TOKEN METRICS WATCHLIST

We scored many projects this week. Here are a few you should know about:

- Eloop Network

- Ojo

- Nesa

- Tunachain

- PrimeX

Please remember that some of these projects must still be subjected to our code review process. Still, we want to call them out here for preliminarily catching our eye based on our fundamental analysis process.

ELOOP Network- 68.75%

Website | X(Twitter)

Sector – Real World Assets/DePin

Status – Active

ELOOP is pioneering the tokenization of real-world assets (RWAs), specifically focusing on machine assets, to establish decentralized physical infrastructure networks (DePINs). The platform provides a unique opportunity for businesses to fractionalize and monetize their assets, opening up a novel investment avenue for individuals and companies alike.

ELOOP Network enables direct interaction with industries, companies, or service providers, offering transparent investment opportunities through the tokenization of Real World Assets. Blockchain technology ensures transparency and safety for investment funds and revenue streams within the ELOOP Network. Assets such as electric cars in a car-sharing fleet or solar energy infrastructure are tokenized on the blockchain, allowing users to participate in value creation without intermediaries and with complete transparency. ELOOP Network offers asset tokens that represent fractional ownership in machine assets, providing investors with the opportunity to earn based on the performance of the asset. Through this mechanism, token holders receive their earnings in ELOOP Coins in proportion to their investment and the revenue generated by the asset. This approach ensures a link between asset performance and investor returns, enhancing transparency and aligning incentives between asset owners and token holders.

In addition to facilitating revenue sharing, the platform prioritizes transparency and accessibility. It provides clear and detailed information about asset performance and token details, making the investment process accessible even to non-technical users. This commitment to transparency and accessibility is integral to the ELOOP Network’s mission of democratizing access to investment opportunities in real-world assets.

Token

The ELOOP Coin functions as the primary currency within the network, serving as a vital component with tangible real-world applications. It acts as a key link between all ecosystem participants, serving as the primary reward method, generating fees through DeFi functions, and granting access to exclusive partner offers within the ELOOP Network.

Ojo- 66.67%

Website | X(Twitter)

Website | X(Twitter)

Sector – Oracle

Status – Active

OJO is a decentralized price oracle explicitly designed for the ecosystem, providing support for a wide range of crypto assets within the Interchain. This solution enables secure and reliable interchain communication by delivering precise price data sourced from authenticated centralized and decentralized data sources. Initially, Ojo will prioritize offering highly accurate and dependable price feeds. Thanks to its Smart Oracle functionality, Ojo can support assets that other oracles may be unable to accommodate. Drawing from an extensive catalog of on and off-chain sources, OJO utilizes advanced security mechanisms to safeguard the integrity of the provided data. A key feature, the Smart Oracle, has been intricately designed to counter market manipulation.

Ecosystem – Ojo is compatible with all IBC, EVM, and MoveVM chains. Once deployed onto these ecosystems by the Ojo team, any protocol can access data trustlessly. Presently, Cosmos price feeds are accessible on multiple chains.

Smart Oracle – OJO draws from a comprehensive array of on and off-chain sources and employs advanced security mechanisms to ensure the data’s integrity. One of its key features, the Smart Oracle, is intricately designed to counter market manipulation, enhancing resilience and reliability.

Trustless – Ojo operates as a decentralized Proof of Stake oracle chain, driven by a distributed network of validators. These validators collectively vote on the prices utilized in Ojo’s price feeds. Validators who contribute the most accurate prices are rewarded, while those submitting inaccurate prices face penalties. To ensure robust participation and decentralization, validators failing to vote are subject to being jailed, resulting in a substantial portion of their stake being slashed and their removal from the active set. These measures significantly mitigate Oracle risks for protocols relying on its data feeds.

Nesa- 64.58%

Website | X(Twitter)

Website | X(Twitter)

Sector – Aritficial Intelligence

Status – Not yet launched

Nesa is a lightweight Layer-1 platform designed to execute critical AI inference on queries requiring high levels of privacy, security, and trust, utilizing ZKML on-chain. Traditional inference platforms lack visibility or accountability into their output on critical transactions, providing no privacy on data and results, posing a significant issue in AI. Nesa addresses this challenge with its innovative AIVM architecture, integrated mining network, and ZKML solution built on Cosmos WASM. The platform introduces the first decentralized query marketplace, a GPTs store for Web3 powered by a reward economy for AI developers, queriers, miners, and model reviewers. This marketplace establishes the first global repository for AI that is decentralized and on-chain.

Artificial Intelligence Virtual Machine(AIVM) – The AIVM ensures uniform execution across all nodes in the NES network, analogous to the role played by the Ethereum Virtual Machine (EVM) in the Ethereum ecosystem. This standardized design across all system requests, regardless of origin, function, and purpose, solves the major industry problem of discrepancy in model execution that can prevent consensus on AI inference results. At its foundation, the AIVM is designed to streamline the AI computation process by providing a consistent set of rules and execution protocols that every participating node must follow. The AIVM framework offers the flexibility to accommodate a wide range of AI models. By incorporating AIVM instances with model parameters on the blockchain, we create an on-chain repository of AI models that users can access and utilize for various inference tasks.

Zero Knowledge Machine Learning(zkML)- Nesa’s technological innovation is its privacy-focused decentralized inference protocol, driven by ZKML. This protocol implements bifurcated transactions at the blockchain level, utilizing a cryptographic hybrid-privacy design to ensure confidentiality and verifiability of transactions. This book explores Nesa’s architectural design details, highlighting its cryptographic advancements in ZKML and the platform’s tokenomics structure. It also discusses the broader implications of the project in reshaping the landscape of decentralized AI applications.

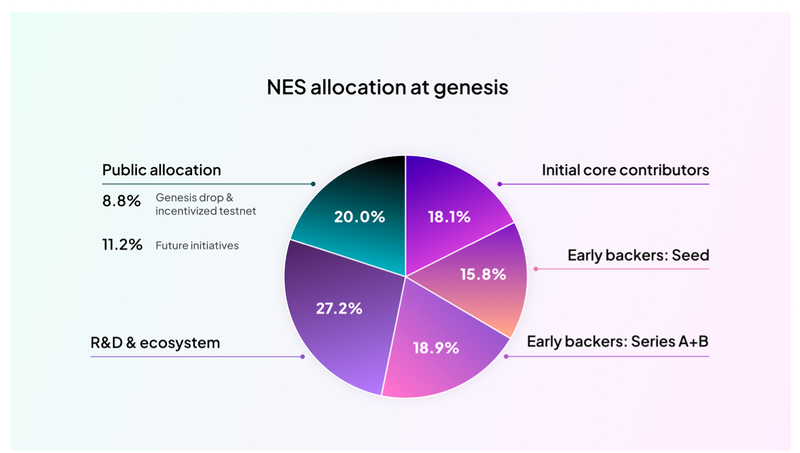

Token

The native token of the platform, $NES, serves multiple functions, including acting as a gas token and currency, as well as paying for query availability. Users on the Nesa mining network can contribute to securing the network and participate in voting on model updates by delegating their $NES to a Nesa validator, earning a portion of the validator’s staking rewards. $NES is a crucial component in enabling developers to build on the first autonomous AI oracle network for on-chain inference. Developers utilizing Nesa for AI model inference submit PayForQuery transactions on the network, paying a fee of $NES. The total supply of $NES at Genesis will be 1,000,000,000 $NES.The initial annual inflation rate for $NES is 8%, decreasing by 8% annually until it reaches a long-term issuance rate of 1.8%.

Tuna Chain- 62.50%

Website | X(Twitter)

Website | X(Twitter)

Sector – Bitcoin Layer 2

Status – Not yet launched

Tuna Chain represents a pioneering Layer 2 (L2) solution on the Bitcoin (BTC) network, potentially reshaping the parameters of blockchain capabilities. The project aims to combine Bitcoin’s robust security features with EVM (Ethereum Virtual Machine) functionality. While Bitcoin is widely regarded as the most reliable cryptocurrency, its ability to support complex smart contracts and advanced applications is constrained. Tuna Chain seeks to address this limitation by incorporating EVM compatibility into Bitcoin’s L2 framework, thereby enhancing the scope of potential applications and utility for Bitcoin.

- $Toro: At the core of Tuna Chain is $Toro, an exclusive stablecoin designed to meet user needs. With $Toro, users can obtain a stable digital asset by over-collateralizing their BTC holdings. Beyond its role as a stablecoin, $Toro serves as the transactional fuel for the Tuna Chain network. This integration ensures transactional stability and introduces an innovative yield system. To streamline transactions on Tuna Chain, $Toro, the native stablecoin, is utilised for gas fees. This approach guarantees stable and cost-effective transactions for users.

- Modularity: Tuna Chain adopts Celestia as its data availability layer, employing a modular design in its architecture. This approach effectively tackles data availability challenges associated with Layer 2 solutions.

- ZK-OP Layer: Tuna Chain’s execution layer is built on an innovative hybrid ZK-OP (Zero-Knowledge Optimistic Rollup) solution. Initially, Tuna Chain adopts OP Stack Bedrock’s codebase to ensure EVM compatibility. As it progresses, Tuna Chain’s development roadmap leads toward a sophisticated ZK-OP hybrid architecture. This dual-phase strategy offers fast, secure transaction processing and robust execution of smart contracts.

- Yield Opportunities: Tuna Chain offers users a unique opportunity to earn attractive yields while staking their wrapped BTC assets. This contributes to the network’s security and stability and provides users with profitable $Toro yields. This feature enhances the overall BTC holding experience, allowing users to benefit from their BTC assets without liquidation.

- Expanding Capabilities: By introducing compatibility with Ethereum Virtual Machine (EVM), Tuna Chain opens up new possibilities for Bitcoin. This compatibility unlocks Bitcoin’s untapped potential, leading to a broader range of use cases and applications within the Tuna Chain ecosystem.

Investors

Token

$TUNA serves as the native token of the Tuna Chain Governance token, enabling holders to participate in network decisions through voting. Revenue within the Tuna Chain ecosystem is primarily generated through the demand for blockspace, supporting the Tuna Foundation, and protocol development. Builders and contributors involved in on-chain activities receive direct funding, stimulating growth in tools, apps, and infrastructure. Token holders benefit from revenue and savings generated by transactions and decentralized applications, thus driving demand for backspace.

PrimeX- 62.50%

Website | X(Twitter)

Website | X(Twitter)

Sector – DEX

Status – Active

Primex operates as a fully decentralized, non-custodial protocol designed for leveraged spot trading on DEXs. It offers traders a CEX-like user experience, including features like position management, take profit/stop loss orders, limit orders, and limit swaps. Additionally, Primex supports unlimited assets and their combinations for trading with leverage. Primex seeks to diminish fragmentation in digital asset markets by offering a decentralized platform that connects lenders with traders.

Features

- Cross-DEX Integration- This feature aggregates liquidity from various decentralized exchanges (DEXs), optimizing trading and reducing market fragmentation.

- Non-Overcollateralized Loans- Traders can leverage their positions without over-collateralization, a common requirement in decentralized finance (DeFi) lending.

- Decentralized Trade Execution- Primex utilizes a network of Keepers to execute trades, moving away from centralized order book mechanisms for greater decentralization.

- Enhanced Accessibility- Primex aims to make margin trading more accessible, particularly in regions with strict regulations on derivatives trading.

- Dynamic Roles- The protocol incorporates multiple user roles such as Lender, Trader, Keeper, Liquidity Provider, and Notary, each with specific functions and incentives.

Investors

Token

The $PMX token is the native token of the Primex ecosystem, functioning as both a governance and utility token. Users can earn $PMX through various activities within the ecosystem – protocol fees, keeper rewards, mining etc.