TOKEN METRICS WATCHLIST

We scored many projects this week. Here are a few you should know about:

- Goldfinch Finance

- Microvision Chain

- Boson Protocol

- Nexa

- GPU.Net

Please remember that some of these projects must still be subjected to our code review process. Still, we want to call them out here for preliminarily catching our eye based on our fundamental analysis process.

Goldfinch Finance- 66.67%

Website | Twitter

Website | Twitter

Sector – DeFi

Status – Active

TVL – $1.36M

FDV – $44M

Goldfinch is a decentralized, globally accessible credit protocol with a primary objective of digitizing worldwide credit operations and enhancing access to capital, thereby promoting financial inclusion. This innovative credit protocol facilitates cryptocurrency borrowing without crypto collateral, as loans are securely collateralized off-chain.

Real World Assets to Defi – Goldfinch is a decentralized and globally accessible credit protocol with a core mission to digitize worldwide credit operations while extending access to capital and promoting financial inclusivity. One of its distinctive features is its capacity to facilitate cryptocurrency loans without necessitating cryptocurrency collateral. This pivotal feature addresses a long-standing barrier, making cryptocurrency capital accessible to a broader global audience.

By incorporating a consensus-based trust model, Goldfinch establishes a mechanism through which borrowers can demonstrate their creditworthiness, not through the conventional method of over-collateralization with crypto assets, but rather by relying on the collective assessment of fellow participants. This innovation lays the groundwork for creating an immutable, on-chain credit history, a fundamental building block for any scalable lending framework. This element has yet to be present in many emerging markets, representing a significant gap Goldfinch aims to fill.

How GoldFinch Finance Works?

Borrowers, which presently encompass off-chain lending enterprises, submit credit line terms for consideration to Goldfinch’s protocol. Within this ecosystem, the Goldfinch community of Investors can supply capital to these credit lines, denoted as Borrower Pools. This capital allocation can occur directly to individual Pools in the capacity of Backers, or it can be achieved indirectly through automatic capital distribution across the protocol, where Investors serve as Liquidity Providers via the Senior Pool.

These Borrower businesses access their credit lines to draw stablecoins, particularly USDC, from their designated Pool. Subsequently, they convert the USDC to fiat currency and allocate it to end-borrowers within their local markets. This approach allows the protocol to harness the advantages of cryptocurrencies, such as their global accessibility to capital, while entrusting the actual loan origination and servicing to the businesses most suited to manage these processes within their respective communities.

Investors

Tokenomics

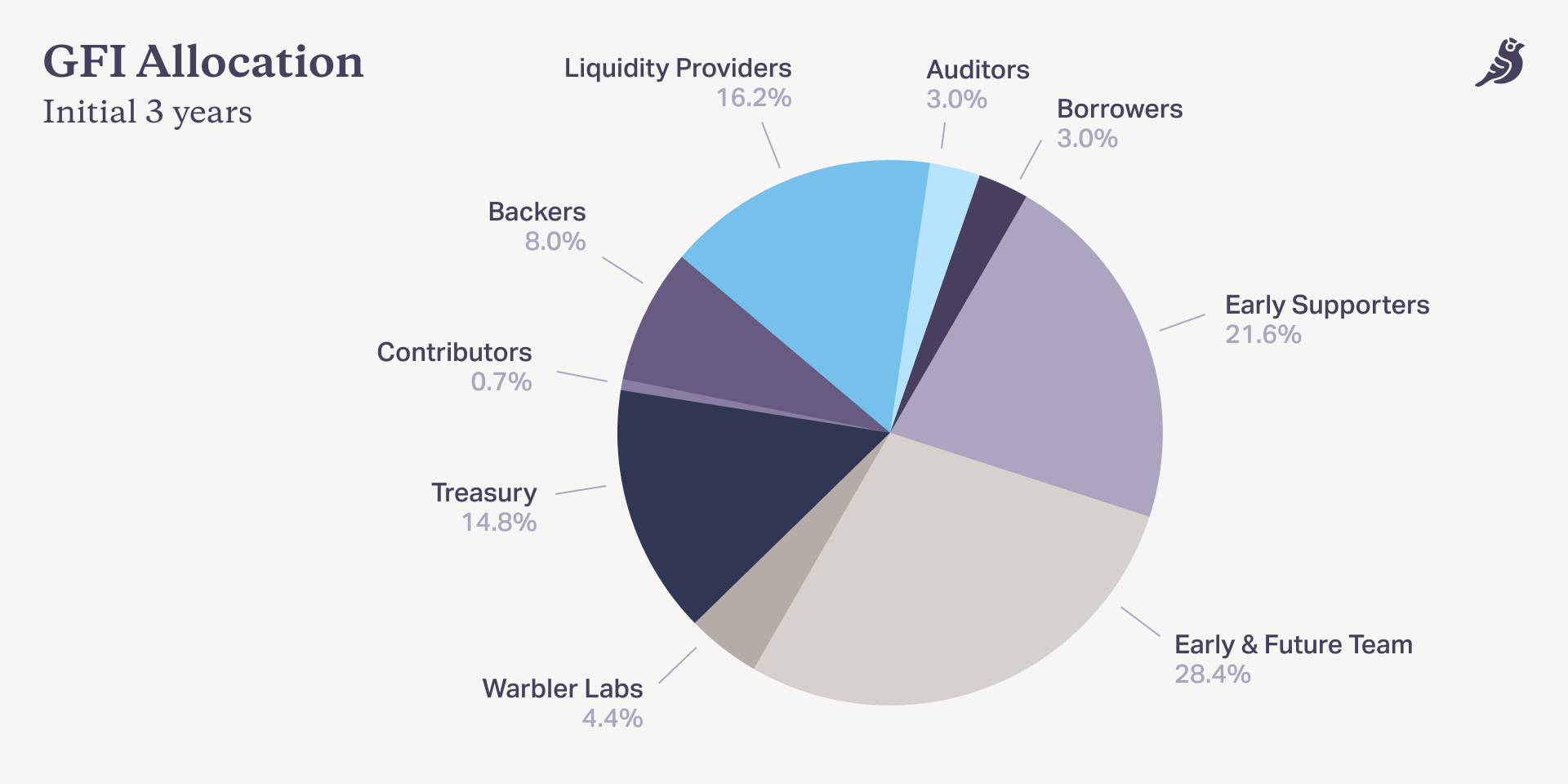

$GFI – $GFI is Goldfinch’s core native token. $GFI is used for governance voting, Auditor staking, Auditor vote rewards, community grants, staking on Backers, and protocol incentives and can be deposited into a Member Vault to earn Member Rewards in exchange for helping to secure the protocol’s growth.

Inflation: The initial token supply is limited to 114,285,714 $GFI tokens, ensuring a fixed and finite number of tokens in circulation.

As of the present, there is no inflationary mechanism in place; however, it is anticipated that introducing a controlled inflation rate may prove advantageous for the protocol’s long-term sustainability. This prospective inflation, if implemented, is envisioned to come into effect after a three-year period to reward and incentivize active participants within the ecosystem.

$FIDU – $FIDU is a token that represents a Liquidity Provider’s deposit to the Senior Pool. When a Liquidity Provider supplies to the Senior Pool, they receive an equivalent amount of $FIDU.

Where can you buy the token?

You can buy $GFI tokens from exchanges like Coinbase, Gate.io, Uniswap V3, etc.

Microvision Chain(MVC)- 66.67%

Website | Twitter

Website | Twitter

Sector – Layer 1 chain

Status – Active

TVL – $266K

FDV – $196M

Microvision Chain represents a pioneering public blockchain that incorporates numerous groundbreaking innovations. Leveraging the UTXO (Unspent Transaction Output) and POW (Proof of Work) model, it has achieved an unprecedented combination of High Performance, exceptionally Low Fees, and a high degree of Decentralization. Furthermore, by integrating Layer 1 DID (Decentralized Identity) and Smart Contract technologies, MVC aspires to ascend as the preeminent blockchain, uniquely positioned to facilitate the transition of 8 billion users into the Web3 Era.

MVC is a blockchain that solves the blockchain trilemma and is born in the Web3 Era.

Features

Decentralized: The concept of decentralization is pivotal in ensuring the system’s resilience, cross-regional viability, and equitable competition. It cultivates self-sustaining vitality throughout the entire system.

High performance: The system adopts an optimized UTXO high-concurrency model and enhances the traditional UTXO transaction format. This upgrade results in the creation of super nodes capable of high-performance parallel computing, enabling the establishment of a dynamically scalable public blockchain. This blockchain can support millions of transactions per second (TPS) and is accessible to users worldwide.

Built-in native distributed ID: Incorporating native distributed IDs allows data to be directly associated with specific users, granting users natural control over their data. This facilitates seamless data interconnection between applications, streamlines the development process, and forms a solid foundation for constructing high-performance Web3 applications.

Layer 1 UTXO smart contract: This innovative feature empowers the system to execute all the logical functions of an Ethereum Virtual Machine (EVM). Leveraging the advantages of the UTXO model, this solution excels in high performance and meager transaction fees.

Token

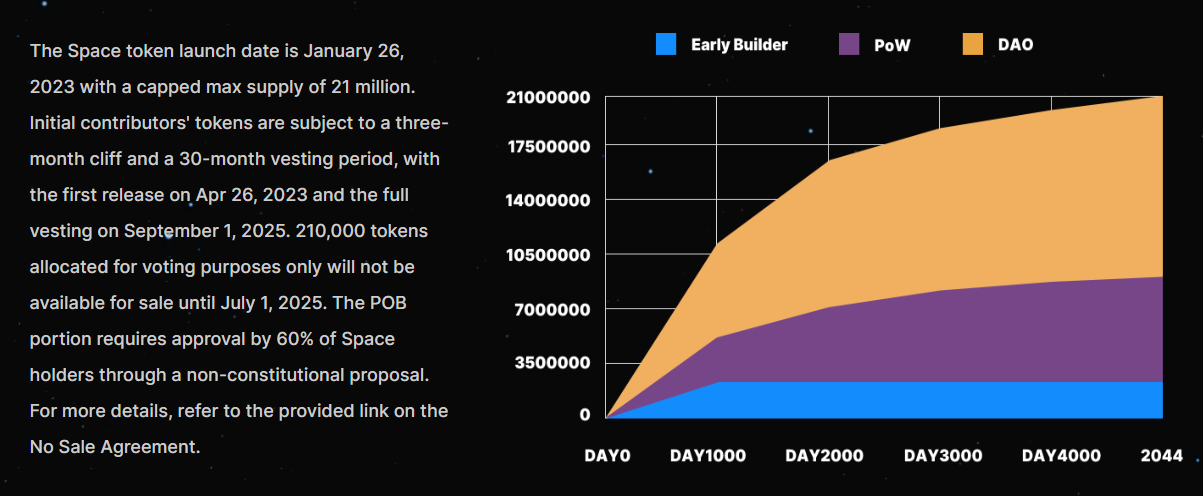

$SPACE functions as the native token of Microvision, playing multiple critical roles within its ecosystem. It serves as a medium for carrying value, operates as the governance token of the MVC platform, and facilitates transaction costs within the broader ecological framework.

The distribution is as follows:

| DAO | 55% |

|---|---|

| POW | 35% |

| Early Builders | 10% |

$SPACE has a cap supply of 21 million.

MVC DAO: MVC DAO serves as an entity structured on decentralized principles. Its primary purpose is to provide support and empower $Space token holders to engage in the proposal and voting process for effecting changes within the protocol under its governance. A distinctive feature of MVC DAO is its incorporation of a built-in treasury system known as the “MVCDAO treasury.” This treasury mechanism is instrumental in incentivizing and fostering continuous development and maintenance efforts for the MVC ecosystem. The ultimate aim is to ensure that all participants within the ecosystem are active contributors, thus transforming them into genuine beneficiaries rather than mere observers.

Where can you buy the token?

You can buy $SPACE tokens from exchanges like MEXC, BingX, CoinW, etc.

Boson Protocol- 66.67%

Website | Twitter

Website | Twitter

Sector – Real-World Assets

Status – Active

FDV – $39M

Boson Protocol represents the decentralized public infrastructure for commerce, designed to be accessible to all and foster trust among its users. Developed by Redeemeum Labs and in collaboration with a growing network of decentralized teams, Boson Protocol empowers the tokenization, transfer, and exchange of physical assets as redeemable Non-Fungible Tokens (NFTs).

Boson Protocol addresses a critical challenge within Web3, which revolves around facilitating commerce transactions for real-world assets through smart contracts, all while circumventing the need for a centralized intermediary.

Features

Decentralized Commercial Exchange: Boson Protocol offers a highly efficient and optimistic fair-exchange protocol that facilitates decentralized commercial transactions involving real-world assets, all while eliminating the need for centralized intermediaries or trusted third parties.

Tokenization of Real World Assets: Furthermore, Boson Protocol specializes in tokenizing real-world assets through Redeemable NFTs (rNFTs), which can be perceived as forward contracts for physical assets, thoughtfully programmed within smart contracts. These rNFTs can be securely held, transferred, or traded just like any other NFT, providing a versatile solution for asset ownership and exchange.

Fair-exchange assurance: To ensure a fair and secure exchange, the Boson Protocol leverages game theory and independent resolvers. This approach furnishes the holder of an rNFT with robust and credible assurance that they will either be able to redeem the token for the physical asset or receive a refund, thus establishing a foundation of trust in the exchange process.

Token

The $BOSON Token serves as the fundamental economic unit within the Boson ecosystem, playing a pivotal role in governing the protocol, providing incentives to various stakeholders, and allowing for the equitable distribution of the value generated. The maximum supply of $BOSON is 200 million.

Acquiring BOSON tokens can be accomplished through engagement in several avenues. These include contributing to development bounties, participating in meetups and Ask-Me-Anything (AMA) sessions, participating in competitions, or demonstrating an active involvement within the community.

Where can you buy the token?

$BOSON token can be brought from exchanges like Gate.io, BingX, etc.

Nexa – 62.50%

Website | Twitter

Website | Twitter

Sector – Layer 1

Status – Active

FDV – $21M

Nexa stands as a highly scalable Layer-1 blockchain solution designed to support an impressive throughput of more than 10 billion transactions daily. It achieves this remarkable performance while providing functionality akin to Ethereum Virtual Machine (EVM) for smart contracts and native token services, all while upholding the principles of decentralization.

Features

Global Scalability: Nexa’s exceptional scalability results from its innovative Proof-of-Work (PoW) algorithm, enabling the network to process over 10 billion transactions daily. This ample capacity accommodates global demands without the inconvenience of high fees or transaction delays. Nexa leverages cutting-edge technology to overcome traditional bottlenecks related to bandwidth, storage, and computation speed of network nodes.

Native Token Services: Tokens represent a well-established use case in the cryptocurrency market, and Nexa seamlessly integrates native token functionality into its ecosystem. Users can harness the value and network effects of tokens without needing specialized smart contracts or adherence to token standards such as ERC-20. For those seeking the full capabilities of smart contracts for their tokens, Nexa provides that option as well.

Native NFTs: Nexa simplifies the creation of Non-Fungible Tokens (NFTs), allowing them to be generated with the same ease as fungible tokens. These versatile NFTs serve diverse purposes, including digital artwork, asset ownership, tickets, in-game items, certificates, and countless other yet-to-be-discovered applications. The comprehensive functionality available to tokens is equally accessible to NFTs, opening up a world of possibilities.

Wise-Contracts: Nexa introduces an ultra-scalable smart-contract system known as “wise-contracts,” which empowers many applications on par with those offered by Turing-complete networks. These wise contracts are not only smart but also prudent in utilizing network resources, eliminating the significant scaling challenges often encountered by other platforms.

PoW-Based Scaling: Nexa’s Proof-of-Work algorithm harnesses the expansive scaling potential of mining incentives, incentivizing the development of hardware that nodes can utilize to expedite transaction validation. This approach yields unprecedented transaction speeds, setting Nexa apart from other blockchain networks.

Instant Transactions: Transactions on Nexa are swiftly propagated across the network, benefiting from the network’s miner rules to ensure the security of specific transactions. Shortly, Nexa will introduce a groundbreaking technology that facilitates instant, trustless transactions of any value, granting users the option to have their payments credited instantly.

Team

Nexa has been meticulously constructed and is under the stewardship of Bitcoin Unlimited, an organization with a seven-year history and a team of seasoned crypto pioneers. Collectively, this team boasts over 70 years of invaluable experience in cryptocurrency development. Bitcoin Unlimited’s software has served as the foundational technology behind Bitcoin (BTC) and, subsequently, Bitcoin Cash (BCH), facilitating the smooth operation of billions of dollars in mining and economic infrastructure for an extended period.

Token

The NEXA ecosystem is centered around the core element, the NEXA token, which functions as the native cryptocurrency for the blockchain. This versatile digital asset serves a multitude of purposes, encompassing the payment of transaction fees, active engagement in staking activities to fortify the network and receive incentives, and as a means to access a diverse array of decentralized applications developed on the NEXA blockchain.

Supply: The supply is capped at 21 trillion tokens.

Where can you buy the token?

You can buy $NEXA tokens from exchanges like MEXC, Bitmart, CoinEx, etc.

GPU.Net- 62.50%

Website | Twitter

Website | Twitter

Sector – Artificial Intelligence(AI)

Status – Not yet launched.

The GPU Network represents a decentralized infrastructure providing on-demand graphics processing units, underpinning the future of Generative AI, Web3 Metaverses, high-end graphics rendering, and cryptocurrency mining. The GPU Network project embodies a visionary undertaking focused on addressing the escalating global demand for GPU resources by harnessing the inherent decentralization of blockchain technology.

GPU.Net is committed to establishing a distributed network of GPUs that will enable an efficient, accessible, and cost-effective ecosystem for sharing GPU resources. This ecosystem will facilitate advanced computational tasks, including the training of AI/ML language models, complex gaming, scientific computing, and more, all on a substantial scale.

Use Case

AI/ML Training and Inference: The GPU Network can elevate AI/ML language model training to a broader scale. Its decentralized and distributed GPU resource infrastructure can be harnessed for AI/ML training and inference endeavors. This empowers users to efficiently and cost-effectively train intricate models and conduct large-scale inference tasks.

Rendering and Animation: The entertainment industry stands to benefit significantly from the opportunity to expand rendering and animation production through the utilization of the distributed GPU network. This advancement equips artists and studios with the means to expedite the rendering of high-quality graphics and animations, all while maintaining affordability.

Gaming and Virtual Reality: The GPU Network possesses the potential to revolutionize the gaming industry and enhance user experiences. It enables gamers to access potent GPUs for real-time rendering, complex physics simulations, and applications in virtual reality, thereby optimizing gaming experiences and performance.

Generative AI Tools: The GPU Network is home to a diverse array of cutting-edge Generative AI tools, including Video to 3D, NeRF, and novel view synthesis products. These tools rely on neural network-based rendering for converting video, images, and text into 3D representations, offering various creative possibilities.

Scientific Computing: Scientists and researchers can tap into the GPU Network’s capabilities to expedite scientific simulations, data analysis, and other computationally intensive tasks. This acceleration in computational capabilities accelerates the pace of scientific discovery, opening new horizons in research and innovation.

Investors

Token

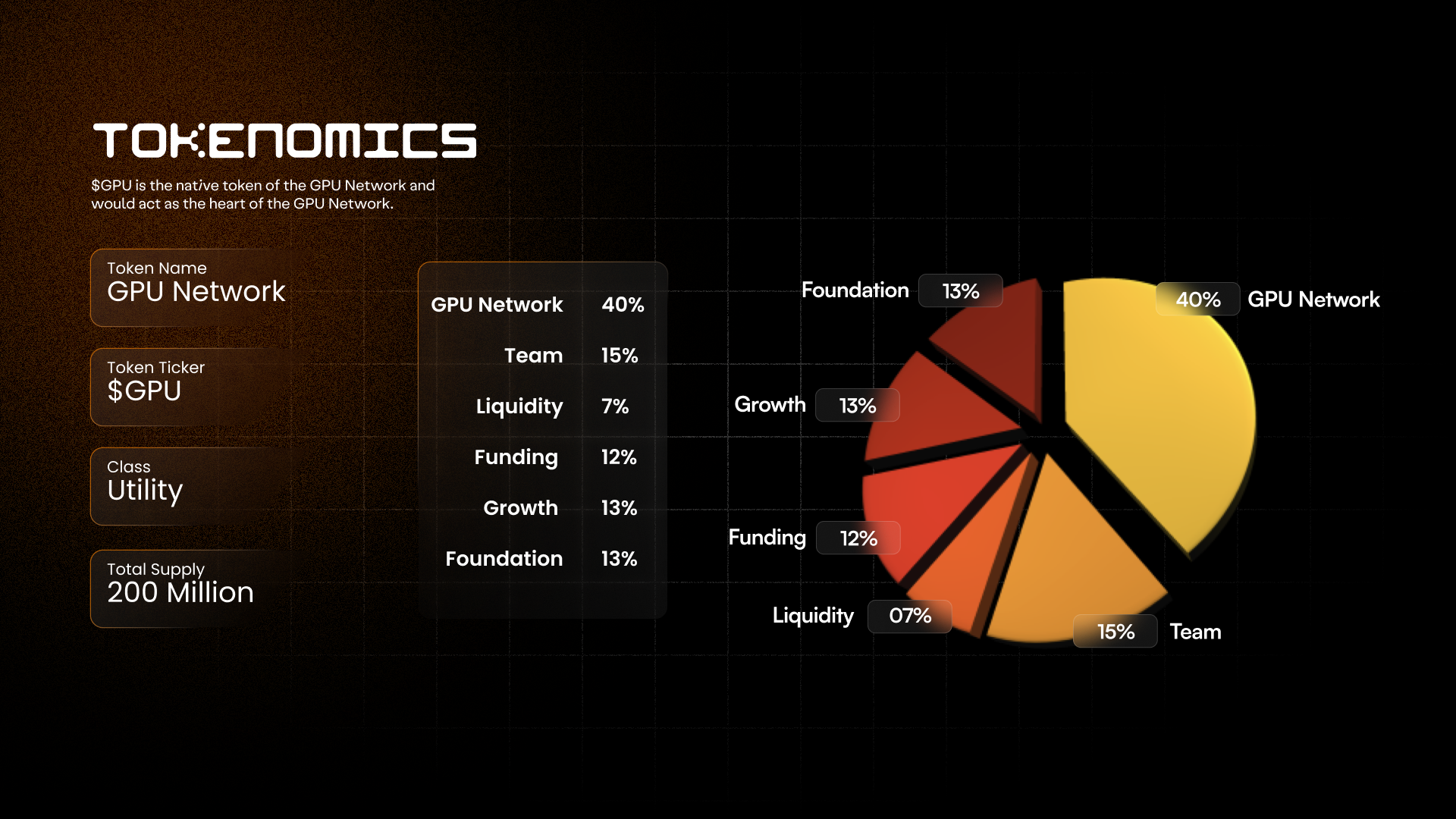

Within the GPU Network ecosystem, the $GPU token is pivotal as the primary transactional currency. Its value and usage are determined by a dynamic protocol that considers the balance between supply and demand, thereby establishing the $GPU provider rate for each machine. This innovative approach allows for flexibility in incentivizing or penalizing network stakeholders, encompassing both providers and consumers.

Consumers within the ecosystem can further engage with $GPU by staking it, which not only grants them uninterruptible instances but also influences the priority and duration of their running instances. The level of staking directly correlates with the priority for extended usage. Additionally, $GPU can serve as an investment avenue for interested parties, allowing them to stake and earn a yield while providing a yield to single asset LPs, catering to diverse preferences and participation within the GPU Network.