Executive Summary

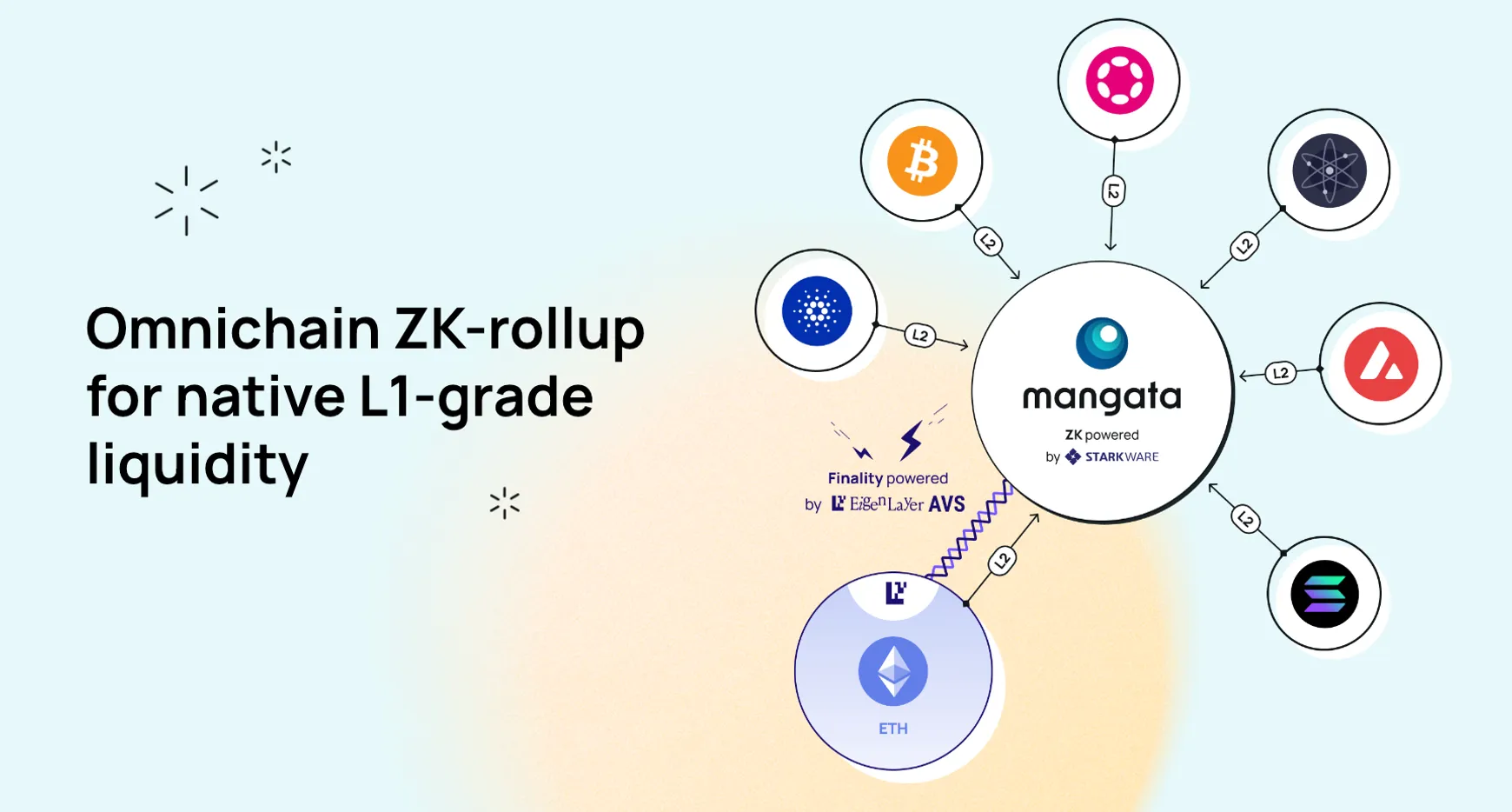

Mangata represents an omnichain zk-rollup designed to facilitate native liquidity at the L1 level, aspiring to enable the tradability of tokens across diverse ecosystems. It is constructed upon Eigenlayer and Starkware technology, boasting gas-free swaps while mitigating front-running and Miner Extractable Value (MEV) risks. The platform enhances capital efficiency through its innovative proof-of-liquidity consensus mechanism and incorporates features such as weight voting and open third-party incentives. They aim to develop an omnichain liquidity protocol that enables the seamless trading of tokens across diverse blockchain networks.

Features

- Hybrid DEX – Mangata’s Hybrid DEX ingeniously merges the AMM and order book models, harnessing the strengths to deliver unparalleled trading efficiency and refined price discovery. This unique fusion ensures traders benefit from enhanced liquidity while also experiencing precise transaction execution, thereby guaranteeing optimal trading costs and efficiency.

- Protection against Miner Extractable Value (MEV) – The platform’s Themis Consensus Extension protects against the predatory actions of Miner Extractable Value (MEV) bots by decentralizing network control. By establishing an equal transaction order for all participants, Mangata eradicates the unfair advantages that often plague centralized networks. This prevents the widespread value theft observed in many existing DEX ecosystems, notably prevalent in Ethereum.

- No Gas fee – Mangata revolutionizes the fee structure by eliminating gas fees entirely and instead implementing a fixed 0.3% trade fee. Unlike most exchanges that charge gas fees for transactional integrity, Mangata utilizes the exchange commission to safeguard against spam while ensuring a seamless user experience without additional gas-related costs.

- Better Staking – Moreover, the Proof-of-Liquidity mechanism on Mangata transcends the traditional trade-offs between staking and providing liquidity. Here, users stake LP tokens, allowing their capital to generate trading fees concurrently, presenting an innovative approach that maximizes earning potential without compromising liquidity commitments.

Market Analysis

Since its inception, blockchain technology has witnessed an unprecedented surge, now valued at $1.6 trillion, with promising projections indicating continued growth. Despite the emergence of various decentralized exchanges (DEXes), the proliferation of distinct chains in the crypto market has presented persistent challenges for users, impeding the seamless trading of assets across different chains and resulting in time-consuming processes. Mangata aims to address this predicament by offering a comprehensive solution wherein users can effortlessly trade many tokens across diverse chains on their platform, establishing itself as an omnichain liquidity protocol.

As industry analysts foresee a rapid expansion in the crypto market, Mangata’s capacity to facilitate cross-chain trading stands to gain heightened relevance and utility. The platform’s potential to streamline inter-chain transactions in the face of the market’s projected growth underscores its value proposition. It underscores its potential to cater to evolving user needs in the crypto space.

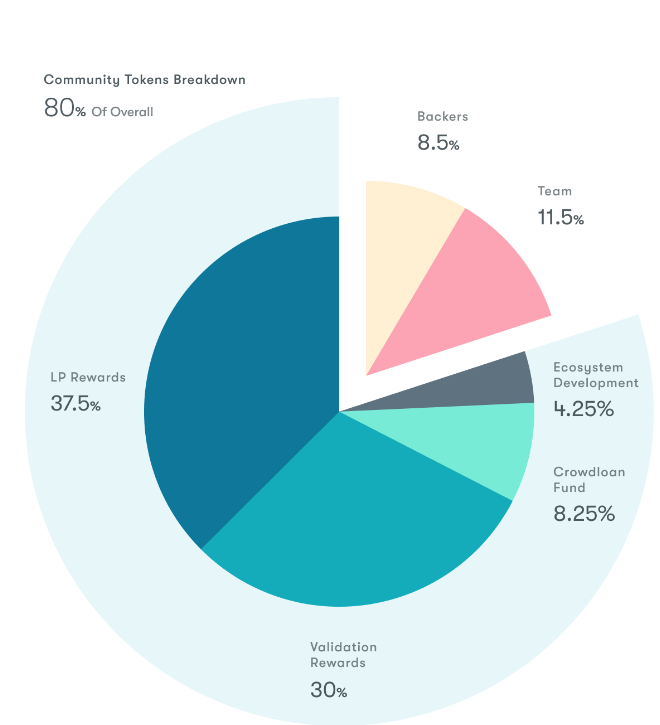

Token

$MGX, will have a total supply of 1 billion $MGX upon the Token Generation Event (TGE). Subsequently, rewards will be generated until a capped supply of 4 billion $MGX is reached, which is expected to transpire within a maximum of 5 years. Notably, 80% of the final token supply has been earmarked for the community’s benefit, strategically allocated to bolster network security and augment liquidity provision.

The token’s utility encompasses several key facets:

- Proof-of-Liquidity Staking: It is pivotal in the Proof-of-Liquidity staking mechanism, incentivizing users to provide liquidity for collator nodes and fostering robust demand.

- Liquidity Base Layer: $MGX’s prominence in attracting liquidity facilitates the establishment of numerous efficient trading routes, thereby establishing a foundational layer of liquidity within the system.

- Algorithmic Buy & Burn: A portion of the exchange commission is utilized for continuous purchases and burning of $MGX, ensuring ongoing validation rewards and fortifying network security against potential threats like front-runners.

- Governance: The token is central in governing various aspects, including managing diversified treasuries, DEX-owned liquidity, liquidity mining incentives, and validation rewards. This governance function generates demand for liquid $MGX, pivotal in overseeing the ecosystem’s operations and strategic decisions.

Investors

Team

Peter Kris serves as the company’s CEO, leading a dedicated and experienced team with extensive backgrounds in the crypto industry spanning numerous years. Comprising computer science academics, experts in Miner Extractable Value (MEV) research, accomplished engineers from notable companies like Twitter, and seasoned veterans in the crypto space, the team embodies a wealth of diverse expertise.

Their collective history reflects a shared journey, indicating a cohesive synergy and a depth of understanding cultivated through shared experiences. This collaborative past likely contributes to the team’s strong cohesion and unified vision in navigating the complexities of the crypto landscape.

Risk assessment

The DeFi initiative, Mangata, confronts regulatory and compliance risks inherent in the swiftly evolving crypto landscape. The potential for heightened regulatory scrutiny poses challenges that could impede the project’s seamless operation and adherence to crucial regulations such as Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols. Furthermore, navigating legal intricacies concerning securities, tax laws, and other regulatory frameworks presents a considerable challenge, potentially demanding substantial resources in terms of time and costs to ensure compliance. Failure to comply could expose Mangata to significant legal or financial repercussions.

Additionally, well-established decentralized exchanges (DEXes) currently dominate considerable market shares within the crypto realm. While Mangata offers unique features and addresses emerging challenges, entrenched exchanges pose potential hurdles.

Conclusion

Mangata represents an omnichain zk-rollup platform, offering L1-grade native liquidity aimed at enabling the tradability of tokens across diverse ecosystems. This strategic vision positions Mangata at the forefront of facilitating cross-chain token exchange.

The project holds promise as an enticing investment opportunity within the dynamic crypto landscape, underscored by its substantial growth prospects. Mangata’s innovative contributions to the crypto sphere and its prospective collaborations across various projects signal ample opportunities for expansion and development. The project’s emphasis on addressing a substantial industry challenge, supported by a proficient team boasting extensive experience in the crypto domain, heightens its appeal and credibility.

| Fundamental Analysis | |||||

| Assessment | |||||

| Problem | Significant, long-term problem | 3 | |||

| Solution | Distinct, defensible solution | 3 | |||

| Market Size | Large market, significant growth potential | 3 | |||

| Competitors | High competition, but room for differentiation | 2 | |||

| Unique Value Proposition | Clear differentiation and value for customers | 3 | |||

| Current Traction | Early traction, user engagement starting to grow | 2 | |||

| Unit Economics | Positive unit economics, with plans for further improvement | 3 | |||

| Tokenomics | Solid token strategy, aligns with user incentives | 3 | |||

| Product Roadmap | Basic roadmap, lacks detail or innovative features | 2 | |||

| Business Model | Proven business model with clear path to profitability | 3 | |||

| Go-to-Market Strategy | Basic GTM strategy, lacks detail or differentiation | 2 | |||

| Regulatory Risks | Minimal regulatory risk, strong mitigation and adaptability | 4 | |||

| Total | 68.75% | ||||