Executive Summary

Mode is a layer 2 blockchain network built using the OP stack. It benefits from the Optimism Superchain’s rapid application development capabilities, lower transaction fees, security, and interoperability. Mode is designed to scale decentralized finance (DeFi) to a broader audience by integrating AI-powered financial applications and on-chain agents that create a new AIFI economy.

The network rewards developers, users, and protocols contributing to its growth. This is done through a unique economic model in which sequencer fees are shared, and a smart treasury powers automated rewards across the ecosystem.

Mode is merging AI with DeFi through an ecosystem where AI agents can autonomously execute financial tasks like MEV searching, arbitrage, and smart contract auditing. The vision extends to AI-to-AI (AI2AI) interactions, enhancing transaction throughput, precision, and security in DeFi. They also have a live AI Agent App Store, with different agents managing over $302k worth of assets.

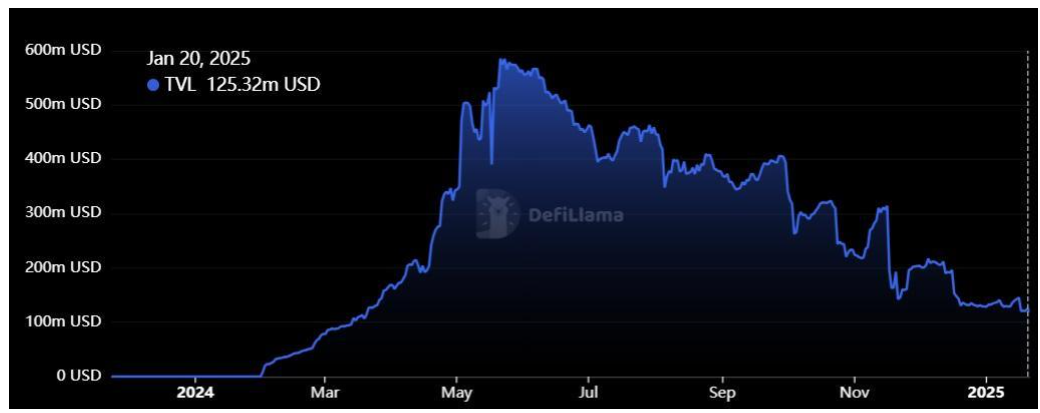

The project received a grant of $5.3M from Optimism. The testnet went live in August 2023, and the mainnet went live in January 2024. The network has more than 439,000 users across 70+ DeFi protocols and an all-time high TVL of $585M, which has now dropped to $125M.

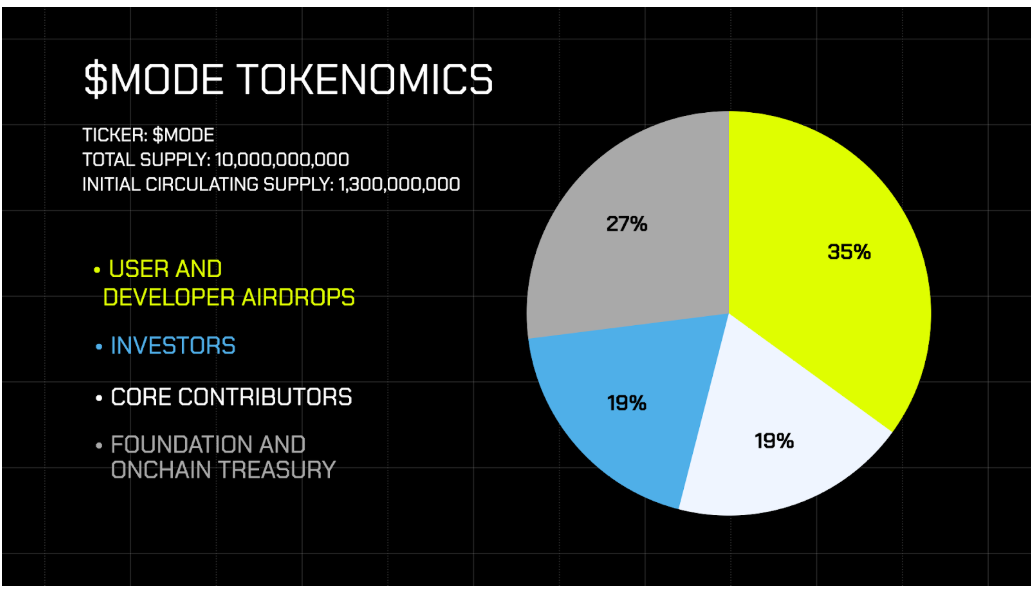

$MODE is the ecosystem’s native token for governance and incentivization. Its total supply is 10 billion, of which 35% is reserved for user and developer airdrops.

About the Project

Vision:

Mode Network’s vision is to scale DeFi to billions of users by leveraging on-chain AI agents and AI applications. It aims to be a user and liquidity hub for the Optimism Superchain, focusing on growth through incentivization and direct rewards. Mode Network is committed to democratizing access to DeFi, making it more inclusive and efficient by reducing transaction costs and enhancing user and developer experiences.

Problem:

The innovative DeFi landscape faces significant scalability challenges due to high transaction costs and a lack of user-friendly interfaces that hinder mass adoption. The current ecosystem often requires users to navigate a complex environment, which can be a barrier to entry for new users. Further, there is a gap in integrating AI and automation to enhance DeFi operations, from yield optimization to security audits, which could streamline processes and enhance user experience.

Solution:

Mode Network addresses these challenges by building a layer 2 blockchain using the OP stack, which reduces transaction fees by 95% and improves transaction processing times. It utilizes an interface layer through which users and agents can transact and deploy on-chain contracts. The agents can perform DeFi actions such as swap, stake, and earn yield across lending apps and assets.

Additionally, the network integrates with Mode’s Bittensor Subnet, called Synth, which enables AI agents to answer probabilistic questions about market data, initially for BTC price and in the future for other assets and industries.

Market Analysis

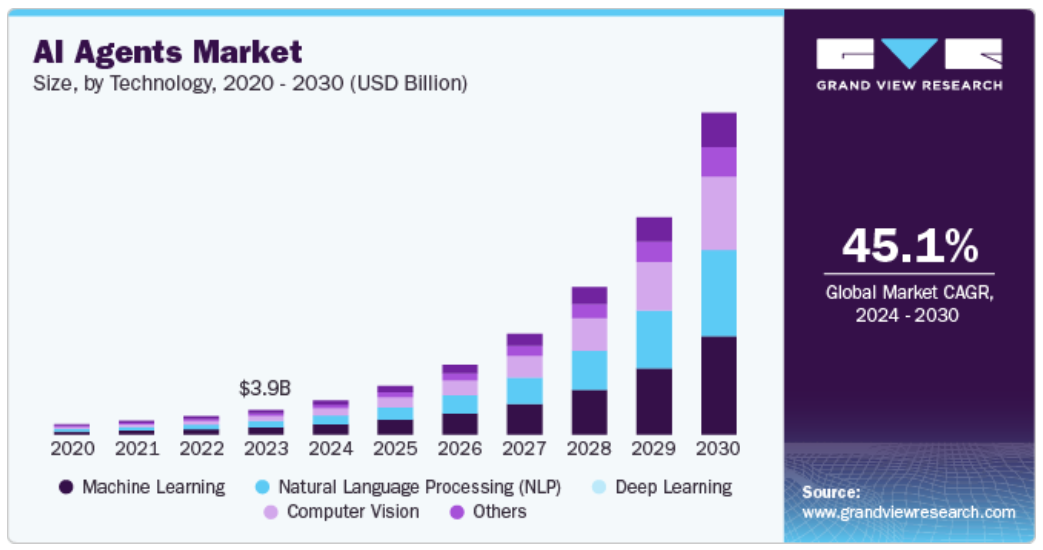

Mode Network operates at the intersection of DeFi and AI. The global DeFi market cap, as per CoinGecko, is $124B, and the global AI Agents market cap, as per a research report by Grand View Research, was $3.9B in 2023. The AI Agents market is expected to grow at a CAGR of 45.1% from 2024 to 2030. Further, the Mode Network is a layer 2 blockchain, and the total market cap of layer 2 blockchains is $26B per CoinGecko.

The key aspects for growth in this sector of decentralized finance using AI agents and applications are the need for automation, improved customer service, and risk management in financial services, areas where Mode Network’s AI agents can play a significant role.

Mode Network targets these rapidly expanding markets by offering a platform that scales DeFi with AI integration. Its growth and liquidity incentivization model aims to attract developers and users. This unique combination of DeFi scalability and AI-driven financial applications positions Mode Network at the forefront of a niche but growing segment.

Features

- Sequencer Fee Sharing (SFS): Mode Network implements a unique “Sequencer Fee Sharing” system in which developers can earn a portion of the network’s sequencer fees. By registering their contracts in a fee-sharing contract, developers can receive rewards in the form of NFTs. This incentive system encourages developers to contribute to the ecosystem’s growth.

- Mode Flare L3 Platform: This platform allows for deploying specialized Layer 3 solutions on top of Mode Network, enabling further customization and scaling for specific applications or use cases within the DeFi space. It is aimed at developers looking to build highly specialized or niche DeFi applications with even lower fees and custom-state machines.

- AI Integration in DeFi: Mode Network is pioneering the integration of AI agents directly into DeFI operations, from yield farming to MEV searching and smart contract auditing. The AI2AI economy concept aims to automate and optimize financial operations, providing a unique value proposition by merging AI’s computational efficiency with DeFi’s decentralized ethos.

- Economic Incentives for Growth: There is a model where both developers and users are incentivized through “Contract Secured Revenue” and “Referral Revenue.” This unique structure directly ties rewards to the network’s growth and usage, encouraging a positive feedback loop of development and adoption.

- Mode Terminal: This upcoming feature allows users to interact with DeFi applications through an AI-enabled chat interface. It will enable users to swap, stake, and farm with the assistance of AI across multiple chains, thus reducing the barrier to entry.

Token

$MODE is the native utility token of the Mode Network with a total supply of 10 billion. It is central to the development and growth of the ecosystem through utilities like governance, user and developer campaigns, DeFi integration grants, and community grants.

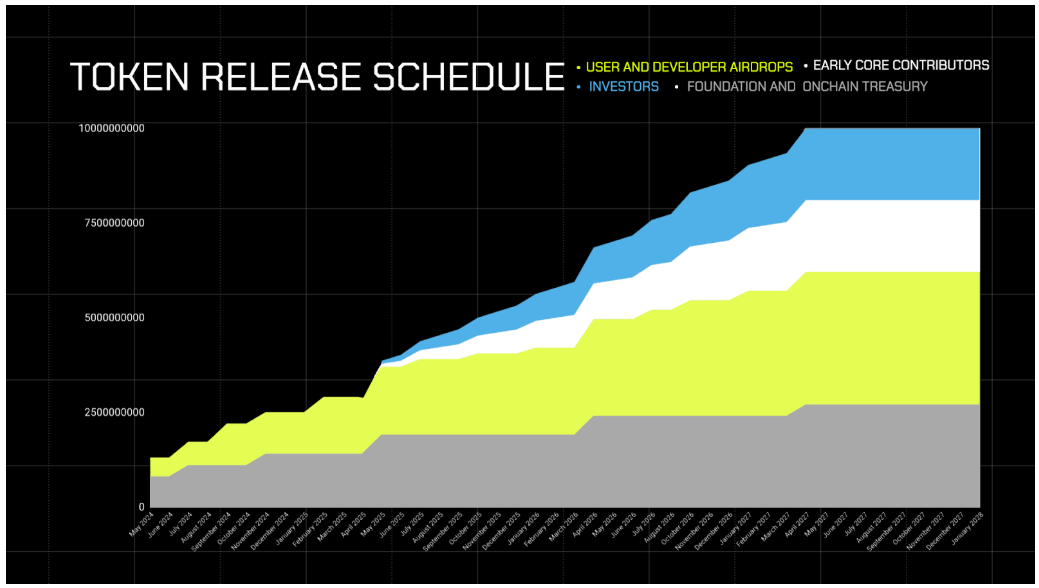

35% is allocated to user and developer airdrops, of which the first two seasons have been completed. Investors and Core contributors each have a 19% allocation, with a 12-month cliff and 24-month linear vesting period after TGE. The foundation’s on-chain smart treasury tokens are used for governance decisions and to fund ecosystem growth initiatives.

Traction

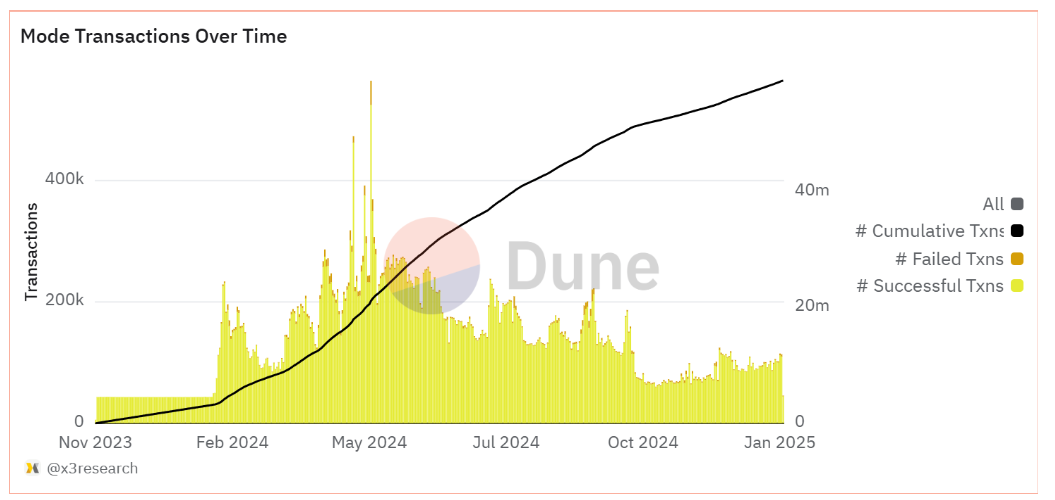

The network has over 439,000 active addresses and has processed 59 million transactions.

The Mode Network saw a significant rise in its TVL post-launch on mainnet and TGE. It reached an all-time high of $585M, which has since corrected and currently stands at $125M.

The network has been gaining momentum with partnerships and has introduced a Bittensor Subnet, Synth, which provides AI agents with synthetic data and probabilistic reasoning capabilities.

Team

James Ross is the founder of the Mode Network and has previous experience in marketing and web3. Nick Dijkstra is the chief product officer and has experience in product development and innovation. Finally, Patrick Woo was the chief technology officer with an engineering background.

Investors

Mode Network received a $5.3M grant from Optimism in January 2024, followed by a $110k IEO on Gate.io Startup in May 2024.

Conclusion

Mode Network is at the intersection of DeFi and AI. It aims to scale DeFi to billions of users through AI Agents and unique economic incentives. The introduction of their AI2AI transactions could revolutionize DeFi operations. The economic model of including Sequencer Fee Sharing and Mode Terminal encourages participation and growth, making DeFi more accessible and efficient.

The network’s traction so far looks promising, with a high number of active users and significant TVL. Features like Mode Flare L3 Platform and the integration of AI agents for tasks like MEV searching and yield farming showcase Mode’s innovation.

Overall, the Mode Network’s approach to incentivizing ecosystem growth and continuous technological development positions it well for future advancements in DeFi and AI.

| Fundamental Analysis | |||||

| Max score | Options | Score | |||

| Problem | 10 | Significant, long-term problem | 9 | ||

| Solution | 10 | Some uniqueness, moderate defensibility | 7 | ||

| Market Size | 10 | Large market, significant growth potential | 8.5 | ||

| Competitors | 10 | High competition, but room for differentiation | 7 | ||

| Use case | 10 | Use case with good potential | 8.5 | ||

| Current Traction | 10 | Early traction, user engagement starting to grow | 6 | ||

| Unit Economics | 5 | Unit economics currently negative, no clear path to profitability | 1 | ||

| Tokenomics | 10 | Basic token strategy, potential for improvement | 7 | ||

| Product Roadmap | 5 | Basic roadmap, lacks detail or innovative features | 2 | ||

| Business Model | 10 | Business model with some potential, but improvement needed | 7 | ||

| Go-to-Market Strategy | 5 | Basic GTM strategy, lacks detail or differentiation | 2 | ||

| Community | 5 | Acive and growing community | 4 | ||

| Regulatory Risks | 5 | Minimal regulatory risk, strong mitigation and adaptability | 5 | ||

| Total Score | 70.48% | ||||