TOKEN METRICS WATCHLIST

We scored many projects this week. Here are a few you should know about:

- Magpie

- Socket

- LI.FI

- Koii Network

- Superform

Please remember that some of these projects must still be subjected to our code review process. Still, we want to call them out here for preliminarily catching our eye based on our fundamental analysis process.

Magpie – 66.67%

Website | X(Twitter)

Website | X(Twitter)Sector – Cross-Chain

Status – Active

Magpie Protocol is developing a cross-chain infrastructure and protocol that aims to provide a straightforward, efficient, and secure method for trading and investing within the decentralized finance (DeFi) ecosystem. Magpie Protocol is a decentralized platform for liquidity aggregation and cross-chain swaps, offering optimal asset exchanges across leading blockchains without asset bridging. The protocol ensures swift and gas-efficient cross-chain swaps, eliminating the requirement for bridging assets. Magpie also plans to expand its protocol with intent.

How does it work?

Magpie facilitates asset swaps by converting your assets into a bridge liquidity pool on one blockchain. It then utilizes a multi-chain messaging or data transfer layer to swiftly transmit a swap signal to the destination chain, achieving near-instant finality. Upon verification, your assets are exchanged from the bridge liquidity pool on the destination chain for the requested asset. Unlike the traditional multi-step process involving visits to multiple websites, dApps, and DEXs, along with the need to approve and complete numerous swaps, Magpie streamlines this process. It allows you to execute cross-chain swaps in just a few clicks. Users select the desired pair and chains for token swapping, receive the best offer available, and then proceed with the swap with a simple click.

Investors

Token

Magpie will introduce its native token, $FLY, serving dual roles as a governance and liquidity token within the ecosystem. Fees generated will be redistributed among liquidity providers, $FLY stakers, and operational funds, enhancing the token’s utility and incentivizing participation in the network.

Socket- 64.58%

Website | X(Twitter)

Website | X(Twitter)Sector – Cross-Chain

Status – Active

Socket is introduced as an interoperability protocol to streamline asset and data transfers for applications spanning multiple blockchains. It offers an infrastructure enabling developers to construct applications with interoperability as a fundamental feature.

Socket consolidates all asset bridges and decentralized exchanges (DEXs) into a unified meta-bridge. It dynamically chooses and directs funds through the most suitable bridge based on user-defined preferences such as cost, latency, or security. Integrating DEXs and DEX aggregators into our meta-bridge enhances its functionality, facilitating the seamless transfer of tokens.

Bungee Exchange – Bungee Exchange is a bridge aggregator by Socket that offers users a seamless experience, guiding them through secure and efficient routes to transition between different blockchain networks in a few simple steps. By highlighting the most cost-effective, expedient, and secure pathways, Bungee simplifies the asset-bridging process.

The platform aims to demystify the complexities of bridging, transforming it into an intuitive and straightforward process. This ensures that users can seamlessly move their funds across different blockchains.

Socket Plugin – The Socket ecosystem offers several vital components to enhance the multichain user experience and facilitate cross-chain interactions. The Socket PlugIn enables protocols to integrate seamlessly, minimizing developer overhead and ensuring a smooth user experience across multiple chains. Additionally, Socket APIs empower developers to create innovative cross-chain use cases, leveraging the full potential of the Socket ecosystem. Furthermore, the Link Bungee feature directs users to any bridging interface powered by Socket, providing customized parameterization options to suit individual needs and preferences.

Refuel – Refuel, ensures that users can consistently access GAS on any required blockchain network. Integrated within the bridging flow, Refuel serves multiple use cases, providing users with native tokens alongside bridged assets or acting as a bridge for small amounts of native tokens. This functionality enhances the overall user experience, offering greater convenience and flexibility in managing assets across different chains.

Investors

LI.FI- 64.58%

Website | X(Twitter)

Sector – Cross-Chain

Status – Active

LI.FI is a comprehensive multi-chain liquidity aggregation protocol designed to facilitate any-to-any swaps by consolidating bridges and DEX aggregators across over 20 networks. Its middleware component provides access to decentralized exchanges (DEXs), DEX aggregators, cross-chain bridges, essential data sources, and smart order routing capabilities. This infrastructure enhances liquidity provision and trading efficiency, allowing users to seamlessly trade assets across various blockchain networks.

LI.FI is a data mesh that integrates various cross-chain liquidity sources, including cross-chain liquidity networks, bridges, decentralized exchanges (DEXs), and lending protocols. As a bridge and DEX aggregator, LI.FI can direct any asset on any chain to the desired asset on the desired chain, enhancing the user experience significantly. This functionality is accessible through an API/Contract level, provided as an SDK, iFrame solution (deprecated), and widget, allowing developers to integrate LI seamlessly LI.FI into their products without requiring users to leave their decentralized applications (dApps).

Use Case

Seamless usage – LI.FI offers seamless user onboarding, simplifying the process of starting to use a new decentralized application (dApp). With LI.FI integrated into a dApp interface, users can select any asset on any chain and instantly bridge, swap, or move it into the desired asset or vault within the dApp, streamlining the onboarding process.

Cross-chain solutions – LI.FI also facilitates cross-chain swaps, addressing the challenge faced by dApps that offer asset swaps on a single chain, potentially losing users who need to access other bridges and DEXes. By implementing LI.FI‘s SDK, dApps can offer cross-chain bridging and swaps, allowing them to utilize a “prefer” setting to prioritize their own liquidity providers (LPs) or automated market makers (AMMs) whenever feasible, thus minimizing revenue loss.

Cross-Chain Yield Farming Strategies – Furthermore, LI.FI enables cross-chain yield farming strategies, a previously underutilized approach due to yield aggregators primarily operating within a single ecosystem. With LI.FI vault contracts can monitor yields across multiple chains, strategically deposit funds, and identify the most trustworthy and cost-effective bridges with sufficient liquidity to deposit into the highest yield-generating protocols.

Multi-Chain Money Markets – LI.FI facilitates multi-chain money markets, allowing users to borrow on one chain without first transferring funds across chains. Through LI.FI, dApps can communicate across chains, enabling users to collateralize, borrow, and repay their loans on different chains, enhancing accessibility and usability in the DeFi space.

Investors

Koi Network- 62.50%

Website | X(Twitter)

Sector – Artificial Intelligence/ DePin

Status – Active

Koii’s primary goal is to democratize the internet’s power by shifting it from centralized entities to individual users and communities, creating a decentralized network. This approach empowers users and fosters a more inclusive and diverse online environment. One of Koii’s key advantages lies in its environmental and cost efficiency. The platform significantly reduces the environmental impact and costs associated with traditional data centers by utilizing existing consumer hardware for edge computing. This approach aligns with the growing focus on sustainability and responsible resource management. Moreover, Koii’s versatility is a notable feature, as it supports various applications, including AI, social media, and web services. This flexibility enables developers and users to explore diverse possibilities and tailor the platform to their needs. Regarding security and privacy, Koii offers enhanced protection compared to centralized systems. Decentralization inherently reduces vulnerabilities, improving security and privacy for users. This aspect is crucial in an era where data protection and privacy are paramount concerns. Additionally, Koii introduces a sophisticated incentive structure that combines a Proof of Stake model with reputation-based systems for node operation and task execution. This approach incentivizes participation and builds trust among users, contributing to the platform’s overall reliability and stability.

Token

$KOII serves as the native token of the Koii protocol, playing a crucial role in governing the network’s operations. Holding $KOII tokens does not grant any network governance rights or ownership.

The total supply of KOII tokens is capped at 10 billion with an annual inflation rate of 3.65% after reaching this limit. This inflation is distributed between attention mining, which receives 50% of new tokens, and K2 settlement layer nodes, which also receive 50%. This distribution model ensures that content creators on the Koii Network are fairly rewarded for their contributions.

A key feature of the Koii ecosystem is the staking mechanism required for node operators when running a Koii task. This process involves locking up tokens for a specific period, serving two primary purposes. Firstly, it enhances the security and integrity of the network by ensuring that validators have a stake in maintaining the consensus. Secondly, it reduces the available token supply in circulation, which, coupled with the increasing demand for KOII tokens due to network usage and adoption, is expected to positively impact the token’s value over time.

Superform – 58.33%

Website | X(Twitter)

Website | X(Twitter)Sector – DeFi

Status – Not yet Launched

Superform operates as a decentralized marketplace for cryptocurrency yields, allowing users to explore various yield opportunities across blockchains. The platform enables users to effortlessly deposit assets into these opportunities using any asset from any chain in a single transaction. Additionally, protocols can list their vaults on Superform permissionless, granting them immediate distribution without requiring a custom frontend. This protocol addresses fundamental challenges within DeFi by establishing a two-sided marketplace that facilitates efficient discovery, execution, and yield management across different blockchains. Superform is characterized by its permissionless nature, modularity, and the ability to conduct intent-based transactions across chains, enabling users to execute transactions involving multiple tokens, chains, and vaults simultaneously.

Superform offers two distinctive experiences. The platform allows developers to deploy their vault once and list it on Superform without permission. This approach enables developers to access users across all chains seamlessly. Superform provides a user-friendly way for yield seekers to deposit into any vault on any chain, using any token from any chain. This flexibility allows users to maximize their yield opportunities without being restricted by the limitations of a single chain.

One of Superform’s key features is its blockchain-agnostic nature. This means that the protocol is not tied to a specific blockchain. Instead, it can be deployed on any EVM-compatible chain, provided that it supports Arbitrary Message Bridge (AMB), has sufficient bridge liquidity, and offers ERC-4626 vault opportunities. Initially, Superform Labs plans to deploy the protocol on several prominent chains, including Ethereum, Base, Arbitrum, Optimism, Polygon PoS, BNB Smart Chain, Avalanche C-Chain, and Fantom. Looking ahead, Superform aims to expand its presence into other domains, further enhancing its accessibility and utility across the broader blockchain ecosystem.

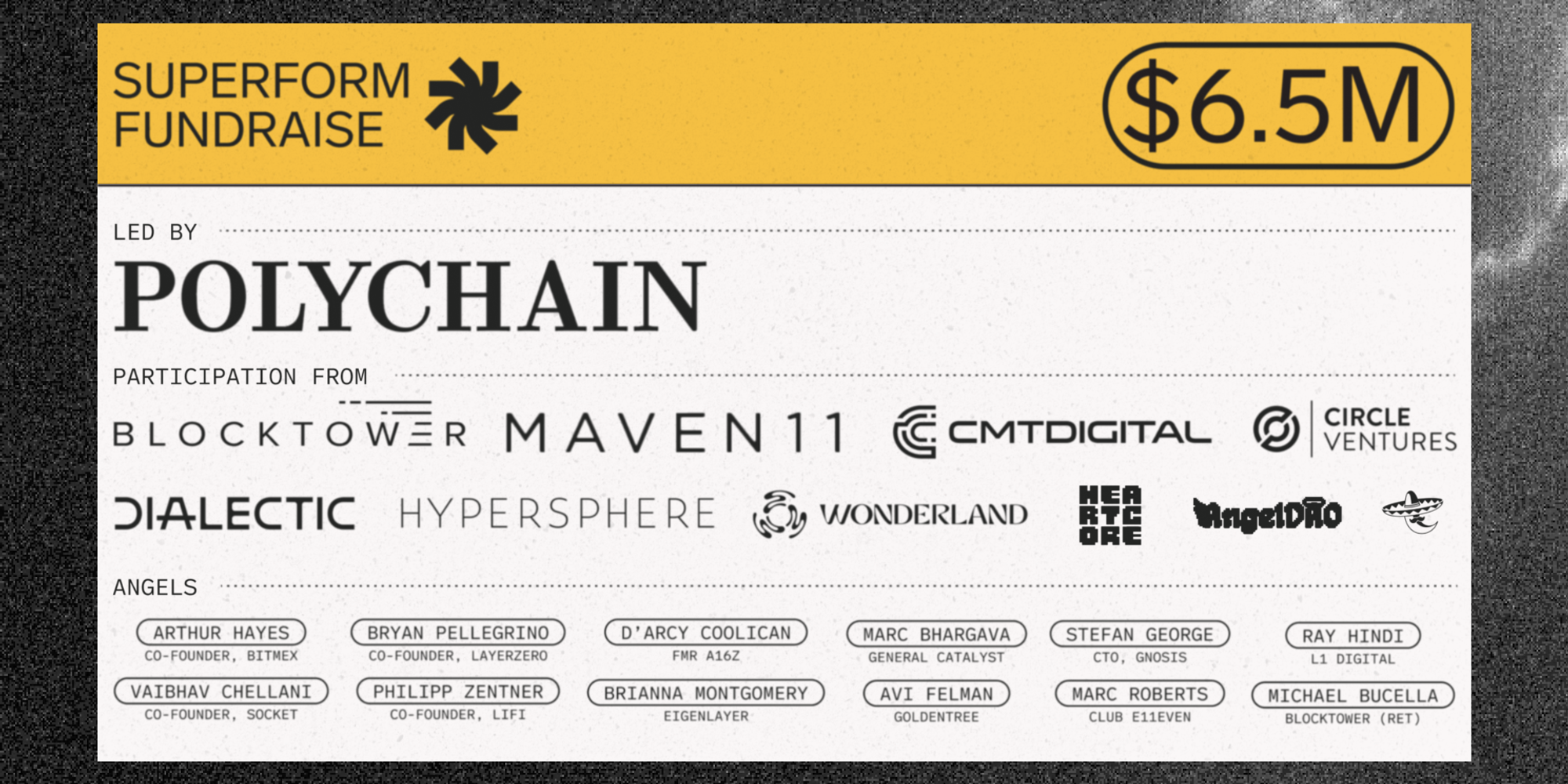

Investors