We scored many projects this week. Here are a few you should know about:

- S….

- Whales Market

- Masa

- Omni Network

- Teleport DAO

Please remember that some of these projects still need our code review process. Still, we want to call them out here because they preliminarily caught our eye based on our fundamental analysis process.

Safe- 70.83%

Website | X(Twitter)

Website | X(Twitter)

Sector – Infrastructure/Wallet

Status – Active

FDV – $2.06B

Safe leads in modular smart account infrastructure, empowering developers to build diverse applications and wallets. It enables universal and open contract standards for the secure custody of digital assets, data, and identity, democratizing digital account ownership.

Safe envisions a future where individuals possess total control and flexibility over digital assets. The company aims to transition from passive interaction to full ownership of digital identities, financial assets, digital art, and other assets. Safe’s objective is to establish smart accounts as the standard, with its strategy for achieving this goal evolving in two key areas.

Features

- Safe Core: Safe Core is an open-source and modular account abstraction stack designed to integrate smart accounts into digital platforms seamlessly. It comprises the Safe Core SDK, API, and the Safe Smart Account, providing developers with flexible and secure capabilities for creating innovative applications.

- Safe Core SDK: The Safe Core SDK equips developers with tools to interact with Safe Smart Account contracts, create new Safe accounts, update configurations, and execute transactions. It encompasses five distinct kits: Protocol Kit, Auth Kit, Relay Kit, Onramp Kit, and API Kit. These kits cater to various functionalities such as account management, authentication, transaction relaying, and API interaction.

- Safe Modules: Safe Modules are smart contracts that extend Safe’s functionality with custom features while maintaining separate module logic from core contracts. These modules can include features like daily spending allowances, recurring transactions, and standing orders, enhancing the flexibility and usability of Safe accounts.

- Safe Guards: Safe Guards are pre- and post-transaction checks that ensure the security and integrity of Safe transactions, enhancing trust and reliability in the system.

- EVM compatible: Safe supports EVM chains, facilitating interoperability and integration with existing blockchain networks, further enhancing its utility and versatility in the digital ecosystem.

Investors

Token

$SAFE is the native token of the Safe platform, offering users various functionalities and benefits within the ecosystem. One key feature is the ability to lock $SAFE tokens, which rewards users. Additionally, token holders can stake their tokens, further engaging with the platform and potentially earning rewards. Another critical aspect of holding $SAFE tokens is the right to governance, allowing token holders to participate in decision-making processes within the Safe platform.

The max supply of $SAFE is 1 billion.

Where can you buy the token?

$SAFE can be brought from Coinbase Exchange, OKX, and OrangeX.

Whales Market- 68.75%

Website | X(Twitter)

Website | X(Twitter)

Sector – OTC Dex

Status – Active

FDV – $71M

Whales Market operates as a decentralized over-the-counter (OTC) trading platform designed for digital assets spanning various blockchains. The platform enables buyers and sellers to execute on-chain transactions that are mutually agreed upon. Using smart contracts, capital is secured until transactions are successfully settled, mitigating the risk of financial losses resulting from deceptive practices. This innovative approach not only enhances the efficiency of trading but also enhances security measures within the ecosystem.

Whales Market has the following offerings-

Runes Market – Runes Markets introduces the Runes protocol, a development in the Bitcoin ecosystem for issuing fungible tokens directly on the blockchain. Whales Market uses a hybrid approach, matching orders on Solana and settling transactions on both Bitcoin and Solana.

Pre Markets – Pre Markets offers P2P trade token allocations pre-TGE, supporting networks like Solana, Ethereum, Manta, Starknet, Base, Arbitrum, and Merlin Chain. Tokens are released with a 24-hour settlement deadline; the seller’s collateral ensures token provision, and failure to settle results in collateral going to the buyer.

OTC & Points system – OTC Markets facilitate P2P trade for tokens and NFTs on Ethereum and Solana. Point Markets introduced an OTC platform for Points P2P Trading, secured by smart contracts for mutually agreed-upon on-chain transactions.

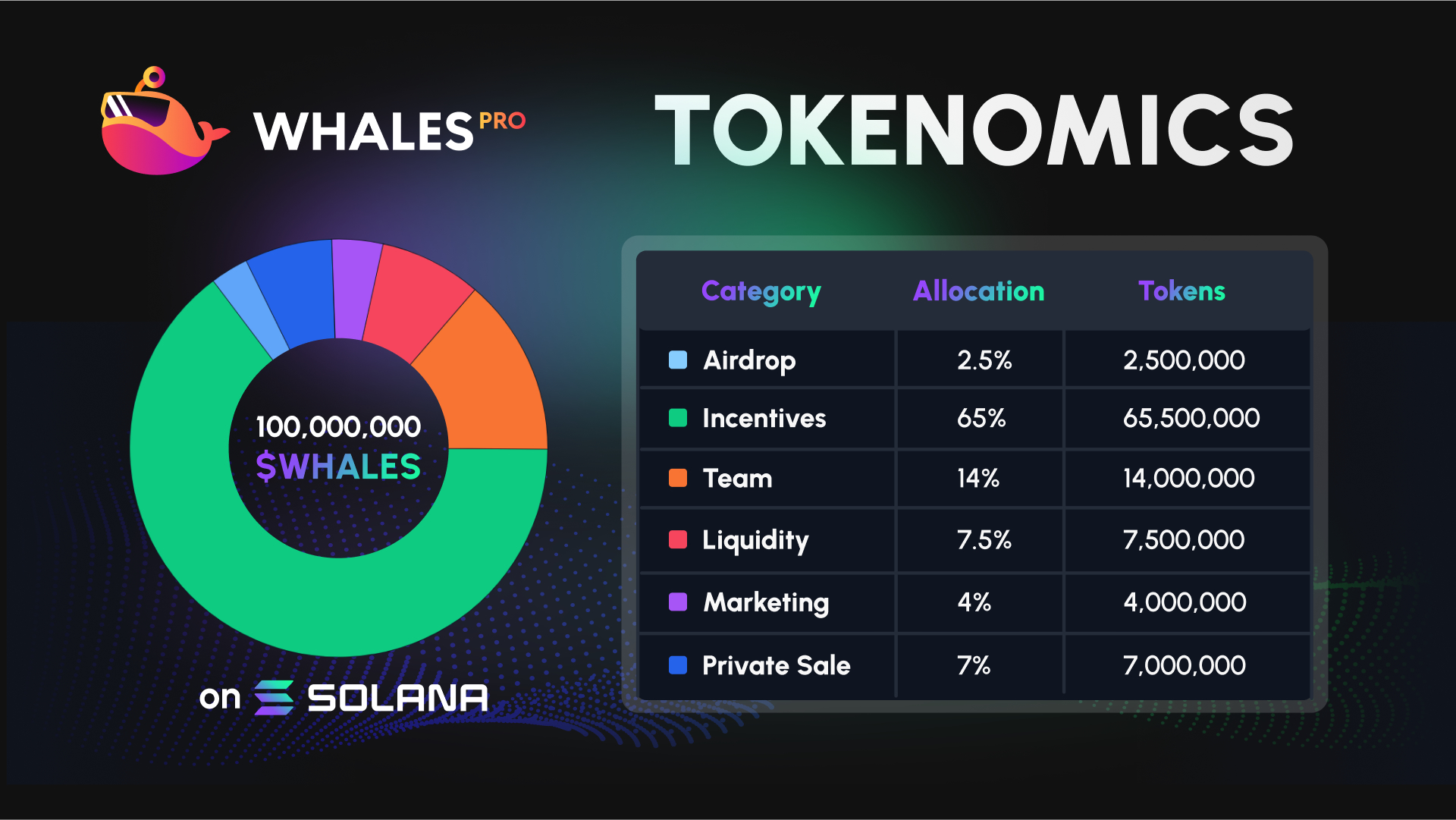

Token

$WHALES serves as an incentive for the transparent and equitable growth of the whale market. Unlike traditional presale models, there will be no presale for $WHALES, with the initial liquidity being bootstrapped by the LootBot Treasury. Holders of $WHALES can vote on key performance indicators (KPIs) in a decentralized manner, aligning to achieve a sustainable balance where revenue from fees exceeds $WHALES emissions. Additionally, users can stake $WHALES to earn revenue generated by the protocol. the total supply is 100 million.

Where can you buy the token?

$WHALEs can be brought from Radium, BingX, and Raydium (CLMM)

Masa- 68.75%

Website | X(Twitter)

Website | X(Twitter)

Sector – Artificial Intelligence

Status – Active

FDV – $235M

Masa is developing the world’s largest decentralized AI data and LLM network, where users can own, share, and profit from their data and computing resources to support AI applications. This initiative aims to establish a landscape where users are compensated for AI training efforts and providing data to numerous AI applications.

Masa’s decentralized Oracle Network enables the seamless extraction of real-time, structured data from public web and social media platforms. Through Masa, every user becomes a node worker, facilitating the utilization of open-source, state-of-the-art LLMs and OpenAI-compatible APIs without the need for complex hosting and inference setup.

Use Case

Developers: Developers can leverage Masa’s Data & LLM Network to build AI applications. This network is the world’s largest decentralized proprietary data network, with data consented to and aggregated by users. Using Masa’s decentralized data network and LLMs, developers can create unique, hyper-personalized applications driven by real-time insights.

Users: Users can share their data and earn rewards. Masa’s innovative zero-knowledge Soulbound Token ensures that personally identifiable data remains encrypted.

Investors

Token

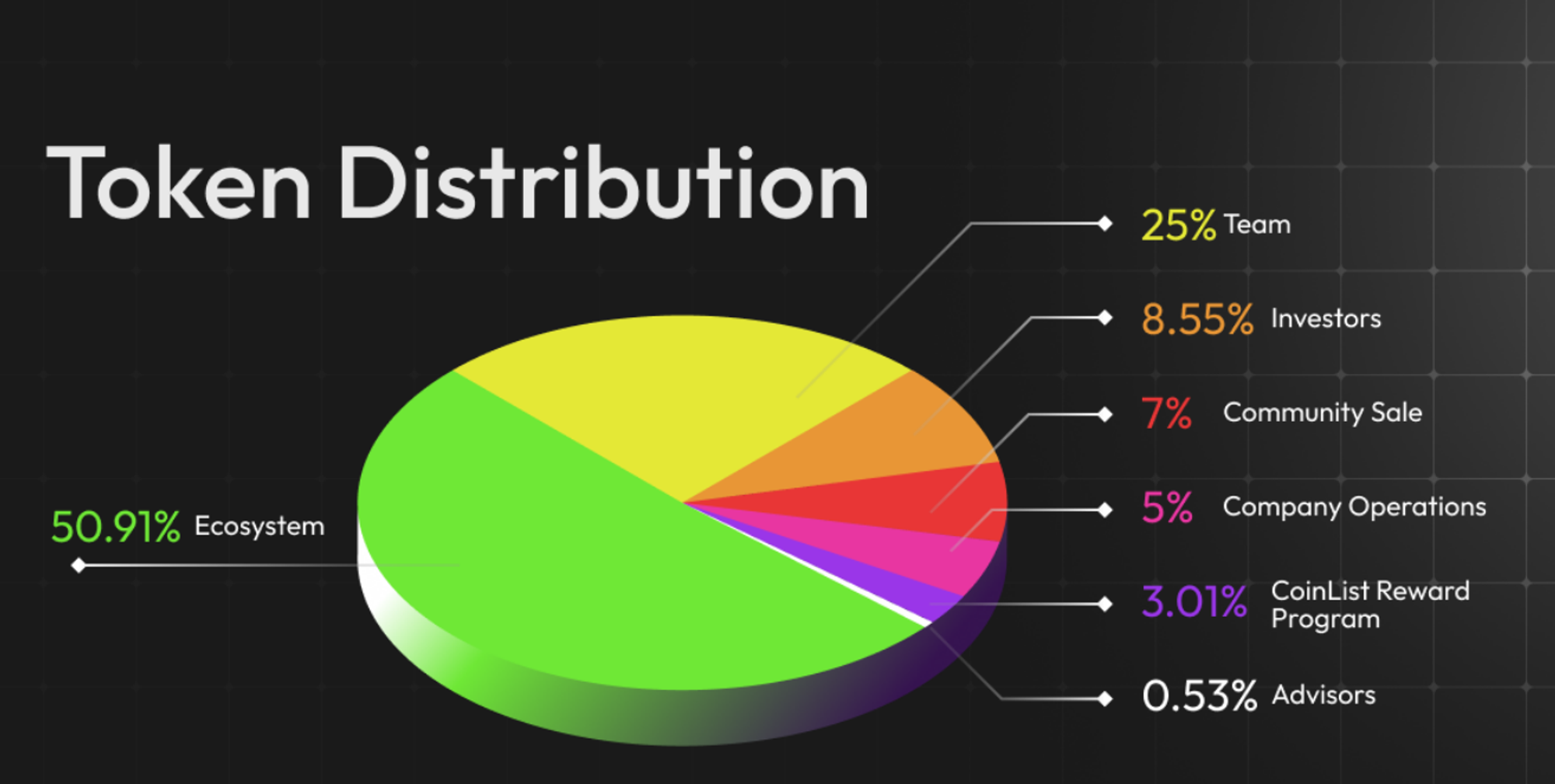

$MASA is the utility and governance token for the Masa Network. Users earn MASA for sharing data, while businesses pay fees in MASA or other tokens to access data. Non-MASA fees are converted to $MASA, with a portion burned. Users pay $MASA gas fees to manage their encrypted data locker. Node operators stake MASA to run Oracle nodes and receive rewards. $MASA holders can vote on network governance.

Where can you buy the token?

You can buy $MASA from Bybit, Gate.io and BitMart.

Omni Network- 66.67%

Website | X(Twitter)

Website | X(Twitter)

Sector – Layer 1/Rollup

Status – Active

FDV – $1.96B

The OMNI network is an interoperability protocol designed to connect different Rollups. It functions as both a public chain and the inaugural AVS (Arbitrum Verifier Shard) on the Eigenlayer. OMNI heavily relies on staking within the Eigenlayer to enhance security, allowing it to share Ethereum’s security model to process significant transactions while maintaining low latency.

Features

- Rollup integration: Omni enables seamless interaction across different Rollups, creating a unified network for users and applications. This capability streamlines processes and enhances user experiences by eliminating the need for complex procedures when moving assets or executing operations across Rollups.

- EVM Compatibility and Global Programmability: Omni incorporates its Ethereum Virtual Machine (EVM), enabling a unified development environment across rollups. This allows deploying complex decentralized applications (dApps) operating across the Ethereum rollup ecosystem without modification or compatibility issues.

- Ease of Use: Developers also benefit from Omni’s standardized communication protocols, which allow them to build applications that work seamlessly across the entire Rollup ecosystem. This developer-friendly platform encourages innovation and interoperability among different applications and networks.

- Gas Abstraction: Additionally, Omni introduces the universal gas concept, simplifying transactions for users holding funds on Ethereum, Optimistic Rollup, ZK-Rollup, or any other connected network. Users can transact without needing specific gas tokens for each network, further enhancing the simplicity and efficiency of the Omni network.

Investors

Token

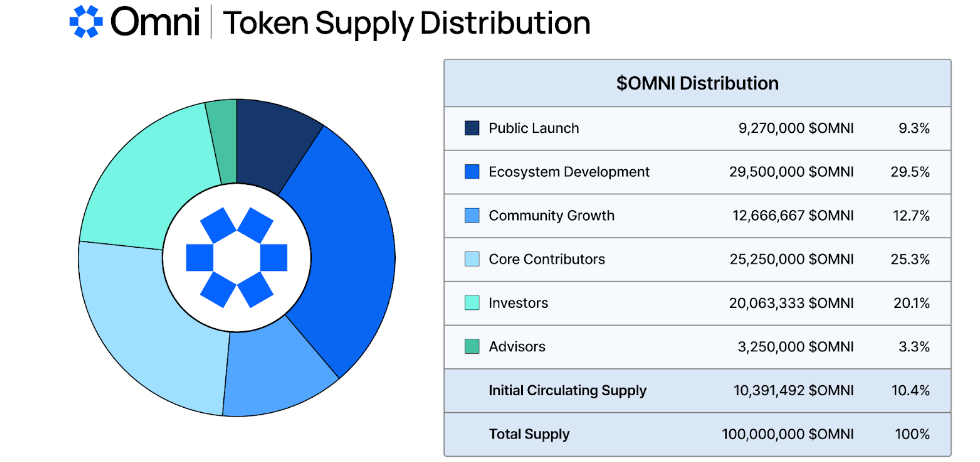

Omni operates as a proof-of-stake network, where the network’s security is ensured by the combined value of re-staked ETH and staked $OMNI token. $OMNI is the native token of the Omni Network, serving as universal gas for transaction relayers and as the primary currency for transactions on the Omni EVM. $OMNI holders also enjoy governance rights for protocol decisions and participate in a dual-staking model for economic security. The total supply of $OMNI is capped at 100 million tokens.

Where can you buy the token?

You can buy $OMNI from exchanges like Binance, Gate.io and Bit2Me.

Teleport DAO- 64.58%

Website | X(Twitter)

Sector – Infrastructure

Status – Active

TeleportDAO is a trustless interoperability protocol offering developers an infrastructure for cross-chain application construction. A light-client bridge establishes a more secure connection between Bitcoin and its Layer 2 networks with EVM chains. TeleportDAO employs relayers responsible for transferring users’ on-chain data to the smart contract that validates these transactions to validate cross-chain transactions. This protocol supports Bitcoin bridging and facilitates the development of cross-chain applications for Bitcoin. It safely ensures the most recent data from other blockchains for dApps, directly connecting blockchains without needing a new consensus layer.

This protocol applies to all blockchains, regardless of their programmability. TeleportDAO simplifies the development process by providing straightforward APIs that allow developers easy access to data from other chains.

Ecosystem

TeleOrdinal -TeleOrdinal is a pioneering cross-chain marketplace designed for Ordinals and BRC-20 tokens, offering fully decentralized trading capabilities. Users can list their Ordinal tokens on TeleOrdinal and receive bids from multiple blockchains, making it the first marketplace to enable trustless auctions for Ordinals. Leveraging the TeleportDAO bridge, TeleOrdinal verifies the transfer of Ordinal ownership on the Bitcoin blockchain.

TeleSwap – TeleSwap, on the other hand, is a trustless protocol focused on bridging and trading BTC with high-security standards. Users can integrate Bitcoin into decentralized finance (DeFi) by minting teleBTC or purchasing Bitcoin directly from any Ethereum Virtual Machine (EVM) using ERC20 tokens. TeleSwap utilizes the TeleportDAO bridge to validate Bitcoin transactions on EVM blockchains, ensuring the integrity and security of the trading process.

Investors

Token

$TST is the TeleSwap and TeleOrdinal token built on the TeleportDAO bridge. In TeleSwap, $TST serves multiple functions, including governance, where $TST holders make decisions about fund allocation, fee adjustments, and adding support for new chains. Additionally, $TST is used as collateral for Lockers, who initially lock native tokens of the EVM chain and later lock $TST. Ultimately, only $TST will be accepted as collateral. Furthermore, holding $TST provides a discount, waiving the treasury fee and reducing user costs by 25%. The max supply of $TST is 1 billion.