Executive Summary

Kinto is a layer 2 blockchain built on Ethereum, designed to merge the security and compliance of traditional finance with opportunities in the decentralized finance space. The project differentiates itself by mandating Know-Your-Customer (KYC) verification for all users to bridge the gap between regulated financial institutions and real-world assets (RWAs). Kinto’s mission is to provide a safe, insured, and user-centric platform for individual users and institutional players seeking a compliant entry in DeFi.

Kinto is built using the Arbitrum Nitro stack, an advanced layer 2 scaling solution that enhances transaction speed and reduces costs while settling on Ethereum for security. The platform also offers every user a non-custodial smart wallet, the Kinto Wallet, which enforces KYC through a unique on-chain identity system, ensuring only verified participants can engage with the network.

Kinto separates personal data from on-chain transactions, enabling access only to requests for certain applications. This makes its KYC process much safer than that of centralized exchanges. It also allows new use cases, such as holding tokenized stocks on-chain, and positions Kinto as a pioneer in compliant DeFi infrastructure. With significant investor backing and partnerships with Kaito and Arbitrum Foundation, Kinto is carving a niche as the first KYC-enabled Ethereum L2 that offers a compelling blend of scalability, security, and regulatory alignment.

About the Project

Vision:

Kinto is working to create a secure, compliant, and user-centric layer 2 blockchain on Ethereum that connects traditional finance (TradFi) with decentralized finance (DeFi). The platform seeks to unlock the best financial opportunities through a customized blockchain and a secure smart wallet. Their commitment to mandatory KYC verification strengthens this vision, positioning the platform as a trusted entry point for financial institutions and individuals.

Problem:

The crypto industry faces a persistent divide between the unregulated, pseudonymous nature of DeFi and the compliance-driven world of traditional finance. This gap creates significant challenges: financial institutions struggle to engage with DeFi due to regulatory uncertainty, while users face risks from centralized exchanges (CEXes) that hold custody of assets and personal data, often leading to hacks or mismanagement. Centralized platforms usually link personal information directly to on-chain addresses, compromising privacy and security.

Further, blockchain networks prioritize scalability over compliance, leaving a void for regulated entities seeking blockchain integration. This disconnect limits the adoption of DeFi for real-world assets (RWAs) like tokenized stocks and bonds, a market potentially worth trillions but constrained by trust and legal barriers.

Solutions:

Kinto addresses these challenges by introducing a modular exchange designed for compliance and safety. The solution is a layer 2 blockchain that enforces KYC verification while maintaining user control through a non-custodial smart wallet, the Kinto Wallet.

The platform ensures privacy while complying with regulations due to its unique capability of disconnecting personal information from on-chain addresses. This enables use cases like holding tokenized stocks on-chain, opening DeFi to financial institutions and RWAs, and offering a secure, insured alternative to centralized platforms.

Market Analysis

Kinto operates within the overlapping domains of decentralized finance (DeFi), layer 2 blockchain solutions, and the tokenization of Real-World Assets (RWAs), specifically financial assets. The platform’s unique feature of native KYC positions it to facilitate the integration of tokenized financial instruments, like bonds, stocks, and treasury securities, into DeFi, aligning with the growing RWA market.

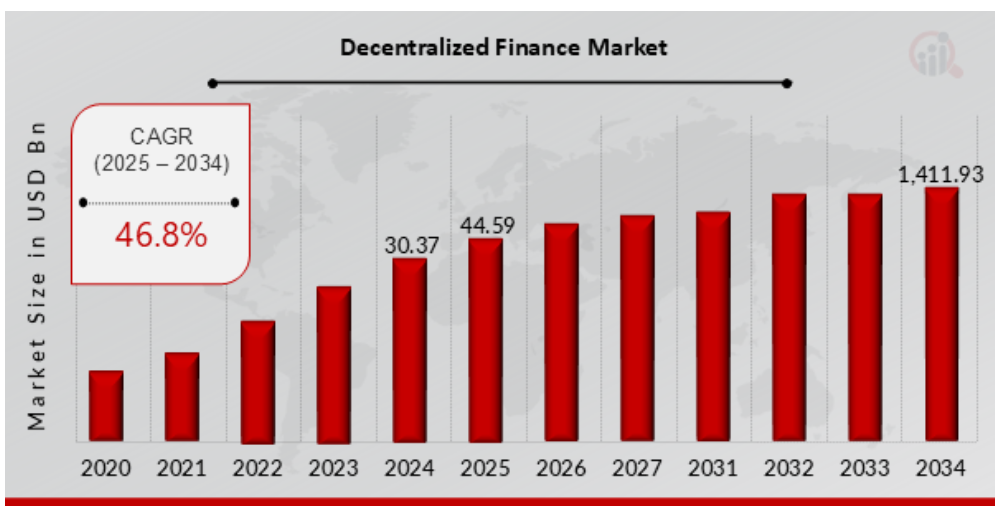

Both market segments, DeFi and RWA, are experiencing significant growth, driven by blockchain adoption, institutional participation, and tokenization trends. The DeFi market is forecasted to grow from $44.59B in 2025 to $1.4T by 2034 at a compound annual growth rate (CAGR) of 46.8% during the forecast period (2025 – 2034). This is per a Market Research Future report titled Global Decentralized Finance Market Overview.

For the larger RWA market, a 2023 report by Citibank titled Money, Tokens and Games estimates that tokenizing RWAs, including financial assets like securities and bonds, could create a market worth $4T to $5T by 2030. This includes $1.5T to $2T in tokenized debt and equity, driven by institutional adoption and regulatory clarity.

The combined DeFi and RWA financial assets market offers Kinto a multi-trillion dollar opportunity by 2030-2034. However, scaling against larger layer 2s and specialized RWA platforms will be key to capturing market share.

Features

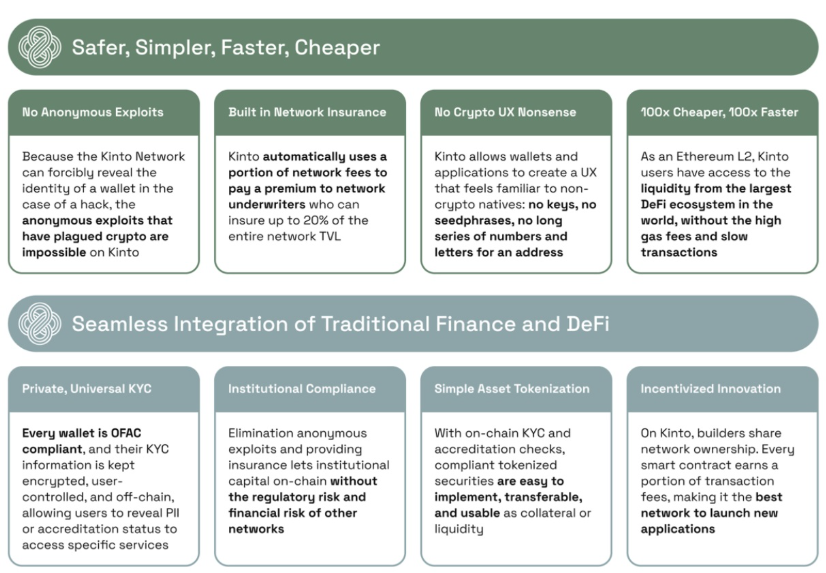

- User-Owned KYC and AML at Chain Level: Kinto provides KYC, insurance, AML, and fraud monitoring at the blockchain level for all participants. Transactions can only be performed by verified participants.

- Non-Custodial Smart Wallet with Account Abstraction: Users can access crypto financial services without installing a browser extension or storing seed phrases or private keys. Applications that remain non-custodial can offer easy onboarding and account creation through username/password, 2FA, or mobile device keys.

- Built-in Insurance and Revenue Stream: The platform offers native insurance against black swan events to all smart contracts and applications built on Kinto. Sequencer fees are shared with every smart contract based on its transaction volume, and a portion of these fees is given to network underwriters as insurance yield.

Finance Use Cases and On-Chain Governance: Kinto is focused on financial use cases and offers a native infrastructure that connects to main DeFi protocols and oracles. On-chain governance fully controls the treasury, fees, integrations, identity providers, and main chain parameters.

Token

$KINTO or $K is the native utility and governance token of the network. $K holders will share protocol ownership and vote on proposals through the dual-governance system.

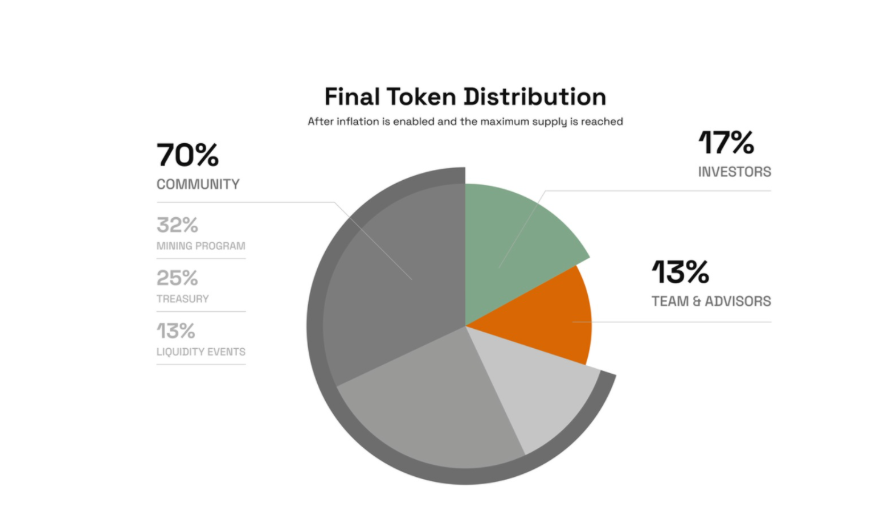

The token’s initial supply will be 10 million, with the maximum supply capped at 15 million. 70% of the maximum supply will be distributed to the community, dynamically rewarding participants for allocating capital, referring users, and developing financial applications. 17% will go to investors, and 13% to the team and advisors.

Utility:

The $K governance token will control the following:

- Nios Election: Token holders will vote to elect Nios every six months. Nios will represent $K holders in the network’s day-to-day activities.

- Constitutional Changes: Any constitutional changes must be explicitly ratified by $K holders.

The Nios will, in turn, reflect the will of $K holders and take action on the following:

- Treasury Management: How to allocate fees and the community’s grant-making powers.

- Network Fees: Control different fees and configuration parameters of Kinto L2.

- KYC Providers: Add or remove KYC providers.

- Integrations: Coordinate integrations and partnerships with other DeFi protocols, institutions, and services in the network.

- System Upgrades: Proposals to upgrade several core protocol components, such as the bridge, wallet, or oracles.

Traction

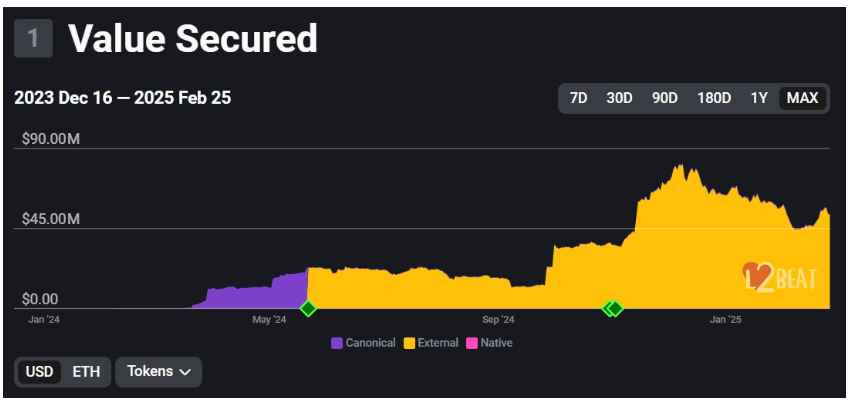

Kinto has been gaining traction since its mainnet launch in May 2024. The user base has been steadily growing at the rate of 5% month on month, and it currently stands at 75,000 users who have fully completed the KYC process. The total value secured by the network currently stands at $53M, and its all-time high was $80M in December 2024, contributed by more than 3600 depositors.

Team

The Kinto team has extensive experience in software development, DeFi, and traditional finance, which is essential for building tools to unlock trillions of institutional funds.

Ramon Recuero is the co-founder and CEO of Kinto. He previously founded Babylon Finance, a community-led DeFi asset management protocol that, at its peak, reached $30M in TVL. Before that, he worked as a software developer at Google, Y Combinator, Open Zeppelin, and Zynga.

Another co-founder is Victor Sanchez, the CTO with over 15 years of experience building software and launching tech startups. He previously founded SyncRTC, an education and corporate training platform, and worked with Ramon as an advisor to Babylon Finance.

Investors

Kinto first raised a $1.5M Pre-Seed round in January of 2023 from Kyber Capital. Subsequently, they raised a $3.5M round in November 2023, which was led by The Spartan Group, ParaFi Capital, Kyber Capital, and participated by Robot Ventures, Modular Capital, Tane Labs, Kraynos Capital, SkyBridge Capital and Deep Ventures.

In February 2025, Brevan Howard Digital’s Abu Dhabi branch deployed $20M in assets on Kinto, enabling participation in the on-chain financial ecosystem. Kinto’s mining program rewards active participants who deposit assets on-chain with token emissions. The program will be active for 10 years, with rewards decreasing over time. Due to their strict security, technical, and compliance requirements, traditional financial entities have found participation in such mining programs difficult. Brevan Howard Digital became one of the first major financial firms to do so.

Conclusion

Kinto is uniquely positioned to bridge the gap between traditional finance and decentralized finance through its KYC-enforced layer 2 solution on Ethereum. By leveraging the Arbitrum Nitro stack and a non-custodial smart wallet, Kinto delivers a platform that balances scalability, security, and regulatory compliance, addressing a critical gap in the crypto ecosystem. The platform connects regulated financial institutions and real-world assets (RWAs), such as tokenized stocks and bonds, with DeFi.

Kinto’s standout features, including chain-level KYC and AML, account abstraction, built-in insurance, and on-chain governance, distinguish it from traditional layer 2s and DeFi platforms. These innovations allow the platform to provide a safer, more accessible alternative to centralized exchanges while unlocking new use cases.

| Fundamental Score | |||||

| Max score | Options | Score | |||

| Problem | 10 | Significant, long-term problem | 9 | ||

| Solution | 10 | Some uniqueness, moderate defensibility | 7 | ||

| Market Size | 10 | Large market, significant growth potential | 8.5 | ||

| Competitors | 10 | High competition, but room for differentiation | 7 | ||

| Use case | 10 | Use case with good potential | 8.5 | ||

| Current Traction | 10 | Early traction, user engagement starting to grow | 6 | ||

| Unit Economics | 5 | Unit economics currently negative, no clear path to profitability | 1 | ||

| Tokenomics | 10 | Basic token strategy, potential for improvement | 7 | ||

| Product Roadmap | 5 | Unclear or unrealistic product roadmap | 1 | ||

| Business Model | 10 | Business model with some potential, but improvement needed | 7 | ||

| Go-to-Market Strategy | 5 | Basic GTM strategy, lacks detail or differentiation | 2 | ||

| Community | 5 | Acive and growing community | 4 | ||

| Regulatory Risks | 5 | Minimal regulatory risk, strong mitigation and adaptability | 5 | ||

| Total Score | 69.52% | ||||