Happy Friday, TM Family!

Welcome to the Token Metrics Research | Daily newsletter, where we cover key market movements, regulatory updates, and early alpha for our readers and investors.

Let's dive in!

In Today's Edition

Privacy Tokens Explode: Zcash Hits 3-Year Highs in Surveillance Backlash

ETF Flows Pivot: ETH Streak Snaps as Luxembourg Bets on Bitcoin

Corporate Treasuries Evolve: BitMine Hoards ETH, Sharps Ties with Coinbase

Miners and L1s Rally: BTC Sector Eyes $100B, BNB Mirrors Solana Surge

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by Miso Robotics.

Elon Musk: “Robots Will…Do Everything Better”

And it’s already happening. Just look at fast food. Miso’s kitchen robots already fried 4m+ baskets of food for brands like White Castle. With 144% labor turnover and $20/hour minimum wages, they’re not alone. Partnered with NVIDIA and Uber’s AI team, Miso’s new robot sold out initial units in one week. Invest before Miso’s bonus shares change on 10/9.

This is a paid advertisement for Miso Robotics’ Regulation A offering. Please read the offering circular at invest.misorobotics.com.

Now let's get back to the top stories of the day.

1. Privacy Tokens Explode: Zcash Hits 3-Year Highs in Surveillance Backlash

Privacy coins are roaring back, echoing 2018 narratives as regulatory scrutiny and financial censorship fears drive capital into shielded assets.

Zcash (ZEC) led the charge, surging 40% in 24 hours to reclaim $230, its first time above $200 in three years, on $1.5B in spot volume, fueled by zk-SNARK integrations like the Zashi wallet for cross-chain shielded swaps.

The broader sector jumped 15%, with Dash (DASH) up 44%, Railgun (RAIL) exploding 117% (300% weekly), and even Verge (XVG) and Decred (DCR) posting 13-35% gains.

X discussions highlight surveillance concerns in Europe and beyond, with endorsements from figures like Thor Torrens (Zcash advisor) emphasizing halving cycles and ethical privacy needs.

Institutional access via Grayscale's Zcash Trust adds legitimacy, but historical patterns warn of top correlations with BTC, although evolving dynamics suggest sustained upside if privacy regulations tighten.

2. ETF Flows Pivot: ETH Streak Snaps as Luxembourg Bets on Bitcoin

Spot Ethereum ETFs halted their eight-day $1.97B inflow run with $8.7M outflows on October 9, led by Fidelity's FETH ($30.3M exits), signaling short-term cooling amid ETH's 2.5% drop to $4.3K.

BlackRock's ETHA bucked the trend with $39.3M inflows, but trading volume hit $2.31B, underscoring institutional resilience.

Meanwhile, Bitcoin ETFs extended nine-day gains to $5.96B, adding $197.8M amid 91% odds of a Fed 25bps cut.

Luxembourg's Intergenerational Sovereign Wealth Fund (FSIL) made waves as the first Eurozone entity to allocate 1% (~€7M) to BTC ETFs, leveraging MiCA regs to position as a fintech hub, echoing Norway's indirect holdings and signaling broader sovereign adoption.

X sentiment leans bullish on BTC dominance (59.36%), with analysts noting ETF bridges between TradFi and crypto.

This edition of the newsletter is co-presented by CoW Swap.

Best Price, Every Trade.

Want the best price on every swap? CoW Swap evaluates routes across DEXs in real time and settles the most efficient path. Tighter pricing, higher success rates, fewer reverts. Find your best price.

Now, let's continue with the top stories of the day.

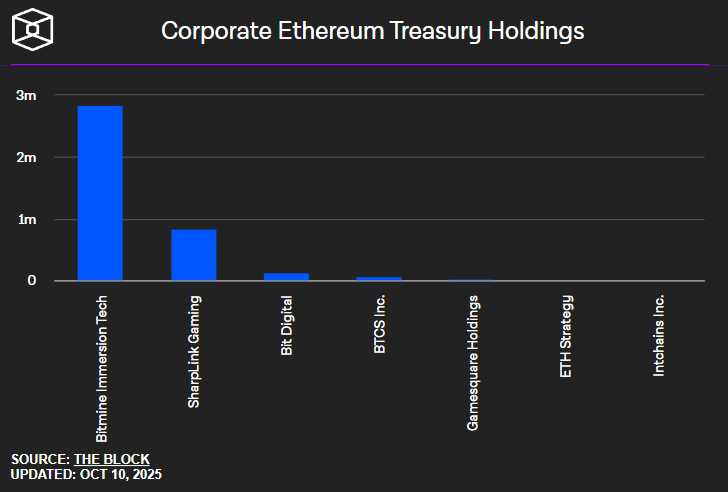

3. Corporate Treasuries Evolve: BitMine Hoards ETH, Sharps Ties with Coinbase

Corporate crypto adoption is accelerating, with treasuries diversifying beyond BTC.

BitMine Immersion Technologies has added 23,823 ETH ($103.7M) to its holdings, now totaling 2.83M ETH (~$12.4B), aiming to reach 5% of Ethereum's supply, making it the second-largest crypto treasury behind MicroStrategy.

Medical firm Sharps Technology partnered with Coinbase Prime for custody and OTC trading of its 2M+ SOL (~$400M) treasury, tapping DeFi yields in a pivot mirroring Tesla's playbook.

Kraken expanded TradFi bridges via its $1.5B NinjaTrader acquisition, offering U.S. traders direct CME futures in oil, gold, and equities, positioning as a crypto-TradFi hybrid amid $20B IPO buzz.

Roger Ver's $48M tax settlement with the DOJ highlights Trump-era enforcement leniency, dropping charges post-pardons for Ulbricht and BitMEX founders. X threads note volatility risks but praise infrastructure depth.

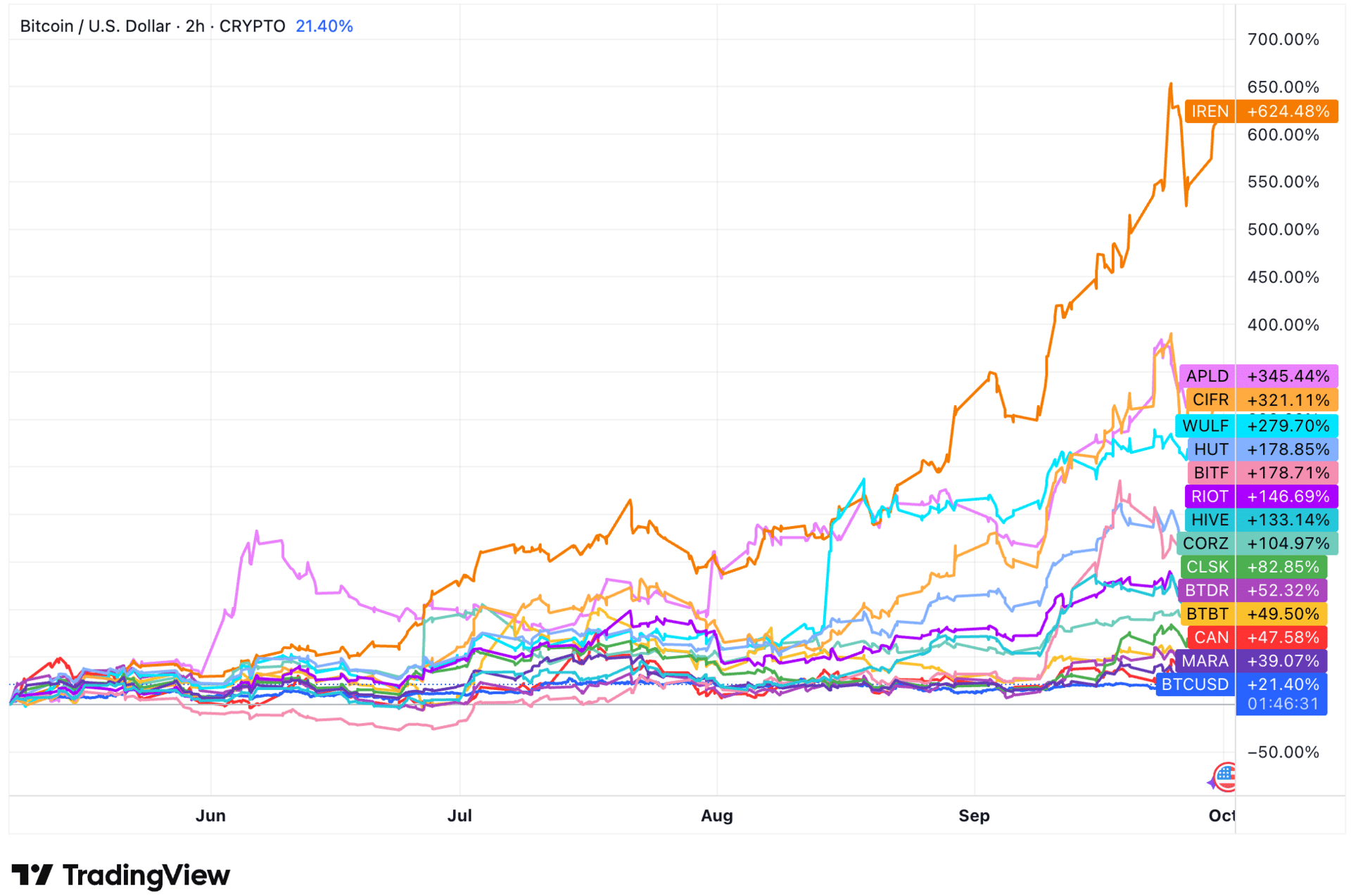

4. Miners and L1s Rally: BTC Sector Eyes $100B, BNB Mirrors Solana Surge

Bitcoin miners are pivoting to AI/HPC, pushing sector market cap toward $90B, potentially $100B by year-end, with pre-market gains like IREN (+4%, 520% YTD) and TerraWulf (+5%, 150% YTD). Microsoft's data center crunch underscores demand, fueling miner expansions.

BNB rocketed 129% YTD to $1,250+ ATHs, mirroring Solana's 2024 "L1 wealth effect" with $14.8B inflows, gas cuts, and rotations into CAKE, HENA, and memes.

BNB Chain overtook Solana in Q3 active addresses (58M vs. 38.3M) and DEX volume ($6.05B). Macro tailwinds include 91% odds of a Fed cut, boosting BTC volatility (implied vols at 30-day highs). X buzz flags Chinese memecoin crashes (>95% drops) as rotation risks, but overall sentiment is "coiling bullish."

Meme of The Day

Helpful Links

Today's newsletter is also powered by The Code.

What 100K+ Engineers Read to Stay Ahead

Your GitHub stars won't save you if you're behind on tech trends.

That's why over 100K engineers read The Code to spot what's coming next.

Get curated tech news, tools, and insights twice a week

Learn about emerging trends you can leverage at work in just 10 mins

Become the engineer who always knows what's next

That's all for today. Let's talk tomorrow.