Executive Summary

HMX is a decentralized perpetual exchange platform on Arbitrum that offers cross-margin and multi-asset collateral support. The platform aims to revolutionize trading by providing traders and investors with the necessary tools to succeed in the fast-paced world of finance. HMX’s multi-asset collateral support enables traders to use a variety of assets as collateral, which can help reduce risk. The platform’s user-friendly interface and advanced trading tools make it easy for traders of all skill levels to participate in the crypto market.

Current metrics

TVL- $28.48M

Open Interest – $42.14M

Total Trading Volume – $4.27B

Total Fees – $1.9M

FDV – $62.5M

Overview

HMX is an innovative decentralized perpetual protocol designed for the future, offering cross-margin and multi-asset collateral support on the Arbitrum network. HMX introduces a range of distinct features to enhance the user experience:

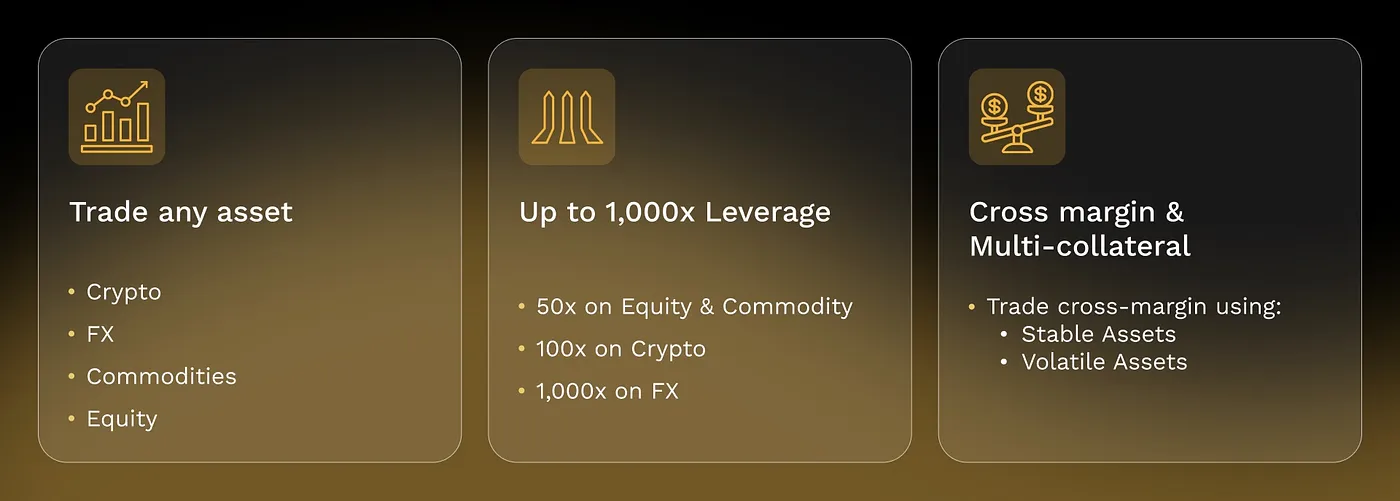

1. Leveraged Trading (Cross-Margin & Multi-Collateral Management Support): HMX empowers users to open leveraged long or short positions, with leverage options of up to 1,000x, across various asset classes, including cryptocurrencies, forex, and commodities. Notably, HMX accepts a variety of cryptocurrencies as collateral, facilitating a cross-margin collateral system that allows for flexible position management and risk mitigation strategies.

2. Leveraged Market Making (HLP Vault): HMX introduces the HLP vault, a unique feature that enables users to become market makers within the HMX ecosystem by simply depositing assets. This vault operates atop GMX’s GLP token, ensuring that the liquidity supplied into the vault serves the market-making needs of traders on both GMX and HMX. Depositors continue to receive 100% of the yields from GMX and earn additional yields from fees generated on HMX. This innovative concept is called “leveraged market making,” emphasizing maximizing passive real yields for our users.

3. Incentive Programs: HMX offers multiple incentive programs to enhance platform engagement. The Traders’ Loyalty Credit program rewards users with tokens based on their trading volume, promoting active participation. Users can stake these tokens to earn HMX rewards. Additionally, rewards for open positions incentivize users to maintain leveraged positions, potentially generating income over time. Liquidity providers receive protocol fees and esHMX rewards, fostering participation in market making. The referral program further encourages user growth by providing discounts to referred traders and rewarding referrers with a share of trading fee revenue.

4. Economics and Fees: HMX offers competitive Annual Percentage Rates (APR%) for liquidity providers, driven by multiple yield sources, including platform revenue allocation and esHMX emissions. Fees such as trading, borrowing, and funding contribute to the protocol’s revenue and incentive structure. Velocity-based funding fees help balance long and short-term open interest, ensuring a fair trading environment.

5. Advanced Trading Features: HMX boasts advanced trading features, including high leverage, one-click trading, on-chart trading adjustments, and multiple order types. Subaccount support enables diverse trading strategies within a single wallet, while a robust price oracle based on the Pyth Network ensures reliable and fair price feeds.

Team

The team is anonymous.

Investors

Market Analysis

Based on the most recent data available as of March 2023, it is clear that cryptocurrency derivatives maintain a dominant and influential position in the market landscape. They assert their significance by representing a substantial 74.8% share of the overall trading volume within the cryptocurrency sector, now reaching an impressive total of $2.95 trillion. Projections and market indicators further affirm that this sector is poised for continued expansion, driven primarily by the growing adoption of Decentralized Finance (DeFi) practices.

The derivatives trading market is highly competitive and saturated, especially in centralized exchanges. However, notable entities such as GMX and dYdX have emerged as significant players in decentralized exchanges, establishing their presence in this evolving landscape. This could present challenges for HMX in gaining market share.

Competitive advantage

HMX excels in the competitive world of decentralized perpetual protocols, offering economic benefits and an array of product features. Economically, HMX stands out by providing one of the market’s highest Annual Percentage Rates for Liquidity Providers (LPs), supported by a revenue allocation system and additional incentives from esHMX emissions. Moreover, HMX keeps trading fees remarkably low, with a 0.01% FX fee and a 0.04% fee for BTC and ETH trading.

High leverage of up to 1,000x is available, empowering users with strong market convictions. HMX also streamlines the trading process with one-click trading and allows for on-chart trading. Additional features include advanced order types, subaccount support, a robust price oracle, LP protection mechanisms, a user-friendly UI/UX, and complete decentralization, eliminating KYC requirements and ensuring users maintain control of their funds.

HMX Tokenomics

$HMX token is the token of HMX Protocol.

According to Coingecko, the current supply information is as follows-

Circulating Supply- 1,009,588

Total Supply-10,000,000

Inflation

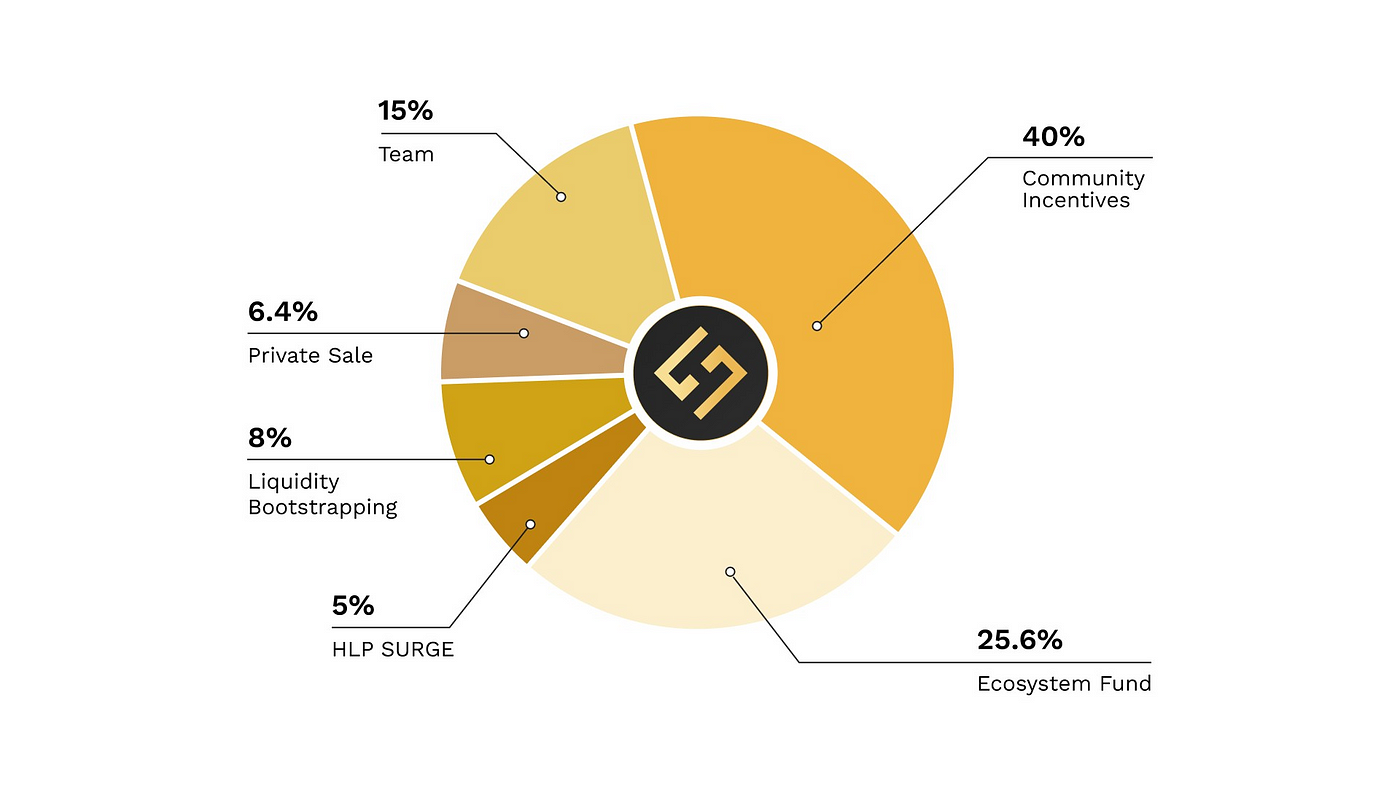

HMX has a fixed supply of 10,000,000 tokens (ten million). Currently, only approximately 10% of the tokens are in circulation, which is a relatively low amount. HMX tokens will experience inflation.

Below is the allocation of the token supply.

Special measures like TLC and Dragon Points are implemented to increase buy pressure on HMX tokens and incentivize long-term holding.

Token Utility

- Earns 25% share of protocol revenue in stablecoins when staked (shared with staked esHMX & DP)

- Earns a share of esHMX token emission when staked

- Earns DP at 100% APR when staked

- Receive governance voting rights to help shape critical decisions on the development of HMX exchange (only HMX token holders can vote. esHMX and DP have no voting power

- Receive tiered trading fee discount when staked.

Conclusion

HMX strategically positions itself as a prominent contributor to the Decentralized Finance (DeFi) sector, demonstrating a dedicated commitment to addressing some of its most formidable challenges. These challenges include high transaction fees and a need for multi-asset collateral options. HMX seeks to solidify its role as a notable player within the evolving DeFi landscape by tackling these critical issues. As HMX continues to develop and implement innovative strategies, it aims to drive positive change within the DeFi sphere, contributing to the industry’s growth and maturation. In doing so, HMX anticipates an increasingly integral role within the ever-expanding world of decentralized finance.

| Fundamental Analysis | |||||

| Assessment | |||||

| Problem | Significant, long-term problem | 3 | |||

| Solution | Distinct, defensible solution | 3 | |||

| Market Size | Large market, significant growth potential | 3 | |||

| Competitors | High competition, but room for differentiation | 2 | |||

| Unique Value Proposition | Some differentiation, but overlap with existing solutions | 2 | |||

| Current Traction | Solid traction, user engagement and retention growing | 3 | |||

| Unit Economics | Positive unit economics, with plans for further improvement | 3 | |||

| Tokenomics | No clear token strategy or poorly conceived strategy | 1 | |||

| Product Roadmap | Clear roadmap, innovative and achievable milestones | 3 | |||

| Business Model | Proven business model with clear path to profitability | 3 | |||

| Go-to-Market Strategy | Solid GTM strategy, clear target market and channels | 3 | |||

| Regulatory Risks | Minimal regulatory risk, strong mitigation and adaptability | 4 | |||

| Total | 68.75% | ||||