TOKEN METRICS WATCHLIST

We scored many projects this week. Here are a few you should know about:

- Lends

- Chain X

- SKALE

- Sphere Finance

- Goracle

Please keep in mind that some of these projects have not yet been subjected to our code review process, but we want to call them out here for preliminarily catching our eye based on our fundamental analysis process.

Lends (Website – Twitter)

Lends is a Cross-chain lending solution with access to the most competitive supply and borrowing rates through the Arbitrum ecosystem. It is a fixed-rate P2P lending protocol that uses order books to offer fixed-term loans to known counterparties. The protocol is secure, reliable and provides cross-chain loans.

Why we like it

Traditional borrowings hoard idle funds, which leads to high spreads for the users. Also, they use interest rate curves and formulas to determine the rates. Lends uses an order book mechanism where the rates are market driven. This way, users are offered better rates matching their needs, improving their real yield. The counterparties are known, and the loans are subjected to flexibility. Lends will generate revenue by charging a 10% fee on the interest received by lenders. 70% of these revenues are returned to liquidity providers, while the remaining 30% are used to reward stakers. Lends is bringing a structured approach to the crypto borrowing market.

Investors

TBA

The Team

TBA

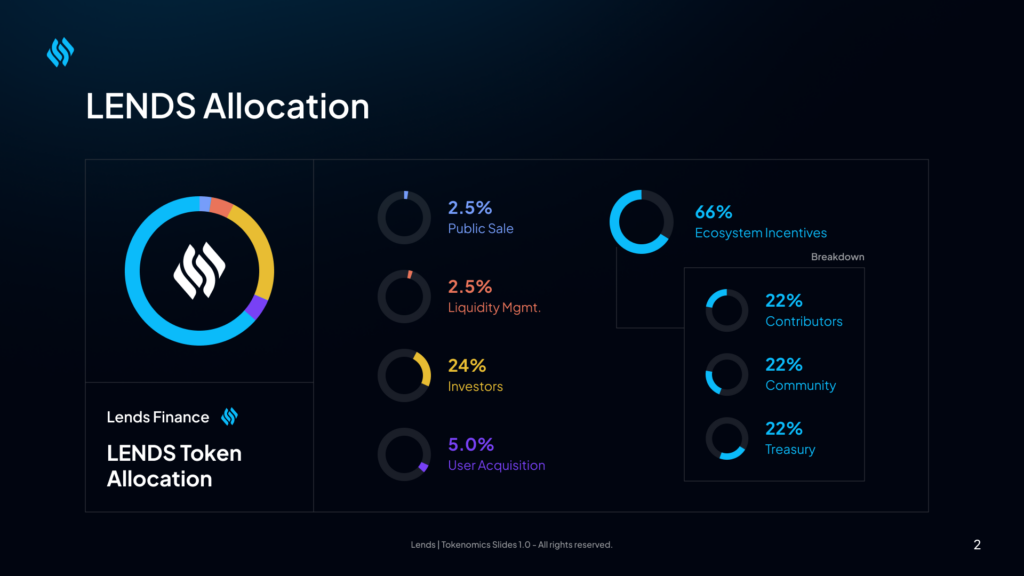

Token Utility

LENDS is the native token of Lends. It will be used to access the platform and governance.

Where can you buy the token

TBA

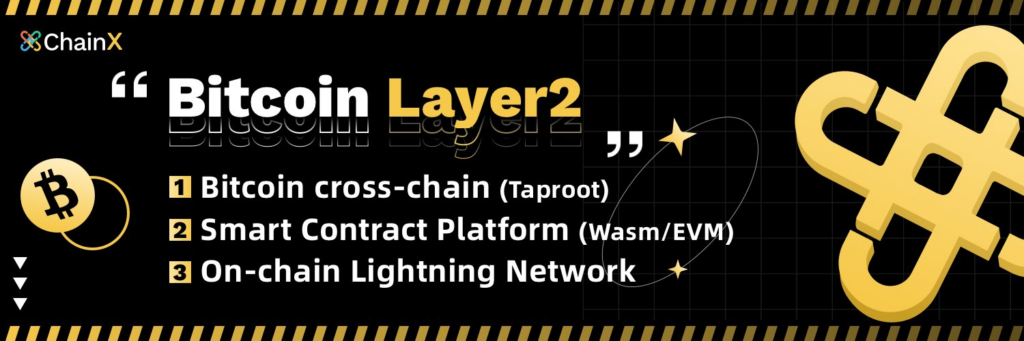

ChainX(Website – Twitter)

ChainX is an innovative BTC Layer2 network that offers trusted and scalable solutions for Bitcoin transactions and custody schemes. It provides a trusted and scalable Layer 2 platform. ChainX will provide its lightning network, the X Lightning, fostering quick transactions. It also ensures full compatibility with the Ethereum Virtual Machine (EVM). ChainX also has a social media app Comingchat, which millions have used.

Why we like it

The Bitcoin Network needs to improve regarding speed and scalability. With its Layer 2 solutions, ChainX s working to eradicate this problem. ChainX’s custodial and non-custodial modes ensure the security of BTC in the layer 2 network, thus establishing its trustworthiness. Dapps in layer 2 significantly improve the throughput of Bitcoin transactions and lower transfer fees. With its lightning network, it will provide faster transactions. It is also EVM and WebAssembly (WASM) compatible, which helps developers build dApps and allows using Ethereum-based tools such as Truffle, MetaMask, Waffle, Remix, and Hardhat.

With Comingchat, they want to build a metaverse for the entire ecosystem. It wants to make a gateway for people to enter Web 3 and provide a secure payment system to transact around the globe. ChainX is working on the most extensive cryptocurrency network and is uniquely adding value, which makes it a promising project.

Investors

TBA

The Team

TBA

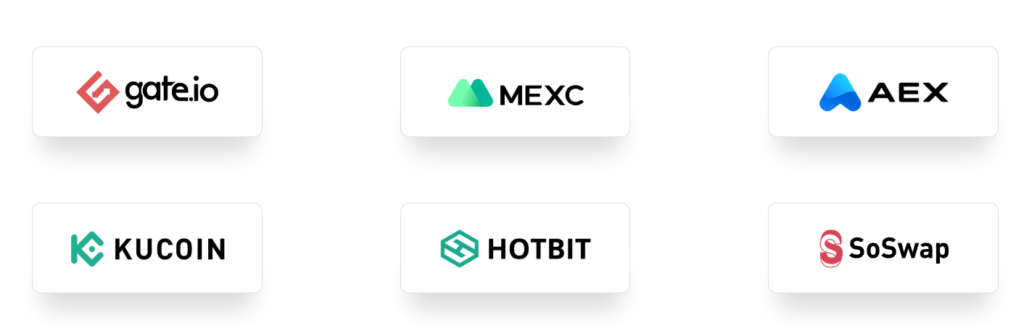

Token Utility

The native governance token of ChainX is PCX, which serves multiple purposes, including governance participation, staking, and payment. The total supply is 21 million, with the output halved every two years.

Where can you buy the token

You can buy PCX directly from an exchange.

SKALE (Website – Twitter)

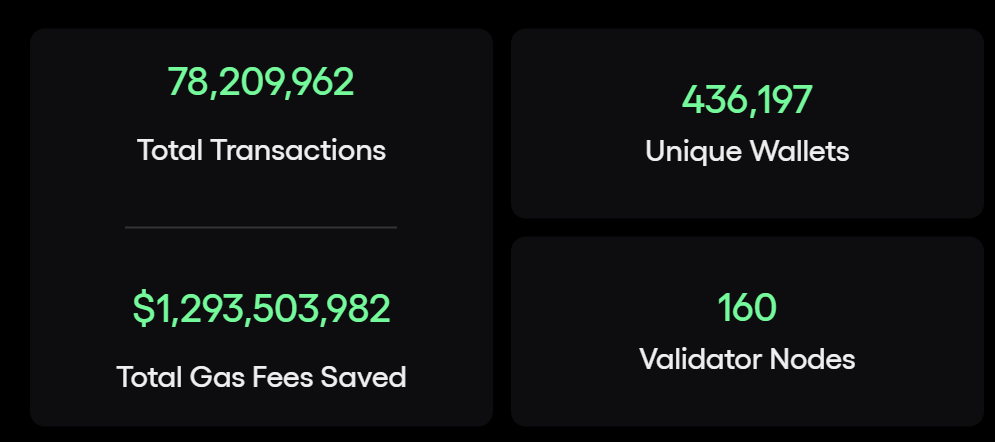

The SKALE Network is an Ethereum-based multichain network designed to scale Ethereum decentralized applications (dApps). SKALE network can run fast, on-demand, pooled-security Blockchains with zero gas fees to end users. The developers can deploy their own inoperable EVM blockchain without compromising security and decentralization.

Why we like it

SKALE is integrated with Ethereum and is interoperable, ensuring smooth network communication. Blocks have instant finality on SKALE Chains. This removes any issues from MEV, time bandit attacks, and chain reorgs that have plagued prior-generation blockchains that struggle with latency and slow finality. The SKALE network is cost-effective and offers high speed. In addition, dApps can store files locally on a chain, providing new use cases in the Web 3 space.

The SKALE network also creates a world-class NFT platform and game user experience. SKALE’s advanced cryptography and pooled security model enable decentralization without sacrificing security. The SKALE protocol has unique features that make it suitable for developers to build upon, and is open source. It has gained attractive traction from users.

Investors

TBA

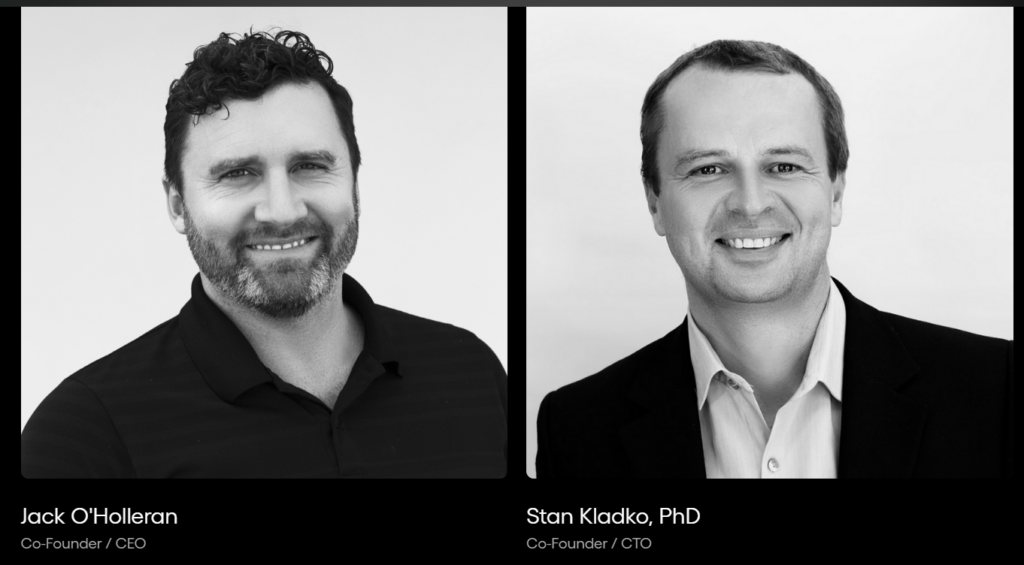

The Team

Token Utility

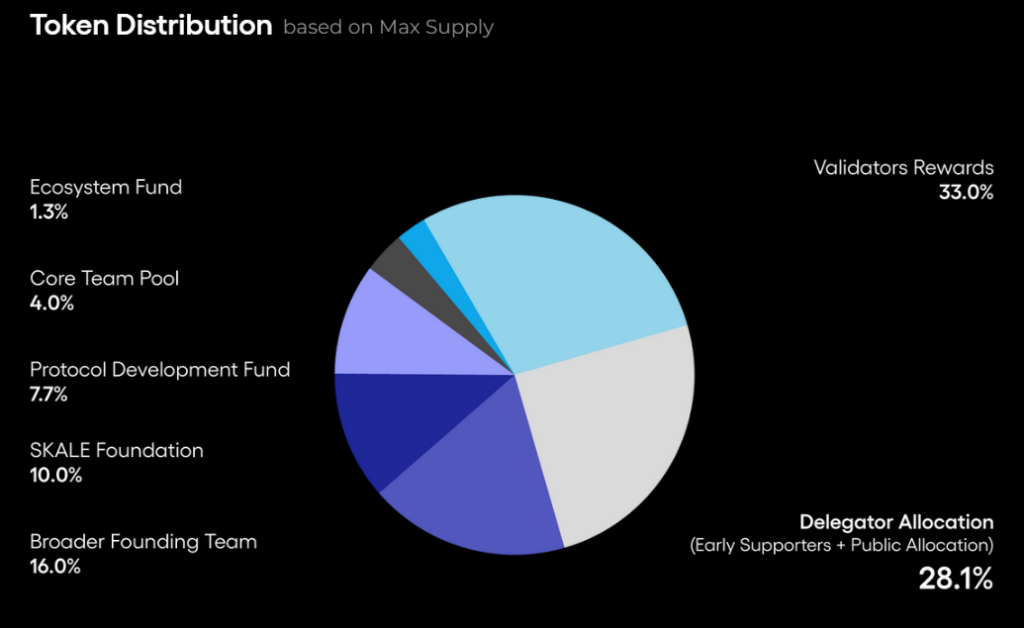

The SKALE token (SKL) is a hybrid use token that represents the right to work in the network as a validator, stake as a delegator, or access a share of its resources by deploying and renting a SKALE Chain for some time as a developer.

Where can you buy the token

You can buy SKL from an exchange.

Sphere Finance (Website – Twitter)

Sphere Finance is a protocol aiming to revolutionize the DeFi space with auto-staking. Mechanism. Sphere’s vision is that of an ecosystem that encompasses the many opportunities of DeFi but only by building the best version of each. Sphere Finance can be thought of as the S&P 500 of Crypto.

Why we like it

Users need to hold $SPHERE tokens to access the benefit of the Sphere platform. The holders can get the best of the DeFi market with just one token. When you buy a Sphere token, the auto-staking automatically happens in the wallet. Sphere uses its treasury to invest in valuable governance tokens across the DeFi space, granting Sphere holders voting power over other influential protocols. Sphere Finance also ensures complete security by hosting its protocol on various servers. Participants hold and stake their $SPHERE token to earn rewards. The high rewards among the users make it an attractive opportunity among the users.

Investors

TBA

The Team

TBA

Token Utility

$SPHERE is Sphere’s governance token that, when locked to $ylSPHERE (yield-locked SPHERE), activates its governance capabilities & turns yield-bearing. $SPHERE is the de-facto governance token of the ecosystem. As Sphere Finance grows, so does $SPHERE’s utility. It claims to allow crypto owners to profit by staking their tokens and employs a Proof-of-Stake consensus model. The $SPHERE token is deflationary.

Where can you buy the token

You can buy a $SPHERE token from an exchange.

Goracle (Website – Twitter)

Goracle is a decentralized oracle network that provides an infrastructure for the protocols that require real-world data for development. They empower blockchain applications and push for better adoption of Web 3. They envision a decentralized, secure, and scalable network governed and operated by the community that uses it.

Why we like it

The Defi market is increasing, and many projects need real-world data in a decentralized manner to operate. The demand for Oracles will increase as people become accustomed to the cryptocurrency network. Goracle assures full transparency and quality when providing data. They are primarily working on the Algorand blockchain. It uses the Pure Proof of Stake and provides a permissionless network. Goracle offers two options to the users- Direct and Aggregated.

The default request is an aggregated option that provides trustless data for the network by aggregating the results from the data providers. They aim to advance the state-of-the-art in Oracle and blockchain reliability, safety, and performance by providing a flexible and modular Oracle architecture. This will aid them in the fast implementation of new upgrades and support for emerging use cases.

Investors

Algoracle’s seed round was led by Borderless Capital, with significant contributions from the Algorand Foundation, Valhalla Capital, and Big Brain Holdings, and rounded out by strategic investors Xpand Capital, Parea Capital, OrcaDAO, GMI Capital, and EXA Finance.

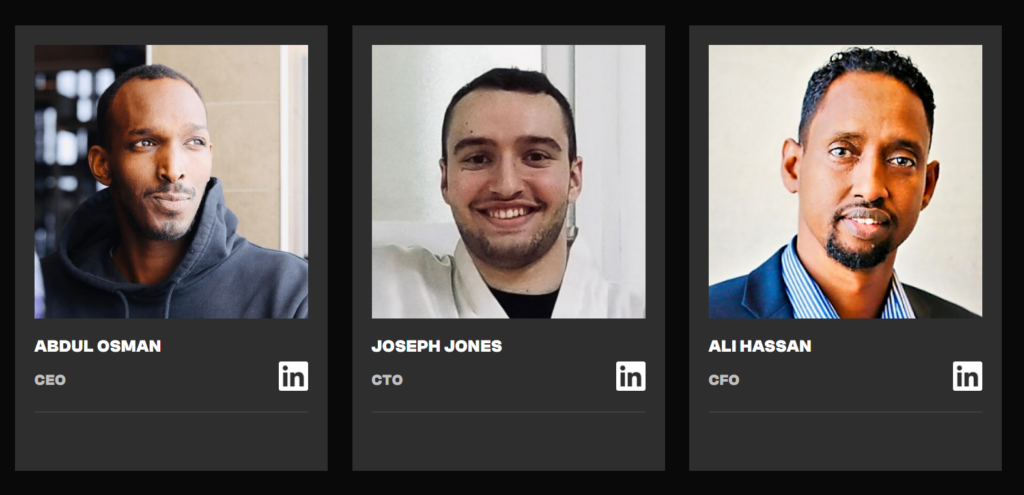

The Team

Token Utility

GORA is the token of the platform. The use case of the GORA token is governance, running a node, and accessing the Goracle protocol.

Where can you buy the token

TBA