How to find out where you can safely purchase a cryptocurrency using Token Metrics.

Video Tutorial

Did you know that you can view all of the trading pairs and exchanges available for any token right within Token Metrics?

The Token Metrics markets page lets our users know where they can purchase cryptocurrencies and perhaps more importantly, where it is safe or unsafe to do so.

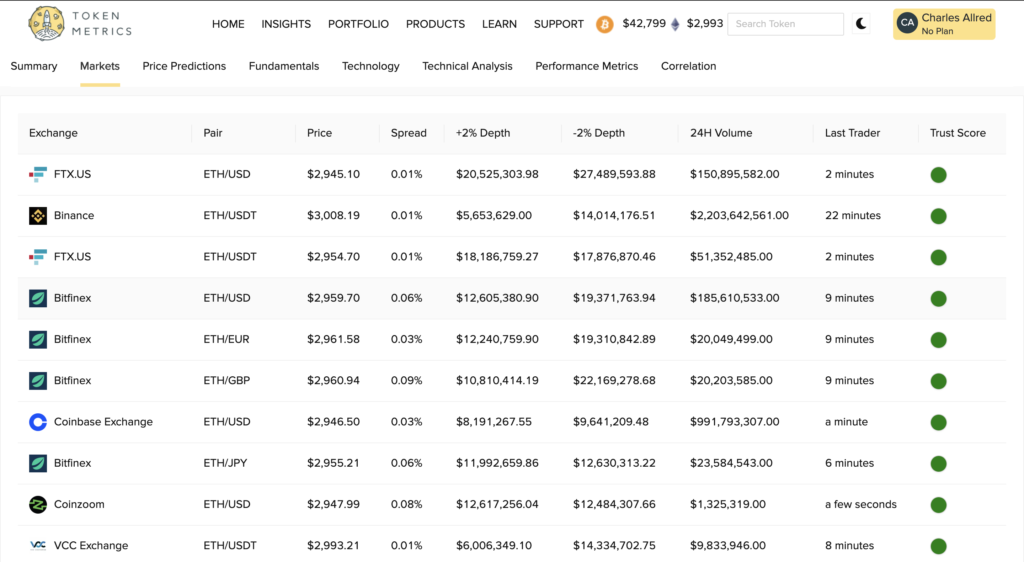

Above we see the markets page for Ethereum.

At the top, we see the reputable exchanges Binance and FTX followed by the decentralized exchange Serum, built on the Solana blockchain.

We mainly see fiat or stablecoin trading pairs in this screenshot, but if you scroll down you will see many other pairs including BTC, LINK, or wBTC.

The markets page lets us view important metrics to look for when picking exchanges, including trading volume, price, and the time since the last trade.

Lesser-known metrics seen here include the spread and +/-2% depth.

The market spread is the percent difference between the bid (buy) price and the ask (sell) price of an asset.

The more active the market, the smaller the spread will be.

The +2% depth is the amount of capital required to move the order book up 2% from the last traded price.

The -2% depth is the amount required to move the order book down 2% from the last traded price.

This is important to consider because it’s helpful in determining whether or not an exchange can handle large orders without significantly affecting price.

The most important aspect of the markets page is the trust score column.

A green trust score points to a trusted exchange with significant liquidity and trading volume, among other positive things.

A yellow trust score means this market is fairly trustworthy.

Often a market gets a yellow because it is on a trusted exchange like Uniswap, but there is very low liquidity, creating a slippage risk.

A red trust score is a bad market, and we recommend staying away from those.