Executive Summary

Mantis leverages the Inter-Blockchain Communication (IBC) Protocol, facilitated by the Picasso Network, to securely connect different blockchains. This enables seamless interoperability and lays the groundwork for a decentralized marketplace where cross-domain intents can be expressed.

Mantis is developing a protocol that enables users to express and fulfill intents across different blockchains. This protocol includes mechanisms for submitting intents, facilitating interactions between solvers and searchers, and settling transactions using IBC. The team plans to launch an application that supports limit orders, swaps, and more complex intents on Solana and Ethereum. A network of solvers will process these intents, minimizing the impact of Miner Extractable Value (MEV) on user transactions and ensuring optimal execution.

About The Project

Vision

Composable Foundation which is the parent organisation of Mantis and Picasso Network, believes that cross-domain interoperability widens the scope of intents. This increased choice in solutions results in value in the forms of a) better user outcomes and b) enhanced maximal extractible value (MEV) collection. This lead to the creation of Multi-chain Agnostic Normalized Trust-minimized Intent Settlement (MANTIS) to resolve current inefficiencies in cross-blockchain operations.

Problem

A cross-domain intent protocol like Mantis has emerged as a solution to several critical issues plaguing the DeFi landscape:

- Poor User Experience (UX): Decentralized applications often present a complex user interface. Cross-chain transactions further complicate this, requiring users to navigate multiple applications and networks.

- Wasted Yield Opportunities: Idle assets in accounts typically generate minimal or no yield, leading to inefficient capital utilization. Additionally, the vast DeFi ecosystem makes it challenging for users to discover the most profitable opportunities.

- Centralization Trends: Recent trends toward centralization, particularly in cross-chain bridges, have raised concerns. Existing decentralized solutions often need to catch up to centralized structures in terms of speed and cost.

Solution

Mantis offers a unified interface for accessing DeFi, allowing users to express their desired outcomes and let the platform handle the execution. This process involves:

- Expressing Intents: Users submit their intentions to solvers.

- Executing Intents: Mantis facilitates the execution of these intentions.

- Settling Intents: Finalized transactions are settled on the blockchain.

In addition, Mantis introduces native yield, providing rewards to users who hold assets on its rollup. This enhances capital efficiency by ensuring that assets generate returns even when not actively used. By combining native yield with optimized cross-chain intent settlement, Mantis offers a profitable way to interact with the entire crypto ecosystem. Users can simply load their accounts onto Mantis, submit their intents for optimal settlement via solver network, and earn a yield on their assets simultaneously.

How Does Mantis Work?

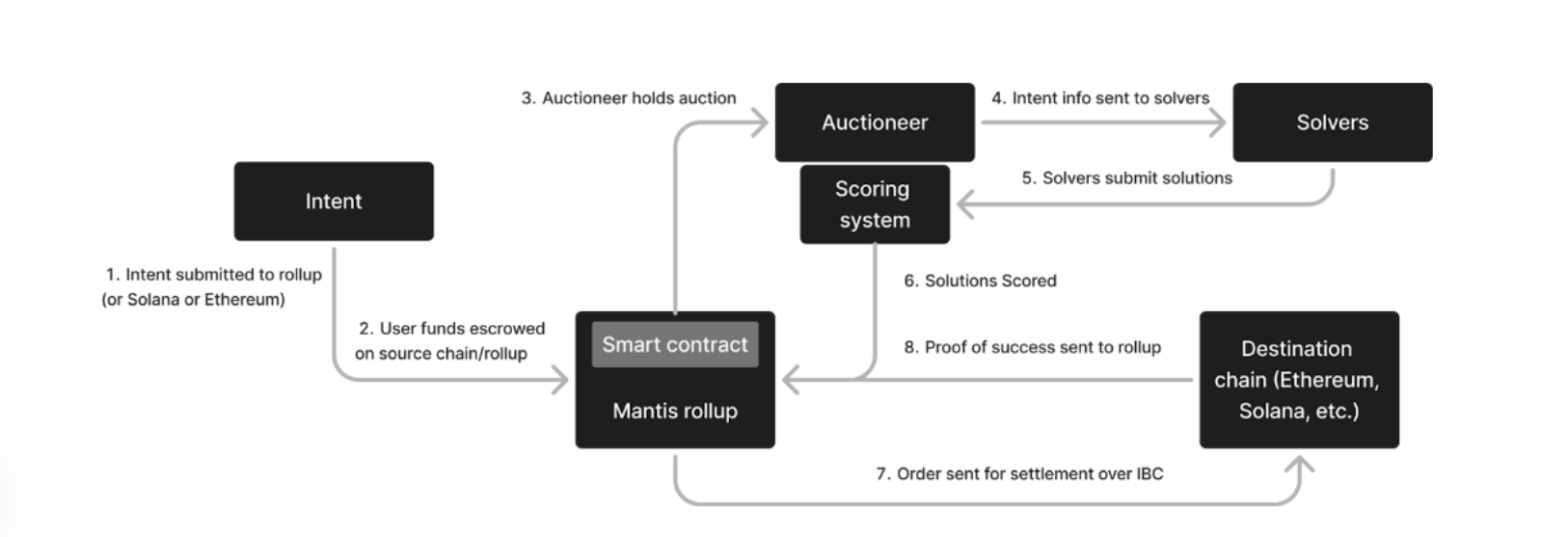

The first iteration of the protocol known as Mantis v1 would be based on the following architecture. Let’s have a look at how it would work.

1. Intent Submission: Users submit their desired cross-chain transaction preferences, known as intents, directly to the Mantis rollup or indirectly via an IBC-connected chain like Solana or Ethereum.

2. Fund Escrow: User funds are held in escrow on either the source chain or the Mantis rollup, depending on where the intent was submitted.

3. Intent Routing: All intents are forwarded to the Mantis rollup. A smart contract on the rollup then transmits these intents to an off-chain auctioneer.

4. Solver Notification: Information about the intents is disseminated to solvers.

5. Solution Submission: Solvers propose solutions, such as the output amount for a swap, and submit them to the rollup.

6. Solution Evaluation: The off-chain auctioneer scores the submitted solutions.

7. Winning Solution Execution: Once the winning solution is determined, the solver who proposed it is responsible for executing the intent. This involves making the necessary state transitions on the respective destination chains.

8. Success Confirmation: After the intent solution is executed, proof of success is transmitted to both the Mantis rollup and the source chain via IBC.

Market Analysis

As the adoption of DeFi protocols increases, the demand for cross-chain bridging and swapping also increases. The fragmented liquidity across different chains has resulted in a huge learning curve for new DeFi users. This has created a strong demand for chain-agnostic protocols.

According to Defi Llama, the 24H volume across all DeFi protocols has hit $5.65B which consists mostly of DEX swaps. Uniswap is by far the biggest decentralized exchange (DEX) and its native UNI token has a current market capitalization of $5.3B. Similarly, ThorChain (RUNE) which is a cross-chain DEX, has a market cap of $1.6B.

Chain abstraction using intents is still an evolving concept in Web3. Most projects in this sector are still under development. A couple of live projects include Across Protocol, CoW Protocol, and Router Protocol. Across Protocol currently has a fully diluted market capitalization of $247M. This market analysis of DeFi and chain abstraction protocols gives a huge upside to upcoming projects like Mantis.

Competitors

Anoma

Anoma introduces an intent-centric platform that revolutionizes decentralized application (dApp) design, emphasizing user-driven interactions through the innovative concept of “intents.” This review delves into the intricate mechanics, architecture, and technical components that set Anoma apart in the ever-evolving landscape of blockchain technologies.

Across Protocol

Across is a cross-chain bridge designed for Layer 2 solutions (L2s) and rollups, utilizing UMA’s optimistic oracle for security. The platform emphasizes capital efficiency through several key features, including a single liquidity pool, a competitive landscape of relayers, and a fee model that eliminates slippage. The Across protocol represents an innovative approach to bridging and integrating an optimistic oracle, bonded relayers, and single-sided liquidity pools. This combination enables decentralized instant transactions from rollup chains to the Ethereum mainnet. ACX token is the native asset of the protocol and has a $247M FDV.

CoW Protocol

CoW Protocol, known initially as Gnosis Protocol V2, is a unique decentralized exchange (DEX) market player. As a Meta DEX Aggregator, it is designed to offer the lowest prices for trades across various exchanges and aggregators. Its underlying principle revolves around the Coincidence of Wants (COWs) and Batch Auctions. This innovative approach enables two parties to exchange tokens directly without using a traditional DEX or incurring additional fees. With its dedicated trading interface – CoW Swap- the protocol has been operational for a year, with a skilled and experienced team directing its operations. The native asset of CoW Protocol is CoW, which has an FDV of $268M.

Unique Value Proposition

Mantis offers a comprehensive solution for cross-chain transactions, encompassing intent expression, execution, and settlement. This is achieved through the Mantis protocol, rollup, and token, in conjunction with the Inter-Blockchain Communication (IBC) Protocol and the Picasso Network. By exploring the untapped potential of cross-chain Miner Extractable Value (MEV), Mantis aims to create a decentralized marketplace for expressing and executing cross-domain intents.

Features

Mantis offers a significantly improved cross-chain transaction user experience thanks to the following key features:

- User-Friendly Interface: Mantis provides an intuitive interface where users can easily specify their desired outcomes for cryptocurrency transactions, which are also known as intents

- Native yield: Mantis Accounts are network-level accounts on the Mantis Rollup that can be used for participating in on-chain actions. Mantis Account users will earn native yield for any assets deposited to the Mantis L2. Therefore, assets held in Mantis Accounts earn yield even when not actively being used..

- Streamlined Process: Mantis simplifies the complexities of cross-domain communication.

- Enhanced Security: Mantis protects user funds by requiring solvers to stake before handling them. Additionally, it eliminates reliance on centralized entities, mitigating risks associated with potential manipulation.

- Optimized Solutions: Solvers offer the most efficient routes for executing intents. Whenever possible, solvers utilize cross-domain Coincidence of Wants (CoW) matching to minimize fees and maximize user returns.

- Incentivized Network: Mantis promotes a decentralized and competitive environment by offering revenue sharing to participants like block producers, validators, searchers, and relayers. This incentivizes them to perform their roles optimally.

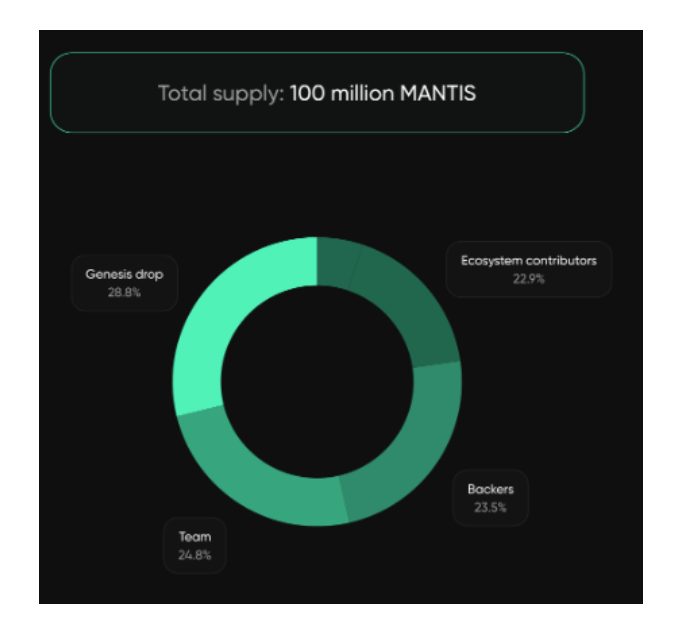

Token

MANTIS token has a broad utility in the form of staking to secure roll-up, settling transactions on Solana, revenue sharing via staking and network fees etc. The max supply of MANTIS will be 100 million coins which will be distributed as follows.

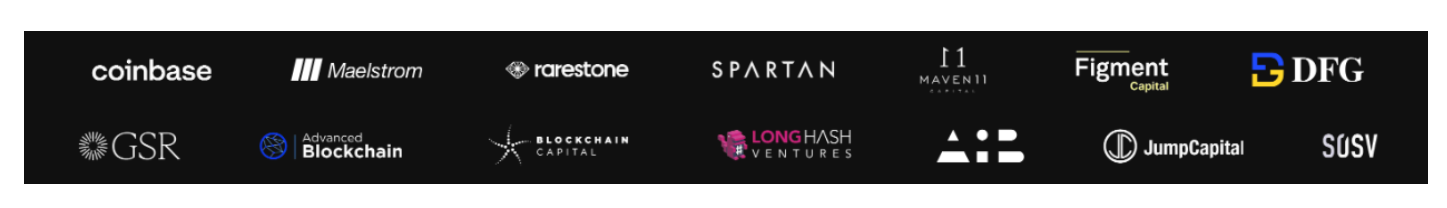

Investors

Mantis was previously known as Composable Finance. Composable which is the developer of Mantis and Picasso Network has raised a collective sum of $39M from investors like Coinbase Ventures, GSR, Spartan Group, NGC Ventures and many others.

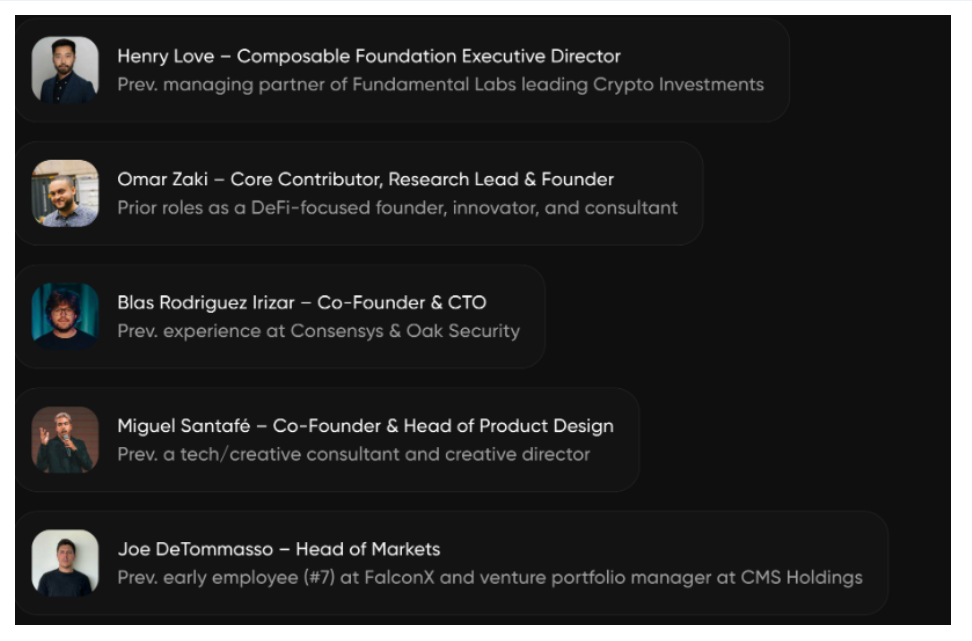

Team

The founding team of Mantis consists of industry veterans and many developers. Team members bring valuable experience from Consensys, Near, Google, FalconX, McKinsey & Company, AIG, and Harvard.

Conclusion

Intents are another new area of development in the DeFi space that are positioned to further assist in resolving cross-chain operational issues. These protocols are set to revolutionize the user experience for the next wave of adoption in decentralized finance (DeFi).

Cross-domain intent protocols, such as Mantis, have gained prominence due to several factors. The combination of user-friendly interfaces and efficient execution has been a critical element in unlocking capital efficiency and value generation for participants in the decentralized finance (DeFi) transaction ecosystem.Therefore, considering the innovative features and strong fundamentals, Mantis seems poised to become a top project in the chain abstraction sector.

| Fundamental Analysis | |||||

| Assessment | |||||

| Problem | Significant, long-term problem | 3 | |||

| Solution | Distinct, defensible solution | 3 | |||

| Market Size | Large market, significant growth potential | 3 | |||

| Competitors | Emerging market with few strong competitors | 3 | |||

| Unique Value Proposition | Some differentiation, but overlap with existing solutions | 2 | |||

| Current Traction | No or very limited user engagement | 1 | |||

| Unit Economics | Unit economics currently negative, no clear path to profitability | 1 | |||

| Tokenomics | Solid token strategy, aligns with user incentives | 3 | |||

| Product Roadmap | Basic roadmap, lacks detail or innovative features | 2 | |||

| Business Model | Proven business model with clear path to profitability | 3 | |||

| Go-to-Market Strategy | Solid GTM strategy, clear target market and channels | 3 | |||

| Regulatory Risks | Minimal regulatory risk, strong mitigation and adaptability | 4 | |||

| Total | 64.58% | ||||