Executive Summary

Kujira functions as a Layer 1 blockchain platform, providing a comprehensive range of Decentralized Finance (DeFi) infrastructure and enduring financial technology solutions tailored to the diverse user base of Web3. Positioned upon the Cosmos network, Kujira harnesses the adaptable Software Development Kits (SDKs) offered by Cosmos, establishing the bedrock of its architectural framework, and integrates numerous internally developed decentralized applications (dApps). Within the Kujira ecosystem, various engagement channels exist: developers can innovate on their blockchain, validators play a crucial role in ensuring its security and decentralization, and community members actively participate in governance through voting mechanisms and other essential ecosystem functionalities.

Project Overview

Kujira’s mission is to furnish a diverse array of easy-to-use, cost-effective tools catering to individuals across the spectrum of crypto experience, from novice enthusiasts to seasoned retail investors. They aspire to empower people to generate income irrespective of market trends, fostering inclusivity across various blockchains and networks.

Key attributes of Kujira include its status as a Sustainable Sovereign Layer 1 Ecosystem, specifically focusing on providing sustainable FinTech solutions for protocols, builders, and Web3 users. The platform offers a comprehensive suite of innovative and user-friendly products that generate revenue and endeavor to revolutionize payment infrastructure. Emphasizing accessibility, Kujira is committed to delivering tools that are easy to navigate and cost-effective, ensuring participation from individuals at all levels of crypto proficiency. Crucially, Kujira is distinguished by its inclusive approach, accommodating all blockchains and networks. The platform prides itself on offering products that do not expose participants to risks beyond their comfort thresholds. The overarching goal is democratizing access to opportunities, enabling retail investors to partake in ventures historically reserved for the privileged few.

- Numerous Products: The platform showcases ecosystem products such as ORCA, FIN, BLUE, FINDER, USK, and more. This collection underscores Kujira’s steadfast commitment to generating revenue, bolstering the network’s overall value proposition.

- Governance: The ecosystem embraces a community-driven ethos, empowering users through voting mechanisms. This inclusive approach ensures quality control measures and sustains the network’s longevity through collective decision-making.

- Oracles: Central to Kujira’s functionality is its robust price Oracle, meticulously overseen by actively engaged validators. This ensures a consistent and reliable flow of price information critical for the platform’s operations. Additionally, the platform integrates an entropy beacon to secure on-chain randomness, a fundamental element for trustless applications, bolstering the platform’s security and reliability.

- Staking and Cross-Chain Functionality: Kujira uses a stake-based network model to incentivize user engagement. Its integration with Cosmos’ IBC facilitates seamless interactions across diverse blockchains, enhancing interoperability.

- Moving funds to Kujira: Various avenues exist for transferring funds to the Kujira blockchain, allowing flexibility based on one’s familiarity with Decentralized Finance (DeFi) and the location of their funds. The platform offers multiple methods catering to diverse needs, ensuring accessibility and ease of use. Moreover, it provides an accessible on-ramp for newcomers to the decentralized finance space, streamlining the process for individuals new to this ecosystem.

In summary, Kujira’s mission is rooted in the ambition to help individuals generate income independent of market direction, fostering a more inclusive and accessible landscape for participants across the crypto spectrum.

Kujira dApps

- ORCA – ORCA stands as the pioneering public marketplace for liquidated collateral globally. ORCA serves as the inaugural product within the Kujira ecosystem, functioning as a marketplace specifically designed for liquidated collateral auctions. It has transitioned beyond exclusive bot-driven engagement, allowing users to actively participate in securing their preferred assets while benefiting from associated discounts.

- FIN- FIN operates as a decentralized platform on Kujira, employing an order book trading system akin to centralized exchanges. Unlike automated market makers (AMMs), FIN’s order book model doesn’t rely on inflationary incentives, enhancing trade execution.

- BOW – BOW, dedicated to providing value and ensuring equitable profit distribution, enhances the trading experience on FIN. Narrowing price spreads and deepening liquidity pools fosters an environment where liquidity providers share fees and additional incentives. This approach aims to generate sustainable yield while contributing to the overall growth and value of the ecosystem, fostering a mutually beneficial environment for all participants.

- PILOT – PILOT is the platform where capital and innovative ideas converge to create transformative developments. It champions fair and inclusive token launches, ensuring equal access and benefits for all participants. Launchers are provided with customizable mechanisms tailored to their priorities and target audience, facilitating a streamlined process for bringing tokens to market.

- GHOST – GHOST functions as Kujira’s money market, utilizing users’ assets for lending, interest accrual, and maintaining operational liquidity through collateralization. ORCA powers it as its liquidity engine and offers features such as leverage for lending or borrowing assets, community-driven asset inclusion, and a robust liquidation engine beneficial for the Kujira community.

- BLUE – BLUE, as the central hub in the Kujira ecosystem, facilitates various network activities, including staking, minting, bonding, swapping, cross-chain transfers, and governance**.** The KUJI Dashboard is the heart of Kujira, offering a central space for governance participation, KUJI staking to earn from Kujira’s revenue, and easy token management. It’s where users shape the protocol’s future and manage their KUJI-related activities efficiently.

- POD – POD, emphasizing the significance of decentralization in cryptocurrency, offers a solution for token holders to contribute to chain security by delegating to validators. By simplifying and expediting the delegation process, POD enables token stakes to delegate to their preferred validators efficiently, fostering enhanced security for Cosmos chains.

- FINDER – Finder, echoing the importance of decentralization in cryptocurrency, reinforces the role of token holders in chain security through validator delegation. Offering a streamlined approach, Finder empowers token stakers to delegate to their chosen validators seamlessly, irrespective of the Cosmos chain, thereby fortifying chain security through increased validator participation.

- USK – USK represents Kujira’s decentralized stablecoin, designed to uphold a soft peg to the US dollar while being collateralized by a diversified selection of cryptocurrencies. These assets include ATOM, wBTC, wETH, wstETH, wBNB, stATOM, wAVAX, DOT, gPAXG, MNTA, and LUNA, ensuring stability and security. Acquiring USK is facilitated through minting on the BLUE platform or purchasing via the FIN platform, offering users multiple avenues to access this stablecoin.

Tokenomics

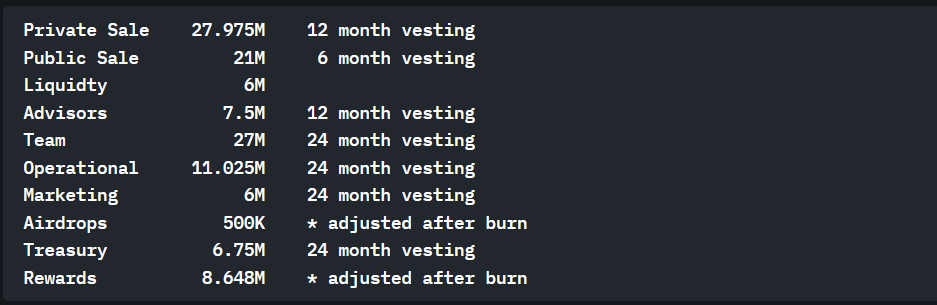

$KUJI is the native token of Kujira Network. The KUJI token was released through a token generation event in November 2021, with a specific release schedule as follows:

Supply – $KUJI, holds a total supply of 122,398,190.844391 (122.4 million) tokens following a governance decision on January 18, 2022, which reduced the initial supply of 150 million tokens. This reduction involved burning liquidity pool rewards, enhancing token value and scarcity within the ecosystem. It has a circulating supply of 122,349,542, meaning no inflation concerns exist.

Utility – Staking $KUJI on the Kujira Network, facilitated by validators, allows users to accrue a diverse range of apex assets over time. Unlike traditional methods where network fees are first converted to $KUJI, all collected fees are directly distributed to stakers through validators. This approach simplifies accumulating a varied staking yield beyond just acquiring more $KUJI. Additionally, Kujira plans to introduce the option for stakers to redeem rewards as $KUJI, addressing user demand.

Beyond staking benefits, $KUJI serves a crucial role in governance within the Kujira network. Holders who stake $KUJI gain voting rights, enabling them to actively influence the network’s direction by participating in decisions such as electing new Senators and contributing to other governance aspects.

Furthermore, GHOST, Kujira’s native money market platform, leverages ORCA functionality to enable community members to borrow against $KUJI collateral or borrow $KUJI against other provided assets. This innovative feature allows traders and holders to engage in long and short positions involving $KUJI, fostering dynamic market participation and diverse trading strategies.

Adoption

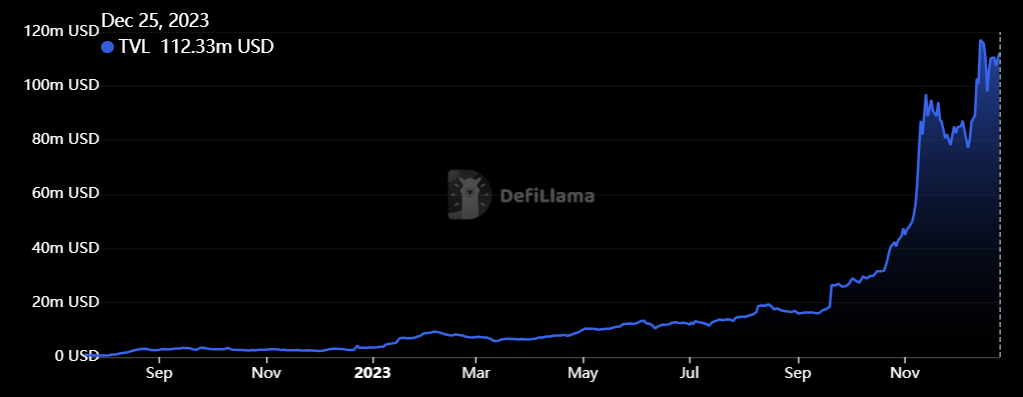

Kujira boasts a Total Value Locked (TVL) of $112M, indicative of its substantial presence and utilization within the ecosystem. Over the past year, this figure has exhibited consistent growth, underscoring an increasing trend in the adoption and utilization of Kujira’s offerings. This substantial TVL is a testament to the platform’s resilience and attractiveness within the Decentralized Finance (DeFi) landscape.

At the moment, public projects building on Kujira include Black Whale, Blend, CALC Finance, DLOYAL Refer, Entropic Labs, Fuzion (PILOT & PLASMA), Fitlink, Ghost Games, Hummingbot, Kujira Name Service, Kujirans, Local Money, MantaDAO, and SRL Finance.

Team

While maintaining anonymity, the Kujira team has demonstrated commendable expertise and performance throughout their endeavors. Despite operating without disclosed identities, their collective efforts have yielded impressive outcomes and accomplishments thus far. This anonymity, while unconventional, has not hindered their ability to execute and deliver on their objectives within the ecosystem.

Conclusion

The Kujira network is the foundation for various DeFi products, encompassing order book trading, collateral auctions, a decentralized stablecoin, and various other functionalities. Positioned within the Cosmos Inter-Blockchain Communication (IBC) ecosystem, Kujira offers seamless integration opportunities, enabling external platforms to leverage its robust liquidity infrastructure for enhanced functionality.

One of Kujira’s primary objectives is to democratize access to decentralized finance, striving to simplify the complexities associated with DeFi for a wider audience. By providing a comprehensive suite of financial tools and services, Kujira aims to streamline the DeFi experience, making it more accessible and user-friendly for all participants.

| Fundamental Analysis | |||||

| Assessment | |||||

| Problem | Moderate, somewhat persistent problem | 2 | |||

| Solution | Some uniqueness, moderate defensibility | 2 | |||

| Market Size | Large market, significant growth potential | 3 | |||

| Competitors | High competition, but room for differentiation | 2 | |||

| Unique Value Proposition | Clear differentiation and value for customers | 3 | |||

| Current Traction | Solid traction, user engagement and retention growing | 3 | |||

| Unit Economics | Positive unit economics, with plans for further improvement | 3 | |||

| Tokenomics | Solid token strategy, aligns with user incentives | 3 | |||

| Product Roadmap | Clear roadmap, innovative and achievable milestones | 3 | |||

| Business Model | Proven business model with clear path to profitability | 3 | |||

| Go-to-Market Strategy | No clear GTM strategy or major flaws | 1 | |||

| Regulatory Risks | Moderate regulatory risk, solid mitigation strategy | 3 | |||

| Total | 64.58% | ||||