TOKEN METRICS WATCHLIST

We scored many projects this week. Here are a few you should know about:

- Script Network

- Aori

- Chainway

- Drift Protocol

Please keep in mind that some of these projects have not yet been subjected to our code review process, but we want to call them out here for preliminarily catching our eye based on our fundamental analysis process.

Script Network- 75% (Website – Twitter)

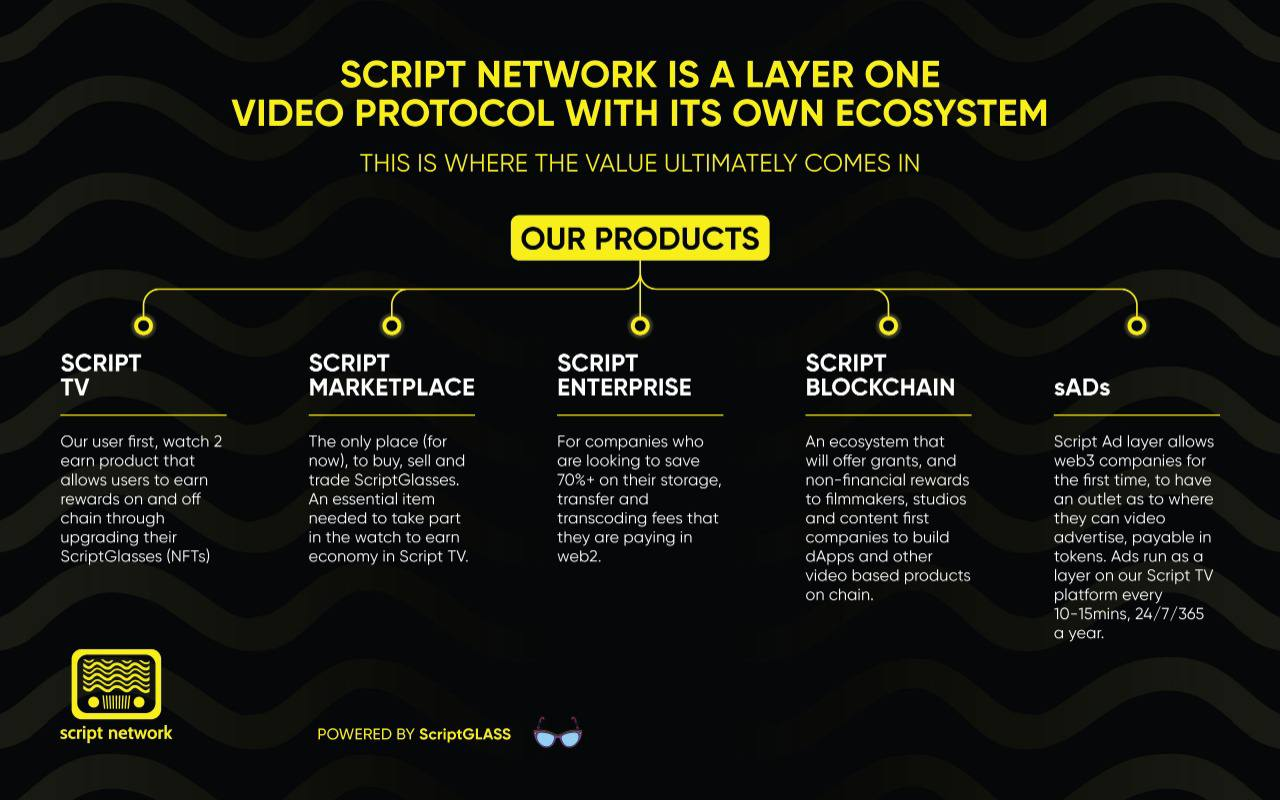

Script TV represents a decentralized video delivery network that provides a comprehensive suite of blockchain-driven solutions to address challenges prevalent in the traditional video streaming industry. This platform is committed to delivering top-notch video streaming services while incorporating various incentive mechanisms for decentralized bandwidth allocation and content sharing. Importantly, Script TV offers these benefits at a notably reduced cost compared to conventional service providers.

Why we like it

The Script Blockchain is purposefully designed for video and data relaying, featuring a unique multi-BFT consensus model that amalgamates committee Validator Nodes with a community-operated second layer of Validator Nodes. Validator Nodes play a crucial role in proposing and generating new blocks within the chain, while Lightning Nodes serve as safeguards against malicious or non-functional Validator Nodes. On the other hand, Script TV is a pioneering watch-to-earn television platform.

Users engage with the platform by watching television content and accomplishing tasks and achievements to earn rewards. The platform is a fully operational linear TV platform, offering uninterrupted 24/7 streaming across multiple channels. ScriptGLASS NFTs introduce an element of uniqueness in design, complemented by upgradable attributes that seamlessly integrate into the overall user experience and reward system. The watch-to-earn mechanism allows users to accumulate rewards while consuming content, with earnings structured around the NFT reward system, exemplified by ScriptGLASS.

The ecosystem also comprises achievement-based enhancements, akin to gaming, where users can unlock additional products and earnings by completing achievements on and off the blockchain. This includes activities like referrals and online interactions with others. Furthermore, an in-app NFT marketplace facilitates user-to-user NFT trading, providing a dynamic environment for the exchange of digital assets. Additionally, users can use the in-app swap feature to convert their token earnings into various other forms of cryptocurrencies. An in-app decentralized wallet is provided to round out the ecosystem’s offerings, enabling users to deposit and send cryptocurrencies to their wallets to fund their spending accounts.

Investors

Script Network has secured investments from Gate Labs, Panony, JinLin Capital, GameFi Capital, BigOne Exchange, Kenzo Ventures, etc.

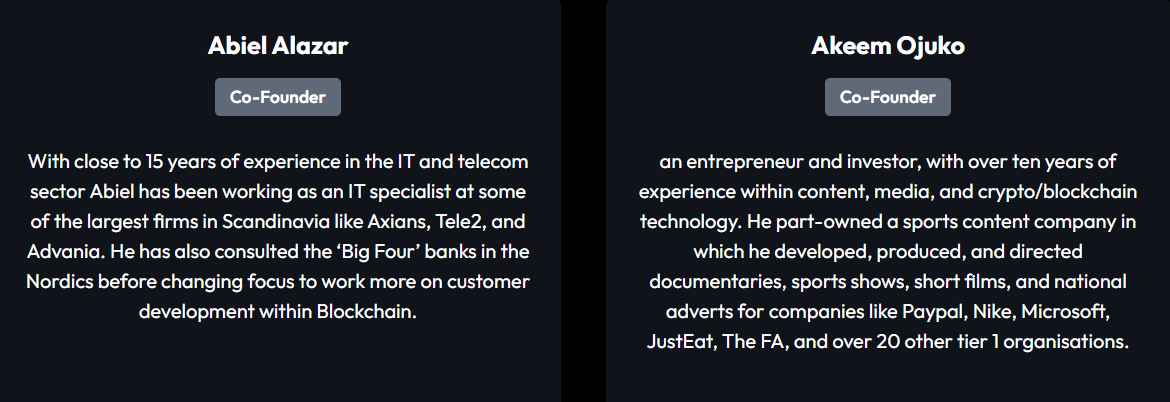

The Team

Token Utility

The Script blockchain ecosystem features two fundamental native tokens: the Script Token ($SCPT) and the Script Pay token ($SPAY). $SCPT is a governance token predominantly utilized for staking purposes within the validator and Lightning nodes. Conversely, $SPAY, as a utility token, assumes a pivotal role in compensating content consumers, rewarding node operators, and facilitating transactions conducted on the Script blockchain network.

Where can you buy the token

The token is not available to trade.

Aori-66.67% (Website – Twitter)

Aori represents a high-performance order book protocol for on-chain spot trading and over-the-counter (OTC) settlement. Their approach incorporates Seaport as an integral settlement layer, which inherits the decentralization assurances akin to a sequencer. Notably, they offer gasless functionalities for order creation and cancellation, empowering market makers to manage, modify, and withdraw limit orders efficiently.

Why we like it

Aori represents a decentralized order book protocol for on-chain spot trading and over-the-counter (OTC) settlement. At its core, Aori relies on Seaport as its intent settlement layer, offering advantages such as gasless order placement and cancellation. One of its noteworthy features is the “last look” market making, enabling market makers to settle transactions on-chain while capitalizing on potential Miner Extractable Value (MEV). As this protocol gains prominence, the integration of MEV into the pricing of limit orders is anticipated, potentially rendering more competitive pricing compared to Request For Quotation (RFQ) systems.

Aori’s adaptability extends to the development of diverse protocols, encompassing Aori Market Making Vaults, which enable the integration of traditional market-making strategies within Aori’s order book, providing users with opportunities for liquidity provision, Exchange for Derivatives, offering comprehensive support for tokenized financial derivatives, facilitating the creation and trading of derivative assets on the Aori platform, Decentralized Token Market Making, which enables on-chain market-making activities for alternative cryptocurrencies, fostering liquidity and trading options in a decentralized manner, MEV Capture Vaults, providing specialized arbitrage vaults designed to capture Miner Extractable Value (MEV) within the blockchain ecosystem, enhancing potential profitability, and Execution Management Systems, assisting hedge funds, professional traders, and retail users in achieving efficient and transparent on-chain execution of trades, thereby reducing execution uncertainty and enhancing market participation.

Aori’s settlement infrastructure is built upon Seaport.sol, recognized for its role in NFT trades on platforms like OpenSea, offers features including gasless order creation and cancellation, adherence to traditional limit order dynamics, and direct on-chain settlement capabilities.

Investors

No Investors found for Aori.

The Team

Joshua Baker is the Chief Executive Officer (CEO) of Aori, bringing with him a wealth of expertise. He leads a dedicated team of seasoned professionals who collectively contribute their knowledge and skills to the success of Aori.

Token Utility

The details of the token will be revealed later.

Where can you buy the token

The token has yet to launch.

Chainway- 62.50% (Website – Twitter)

Chainway is developing the first-ever ZK roll-up solution for Bitcoin. Their roll-up implementation is carefully built solely on the Bitcoin blockchain, leveraging its security measures, and offers full compatibility with the Ethereum Virtual Machine (EVM).

Why we like it

Their innovative roll-up framework leverages several critical attributes of the Bitcoin ecosystem. Their roll-up solution derives its vitality from Bitcoin’s inherent liveness, as it assembles a complete roll-up state directly from a Bitcoin full node. The roll-up transactions are imbued with censorship resistance by being inscribed onto the Bitcoin blockchain, ensuring their integrity and accessibility. Each batch within their rollup achieves finality concurrently with confirming a Bitcoin block, thus mitigating reorganization risks. Furthermore, they are integrating the Ethereum Virtual Machine (EVM) into a ZK-STARK-based zkVM, resulting in a zkEVM capable of generating zero-knowledge proofs for the rollup state. Their approach hinges on the robust security provided by Bitcoin’s liveness and consensus mechanisms and the validity verification afforded by Zero-Knowledge Proofs for transactions.

Consequently, they have emerged as the inaugural trustless programmable execution layer on Bitcoin that seamlessly incorporates the EVM. Unlike traditional sidechains that shift transaction availability and validity to separate peer-to-peer networks, their roll-up construction ensures that any Bitcoin full node can retrieve and verify an EVM transaction without relying on an additional peer-to-peer network. This safeguard ensures that the security of Bitcoin is fully retained throughout the process. In the rollup’s final iteration, lightweight nodes will be able to verify the entire rollup state effortlessly by retrieving the relevant ZK proof from the latest Bitcoin block.

Investors

No investors found for Chainway.

The Team

With a deep reservoir of substantial industry expertise, the founding team of Chainway brings a wealth of knowledge and experience to their role. Their collective proficiency in the field, such as roll-ups, Bitcoin development, modular blockchains, etc., ensures that they are well-equipped to navigate the complexities and challenges of the industry.

Token Utility

The details of the token have not been released.

Where can you buy the token

The token has not yet launched.

Drift Protocol-62.50% (Website – Twitter)

Drift Protocol represents an open-source, decentralized exchange operating on the Solana blockchain, facilitating transparent and non-custodial cryptocurrency trading. Through Drift Protocol, individuals can engage in various financial activities, including trading perpetual swaps with leverage of up to 10x, participating in borrowing or lending operations with variable rate yields, staking assets, and providing liquidity. Additionally, the platform enables seamless token swapping for spot trading purposes.

Why we like it

Drift Protocol offers a comprehensive suite of DeFi tools powered by a robust cross-margined risk engine, providing traders with a balanced blend of capital efficiency and risk management. Each device extends its functionality within this engine while maintaining a responsible approach to risk. For instance, the borrow/lend markets enable cross-collateralization, enhancing margin trading efficiency for spot assets and perpetual futures. Every deposited token can generate yields through borrows and serve as margin collateral for perpetual swaps, with borrowing following strict safety protocols.

The protocol’s order book, liquidity, and liquidation layer operate through a Keeper Network, consisting of agents and market-makers incentivized to deliver optimal order execution. Keepers can route orders through various liquidity mechanisms, efficiently scaling and offering competitive pricing even for large orders. The JIT Auction, or ‘Just-in-Time’ liquidity mechanism, also allows Market Makers to compete to fulfill user market orders at favorable prices. If no Market Maker intervenes, Drift’s AMM executes the order. This combination of features ensures both efficiency and security for traders on Drift.

Investors

The Team

The team is anonymous.

Token Utility

The token is yet to be released. The token cannot make the process the best in the world.

Where can you buy the token

Drift Protocol doesn’t have a token yet.