We at Token Metrics scored multiple projects this week. Here are a few you should know about:

Payy

The Clearing Company

Inversion

Solstice

MegaETH

Please remember that some of these projects still need our code review process. Still, we want to highlight them here because they initially caught our attention through our fundamental analysis process.

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by CoW Swap.

No MEV. No Gas

CoW Swap blocks MEV so bots can’t front-run your trades. Keep more of every swap.

Now, let's get back to the hidden gems.

1. Payy

Sector - DeFi

Status - Active

Payy is a stablecoin-native banking platform designed as a vertically integrated on-chain solution, combining a non-custodial wallet app with a privacy-preserving blockchain to enable seamless spending of stablecoins like USDC worldwide.

It addresses key pain points in traditional and crypto finance, including the public visibility of blockchain transactions (which exposes user activity), the risk of account freezing or suspension by centralized banks, high transaction fees, and fragmented tools for fiat on/off-ramps and DeFi yields.

Payy's solution breaks the link between KYC data and on-chain transactions using zero-knowledge (ZK) proofs for compliant privacy, allowing users to self-custody funds while accessing banking features like Visa cards and payment links, all without gas fees or debanking risks.

The tech stack centers on Payy Network, an Ethereum Layer 2 ZK-rollup (validium model) built with UTXO for privacy and scalability, employing Halo2 circuits with HyperPlonk arithmetization, KZG commitments on the BN256 elliptic curve, Poseidon hashes for nullifiers, and HotStuff consensus for ~1-second soft finality.

Sequencers handle off-chain processing, provers generate ZK validity proofs submitted to Ethereum every ~6 minutes, and features like proof-of-innocence ZK circuits ensure regulatory compliance (e.g., tracking fund lineage without revealing details).

The team operates under Polybase Labs, with open roles for senior talent in marketing and full-stack engineering (Rust/React).

1.1. Features

Magical Payment Links: Users generate shareable links through the app to send stablecoins instantly via messaging apps like WhatsApp or Telegram, enabling frictionless peer-to-peer (P2P) transfers without exposing wallet addresses or transaction histories.

Free Transactions: Powered by the ZK-rollup, all on-chain activity incurs zero gas fees, eliminating cost barriers for everyday spending and making micro-transactions viable.

ZK-Compliant Privacy: Transactions are shielded using ZK proofs and UTXO notes in a sparse Merkle tree, storing only commitment hashes on-chain to prevent doxxing while allowing selective disclosure for compliance (e.g., proving non-blacklisted sources).

Undoxxable Non-Custodial Card: A physical or virtual Visa card (with light-up logo for limited editions) integrates with the wallet for real-world spending; KYC is cryptographically separated from Payy Network transactions, ensuring privacy even during fiat settlements.

Guardians for Security: An upcoming multi-sig-like recovery mechanism where trusted contacts can assist in account access without compromising self-custody, enhancing user control against key loss.

Payy Points Program: A spend-to-earn system rewarding users with points for card usage and app interactions, redeemable for future perks like airdrops; currently in beta with multipliers for early adopters, tracking 18K MAU and 80% retention organically.

1.2. Investors

Payy has raised $2M in funding, including from Mysten Labs, in a recent round. Backers include Robot Ventures, 6th Man Ventures, DBA, and Protocol Labs.

2. The Clearing Company

Sector - Prediction Market

Status - Testnet

The Clearing Company is a regulated, on-chain prediction market platform enabling permissionless trading on real-world events across crypto, politics, sports, culture, and more, with tools for intuitive betting and deep liquidity.

It solves the fragmentation and regulatory hurdles in current prediction markets, where centralized platforms like Kalshi limit accessibility and decentralized ones like Polymarket face compliance risks, by combining on-chain transparency with U.S. regulatory readiness for retail-friendly, high-volume trading.

The solution features atomic settlements, cross-parlay "lineups" for bundled bets, and Bloomberg-like terminals for degens, built on a modular stack (specific blockchain not detailed, but on-chain focus implies Ethereum-aligned L2s).

The team comprises prediction market veterans: CEO Toni Gemayel (ex-Polymarket, Kalshi, Figma), Engineering Lead Liam Kovatch (ex-Polymarket, 0x), Product/Markets Head Niraek Jain-Sharma (ex-Polymarket), and engineers Nick Beattie (ex-Polymarket, Rainbow), Daniel Ramirez (ex-Polymarket, Avara), with finance support from Nina Coughlin (ex-Uber, Autodesk).

2.1. Features

Thousands of Event Markets: Users trade yes/no outcomes on diverse topics (e.g., election results, game scores) with real-time pricing and liquidity pools, democratizing access to information markets beyond traditional books.

Cross-Parlay Lineups: Bundle multiple bets into custom "lineups" for correlated outcomes (e.g., sports parlays), with automated payouts and risk-adjusted odds to enhance strategic trading.

Regulated On-Chain Trading: Permissionless entry with built-in compliance (e.g., U.S. regs via CFTC alignment), ensuring atomic, non-custodial settlements while supporting fiat on-ramps for broad adoption.

Deep Liquidity Tools: Advanced order types and market-making incentives provide tight spreads and high volumes, rivaling centralized exchanges like FanDuel without counterparty risks.

Intuitive UI for Retail: Bloomberg-terminal-inspired dashboards with visualizations, alerts, and social sharing, lowering the barrier for non-experts to participate in event speculation.

2.2. Investors

The Clearing Company raised $15M in a seed round announced in August 2025, led by Union Square Ventures, with participation from Haun Ventures, Variant Fund, Coinbase Ventures, Compound VC, Rubik VC, Earl Grey Capital, Cursor Capital, Asylum VC, Otherwise Fund, and angels including Soleio, Terrance Rohan, Furqan Rydhan, Bill Lee, Henri Stern, Elena Nadolinski, Jonah Van Bourg, and Ben Levy. Valuation and specific terms were not disclosed.

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by Proton Mail.

Free email without sacrificing your privacy

Gmail tracks you. Proton doesn’t. Get private email that puts your data — and your privacy — first.

Now, let's get back to the hidden gems.

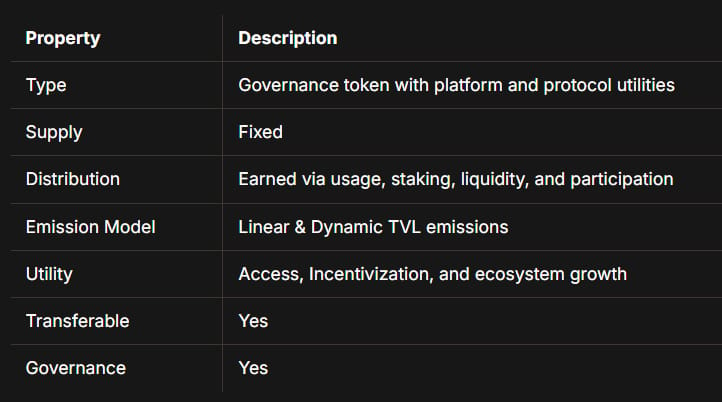

3. Inversion

Sector - L1

Status - Active

Inversion Capital is a crypto-native private equity firm that acquires undervalued legacy businesses in sectors like telecom, finance, and supply chains, then integrates blockchain rails to enhance efficiency, cut costs (e.g., 60% faster settlements, 75% lower wireless COGS via Helium-like models), and onboard real-world GDP without disrupting users, targeting 1.4B unbanked via mobile wallets.

It tackles crypto's "noise" from speculative failures (e.g., FTX, Terra) by focusing on resilient, non-speculative transaction volume through strategic acquisitions and on-chain migrations, fostering ecosystem monetization and repeat investments.

The core tech is the Inversion Chain, a custom L1 blockchain (built on Avalanche for scalability), enabling seamless on-chain workflows like tokenized revenues and acquisitions.

Founded in 2025 by serial investor Santiago Roel Santos, the team emphasizes enterprise-grade transformations but lacks further public bios.

3.1. Features

Strategic Business Acquisitions: Targets core services firms (e.g., telecom providers) for buyouts, leveraging blockchain to unlock efficiencies such as instant settlements and replacing wire transfers.

On-Chain Functionality Migration: Converts legacy operations (e.g., payments, data routing) to blockchain rails, reducing costs and enabling new revenue from tokenized assets without user-facing changes.

Ecosystem Monetization: Builds high-value user bases post-migration, capturing transaction fees and staking yields to fund further acquisitions and drive network effects.

Resilient GDP Onboarding: Focuses on "invisible" integrations for mass adoption, settling $7T+ in global payments via stablecoins while mitigating speculation risks through enterprise utility.

3.2. Investors

Inversion raised $26.5M in a seed round on September 8, 2025, at a $100M post-money valuation, led by Dragonfly with participation from HashKey Capital, VanEck, Faction VC, Mirana Ventures, and angels including Haseeb Qureshi and Omkar Phatak. Terms beyond the lead structure were not disclosed.

4. Solstice

Sector - DeFi

Status - Active

Solstice Finance is an institutional-grade DeFi protocol on Solana, centered on USX (a synthetic stablecoin) and YieldVault (a delta-neutral yield platform), providing permissionless access to high-yield strategies typically reserved for institutions.

It resolves the trade-off between stablecoin stability and yield generation in volatile markets, where most DeFi APYs collapse during downturns or rely on unsustainable emissions, by tokenizing proven private strategies (yielding 21.5% returns in 2024 with over $200M AUM) for on-chain composability.

The solution utilizes Solana's high-throughput capabilities (with low fees and 150ms settlements) for USX minting/redemption, YieldVault locking, and staking infrastructure, featuring modular programs governed by multisig and Chainlink oracles for pricing/compliance.

Solstice Labs, founded by Deus X Capital, features a team with TradFi and blockchain pedigrees: CEO Ben Nadareski (ex-Galaxy Digital, SIX), Chairman Tim Grant (ex-Galaxy, UBS), CTO Luis Marques (ex-BlackRock, Refinitiv), COO David Plisek (ex-Accenture, National Australia Bank), and CPO Chris Abbott (ex-Deloitte Digital, Web3 exits).

4.1. Features

USX Synthetic Stablecoin: Over-collateralized (1:1 USDC/USDT backing) for peg stability; permissionless minting via DEXs or institutional OTC ($500K min with KYC), enabling fast capital deployment across Solana DeFi without slippage.

YieldVault Delta-Neutral Strategies: Lock USX to mint eUSX (yield-bearing LST), earning from funding rate arb, hedged perps, and tokenized treasuries; 7-day lock/cooldown for redemptions, with 11.8-16.2% trailing 12-month APY and zero principal loss in past crashes.

Solstice Staking Infrastructure: Non-custodial platform powering $1B+ staked assets via 8K+ validators (100% renewable, 99.99% uptime), integrating with protocols for liquid staking and rewards.

Flares Rewards System: Multiplier-based points (up to 15x) for USX holders, YieldVault lockers, and LP providers, distributed monthly (e.g., 20K USX rewards) to bootstrap ecosystem participation.

Composable Yield Tools: Partnerships like Exponent Finance for PT/YT-eUSX (fixed/variable splits) and liquidity incentives, turning yields into tradable assets for advanced strategies.

4.2. Token

SLX is Solstice's native utility token for governing protocol revenue and growth coordination, with a community-first distribution model (no VC backing) emphasizing alignment via flares and staking.

4.3. Investors

Solstice is backed by Deus X Capital as the founding entity, with no disclosed funding amounts, rounds, valuations, or additional investors.

5. MegaETH

Sector - L2

Status - Active

MegaETH is a real-time Ethereum Layer 2 blockchain that achieves sub-1ms latency and 100k+ TPS through a hybrid optimistic-ZK architecture, enabling "fat apps" such as high-frequency trading and AI agents that current rollups can't support due to delays.

It addresses Ethereum's scalability bottlenecks and high latency from sequencers and DA layers by pioneering mini-blocks (10ms) for ultra-fast execution, while leveraging Ethereum for security and EigenDA for availability.

The stack includes an EVM ahead-of-time compiler, revm for execution, reth for modular protocol, and Rust/Go/C++ for core nodes, with JSON-RPC compatibility and a real-time API for streaming updates.

Testnet has been live since March 2025, it's developed by MegaLabs with ex-Facebook and Paradigm engineers, emphasizing conviction-based distribution over task farming.

5.1. Features

Mini-Blocks and Realtime Execution: 10ms block times for EVM blocks (1s aggregation), enabling instant reactions in apps like oracles (e.g., Redstone pricing at 2.4ms intervals, 400+ TPS baseline).

Bimodal Allocation and KPI Rewards: Token emissions are tied to growth milestones (e.g., TVL, usage) rather than timers, with over 50% of the supply reserved for stakers (10-30d locks) to reward decentralization and performance.

Proximity Markets and Sequencer Rotation: $MEGA-locked bids for colocation seats with dynamic allocation and failover, streaming real-time data for minimal latency in high-demand apps.

Ecosystem Tools: One-click Goldsky indexing for 10ms block streams, Ultra dashboard for voting/building, and grants for devs; testnet faucet/RPC for experimental dApps with no real value.

Sustainable Unlocks: Vesting linked to ecosystem maturity, with liquid staking for unvested tokens to compound rewards without dumps.

5.2. Token

$MEGA is the native token that enables sequencer rotation (via locked bids for low-latency seats) and proximity markets (dynamic colocation allocation that returns value to holders), with a bimodal public sale distribution prioritizing community (minimum bid of $2,650, with over 5,000 participants) and core supporters.

ICO has a total committed value of $1.2B, with a raise cap of $50M. 500M tokens for sale at a $1B fair value from October 27-30, 2025, oversubscribed 24x; over 50% of the total supply was reserved for KPI-based rewards (gated to stakers, time-weighted).

5.3. Investors

MegaETH has secured investments from top funds and angel investors, including Dragonfly Capital, Ethereum co-founders Vitalik Buterin and Joseph Lubin, alongside other notable backers such as Big Brain Holdings, Figment Capital, Credibly Neutral, and Qiming Venture Partners.

The project raised $20M in a seed round in June 2024, $10M in a community round in December 2024, and over $50M through a 24x oversubscribed public token sale in October 2025, which marked one of the most significant crypto raises of the year.

Today’s newsletter is also powered by Money.com.

Could you go from being $50k in debt to $20k?

If you feel you're languishing in debt, debt relief companies can take over negotiations with your creditors and potentially get them to accept up to 60% less than you owe. Sounds too good to be true? Our debt relief partners have already helped millions of Americans just like you get out of debt. Check out Money’s list of the best debt relief programs, answer a few short questions, and get your free rate today.

That's all for today. Let's talk tomorrow.