Executive Summary

Mantra is a layer 1 blockchain designed for tokenizing real-world assets (RWAs) while ensuring regulatory compliance at the protocol level. It is built using Cosmos SDK, is compatible with IBC, and supports CosmWasm. Mantra enables the seamless fractionalization and tokenization of assets like real estate, art, and commodities. The platform’s technology stack includes a native decentralized exchange (DEX) and other applications. It supports high transaction throughput of up to 10,000 TPS, secured by a Proof-of-Stake (PoS) consensus mechanism.

The platform addresses the key challenges of regulatory compliance in the RWA market by embedding compliance mechanisms at the protocol level rather than at individual applications. So, it provides a framework for institutions, businesses, developers, and users to create, trade, and manage RWAs with its unique modular layer. This innovation allows for a standardized compliance process across the ecosystem, enhancing interoperability and efficiency.

Mantra introduces a unique ‘Compliance ID’ feature. Users undergo KYC once to access multiple permissioned applications, utilizing a decentralized identity (DID) system to manage secure and transparent identity verification.

The platform has secured significant partnerships, including a $1B deal with DAMAC Group to tokenize assets in the Middle East and collaborations with major entities like BlackRock, SwissBorg, Ondo, Chainlink, and Google Cloud. These partnerships and solid investor backing have contributed to the project’s growth, with the $OM token reaching the highs of $5.9B in market capitalization, with a fully diluted valuation (FDV) of $10.8B. So Mantra’s focus on integrating real-world assets into blockchain with regulatory compliance positions it as a leader in the growing RWA sector.

About the Project

Vision:

Mantra’s vision is to bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi) by facilitating the tokenization of RWAs on a secure, compliant blockchain platform. They aim to create a permissionless blockchain for permissioned applications. By leveraging Cosmos SDK and IBC protocol, Mantra seeks to offer a scalable, interoperable, and user-friendly environment for global financial inclusion, democratizing access to investment opportunities that were traditionally accessible only to a select few.

Problem:

The primary issue in the RWA market is effectively navigating regulatory compliance across different jurisdictions. Most RWA platforms implement compliance at the application layer, which leads to redundancy in user verification processes and limits the fluidity of asset trading across platforms. This approach also leads to fragmented liquidity, complexity in user onboarding, and a lack of standardization in compliance practices. Additionally, tokenization often lacks the infrastructure to ensure security and regulatory adherence, which is crucial for mainstream adoption and trust in the DeFi ecosystem.

Solutions:

Mantra solves these issues by embedding compliance mechanisms directly into its blockchain protocol. This approach centralizes compliance verification, allowing users to undergo KYC once to access multiple ecosystem applications. It uses a DID system and Soulbound NFTs for identity management.

The platform introduces modules like Mantra Compliance, Guard, and Token Service, which manage regulatory tasks, enforce access controls, and facilitate the creation and management of tokenized assets, respectively. By optimizing transactions through IBC, Mantra enhances cross-chain interoperability, reduces costs, and simplifies tokenization, fostering more integrated, efficient, and compliant markets for RWAs.

Market Analysis

RWAs include a wide range of tangible and intangible assets converted to tradable tokens through tokenization. Tangible assets like real estate, commodities, art, infrastructure, natural resources, and non-tangible assets like intellectual property (IP), financial instruments, and royalties can be tokenized.

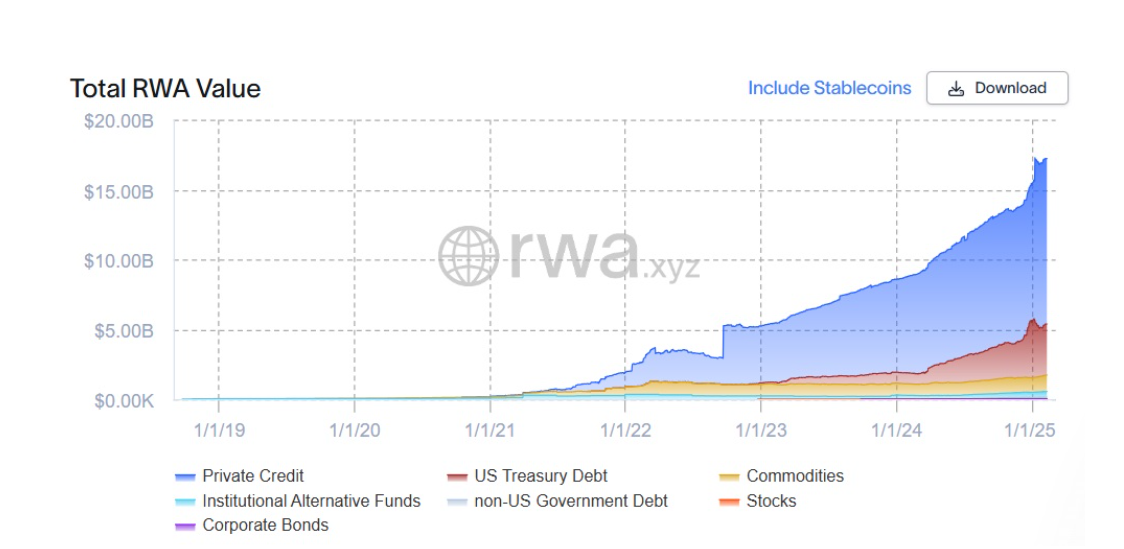

The total on-chain RWAs, as per rwa.xyz, are worth $17.18B, with 83,704 total assets tokenized across 112 issuers. This includes RWAs across Private Credit, the leading market, followed by US Treasury Debt, Commodities, Institutional Alternative Funds, non-US Government Debt, Stocks, and Bonds. This excludes stablecoins, which alone capture a market of $220B.

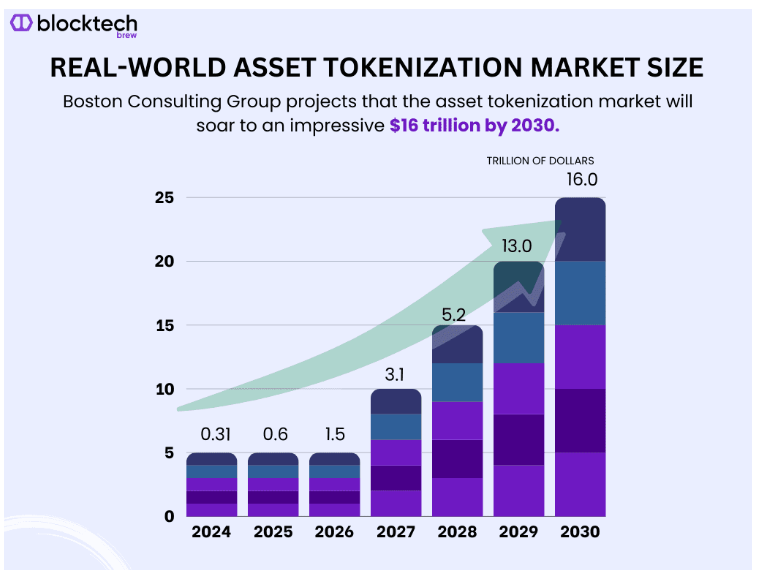

According to a research report from Boston Consulting Group, the asset tokenization market is estimated to grow to a staggering $16T by 2030, but only 1% of the total market size is captured in 2025.

Competitors:

- Ondo Finance: Ondo is tokenizing traditional finance instruments, particularly focused on the U.S. Treasury Bills and other fixed-income securities. Their flagship product, OUSG, allows investors to gain exposure to the U.S. Treasuries directly on the blockchain, bridging DeFi and traditional finance.

- Polymesh: Polymesh is focused on creating an institutional-grade blockchain tailored for regulated assets. Like Mantra, it emphasizes compliance, identity, governance, and confidentiality at the protocol level. However, Polymesh is more specialized in security tokens, which might give it an edge in that segment. This also means it’s less versatile regarding asset types than Mantra’s broader RWA focus.

- Centrifuge: Centrifuge focuses on on-chain credit loans. They enable businesses to issue tokenized invoices, real estate, art, or other assets as collateral for loans. This platform is geared toward small and medium-sized enterprises, providing them access to capital through RWA tokenization.

- Goldfinch: Goldfinch is a decentralized credit protocol that facilitates lending to real-world businesses without requiring crypto collateral. It democratizes access to capital by creating a global credit marketplace where investors can lend stablecoins to earn yield, and borrowers can access funding for real-world projects, especially in emerging markets. The platform operates through a ‘trust through consensus’ model, where community members assess borrower’s creditworthiness.

Features

- Compliance ID: This feature introduces a revolutionary compliance ID system that issues and utilizes verifiable compliance IDs for all participants, including investors, traders, and developers. Users must undergo KYC once to access all permissioned applications on the chain, significantly reducing onboarding friction in regulated environments. It leverages a DID system and Soulbound NFTs to ensure secure, efficient identity verification that can be used across multiple platforms.

- Mantra Token Service (MTS): MTS is a comprehensive module enabling tokenized asset creation, management, and control. It includes functionalities like the token factory, configurable workflows, admin rights, and comprehensive token management (minting, burning, seizing, freezing, and distributing). MTS supports jurisdiction compliance and integrates with the Bank Module, offering developers the tools to create permissioned tokens with seamless interactions across the entire ecosystem via IBC.

- Mantra Gaurd: Gaurd is the central module of Mantra’s compliance and permissioning system. It works with the DID module to enforce permissions at the protocol level by interpreting metadata within the Soulbound NFTs. It provides fine-grained control over user permissions, ensuring only verified and compliant users can access specific features, assets, or services.

- Mantra DEX: Mantra DEX introduces a protocol-level liquidity pool system. Using an Automated Market Maker (AMM) model, it operates with allowed liquidity pools. It is built to be permissionless while maintaining blockchain-integrated liquidity, offering an innovative approach to trading tokenized RWAs in a compliance environment.

- Mantra LEEP (Liquidity Efficient Emissions Protocol): Currently under development, LEEP aims to address liquidity scarcity in crypto markets for tokenized RWAs, often illiquid in traditional markets. LEEP could significantly enhance the tradability and attractiveness of tokenized real-world assets by focusing on bridging liquidity to these assets.

Token

$OM is the native utility and governance token of the Mantra platform. As per CoinGecko, the total supply of the $OM token is around 1.8 billion, and more than 50% of the supply is circulating at about 971 million tokens.

Utility:

- Transaction Fees: Fees are paid to protocol treasury each time a new token is minted or burnt within the Gaurd Module.

- Access to the Guard Module: After completing the KYC, users receive $OM tokens, which they can stake to access the Guard Module. Here, the DApps stake is used to deploy, and the user’s stake is used to access DApps.

- PoS Security: $OM is utilized to secure the PoS network. Both validators and delegators can participate in staking and earn rewards.

- CosmWasm Integration: Since Mantra operates under community governance, the community can propose and collectively decide on important matters, including chain upgrades and protocol integrations.

Traction

Mantra is gaining adoption within the Cosmos ecosystem, but the information about the total assets tokenized so far or the number of platform users is unknown. The platform’s website, Mantra Zone, has had a traffic of 17.6k visits in the last month.

However, Mantra has secured high-value partnerships that can lead to significant adoption. The platform has signed a deal with Dubai-based DAMAC Group to tokenize assets in the Middle East worth at least $1B. Last year, Mantra agreed with developer MAG Property Development to tokenize real-estate assets worth $500M, starting with a residential project. Further, Mantra has partnered with Libre Capital, a UAE-based financial instruments tokenization and issuance platform, to provide investors with onchain access to diverse attractive investment funds, including hedge funds, private credit funds, and BlackRock ICS Money Market funds.

Team

The Mantra team is diverse, with expertise in blockchain development, finance, compliance, marketing, and business strategy. Based on their LinkedIn profiles, Mantra has five co-founders, each bringing a unique skill. Four of the five are based in Hong Kong, and one is in Singapore.

The CEO, John Patrick Mullin, has been actively involved in security token offering and RWA tokenization projects since 2018 and strongly focuses on regulatory compliance. The Council Member, Will Corkin, comes from entrepreneurial work in web3, particularly creating infrastructure for tokenized assets. Another co-founder, Rodrigo Quan Miranda, is a FinTech entrepreneur, investor and advisor. Another Council Member, Stephane Laurent Villedieu, is a serial entrepreneur with experience in web3, digital marketing, and business management. The last co-founder, Jayant Ramanand, has expertise in institutional sales and staking in web3.

Investors

The Mantra team first raised capital in August 2020 from investors like Genblock Capital, Kenetic Capital, LD Capital, Waterdrip Capital, Moonrock Capital, MC Global, and others.

Subsequently, the team raised $11M in March 2024, led by Shorooq Partners and Mapleblock Capital, IBC Ventures, Token Bay Capital, GameFi Ventures, Forte, and others.

Finally, in May 2024, the team raised a strategic round from Laser Digital, a digital asset subsidiary of Nomura Securities. This strategic investment is a significant step and solidifies Mantra’s financial standing and potential for growth in the RWA market.

Conclusion

Mantra stands out as a pioneering layer 1 blockchain for RWA, focusing on regulatory compliance. The team has made several high-value partnerships like DAMAC Group and collaborates with industry giants like BlackRock and Google Cloud, which can significantly bridge traditional finance with decentralized finance.

Innovative features like Compliance ID, Mantra Token Service, Guard, DEX, and LEEP address key challenges in the RWA market and offer scalable solutions for tokenization, enhancing liquidity for tokenized assets. Mantra’s vision to democratize access to a wide range of investment opportunities is backed by a strong team with diverse expertise, substantial investor funding, and a growing market for RWAs projected to reach $16T by 2030.

Although the detailed traction metrics are not available at the moment, Mantra’s focus on regulations, innovative technology stack, and strategic market positioning suggest that it is well on its way to becoming a leader in the RWA tokenization sector.

| Fundamental Analysis | |||||

| Max score | Options | Score | |||

| Problem | 10 | Significant, long-term problem | 9 | ||

| Solution | 10 | Some uniqueness, moderate defensibility | 7 | ||

| Market Size | 10 | Large market, significant growth potential | 8.5 | ||

| Competitors | 10 | High competition, but room for differentiation | 7 | ||

| Use case | 10 | Use case with good potential | 8.5 | ||

| Current Traction | 10 | Early traction, user engagement starting to grow | 6 | ||

| Unit Economics | 5 | Unit economics currently negative, no clear path to profitability | 1 | ||

| Tokenomics | 10 | Solid token strategy, aligns with user incentives | 8.5 | ||

| Product Roadmap | 5 | Basic roadmap, lacks detail or innovative features | 2 | ||

| Business Model | 10 | Proven business model with clear path to profitability | 9 | ||

| Go-to-Market Strategy | 5 | Basic GTM strategy, lacks detail or differentiation | 2 | ||

| Community | 5 | Big, strong and active community | 5 | ||

| Regulatory Risks | 5 | Moderate regulatory risk, solid mitigation strategy | 4 | ||

| Total Score | 73.81% | ||||