.

Contentos – 70.83%

Website | Twitter

Website | TwitterSector – Entertainment

Status – Active

FDV – $76M

Contentos seeks to revolutionize the digital content industry by establishing a decentralized video and content platform rooted in blockchain technology. Their primary objective is to restore fairness to content creators.

The core mission of the development team is to empower creators by providing them with the tools to digitally document their lives while ensuring complete ownership and control over their content. The Contentos platform is meticulously crafted to establish an environment that is fair, transparent, and accessible to content producers worldwide. It facilitates the delivery, promotion, rights protection, and seamless transactions associated with global content production. Central to their goals is the drive to incentivize content creation, celebrate global diversity, and restore content’s rights and inherent value to its users.

COS.TV stands as the pioneering video platform leveraging the capabilities of the Contentos blockchain.

Features

P2P Revenue Distribution – The platform introduces a peer-to-peer revenue distribution model characterized by its decentralized nature, ensuring that the value generated from content creation is transparent and directly benefits its users. This system aims to provide openness and fairness, returning rewards to the creators.

Decentralized Traffic Distribution – Additionally, COS.TV implements a decentralized traffic distribution mechanism, incentivizing users to actively share and promote content within relevant audiences, fostering an environment where compensated efforts drive content dissemination.

Trackable copyright transaction – Blockchain technology serves as the backbone for trackable copyright transactions, offering a robust system for copyright authentication and traceable transactions, ensuring accountability and transparency in content ownership.

Immutable Credit System – The platform incorporates an immutable credit system wherein users maintain responsibility for their credit score. Considering each contribution, this score is intricately calculated, establishing a system that encourages consistent and meaningful user participation.

Investors

Token

The $COS token serves as the native currency within the Contentos system, designed to facilitate the ecosystem’s initiation and acknowledge the efforts of content creators and users. Individuals engaging in malicious activities will be ineligible for reward accumulation. Furthermore, maintaining a minimum credit rating is essential for users to access their rewards (refer to the “Contentos credit system”). The quantity of $COS tokens users hold directly influences the proportion of rewards allocated to their accounts. As the user community expands, opportunities will arise for users to offer services in exchange for tokens.

Where can you buy the token?

$COS can be brought from exchanges like Binance, BingX etc.

Airchains- 70.83%

Website | Twitter

Sector – zk-Rollup

Status – Not yet launched

Airchains introduces a Modular zk Rollup SDK, designed to enhance scalability significantly in contrast to conventional Rollup solutions. The Airchains ZK Stack comprises various tools, incorporating multiple execution layers such as EVM, Cosmos, and Solana-compatible chains. By integrating tools and APIs, the platform empowers developers, enterprises, and institutions to construct and operate their blockchain networks. This capability extends to developing dApps and NFTs, bolstering network security and overall performance.

Features

- Its modular nature enables users to select execution layers like EVM, Cosmwasm, SVM, and choose a dedicated data availability layer from options such as Avail, EigenDA, or Celestia. This versatility provides users with tailored solutions that suit their specific requirements.

- The incorporation of robust measures utilizing zk-Proofs ensures transactions achieve a higher rate of finality, cost-effectively fostering increased security and scalability compared to other rollup alternatives.

- Airchains implement a decentralized sequencer, ensuring Rollup consistency and predictable gas fees, thereby mitigating the impact of gas price fluctuations on external networks. This approach aims to maintain stability and predictability in transaction costs compared to alternative chains.

- Emphasizing better interoperability, Airchains facilitates secure and seamless inter-blockchain communication across multiple adopted blockchain networks. This feature enhances the overall connectivity and functionality of the ecosystem. The platform aims to provide affordable and consistent gas fees, promoting decentralization, efficiency, security, and resistance against single-point-of-failure attacks.

By cultivating a conducive environment for advancing Web3 technologies, Airchains lays the groundwork for the necessary infrastructure to propel the blockchain ecosystem forward.

Connext- 68.75%

Website | Twitter

Sector – Interoperability

Status – Active

TVL – $29.6M

FDV – $213M

Connext is a modular protocol designed for secure transference of funds and data across different blockchain networks. It enables cross-chain applications (xApps) to interact with multiple blockchains or rollups simultaneously.

Connext introduces the concept of xERC20, a cross-chain ERC-20 token solution enabling seamless, slippage-free transfers across chains while prioritizing security. This innovative standard offers token issuers a non-restrictive framework, liberating them from dependence on singular bridges or ecosystems. Embracing a trust-minimized approach, Connext empowers token issuers to harness the advantages of this novel design and seamlessly transition upon activating the xERC20 standard.

The router liquidity network by Connext facilitates rapid token bridging without compromising security, ensuring a mere matter of minutes for the process. Operating on routers that absorb the latency of the most secure bridges available, users experience enhanced reliability without additional concerns.

Delegating transfers to canonical bridges guarantees users identical trust assurances as those provided by the underlying chains. Furthermore, a vigilant system of watchers actively monitors network activity, promptly suspending operations upon detecting any irregularities.

With Connext, dApps can execute logic from any chain, eradicating the necessity for users to switch networks, sign transactions across diverse chains, or expend gas on alternate chains. This capability allows users to engage with dApps from any supported chain, utilizing any token, all within the confines of a unified user interface.

Investors

Connext boasts a roster of distinguished investors, including entities such as Coinbase Ventures, Polygon, 1kx, Polychain, Hashed, Ethereal Ventures, Fenbushi Capital, Scaler Capital, No Limit Holdings, and eGirl Capital.

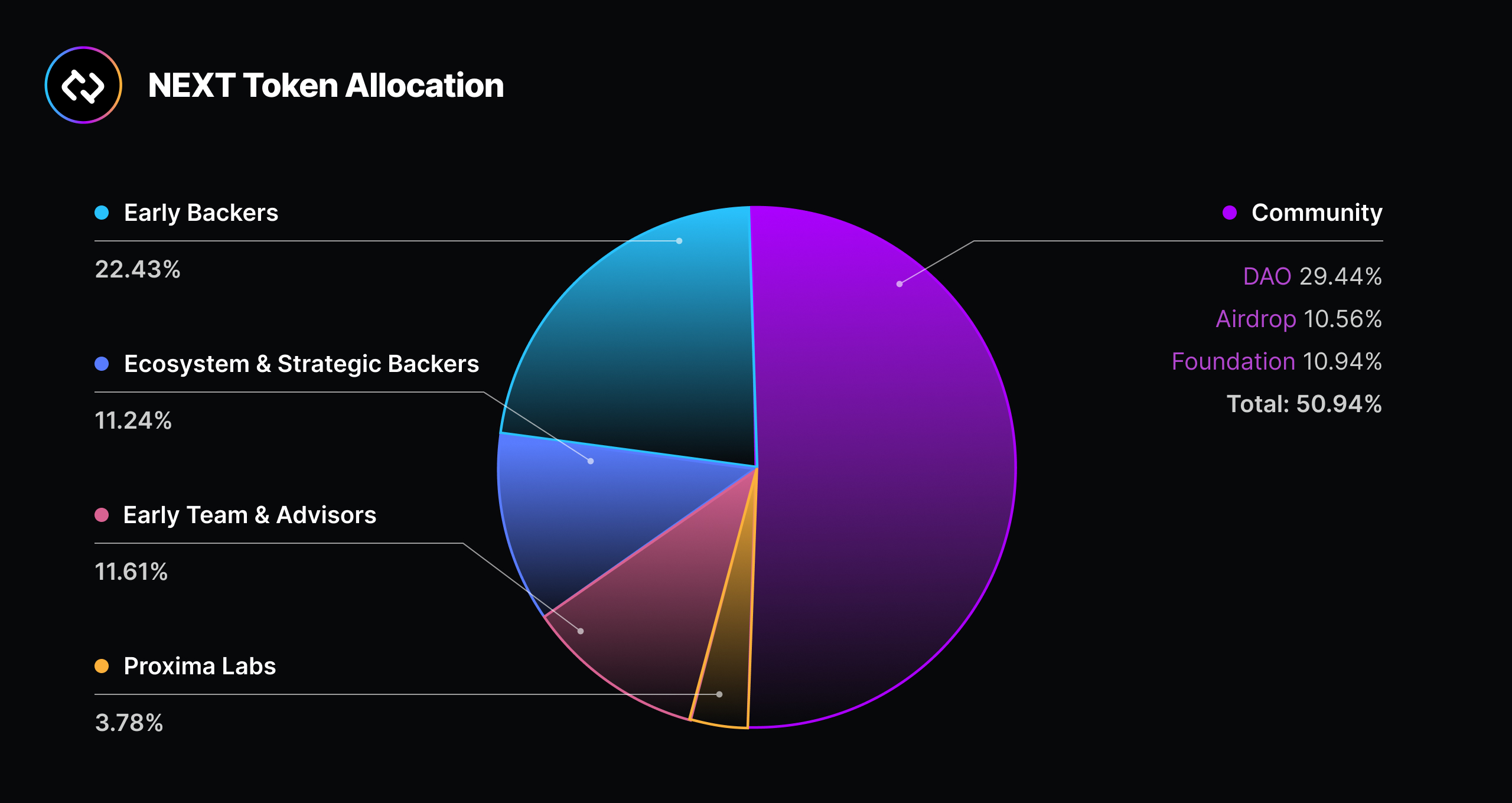

Token

$NEXT serves as the governance and utility token within the Connext ecosystem, functioning as an xERC20 token across all supported chains. Initially, $NEXT holds governance authority within the Connext DAO, responsible for allocating resources dedicated to the continuous evolution of the protocol.

The achievement of genuine decentralization and unrestricted operation of the Connext protocol is realized through establishing repeatable governance procedures integrated directly into the protocol itself, a process referred to as “ungovernance.”

In subsequent phases, $NEXT is poised to expand its role by enabling the ungovernance of the network. Through routing, chain support, and token listing, $NEXT staking will facilitate a permissionless approach contingent upon DAO endorsement, thereby advancing the network’s autonomy.

Where can you buy the token?

$NEXT token can be brought from exchanges like Bybit, Uniswap V3(Ethereum), Bitkub etc.

Equation- 64.58%

Website | Twitter

Website | Twitter

Sector – Decentralized Exchange

Status – Active

TVL – $22.4M

FDV – $17M

Equation operates as a decentralized perpetual protocol constructed on Arbitrum, offering an innovative BRMM model. This model empowers traders and Liquidity Providers (LPs) with leverage of up to 200x, enabling traders to access larger, unrestricted positions while optimizing capital efficiency for LPs.

BRMM – Within the BRMM model, LPs serve as transient counterparts to traders. LPs might encounter net open position risk when there is a disparity between users’ long and short positions. However, the anchoring effect of the funding rate ensures that the BR value remains relatively close to 0, minimizing significant deviations. Consequently, the value of LPs’ positions typically remains considerably smaller than the overall liquidity, limiting LPs’ risk.

For instance, if a substantial imbalance emerges where long positions substantially outweigh short positions within the liquidity pool, holders of long positions may experience intensified pressure from the funding rate. Simultaneously, this scenario presents arbitrage opportunities for individuals exploiting spread and funding rate differentials. This dynamic nature significantly reduces the likelihood of prolonged substantial imbalances in tokens with abundant liquidity. Consequently, losses stemming from LPs holding temporary net open positions are termed “Temporary Losses.”

Token

Equation implements an inventive hybrid token model that amalgamates Fungible Tokens (FT) and Non-Fungible Tokens (NFT), offering numerous advantages:

- Resolving conflicts of interest among community members, the founding team, and early investors inherent in traditional token models.

- Rewarding community contributors engaged in promoting Equations with substantial and enduring income guarantees.

$EQU is the native token within the Equation ecosystem, capped at a maximum supply of 10 million tokens. The entire token supply, 100%, is generated through position, liquidity, and referral mining, all distributed as rewards to community participants. The initial daily emission of $EQU amounts to 10,000 tokens, subject to potential adjustment through DAO governance but capped at 10,000. Holders of $EQU tokens earn 25% of the protocol’s trading fees by participating in staking activities.

EFC is the native NFT of Equation

Where can you buy the token?

You can buy $EQU from exchanges Uniswap V3(Arbitrium one).

Circuit Trade- 64.58%

Website | Twitter

Sector – Decentralized Finance(DeFi)

Status – ActiveCircuit is a decentralized, multi-chain market maker focusing on enhancing liquidity within DeFi protocols and decentralized exchanges. Its primary aim is to democratize market making, striving to broaden access to a more extensive audience. By doing so, Circuit seeks to enable a larger population to partake in and benefit from market-making rewards within the DeFi sphere.

Circuit Vaults

Circuit Vaults represent non-custodial repositories enabling anyone to deposit funds within a fully algorithmic order book market-making strategy meticulously crafted by the Circuit team’s professionals. These Vaults seamlessly integrate into each decentralized exchange (DEX), facilitating order book liquidity within the platform.Circuit offers users access to institutional market-making strategies, granting them entry into high-yield MM strategies typically beyond their reach. Users can deposit USDC into their vault contract through Circuit Vaults, ensuring complete visibility and autonomy over their funds. The trustless nature of these deposits ensures that vault managers can only execute or cancel orders within the account, unable to withdraw assets. This arrangement maintains the user’s custody of funds, significantly enhancing security and engendering trust.

Furthermore, Circuit Vaults adopts a user-centric approach to distributing market-making returns. Returns generated from market-making activities are equitably distributed among depositors based on their proportional share of total deposits. This systematic approach ensures a fair and balanced allocation of profits, aligning the incentives of all participants within the Circuit ecosystem.

Investors

Circuit has Ethereal Ventures, Multicoin Capital, and Folius Ventures among its investors.