TOKEN METRICS WATCHLIST

We scored many projects this week. Here are a few you should know about:

- Fluid

- zkLink

- Pixels

- Alephium

- Algebra Finance

Please remember that some of these projects must still be subjected to our code review process. Still, we want to call them out here for preliminarily catching our eye based on our fundamental analysis process.

Fluid – 68.75%

Website | Twitter

Website | TwitterSector – Telegram App

Status – Active

FDV – $2.9M

Fluid represents a cutting-edge fintech entity specializing in advanced crypto trading software that seamlessly integrates with leading platforms such as Telegram and Discord. This innovative platform facilitates the swift trading of major cryptocurrencies like BTC, ETH, and AVAX, offering leverage of up to 50x. Users benefit from real-time Profit and Loss (PnL) statistics, asset bridging, and seamless token swaps within the Fluid ecosystem. Fluid stands out by empowering crypto enthusiasts on Telegram and Discord to execute instant trades, ensuring they capitalize on profitable opportunities without delays.

Features

Limit and Market Orders – The platform offers an intuitive, step-by-step interface to facilitate rapid trading decisions or strategic planning in response to market volatility.

Automated Risk Controls – Users benefit from swift risk management through the ability to instantly set Stop Loss and Take Profit parameters on trades. Pre-configured default settings expedite transactions, while Trailing Stops secure profits amid market fluctuations.

Enhanced Account Security – The platform prioritizes robust security measures, ensuring the safety of user funds by implementing secure wallets and Account Abstraction. This approach minimizes risks associated with bot-generated wallets, enabling users to maintain complete control over their assets using user-controlled Smart Wallets.

Real-Time Analytics – Access real-time analytics offering performance metrics like ROI, win/loss ratios, and trade durations. Get live market data for up-to-date prices, volumes, and indicators. Review historical data for past trades and patterns. View a concise portfolio overview with asset distribution, total value, and growth trends for informed decision-making.

Alerts – Access a suite of essential alerts for optimized trading efficiency and security: Receive instant Trade Execution Alerts providing real-time updates on completed trades, set custom Price Alerts to monitor asset thresholds and respond promptly to price movements, stay informed with Market News Alerts regarding impactful market developments, and prioritize security with immediate Security Alerts for suspicious activities or potential breaches, ensuring heightened vigilance over your trading activities.

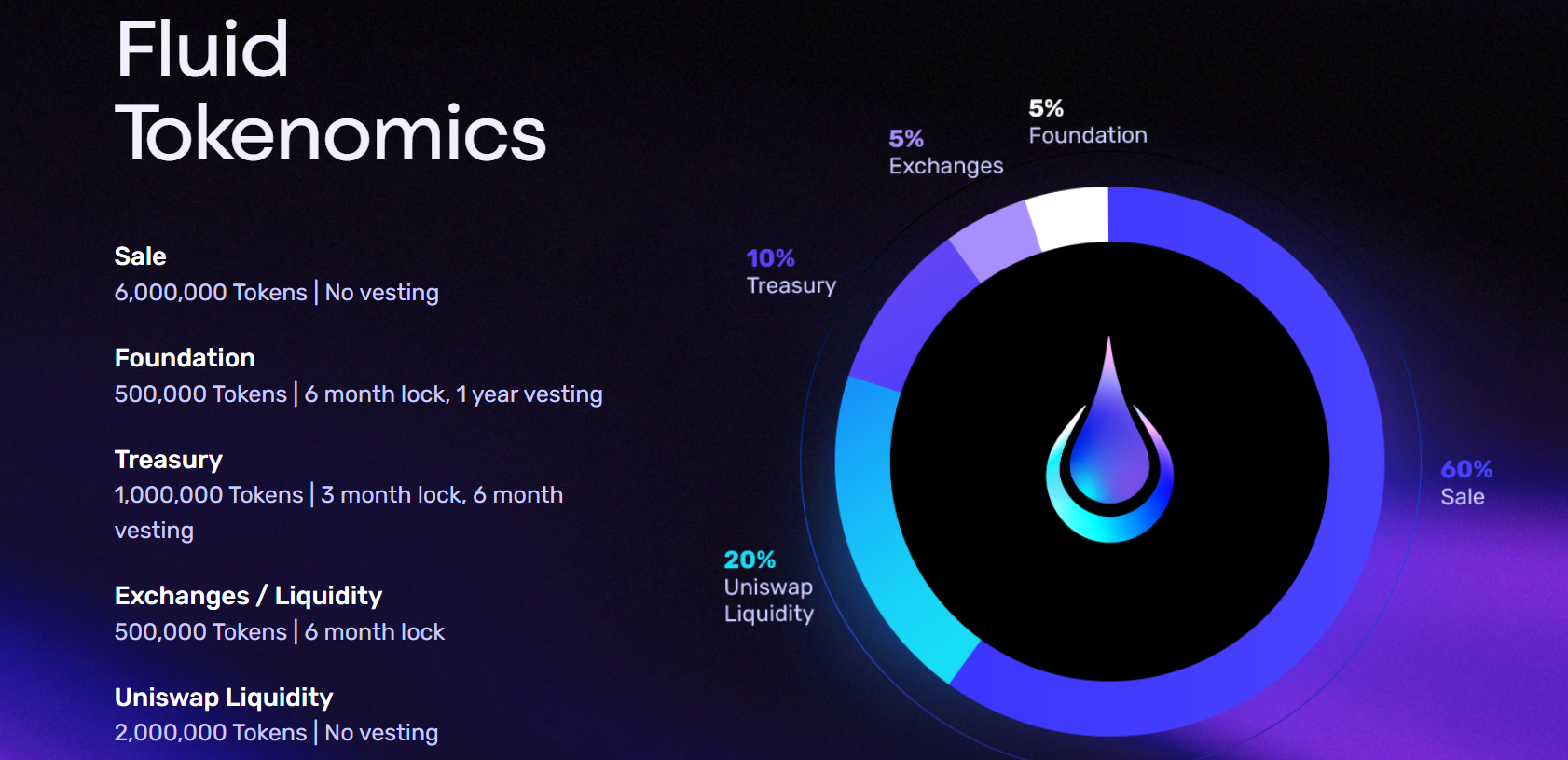

Token

A significant portion(50%) of the trading fees goes directly to those holding the token, rewarding their participation and investment. Token holders also receive a substantial part(40%) of the tax, further incentivizing their involvement and trust in the platform.

Where can you buy the token?

The token can be brought from Uniswap V2.

zkLink -68.75%

Website | Twitter

Website | TwitterSector – Zero Knowledge

Status – Active

zkLink operates as a unified multi-chain trading infrastructure fortified by zk-SNARKS, empowering the evolution of decentralized trading products like order book DEX and NFT marketplaces. Through its ZK-Rollup middleware, zkLink seamlessly integrates with diverse Layer 1s and Layer 2s, offering a suite of advanced APIs. This facilitates developers in effortlessly deploying highly customizable trading dApps while granting end-users access to aggregated liquidity across multiple chains, ensuring a smooth and cohesive trading experience. Additionally, zkLink supports OFT (Omnichain Fungible Token) issuance and bridging functionalities.

Features

- Asset Aggregation – Firstly, the platform enables Multi-chain Token Listing and Trading across diverse Layer 1 and Layer 2 blockchains. This feature facilitates the listing and trading of tokens, including fungible tokens (FTs) and non-fungible tokens (NFTs), eliminating the necessity for a bridge. As a result, zkLink mitigates cross-chain risks and reduces associated fees. Secondly, zkLink provides a robust Multi-chain Token Portfolio Management system, offering users a single wallet interface for managing portfolios spread across multiple chains. This streamlined approach parallels the centralized exchange experience, enhancing user accessibility and convenience.

- Liquidity Aggregation – Token Merge functionality consolidates tokens issued by the same entity on different blockchains (such as USDT ERC20, USDT SPL, USDT BEP20) into a singular token (e.g., USDT) within the zkLink rollup network. Additionally, zkLink introduces Stablecoin Liquidity Unification by implementing USD as a universal pricing currency within its system. This approach eliminates discrepancies among fiat-backed stablecoins on various chains, offering optional auto-conversion from select stablecoins (e.g., USDC, USDP, BUSD) to USD for dApps, thereby standardizing stability across chains.

- App-specific Zero-knowledge Circuit – This feature empowers developers with high customizability, allowing them to choose connected networks, designate where DA (data availability) resides, and fine-tune specific functions to suit their applications. The platform also ensures high performance, boasting over 1000 transactions per second (TPS), catering to the demands of high-frequency traders while supporting on-chain products.

Investors

Token

$ZKL is the primary token of zkLink. $ZKL, the utility and governance token integral to the zkLink protocol, conforms to the ERC20 token standard. With a total fixed supply of 1 billion tokens, $ZKL is designed to be non-inflationary, ensuring a consistent total supply without any issuance of new units by individuals or entities.

As the primary payment token within the zkLink ecosystem, $ZKL is the default currency for dApps to access the zkLink service and cover the expenses of utilizing network block space. Its significance lies in enabling seamless transactions and facilitating access to the zkLink network’s functionalities for decentralized applications (dApps).

Where can you buy the token?

The token has yet to be made available to trade.

Pixels -64.58%

Website | Twitter

Website | TwitterSector – Gaming

Status – Active

Pixels offers an immersive, expansive environment centered around farming and discovery, crafted meticulously pixel by pixel. Engage in resource gathering, skill development, and interpersonal connections while delving into the narrative and missions intricately integrated into the Pixels Universe. Experience a captivating fusion of management, creation, and exploration within a realm that combines blockchain ownership with your journey and achievements.

The game features primary mechanics essential for overcoming challenges and progressing in the gameplay. Current primary mechanics include farming, quests, cooking, and personalization of spaces. Anticipated additions encompass foraging, pets, flower breeding, expanded personalization, industry balancing, competitions, mini-games, character relationships, and narrative exploration.

Secondary mechanics facilitate player interaction and support progression, including features like the in-game store, social elements, taxes, leaderboards, recipe compilation, and achievements. Future secondary mechanics involve income benchmarks, level and skill progression, and elements of sabotage.

Investors

Team

The company has assembled the most skilled team within this particular field. Each team member boasts extensive experience developing products from inception, while the design team has successfully launched games enjoyed by hundreds of millions of users.

Token

Pixels has two tokens –

$Berry – $BERRY serves as the primary in-game currency within Pixels, constituting the primary means for players to progress and navigate through the game’s loops. Classified as a ‘soft currency,’ its accessibility and easy in-game acquisition are crucial to core gameplay mechanisms. Initially, players can acquire $BERRY chiefly through the in-game store by selling generated resources, thereby exchanging these resources for $BERRY.

$PIXEL – $PIXEL, the premium in-game currency in Pixels, purchases items, upgrades, and cosmetic enhancements beyond the core gameplay loop. Scarcer and more challenging to obtain, $PIXEL serves various purposes such as minting new Land, speeding up build times, boosting energy temporarily, unlocking special items and skins, enhancing XP and Skills, accessing new Crafting Recipes, Player Pets, and even buying real-life merchandise.

Its controlled and predictable supply involves minting 100,000 new $PIXEL daily, distributed to active players exhibiting beneficial behaviors within the Pixels ecosystem. Exclusive premium items can be bought from the in-game store, with no option for their repurchase. All proceeds flow into a Pixels-managed treasury, with a substantial portion likely to be burnt daily.

Where can you buy the token?

The token has yet to be made available to trade.

Alephium -64.58%

Website | Twitter

Sector – Layer 1(L1)

Status – Active

TVL – $1.87M

FDV – $116M

Alephium is a Layer 1 blockchain platform built on the innovative BlockFlow sharding algorithm, offering advancements in scalability, security, and smart contract functionality. BlockFlow enhances the scalability of the UTXO model by utilizing a Directed Acyclic Graph (DAG) structure. This innovation allows for consensus among different shards, paving the way for up to 10,000 Transactions Per Second (TPS) and ensuring a highly scalable network architecture.

Features –

- Scalable & Sharded – Alephium is a scalable and sharded blockchain underpinned by the innovative BlockFlow sharding algorithm. Departing from the UTXO model of BTC, Alephium leverages a DAG data structure to achieve consensus among disparate shards, resulting in the potential for up to 10,000 Transactions Per Second (TPS) – a stark contrast to Bitcoin’s current 7 TPS.

- Efficiency in Energy Consumption – Noteworthy for its energy-efficient design, Alephium employs the ‘Proof of Less Work’ mechanism, seamlessly integrating physical work and coin economics to regulate the mining process dynamically. Under similar network conditions, Alephium operates on approximately 90% less energy than Bitcoin, addressing energy consumption concerns.

- Programmable & Secure – Alephium introduces a stateful UTXO model, combining layer-1 scalability and the programmability akin to the account model employed by ETH while enhancing security measures.

- Virtual Machine – The platform further boasts the Alphred Virtual Machine, resolving critical issues inherent in existing dApp platforms by significantly enhancing security and development experience. This innovation introduces novel paradigms, notably enabling trustless peer-to-peer smart contract transactions. Alephium introduces its programming language, Ralph, complementing this advancement, drawing inspiration from the syntax of the Rust programming language. Ralph facilitates the streamlined development of efficient and secure smart contracts explicitly tailored to expedite the creation of DeFi dApps.

Investors

Token

$ALPH, Alephium’s native token, incentivizes miners to process blocks, enhancing decentralization and network security. It secures the network against attacks through transaction fees payable in $ALPH. Staking isn’t native to Alephium but could be offered by third-party apps. With a maximum supply of 1 billion tokens, $ALPH ensures controlled distribution within the ecosystem.

Where can you buy the token?

$ALPH can be brought from exchanges like Gate.io, Uniswap V3, etc.

Algebra Finance – 62.50%

Website | Twitter

Website | TwitterSector – Decentralized Exchange

Status – Active

TVL – 259K

FDV – $21M

Algebra represents a protocol enabling projects to integrate Concentrated Liquidity technology, among other pioneering features. Algebra significantly enhances their trading volumes and capital efficiency. Algebra effortlessly elevates capital efficiency and user convenience for your project’s advancement by offering optimal concentrated liquidity solutions to decentralized exchanges (DEXs). Already seamlessly integrated into prominent platforms like Camelot, THENA, QuickSwap, StellaSwap, Zyberswap, SpiritSwap, Nomiswap, SkullSwap, LitX, and various other DEXs across diverse chains, Algebra significantly enhances their trading volumes and capital efficiency.

The intention when consolidating liquidity is to facilitate adaptability among protocols, accommodating diverse settings and strategies for fee management. This approach ensures that protocols leveraging the liquidity layer retain their independence and individuality while capitalizing on collective synergy, thereby augmenting their overall operational efficiency.

Unique Value Propositions:

- Modular Architecture Engine: Algebra Finance offers a unique modular architecture for decentralized exchanges (DEXes), enhancing flexibility and upgradeability without migrating liquidity.

- Dynamic Fee Mechanism: Utilizes a sophisticated formula to calculate fees based on asset volatility, liquidity, and trading volume, ensuring optimal conditions for liquidity providers and traders.

- Built-in Farming Capabilities: Incorporates yield farming directly within the platform, incentivizing liquidity providers with rewards based on their active participation.

Token

$ALGB serves as the native token within the Algebra Finance ecosystem, catering to staking, governance participation, and yield farming functionalities.

Deflationary – Employing a deflationary model, Algebra’s Tokenomics operates on a system where the protocol accumulates fees from all integrated DEXs utilizing the v3 codebase powered by Algebra. The fee structure is not static and is contingent on the specific tokenomics of each DEX. These fees, dependent on trading volumes, are collected weekly:

- The protocol aggregates fees from all participating DEXs.

- 30% of the accumulated fees are allocated to operational requirements.

- The remaining 70% is designated for the buyback of $ALGB tokens, followed by burning, contributing to the reduction of token supply.

Where can you buy the token?

$ALGB can be brought from exchanges like Quickswap, MEXC etc.