TOKEN METRICS WATCHLIST

We scored many projects this week. Here are a few you should know about:

- Eigenlayer

- Across Protocol

- Levana Finance

- Velas

- Tectum

Please remember that some of these projects must still be subjected to our code review process. Still, we want to call them out here for preliminarily catching our eye based on our fundamental analysis process.

Eigenlayer – 70.83%

Website | X(Twitter)

Website | X(Twitter)

Sector – Restaking and Data Availability

Status – Active

EigenLayer represents a pioneering protocol established on the Ethereum network, introducing the concept of ‘restaking’. This innovative framework enables Ethereum stakers to redeploy their staked ETH or Liquid Staking Tokens (LSTs) across various applications, fortifying the network’s crypto economic security. By facilitating pooled security, EigenLayer effectively diminishes the capital expenses for stakers while reinforcing confidence across diverse services. Noteworthy features include customizable decentralization choices, distinctive slashing mechanisms tailored for each service, and operator delegation, granting stakers the ability to delegate operations while actively contributing to the network’s security.

- Restaking – EigenLayer’s Restaking Mechanism utilizes ETH stakes to fortify security across applications via direct ETH restaking or Liquid Staking Tokens (LSTs). This bolstering occurs through EigenLayer’s smart contracts, enhancing network security.

- Decentralization and Slashing – Decentralization options empower services to customize preferences for attracting native stakers while defining slashing terms through unique contracts, creating distinct risk profiles.

- Operation Delegation – Operator Delegation allows stakers to assign module operations to operators based on trustworthiness, rewards, and service alignment.

- Node classes – Node classification streamlines efficiency by categorizing nodes based on performance, simplifying development.

- Data Availability – EigenDA enhances rollup efficiency by reducing transaction costs and increasing throughput through data blob processing, necessitating on-chain and off-chain integration.

Investors

Team

Sreeram Kannan assumes the role of founder and CEO at Eigenlayer. Alongside this position, he holds the title of associate professor at the University of Washington and serves as the head of the UW Blockchain Lab. The initial team members of EigenLayer emerged from this esteemed academic laboratory, fostering a strong foundation for the project. The EigenLayer team boasts extensive expertise.

Across Protocol -68.75%

Website | X(Twitter)

Website | X(Twitter)

Sector – Cross Chain Protocol

Status – Active

TVL – $102M

FDV – $135M

Across operates as a cross-chain bridge tailored for L2s and rollups, safeguarded by UMA’s optimistic oracle. Engineered for capital efficiency, it features a singular liquidity pool, a competitive landscape of relayers, and a fee model devoid of slippage.

The protocol’s design, characterized by a unified liquidity pool and an interest rate fee structure, translates into reduced user costs and amplified yields for liquidity providers. With most LP assets secured on the main net for heightened security, Across employs automated bots to rebalance assets across destinations via the canonical bridge. Its interest rate fee model is intricately linked to the overall asset utilization within the single liquidity pool, ensuring more dependable pricing dynamics.

By primarily securing LP assets on the L1 mainnet, where security and efficiency are maximized, the Across Protocol operates robustly. Fuelled by a permissionless relayer ecosystem, it relies on third-party entities risking their funds to bridge assets. These relayers operate at speeds surpassing the finality times of the origin or destination chains, enabling swift fills for users’ deposit requests. This agility permits relayers to strategically manage risks and compete based on speed, facilitating efficient asset transfers.

Features

- Safe – Safe by design, Across operates optimistically, relying on a single honest actor to dispute any false claim, irrespective of the number of participants involved in the bridge.

- Super-fast – With its agility, Across ensures swift bridging, currently averaging under 1 minute, with prospects aiming for near-instantaneous bridging in subsequent blocks.

- Growing – Aligned with its growth trajectory, Across invites individuals to engage with the mission, offering opportunities to earn ACX rewards and contribute to shaping the trajectory of the Across DAO, starting within its community hub.

- Capital Efficient – Emphasizing capital efficiency as a paramount metric for a cross-chain bridge, Across is engineered to optimize capital usage, aiming for reduced costs and minimized exposure of funds at risk. This foundational principle underscores the bridge’s construction and operation.

Investors

Token

The $ACX token is pivotal in governing the Across Protocol operations and managing the DAO treasury. Operating as an ERC-20 token facilitates decentralized ownership and control over the protocol’s functionalities. Token holders wield governance authority over the Across Protocol through the ACX token, ensuring decision-making power resides in their hands.

Beyond governance, $ACX is an incentive mechanism for liquidity providers and participants engaging in the Across Referral Link program. This incentivization structure encourages active participation and contribution within the ecosystem.

The maximum supply of $ACX is capped at 1 billion tokens, setting a definitive limit on the total available tokens within the system.

Where can you buy the token?

$ACX can be brought from exchanges like Gate.io, MEXC etc.

Levana Protocol – 64.58%

Website | X(Twitter)

Website | X(Twitter)

Sector – Perpetual Dex

Status – Active

TVL – $9.13M

FDV – $210M

The Levana Well-funded Perps protocol represents a pioneering approach to perpetual swaps, constituting leveraged trading contracts. Its primary objective is managing risk effectively while offering traders and liquidity providers substantial benefits.

For traders, Levana’s innovation revolves around ensuring that all positions are “well-funded,” thereby predefining the maximum profit for each position. This crucial aspect eliminates the risk of bad debt and insolvency, substantially enhancing overall security for traders. In contrast, liquidity providers are incentivized by receiving a yield to assume the inherent risk of market instability. These providers contribute funds that serve as collateral, earning a fee and a risk premium in return.

The protocol strategically addresses prevalent issues within existing perpetual swap models, notably surpassing the limitations of virtual AMM-based models. Levana’s differentiation lies in its ability to mitigate risk more effectively in volatile markets, diverging from complex mechanisms prone to inherent risks. By segregating various trading pairs and establishing a decentralized market for liquidity, Levana significantly diminishes the risk of contagion between diverse markets. This deliberate segregation further facilitates its seamless expansion across multiple blockchain networks.

Users on the platform can engage in trading activities with various advantageous features. This includes access to trading with up to 30 times leverage, enabling both long and short positions. The platform also offers adjustable fees, allowing users to tailor their trading experience based on their preferences and strategies. Additionally, it supports market-neutral trading strategies, allowing users to navigate the market in a balanced manner, irrespective of market directionality.

Overall, Levana’s perpetual swaps protocol emerges as a dependable and secure platform catering to the needs of both traders and liquidity providers. It ensures equitable settlement, minimizes risks, and fosters the creation of supplementary financial protocols atop tokenized positions.

Investors

Token

The native token within the Levana ecosystem, $LVN, is a pivotal governance instrument that empowers holders to participate in crucial decision-making processes. This voting capability ensures that the protocol’s trajectory remains aligned with the interests and preferences of the community. As the ecosystem progresses, the $LVN token is slated to evolve into a comprehensive governance tool, granting holders increased influence over pivotal decisions and progressively expanding the scope of governance. Levana’s fee structure is designed in such a way as to enable this type of staking reward should a future DAO move in this direction.

Where can you buy the token?

You can buy $LVN from Osmosis, Gate.io, MEXC etc.

Velas- 64.58%

Website | X(Twitter)

Website | X(Twitter)

Sector – Layer 1

Status – Active

FDV – $69M

TVL – $3.37M

Velas is a leading EVM blockchain and open-source framework catering to decentralized ventures and applications globally. It boasts a remarkable processing capacity of up to 75,000 transactions per second, providing instantaneous finality, minimal transaction fees, and comprehensive support for Solidity. The Velas Blockchain is an evolution of Solana’s architecture, incorporating enhancements focused on advancing scalability, fortifying security measures, and enhancing overall user accessibility.

Features –

- Velas Account: Offers passwordless secure access to services, incorporating unique authorization quotas for a safe and user-friendly experience.

- Ethereum Virtual Machine (EVM) Compatibility: Enables Ethereum smart contract creation and execution, boosting DeFi capabilities, cutting transaction costs, and attracting Ethereum’s developer community.

- Solana-based Architecture: Harnesses Solana’s high-speed transaction processing and scaling potential (710,000 TPS), leveraging innovative technologies for faster transactions than Ethereum and Bitcoin.

- Velas Vault: Utilizes Velas blockchain speed and security for swift, cost-effective transactions, decentralizing data storage for privacy and diverse authentication options.

- Velas Freedom: Allows backend transactions, removing user payment obligations for blockchain operations, mirroring cost-free experiences in centralized apps.

- Expanded Velas Account: Simplifies blockchain service access without requiring technical knowledge like private keys, aiming to enhance crypto adoption by mimicking traditional service interfaces.

Investors

Velas secured a substantial financial commitment of $135 million from GEM Digital Limited, an esteemed digital asset investment firm headquartered in the Bahamas.

Token

$VLX is the native token of the Velas ecosystem. Velas operates on DPoS economics, fostering favorable conditions for participant interaction and incentivizing actions benefiting the network. Its token serves staking purposes, offering two investor pathways: creating a pool as a validator or joining an existing pool as a delegator.

Validators require a minimum of 1 million $VLX tokens, while becoming a delegator is more accessible, necessitating only 1 $VLX token. AIDPoS empowers delegators to vote for potential validators by staking tokens, enhancing their chances of becoming validators themselves.

Beyond staking, $VLX serves multiple roles within the ecosystem. It functions as a transaction and payment token, serving as the primary unit of account for payments and fees. $VLX also facilitates consensus among block producers, enabling them to earn staking rewards by creating blocks.

Inheriting settings from Solana, Velas presently has a total supply of 2.3 billion tokens, with a projected long-term inflation rate of 1.5%.

Where can you buy the token?

$VLX can be brought from exchanges like Gate.io, Kucoin, etc.

Tectum – 60.42%

Website | X(Twitter)

Sector – Layer 1

Status – Active

FDV – $349M

Tectum blockchain demonstrates exceptional speed, optimizing data distribution to ensure the network operates efficiently and reliably. Tectum Blockchain is the swiftest decentralized blockchain, enhancing the speed and cost-efficiency of established networks like Bitcoin.

Features

- Tectum Blockchain – The blockchain platform, Blockchain, boasts a remarkable transaction processing speed surpassing 1 million TPS, delivering instantaneous event status updates and ownership changes. Rather than directly storing data on the blockchain, Tectum employs hash mapping to store hashes linked to original data at a lower level. This approach segregates transaction-heavy data from the primary pipeline through hashing, encryption, and bundling after each transaction, subsequently archiving it.

- Softnote – SoftNote, an innovation within Tectum, introduces a transactionless payment system offering instant payments devoid of fees. Leveraging Tectum’s Bitcoin node and overlay network, SoftNote facilitates on-chain transfers with minimal fees and swift transaction durations. Its capabilities extend to reducing transfer costs to zero while ensuring immediate finality, positioning Bitcoin as a globally scalable cash system. SoftNote enhances transaction speed and anonymity by substituting transactions with handovers. Payment bills within SoftNote leverage Bitcoin, Ethereum, and USDT as stores of value and are accessible for purchase via Tectum’s web wallet and mobile application.

- Softnote wallet – The SoftNote Wallet enables instantaneous Bitcoin and cryptocurrency transactions without imposing expensive fees. Anchored within the Tectum Wallet and SoftNote platform ecosystem, it delivers rapid, cost-effective, and highly secure payment services. This system circumvents unnecessary derivative settlement stores of value and supplemental liquidity contracts, establishing itself on the robust foundation of the Tectum blockchain.

- 3FA – Tectum introduces Tectum 3FA, a revolutionary Three-Factor Authentication system addressing vulnerabilities in conventional Two-Factor Authentication solutions. Offering flexibility, scalability, and robust security, Tectum 3FA mitigates risks associated with compromised phones, duplicated SIM cards, and potential hacks.

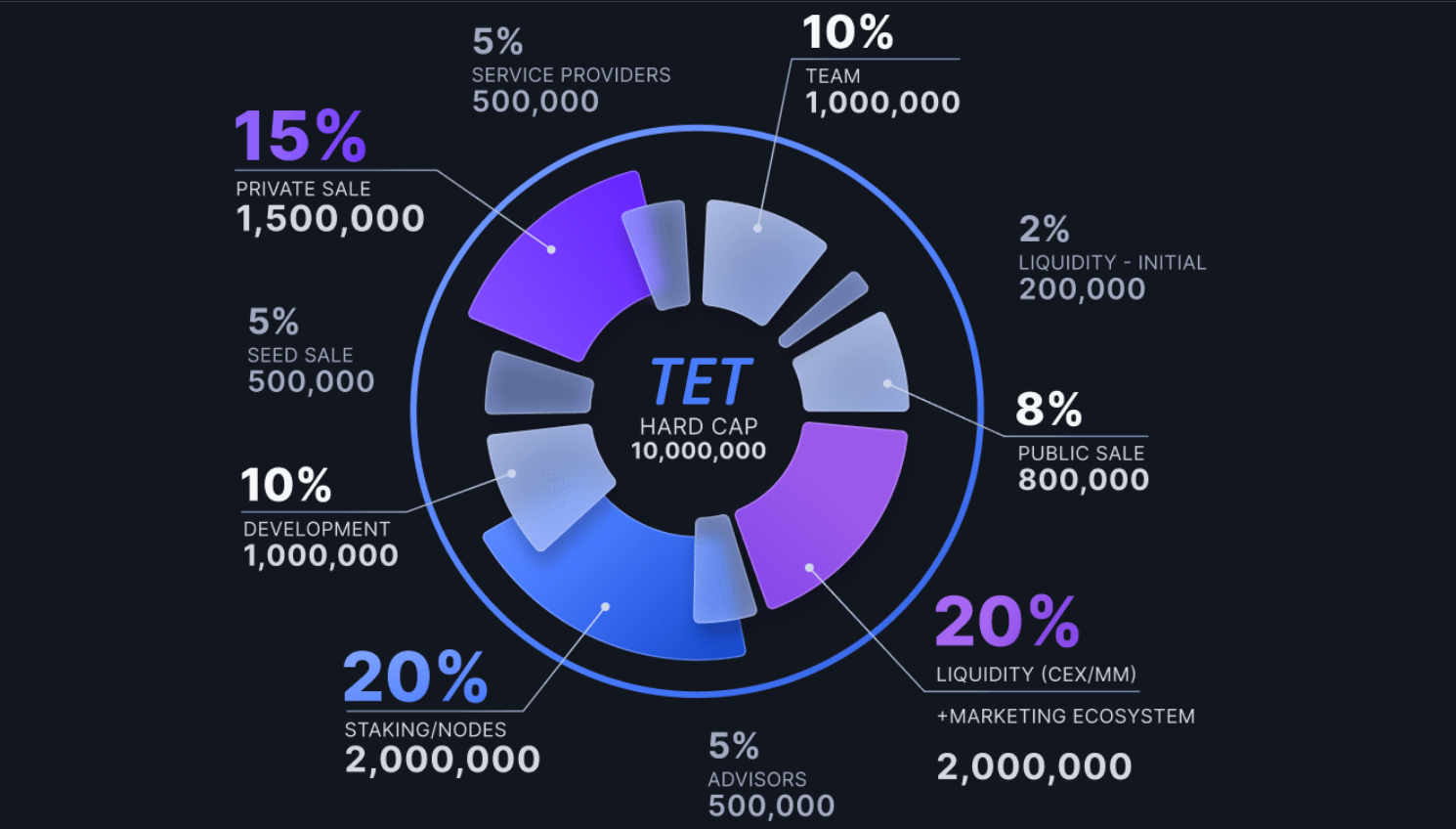

Token

The native token of the Tectum blockchain, $TET, serves as a utility token granting holders access to various Tectum products, including SoftNotes. Additionally, $TET is utilized to cover gas fees within the ecosystem. Notably, this token is capped at a limit of 10 million units.

Where can you buy the token ?

$TET can be brought from exchanges like Uniswap V2, MEXC etc.