Hyperliquid is a high-performance Layer 1 blockchain meticulously designed to create a fully on-chain open financial system. Its vision encompasses user-built applications that interact seamlessly with efficient native components, all while ensuring an optimal end-user experience.The Hyperliquid Layer 1 is capable of supporting a comprehensive ecosystem of permissionless financial applications. Transactions, including orders, cancellations, trades, and liquidations, occur transparently on-chain with a block latency of less than one second. Currently, the platform can handle up to 100,000 orders per second.

Their core product is an innovative decentralized exchange (DEX) that operates on its own Layer 1 blockchain. It is designed to merge the advantages of centralized exchanges with the transparency inherent in decentralized platforms. Hyperliquid primarily facilitates trading in perpetual futures contracts, allowing traders to speculate on cryptocurrency prices without owning the underlying assets.

About the Project

- High-Performance Layer 1 Blockchain: Hyperliquid operates on its proprietary Layer 1 blockchain, specifically designed for high-performance trading. This architecture allows for rapid transaction processing, achieving a throughput of up to 200,000 transactions per second and block finality in under one second.

- On-Chain Order Book: The platform utilizes a fully on-chain order book model, providing users with precision and transparency comparable to centralized exchanges. This feature mainly benefits professional traders seeking low latency and high accuracy in their trades.

- Perpetual Futures: Hyperliquid specializes in perpetual futures contracts, enabling traders to speculate on cryptocurrency prices without owning the underlying assets. The platform offers leverage of up to 50x on these contracts.

- HyperBFT Consensus Mechanism: At the core of Hyperliquid’s infrastructure is the HyperBFT consensus algorithm, which ensures fast, secure, and transparent transactions. This proof-of-stake system enhances the reliability and decentralization of the network.

- Robust Security Measures: The Layer 1 architecture employs a decentralized network of nodes for transaction validation, minimizing risks associated with single points of failure. Additionally, advanced encryption techniques safeguard sensitive information such as transaction records and wallet details.

- Decentralized Governance: Hyperliquid incorporates a governance model that allows $HYPE token holders to participate in key decisions regarding network upgrades and liquidity management, fostering community involvement and decentralization

- Strong Community Approach: Hyperliquid is a community-driven project without venture capital backing, which enhances user trust and engagement within the ecosystem

Hyperliquid L1

The Hyperliquid architecture comprises two interconnected chains: the Hyperliquid Layer 1 (L1) and the HyperEVM (EVM). These chains function as a unified state under a common consensus while operating as distinct execution environments. The L1 is a permissioned chain that supports native components, including perpetual and spot order books and is designed for high performance to facilitate these functionalities. Programmability on the L1 is enabled through an API, where actions submitted must be signed similarly to transactions on an EVM chain.

The HyperEVM is a general-purpose, EVM-compatible chain that allows users to deploy smart contracts without restrictions. This chain offers the added benefit of accessing on-chain liquidity for perpetual and spot trading from the L1.

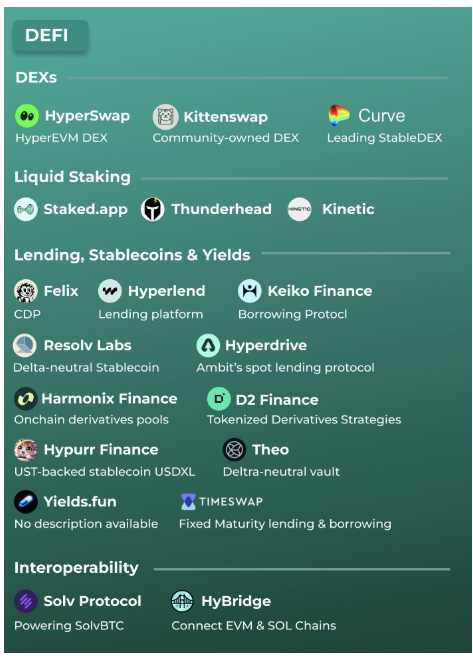

As HyperEVM prepares for launch, numerous DeFi projects are gearing up to deploy simultaneously, including automated market makers (AMMs), lending platforms, liquid staking solutions, and collateralized debt positions (CDPs). The unique characteristics of on-chain order book liquidity are expected to foster the development of innovative applications, positioning Hyperliquid as a preferred platform for emerging DeFi-native protocols.

Overall, Hyperliquid’s dual-chain setup and commitment to high performance and accessibility are set to redefine the landscape of decentralized trading.

Market Analysis

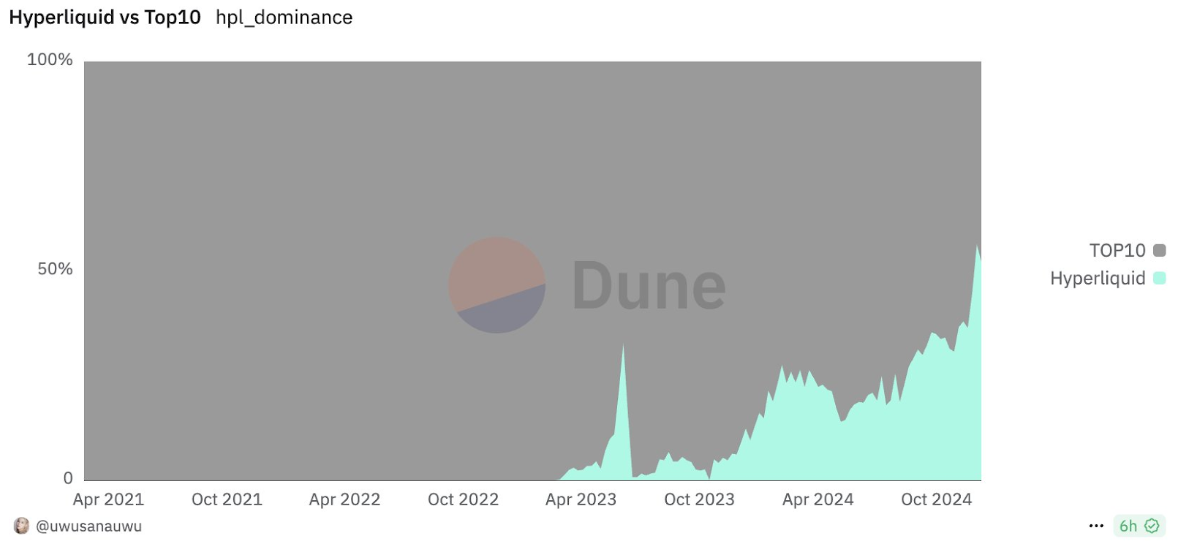

Hyperliquid is rapidly becoming a formidable player in the decentralized exchange (DEX) market, particularly in perpetual futures trading. The platform has captured over 50% of the trading volume in this segment, indicating strong user engagement and market penetration. As of mid-December 2024, Hyperliquid’s market capitalization has surpassed $10 billion, positioning it among the top 20 cryptocurrencies, just behind established players like Polkadot. The successful distribution of 310 million tokens during its genesis airdrop, the largest in crypto history, has also contributed to increased visibility and user acquisition.

Furthermore, Hyperliquid’s unique technological advancements, such as its HyperBFT consensus algorithm and Layer 1 blockchain capabilities, set it apart from competitors like Ethereum and Solana. These innovations enable high transaction speeds of up to 200,000 per second, appealing to professional traders seeking efficiency and reliability.

The upcoming launch of HyperEVM is anticipated to further enhance Hyperliquid’s ecosystem by attracting a variety of decentralized finance (DeFi) projects. This expansion is expected to drive additional trading volume and revenue streams, solidifying Hyperliquid’s position as a leader in the DeFi space.

Traction

Hyperliquid has established itself as a dominant player in the decentralized perpetual exchange (DEX) market, capturing over 50% of trading volume in the past month. The platform has shown remarkable traction in the cryptocurrency sector, underscored by significant trading volumes and robust user engagement. Additionally, Hyperliquid has seen substantial growth in its user base, with over 90,000 early adopters participating in its recent genesis airdrop, which distributed 31% of the total HYPE token supply. As of mid-December 2024, Hyperliquid’s market capitalization stands at approximately $7.22 billion, further demonstrating its expanding influence within the decentralized finance (DeFi) landscape.

Hyperliquid has cultivated a dedicated community of over 200,000 users, with an impressive cumulative trading volume nearing $450 billion. Currently, the platform boasts an open interest exceeding $2.5 billion, reflecting its growing popularity and user engagement in the decentralized finance (DeFi) space. Hyperliquid’s robust performance is underscored by its recent trading activity, which has seen significant daily volumes, further solidifying its position as a leading decentralized perpetual exchange. This traction highlights the platform’s appeal and indicates a strong foundation for future growth and innovation within the cryptocurrency market.

Token

The $HYPE token is integral to the Hyperliquid ecosystem, serving multiple essential functions that drive the platform’s operations and user engagement. As the native cryptocurrency, $HYPE grants holders governance rights, allowing them to actively participate in key decision-making processes that shape the platform’s future. Additionally, $HYPE facilitates seamless transactions within the Hyperliquid network by acting as the primary medium for fee payments.

Moreover, the token is crucial for network security and user incentivization through its staking mechanism. It enables users to lock their tokens to contribute to network stability while earning rewards in return. The combination of these features not only enhances user experience but also fosters a strong community around the platform.

Overall, $HYPE is designed to empower users, promote active participation in governance, and ensure a robust and secure trading environment within the Hyperliquid ecosystem.

Token Distribution

Hyperliquid’s tokenomics emphasizes community-driven growth by intentionally avoiding allocations to venture capitalists or centralized exchanges. The total supply of HYPE tokens is capped at 1 billion, with the distribution structured as follows:

- Genesis Distribution (Airdrop): 31%

- Future Emissions & Rewards: 38.888%

- Core Contributors: 23.8%

- Hyper Foundation Budget: 6%

- Community Grants: 0.3%

Additionally, team tokens are locked for one year, followed by a gradual monthly unlock over two years. This approach ensures a balanced distribution while promoting long-term commitment from the core team and contributors. Hyperliquid’s focus on a decentralized and community-oriented model is designed to foster sustainable growth and engagement within its ecosystem.

The Hyperliquid Airdrop

On November 29, 2024, Hyperliquid executed one of cryptocurrency’s largest and most generous airdrops. This Genesis airdrop distributed 31% of the total $HYPE supply to over 90,000 early adopters and users of the platform. The initiative rewarded loyal community members and established a new benchmark for fairness and inclusivity within the crypto space.

Business Model and Revenue

Hyperliquid employs a straightforward yet effective revenue model primarily based on platform fees and token auctions. The platform generated approximately $26.5 million in USDC in the past month, with $2 million derived from token auctions and an impressive $24.5 million from platform fees. This substantial revenue positions Hyperliquid just behind major players like Ethereum and Solana in annualized revenue, indicating its growing prominence in the decentralized finance (DeFi) sector.

Investors

Hyperliquid has adopted a unique funding model by remaining entirely self-funded and not allocating any of its token supply to private investors or exchanges. This approach ensures that ownership and governance remain with the community of users rather than external investors, which is a distinctive feature in the current crypto landscape. the project has garnered significant attention and participation from the community, particularly during its recent HYPE token airdrop, which distributed 31% of the total supply to early users. This strategy rewards loyal participants and fosters a strong community-driven ecosystem.

Team

Hyperliquid Labs is a key contributor to Hyperliquid’s development and growth. It is led by co-founders Jeff Yan and Iliensinc, who are Harvard alumni. The team includes members from prestigious institutions such as Caltech and MIT, with professional backgrounds at notable companies, including Airtable, Citadel, Hudson River Trading, and Nuro.

Conclusion

Hyperliquid represents a significant advancement in the decentralized finance (DeFi) landscape, combining the speed and efficiency of centralized exchanges with the transparency and security of blockchain technology. This innovative platform has established itself as a revolutionary force in the cryptocurrency space, with success measured by its comprehensive ecosystem rather than just token prices or trading volumes. Recent additions, such as Ethereum Virtual Machine (EVM) compatibility and staking capabilities on the testnet, highlight Hyperliquid’s commitment to ongoing innovation. What sets Hyperliquid apart is its community-first ethos. By remaining self-funded and avoiding venture capital influence, the team is focused on building a platform that genuinely serves user needs. As these elements come together, Hyperliquid is poised to transform on-chain transactions, actively redefining the standards for decentralized trading platforms.

| Fundamental Score | |||||

| Max score | Options | Score | |||

| Problem | 10 | Moderate, somewhat persistent problem | 7 | ||

| Solution | 10 | Distinct, defensible solution | 9 | ||

| Market Size | 10 | Large market, significant growth potential | 8.5 | ||

| Competitors | 10 | High competition, but room for differentiation | 7 | ||

| Use case | 10 | Broad use case with network effects | 10 | ||

| Current Traction | 10 | High traction, strong user growth and retention | 10 | ||

| Unit Economics | 5 | Positive unit economics, with plans for further improvement | 3 | ||

| Tokenomics | 10 | Solid token strategy, aligns with user incentives | 8.5 | ||

| Product Roadmap | 5 | Unclear or unrealistic product roadmap | 1 | ||

| Business Model | 10 | Proven business model with clear path to profitability | 9 | ||

| Go-to-Market Strategy | 5 | Solid GTM strategy, clear target market and channels | 4 | ||

| Community | 5 | Big, strong and active community | 5 | ||

| Regulatory Risks | 5 | Minimal regulatory risk, strong mitigation and adaptability | 5 | ||

| Total Score | 82.86% | ||||