TOKEN METRICS WATCHLIST

We scored many projects this week. Here are a few you should know about:

- Spacemesh

- Router

- Cetus

- Aurora

- Hyperliquid

Please remember that some of these projects must still be subjected to our code review process. Still, we want to call them out here for preliminarily catching our eye based on our fundamental analysis process.

Spacemesh – 64.58%

Website | Twitter

Website | Twitter

Sector – Layer 1

Status – Testnet

The Spacemesh protocol is a Layer 1 blockchain system that introduces the Proof of Space Time (PoST) mechanism alongside the SpacemeshOS, fundamentally altering the terrain of decentralized, energy-conscious, and expansively scalable smart contract platforms. At its essence, Spacemesh restructures consensus mechanisms by implementing Proof of Space-Time, displacing PoW while embracing a mesh topology. This pioneering strategy facilitates concurrent block generation, ensuring the simultaneous validation of all produced blocks within a layered directed acyclic graph (DAG).

- Spacemesh endeavors to establish the most globally decentralized and equitably distributed cryptocurrency. Addressing a significant challenge in cryptocurrency, the aim is to ensure widespread access to billions of individuals worldwide without necessitating acquisition through local currencies. To initiate smeshing, users are required to undergo a one-time initialization process. Spacemesh is structured to operate on home desktop PCs globally, fostering a network of smeshers who offer smeshing power to the system with an exceptionally accessible entry threshold. These smeshers by contributing to the network, these creators become $SMH creators and are duly rewarded for their participation. This model aims to establish the most globally decentralized cryptocurrency, where the distribution of coins is facilitated by smeshers among a wider audience.

- The project strives to develop a cryptocurrency conducive to seamless global transactions between any two parties, free from the specter of censorship. At a technical level, it seeks to overcome intrinsic challenges embedded in PoW-based consensus mechanisms, including centralization in mining pools and ASIC mining. Similarly, it aims to tackle issues inherent in PoS-based consensus mechanisms, such as centralization among affluent validators, the risk of collusion among validators to deviate from the protocol, and the pronounced centralization of consensus forces.

- Envisioning a transformative impact, the platform aspires to facilitate widespread access to smart contracts, enabling diverse communities to establish and manage equitable rule systems. The intention is to democratize technology access and achieve the requisite scalability to realize blockchain’s potential. This shift seeks to mitigate social inequality by fundamentally altering the exploitative nature of the economy, fostering equal participation among all stakeholders.

Investors

Prominent investors in the venture include established entities such as Polychain, Paradigm, Metastable, Slow Ventures, Electric Capital, 1KX, Coinbase Ventures, and Dragonfly Capital, alongside various other notable contributors.

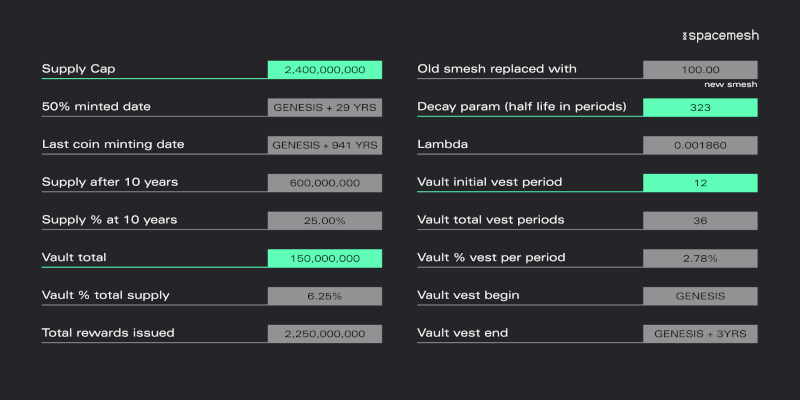

Token

Spacemesh’s native currency, Smesh($SMH), is generated within the network by creating new layers, each encompassing a fresh set of blocks at periodic intervals. The initial layer grants 447 Smesh coins to participating miners, with subsequent issuance gradually declining. The projected total issuance stands at 2.4 billion coins. Approximately 29 years will see the distribution of half this amount, while the issuance of the remaining half is expected to span the subsequent 848 years.

Presently, the Spacemesh Mainnet does not incorporate on-chain governance mechanisms. However, forthcoming details on recommended Mainnet governance will be disclosed closer to the Mainnet launch, offering insights into the platform’s governing structure.

Where can you buy the token?

You can buy $SMH from XT.com.

Router – 62.50%

Website | Twitter

Sector – Interoperability

Status – Active TVL – $217K

Router Protocol is a groundbreaking cross-chain solution that facilitates secure and streamlined communication among various blockchain networks. Its core component, the Router Chain, operates as an L1 infrastructure utilizing Tendermint’s consensus engine. Functioning as a Proof of Stake (PoS) blockchain, the Router Chain relies on a network of validators incentivized to maintain integrity within the system. Notably, the Router chain incorporates CosmWasm and Ethermint—a Cosmos library featuring EVM smart contract support—fostering a versatile environment for developing cross-chain decentralized applications (dApps) within the web3 ecosystem.Furthermore, Router’s CrossTalk library is an adaptable cross-chain framework, enabling smooth state transitions across multiple chains. This framework accommodates stateful and stateless bridging, providing a more seamless interoperability experience within the blockchain landscape.

Use Cases

Cross-chain Stablecoin – Cross-chain Stable Coins facilitate chain-agnostic transfers of stablecoins across different chains via a burn and mint mechanism supported by Router Chain.

Cross-chain Governance – The Cross-chain Governance feature empowers users to create and participate in voting on proposals. The voting power of a user is determined by a snapshot of their token holdings at the proposal’s inception.

Cross-chain Swap – Router Chain’s Cross-chain Swaps offer the ability to find the most efficient path on the source chain, allowing trade division among different chains based on each chain’s liquidity. This optimization enhances the trader’s received amount.

Cross Chain Yield Aggregator – The Aggregator allows users to earn yield across numerous chains. It addresses the challenge of managing multiple yield protocols on various chains by offering a secure cross-chain yield aggregation platform.

Cross Chain Lending Protocol – Moreover, the Cross Chain Lending Protocol on the Router allows lending and borrowing across multiple chains, presenting an opportunity to capitalize on this feature for profitable engagements, unlike the current scenario restricted to isolated chains.

Cross-chain wallet – Crosstalk, powered by Router Chain, is a Cross cross-chain wallet enabling direct interaction with any chain using users’ wallets, regardless of their fund deposition locations. Eliminating the need for bridges, it provides visibility and tracking of funds across multiple chains for users’ convenience and oversight.

Investors

Tokenomics

The $ROUTE token serves as the primary utility within the Router ecosystem, functioning as both the gas token and governance token. Its purpose spans facilitating cross-chain and native transactions within the ecosystem. Moreover, lock rewards will be disbursed in $ROUTE tokens, incentivizing participation and engagement.

In the heart of the NPoS (Nominated Proof of Stake) mechanism lies the $ROUTE token, central to the network’s operation. Holders of $ROUTE tokens wield the authority to partake in voting processes that dictate the future trajectory and evolution of the protocol. This democratic governance structure empowers token holders to shape the protocol’s direction through their voting rights.

It has a maximum supply of 20 million.

Where can you buy the token?

$ROUTE can be brought from exchanges like KuCoin, Bitget etc.

Cetus – 62.50%

Website | Twitter

Sector – Decentralized Exchange

Status – Active

TVL – $39M

FDV – $105M

Cetus is an innovative decentralized exchange (DEX) and concentrated liquidity protocol developed on the Sui and Aptos blockchains. Its overarching mission is to establish a robust and adaptable liquidity network to streamline trading experiences for diverse users and assets within the decentralized finance (DeFi) space. The primary focus lies in delivering optimal trading encounters and enhancing liquidity efficiency by creating its concentrated liquidity protocol and a suite of interoperable functional modules.

At its core, Cetus aims to construct a highly adaptable liquidity protocol utilizing CLMM (Concentrated Liquidity Market Making). This protocol empowers users with the flexibility to engage in various trading strategies encompassing swaps, range orders, and limit orders, mirroring the complexity achievable on centralized exchanges (CEX). This flexibility extends to liquidity providers who can optimize efficiency through diverse Maker strategies utilizing CLMM.

Cetus embraces the “Liquidity As A Service” concept, emphasizing seamless product integration. Developers and applications can effortlessly access Cetus’ liquidity to construct innovative products, including liquidity vaults, derivatives, leveraged farming, and more. Additionally, project teams can swiftly establish swap interfaces on their front ends by integrating Cetus SDK, enabling rapid access to Cetus’ liquidity and the broader market.

The focal point of Cetus’ innovation lies in liquidity efficiency, driven by its concentrated liquidity algorithm. This algorithm concentrates liquidity within an active price range, benefiting liquidity providers and traders. Liquidity providers can earn transaction fees more efficiently, while traders experience low-slippage trading close to the spot price during swaps. Developers also gain easy access to Cetus’s most efficient liquidity source through its openly accessible smart contracts and SDKs, facilitating the development of diverse products.

Investors

Tokenomics

Cetus has implemented a dual-token framework of $CETUS and $xCETUS tokens. $CETUS operates as the intrinsic protocol token within the Cetus ecosystem, obtainable through liquidity mining activities performed on the platform. On the other hand, $xCETUS functions as a non-transferable governance token held in escrow, directly linked to staked CETUS holdings.

Users acquire $xCETUS by converting $CETUS tokens or engaging in specific participation criteria outlined by the protocol. The conversion ratio remains fixed at 1:1, allowing a seamless transition between $CETUS and $xCETUS tokens at any time. However, the redemption process from $xCETUS back to $CETUS involves a vesting mechanism, and the conversion rate is contingent upon the chosen vesting duration. This setup provides users with a structured method to convert between tokens while aligning with the designated vesting timeline.

The maximum supply of $CETUS is 1 billion.

Where can you buy the token?

You can buy $CETUS from exchanges like OKX, Digifinex etc.

Aurora – 60.42%

Website | Twitter

Website | Twitter

Sector – Layer 2 (Near blockchain)

Status – Active

TVL – $27.3M

FDV – $289M

Aurora presents a pioneering solution designed to facilitate the execution of Ethereum contracts within a more efficient environment—the NEAR blockchain. NEAR is a contemporary layer-1 blockchain renowned for its speed, achieving transaction finalization in a swift 2-3 seconds, scalability, and commitment to carbon neutrality.

Functioning as an Ethereum Virtual Machine (EVM), Aurora is realized as a smart contract operating on the NEAR Protocol. Their primary objective revolves around empowering developers within the Ethereum ecosystem to seamlessly transition their applications onto a platform that remains Ethereum-compatible while offering high throughput, scalability, and future-proof infrastructure. This transition comes with the added benefit of lower transaction costs for end users, ensuring accessibility and affordability within the decentralized application landscape.

- Ethereum Compatibility – Aurora boasts full compatibility with Ethereum, eliminating the need for application rewriting and ensuring a seamless transition for users. Operating on the NEAR Protocol, recognized as one of the most high-performing third-generation Layer-1 protocols developed by a highly esteemed team, Aurora guarantees high throughput and scalability, meeting the demands of modern applications.

- Faster throughput – Aurora’s standout features are its ability to provide users with swift transactions and cost-effectiveness. Users benefit from both speed and economical transactions, enhancing their overall experience within the platform.

- Trustless bridging – The Aurora Bridge, an integral component of the NEAR Rainbow Bridge, is the sole fully trustless asset bridge within the Ethereum industry, ensuring a secure and reliable connection between networks.

- Base currency ETH – In Aurora, transaction fees are settled in the base currency, ETH, culminating in an enhanced user experience and opening doors to intriguing possibilities for ecosystem sustainability initiatives. This approach streamlines the user experience and promises to foster a sustainable ecosystem within the platform.

Token

Aurora token holders can utilize their tokens to cover transaction fees and actively engage in network governance. With a fixed supply of 1 billion tokens, these tokens serve a dual purpose, allowing holders to facilitate transactions within the network while granting them a stake in the decision-making processes governing the platform’s evolution and direction.

Where can you buy the token?

You can buy $AURORA from exchanges like Coinbase, Gate.io, KuCoin etc.

Hyperliquid- 58.33%

Website | Twitter

Website | Twitter

Sector – Decentralized Exchange

Status – Active

TVL – $53M

Hyperliquid operates as an order book perpetual futures Decentralized Exchange (DEX) offering functionalities comparable to leading Centralized Exchanges (CEXs) while leveraging an on-chain approach. It thrives as a DEX functioning on the Hyperliquid L1, a purpose-built blockchain utilizing Tendermint for consensus. This robust infrastructure enables the entire exchange’s operations—covering orders, cancellations, trades, and liquidations—to be transparently on-chain, achieving block latency of less than 1 second. The chain currently sustains support for up to 20,000 orders per second.The primary goal of Hyperliquid revolves around fostering an inclusive environment for crypto trading, emphasizing full transparency, minimal costs, and optimal execution. The team is committed to democratizing market access while championing self-custody principles. Ultimately, the aspiration is for Hyperliquid to be recognized by traders worldwide as the premier solution for engaging in futures trading, offering a superior trading experience built upon transparency and efficiency.

Advance orders – Distinguished by its features, Hyperliquid is a powerful platform offering advanced order types, including TP/SL, and a streamlined process allowing users to modify and cancel orders directly from the TradingView chart interface.

Speedy and cheap transactions – It prides itself on its expeditious transaction finality, achieving instant confirmations in less than 1 second, thereby eliminating the waiting period for confirmations and minimizing the impact of Miner Extractable Value (MEV).

50x leverage – The platform empowers traders with up to 50x leverage, providing an avenue to trade with conviction and optimize capital efficiency during critical market moments.

Transparency – Hyperliquid distinguishes itself through its commitment to transparency, facilitating a fully on-chain order book where trades, funding, and liquidations transpire seamlessly on the Hyperliquid L1 blockchain.

Seamless usability – The platform offers a seamless user experience, enabling one-click trading without interruptions from wallet approvals, allowing for a continuous and uninterrupted user trading flow.

Investors

There are no investors in Hyperliquid. Hyperliquid operates entirely independent of external funding.