We're proud to have Elf Labs as today's lead sponsor of Token Metrics, supporting our mission to deliver cutting-edge insights and connect the investment community.

$6B Team Just Unleashed Cinderella on a $2T Market

Cinderella isn’t looking for her glass slipper— she’s busy smashing the $2T media market to pieces.

Elf Labs spent a decade at the US Patent & Trademark office in a historic effort to lock up 100+ historic trademarks to icons like Cinderella, Snow White, Rapunzel and more — characters that have generated billions for giant studios. Now they’re fusing their IP with patented AI/AR to build a new entertainment category the big players can’t copy.

And the numbers prove it’s working.

In just 12 months they raised $8M, closed a nationwide T-Mobile–supported telecom deal, launched patented interactive content, and landed a 200M-TV distribution partnership.

This isn’t a startup. It’s a takeover. And investors are sprinting to get in.

Lock in your ownership now

This is a paid advertisement for Elf Lab’s Regulation CF offering. Please read the offering circular at https://www.elflabs.com/

Market Summary

Welcome back, Token Metrics family. Today’s action screams alt rebound amid Bitcoin's steady grind, as institutions pile into XRP ETFs and ETH breaks out on corporate buying.

Bitcoin's holding firm around $88K after shrugging off last week's FUD, eyeing a push toward $89.6K ahead of today's Core PPI data. ETH's ripping 11% to $2,900+ on BitMine's massive stack, while alts like XRP (+7%), SUI (+11%), and PEPE (+8%) lead the charge—fueled by $164M in fresh XRP ETF inflows and record CME futures volume signaling risk-on flows. The vibe? Regulators in Japan are fortifying exchanges, but Wall Street's betting big on crypto's next leg up.

1. Japan FSA Mandates Liability Reserves: The End of “Hack Goes Unpunished”

Japan’s FSA just fired the loudest regulatory shot of the year: every licensed crypto exchange must hold dedicated liability reserves (¥2B–¥40B depending on volume) or equivalent insurance to cover user losses from hacks and operational failures — full proposal to parliament in 2026.

This comes after DMM Bitcoin ($305M hack in 2024) and Bybit ($1.46B breach earlier this year) left users holding the bag. Japan is effectively saying “no more free rides” for exchanges — you break it, you pay for it, instantly.

Why this matters:

- Asia’s $50B+ retail market just got a lot safer — expect confidence to return to Japanese on-ramps.

- Short-term pain (higher fees, some small exchanges may exit), long-term gain (institutional money loves insured counterparty risk).

- Sets a global template — watch Korea, Singapore, and even parts of Europe copy-paste elements of this framework.

For investors: this is quietly one of the most bullish regulatory developments of 2025. Safer exchanges = bigger inflows = higher crypto AUM in the fastest-growing retail region on earth.

2. XRP ETF Launch Fuels 11% Surge: Grayscale and Franklin Templeton Go Live on NYSE

The altcoin rally kicked into high gear today as Grayscale's spot XRP ETF (XRPG) and Franklin Templeton's XRP ETF (XRPZ) officially launched on the NYSE, sparking an immediate 11% price spike to $1.45 amid $500M in projected first-day inflows.

This marks the first major altcoin ETF approvals post-BTC and ETH, with Ripple's cross-border payment token benefiting from whale accumulation despite recent 250M XRP offloads. Early trading volume has already topped $2B, dwarfing prior altcoin debuts.

Six XRP ETFs have officially launched as of Nov 25, 2025515 — the fastest altcoin ETF rollout in history

Key takeaways:

- Mainstream gateways like these could unlock $10B+ in retail and institutional flows, validating XRP's utility in remittances and tokenized assets.

- Despite regulatory overhang from SEC suits, ETF structure provides compliant exposure, potentially flipping XRP from "speculative" to "blue-chip alt."

- Watch for spillover to other payment tokens — this sets the stage for SOL, LINK, and HBAR filings in Q1 2026.

If inflows sustain above $1B weekly, $2 resistance breaks easily; treat dips as entries in this broader alt rotation play.

We're proud to have 1440 Media as today's lead sponsor of Token Metrics, supporting our mission to deliver cutting-edge insights and connect the investment community.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

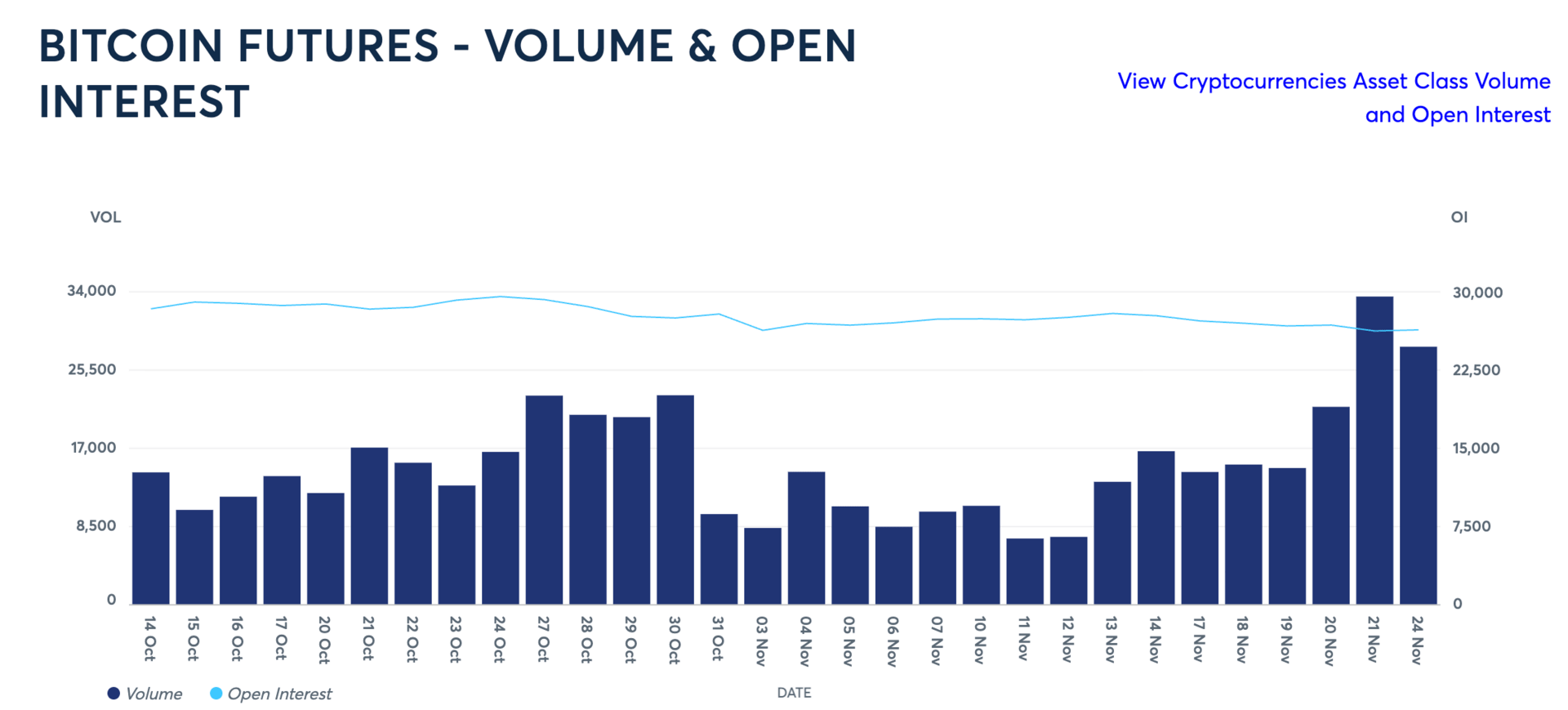

3. CME Crypto Futures Volume Smashes Record — 794,903 Contracts in One Day

CME Group reported its highest-ever single-day crypto futures volume on Monday: 794,903 contracts across BTC and ETH — surpassing the previous record set during the March 2024 ETF launch mania.

Open interest also sits at all-time highs, with basis traders and hedgers piling in as BTC flirts with $90K and ETH tries to reclaim $3K. The surge coincides with volatility spiking back above 60 on the CVIX.

What this tells us:

- Institutions are not waiting for year-end — they’re actively positioning for Q1 2026 rate cuts and potential policy tailwinds.

- Record basis trade volume means arbitrage capital is providing a floor under spot prices.

- When CME volume leads spot volume this hard, it has historically preceded multi-week rallies.

Bottom line: the smart money is speaking loudly through regulated derivatives right now.

4. BitMine Immersion Adds 70K ETH — Corporate Treasury Playbook Now Includes Ethereum

BitMine Immersion Technologies disclosed this morning that it added 69,822 ETH (~$200M at current prices) to its balance sheet last week, bringing total holdings to over 3.6M ETH.

CEO called it “the beginning of Ethereum’s corporate adoption cycle,” mirroring MicroStrategy’s BTC playbook but executed on the second-largest asset.

Why this is a big deal:

- Corporate ETH treasuries have been virtually non-existent until now — this cracks the door wide open.

- Comes as ETH/BTC ratio bounces from multi-year lows and staking yields sit at 4.2%.

- If even 1–2% of public companies follow, that’s billions in new structural demand.

ETH is up 4% on the news and testing $2,900 resistance as I type. A clean break above $3K would confirm the institutional rotation narrative.

Outlook

Today’s message from the market is unmistakable: altseason is no longer a meme — it’s being underwritten by Wall Street balance sheets.

Six XRP ETFs launching in under two weeks with $164M day-one inflows is the loudest signal yet that regulated capital has officially rotated into high-beta alts. Japan’s exchange reserve mandate kills the last excuse for sloppy custody in Asia, CME is printing record volume like it’s March 2024 all over again, and public companies are now treating ETH like BTC 2.0.

The winners of this cycle will be the assets and ecosystems that sit at the intersection of institutional inflows, regulatory clarity, and real economic utility. Everything else gets left behind in the dust of the next leg up.

Buckle up — the adults just turned the lights back on, and the party is moving to the alts floor.

We're proud to have Finance Buzz as today's lead sponsor of Token Metrics, supporting our mission to deliver cutting-edge insights and connect the investment community.

Put Interest On Ice Until 2027

Pay no interest until 2027 with some of the best hand-picked credit cards this year. They are perfect for anyone looking to pay down their debt, and not add to it!

Click here to see what all of the hype is about.