Happy Monday, TM Family!

Welcome to the Token Metrics Research | Daily newsletter, where we cover key market movements, regulatory updates, and early alpha for our readers and investors.

Let's dive in!

We're excited to announce that Token Metrics will be the Media Partner of Malaysia Blockchain Week, Malaysia's biggest and boldest flagship blockchain event!

📍 Kuala Lumpur

📅 July 21–22

🎟 20% off with code TKNM92A20

From crypto and AI to regulatory. #MYBW2025 is where it all comes together.

🎫 Get your ticket now!

The Malaysian government will support Malaysia Blockchain Week (MYBW), with key ministries supporting the week-long event celebrating all things blockchain.

MYBW 2025 will be graced by YB Tuan Gobind Singh Deo, Minister of Digital, and YB Tuan Chang Lih Kang, Minister of Science, Technology, and Innovation, in a show of governmental backing to showcase Malaysia's Web3 influence and blockchain technology. Such will be crucial in furthering Malaysia's influence and advancements within the blockchain space, both internationally and locally, providing a unique opportunity for various parties to come together to build a forward-thinking Malaysia.

In Today's Edition

Altcoin Season Ignites

Record Fund Inflows Peak

NFT Market Rebounds

Bitcoin Treasury Surge

CoinDCX Hack Exposed

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by Pacaso.

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs who backed Uber, Venmo, and eBay also invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties, revamping the $1.3T vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits in their operating history.

Now, after 41% YoY gross profit growth last year alone, they recently reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Now let's get back to the top stories of the day.

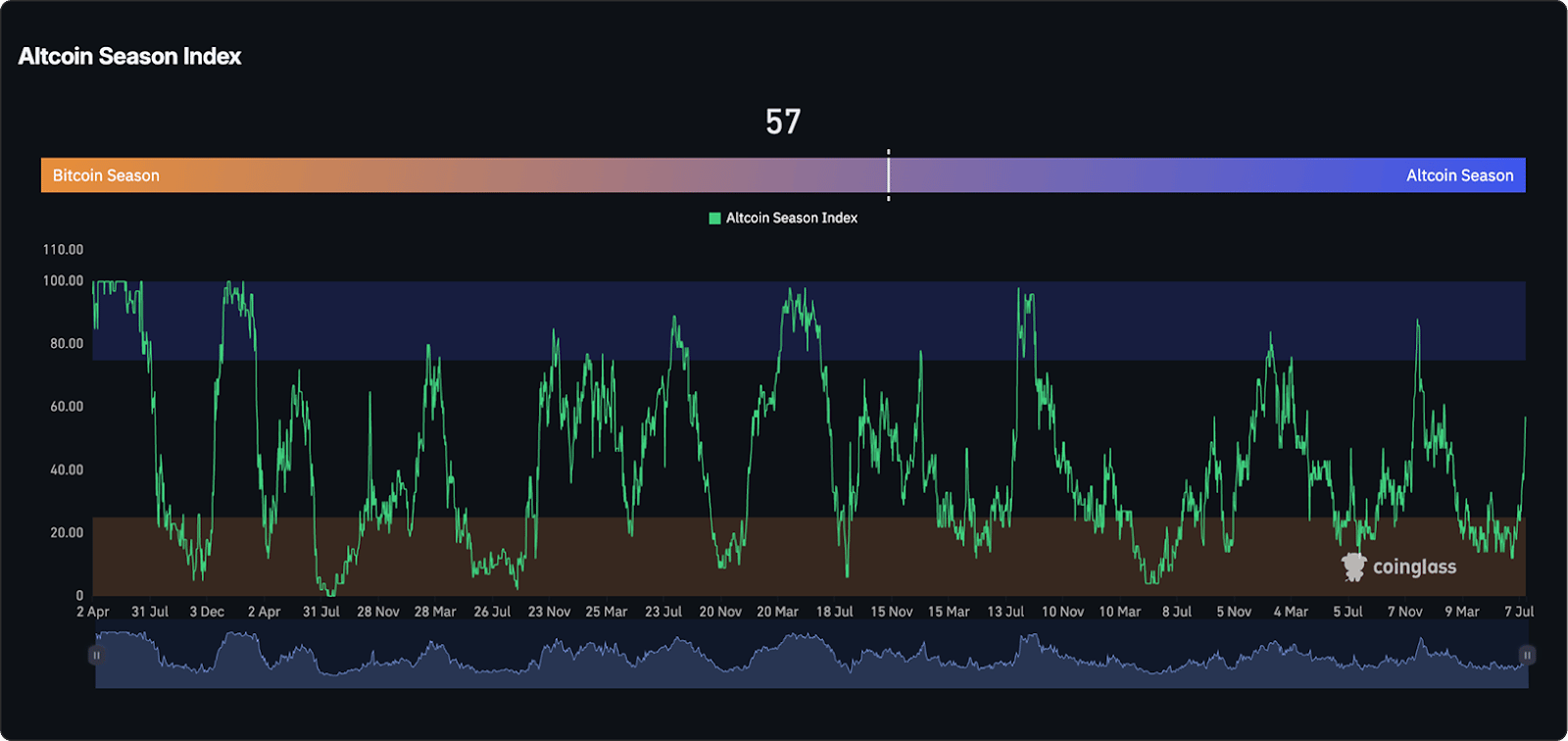

1. Altcoin Season Ignites

Bitcoin's dominance has plummeted 5.8% in a week, hitting a low of under 61%, its steepest drop in three years, while its correlation with altcoins weakens, turning negative in some cases. This signals a classic capital rotation from BTC to alts, fueled by Ethereum's surge to $3,793 (up 25% weekly) amid whale buys and ETF inflows of $2.18B last week. Ether treasuries are exploding: SharpLink Gaming holds 280,706 ETH ($1B+), Bitmine Immersion has 300,657 ETH ($1.13B), and new entity The Ether Machine plans a public debut with 400,000 ETH backed by $1.5B in capital.

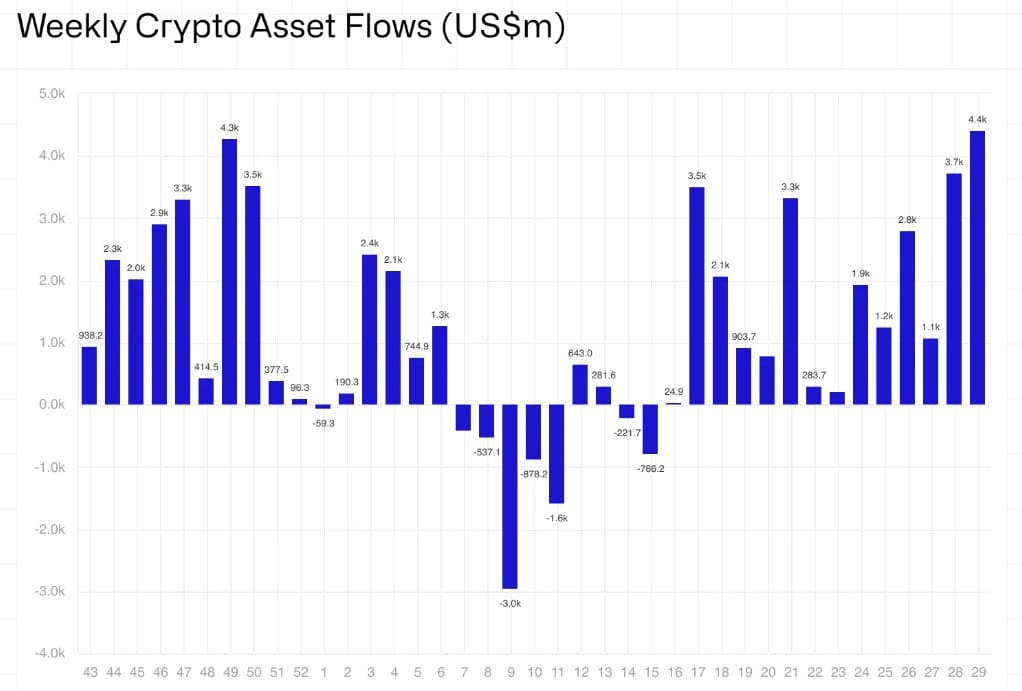

2. Record Fund Inflows Peak

Crypto funds shattered records with $4.39B weekly inflows, topping December 2024's $4.27B, pushing YTD to $27B and AuM to $220B. ETH stole the spotlight at $2.12B (nearly double the prior record), YTD $6.2B. BTC drew $2.2B, Solana $39M, XRP $36M, Sui $9.3M. US-led with $4.36B, Switzerland/Hong Kong/Australia $78.7M combined; Brazil/Germany saw outflows.

This marks 14 straight weeks of gains, signaling institutional conviction amid GENIUS Act tailwinds and BTC/ETH ETF demand.

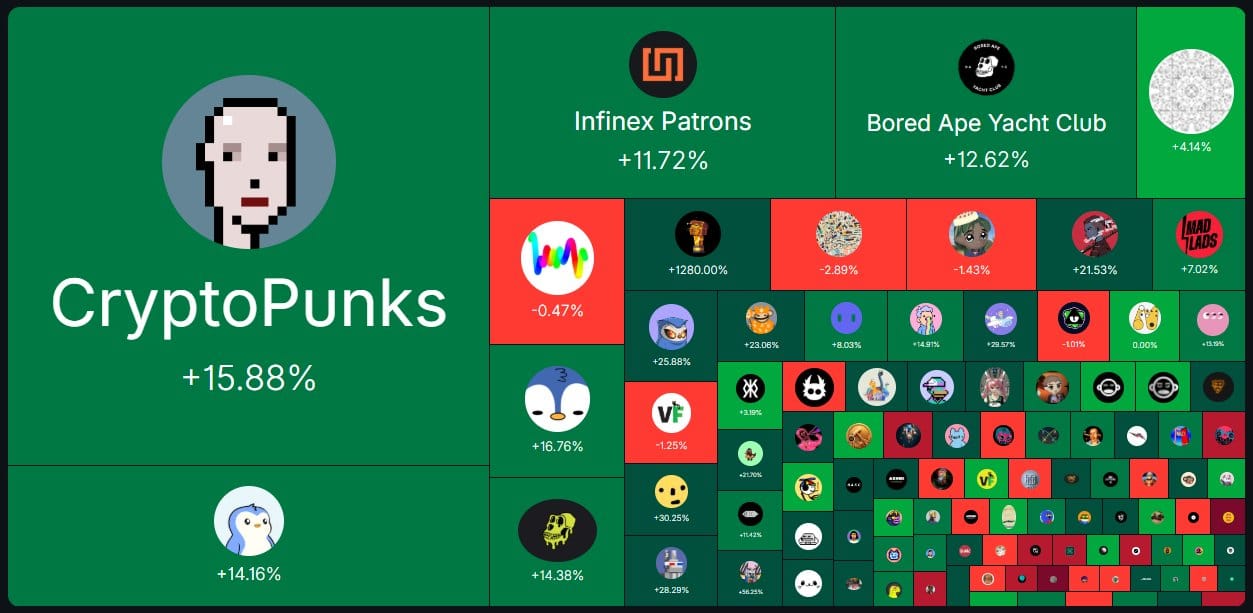

3. NFT Market Rebounds

The NFT market cap topped $6.04B, up 16.9% in 24 hours, the highest since February, and volumes surging 154% to $41.4M. A whale scooped 45 CryptoPunks for 2,080 ETH ($7.8M), boosting floor price 15.9% to 47.5 ETH.

Some drivers can be crypto bull sentiment (BTC $118K, ETH $3.8K), undervalued legacy collections like Punks leading over new mints. Analysts see risk-on vibes, but sustainability needs deeper wallet activity.

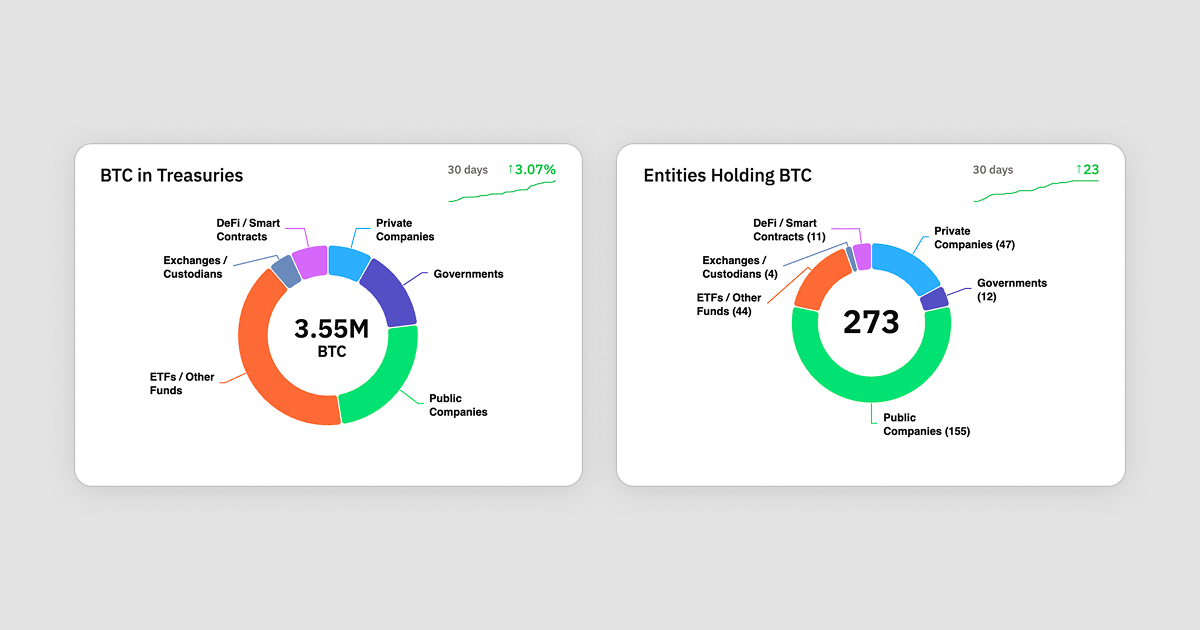

4. Bitcoin Treasury Surge

Sequans bought $150M BTC (1,264 coins at $118,659 avg), doubling holdings to 2,317 BTC ($270M total cost, avg $116,493). CEO Georges Karam cites resilience and value creation; shares dipped 9% then rose 15.9% pre-market.

MicroStrategy added 6,220 BTC for $739.8M (avg $118,940), totaling 607,770 BTC ($43.61B cost, ~$71B value), 3% of supply. Funded via cash/shares/notes; inspires 141 corporates. TD Cowen raised MSTR target to $680, eyeing BTC at $155K by Dec 2025.

5. CoinDCX Hack Exposed

CoinDCX lost $44M via sophisticated server breach on an internal liquidity wallet, funded via Tornado Cash, bridged Solana to Ethereum. User funds safe in cold wallets; exchange absorbed loss from treasury, isolated account. Launched $11M (25%) bounty for recovery, partnering cybersecurity firms. One year after WazirX's $235M hack, highlights Indian exchange vulnerabilities.

ZachXBT previously exposed suspected North Korean links (Lazarus patterns). CEO Sumit Gupta vows compensation, but the community demands proof of solvency.

Meme of The Day

Helpful Links

Sponsor Token Metrics Research | Daily Newsletter

Build AI Agents and DApps Using Token Metrics' API

Buy Limited Edition Token Metrics Merch