Happy Friday, TM Family!

Welcome to the Token Metrics Research | Daily newsletter, where we cover key market movements, regulatory updates, and early alpha for our readers and investors.

Let's dive in!

In Today's Edition

Bitcoin Slides to $115K Amid Broader Market Pressure

Kaito AI Unveils Capital Launchpad

OSL Group Bags $300M in Equity Funding

NFT Treasuries Emerge as a Hot Trend

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by The Daily Upside.

The Briefing Leaders Rely On.

In a landscape flooded with hype and surface-level reporting, The Daily Upside delivers what business leaders actually need: clear, concise, and actionable intelligence on markets, strategy, and business innovation.

Founded by former bankers and veteran business journalists, it's built for decision-makers — not spectators. From macroeconomic shifts to sector-specific trends, The Daily Upside helps executives stay ahead of what’s shaping their industries.

That’s why over 1 million readers, including C-suite executives and senior decision-makers, start their day with it.

No noise. No jargon. Just business insight that drives results.

Now let's get back to the top stories of the day.

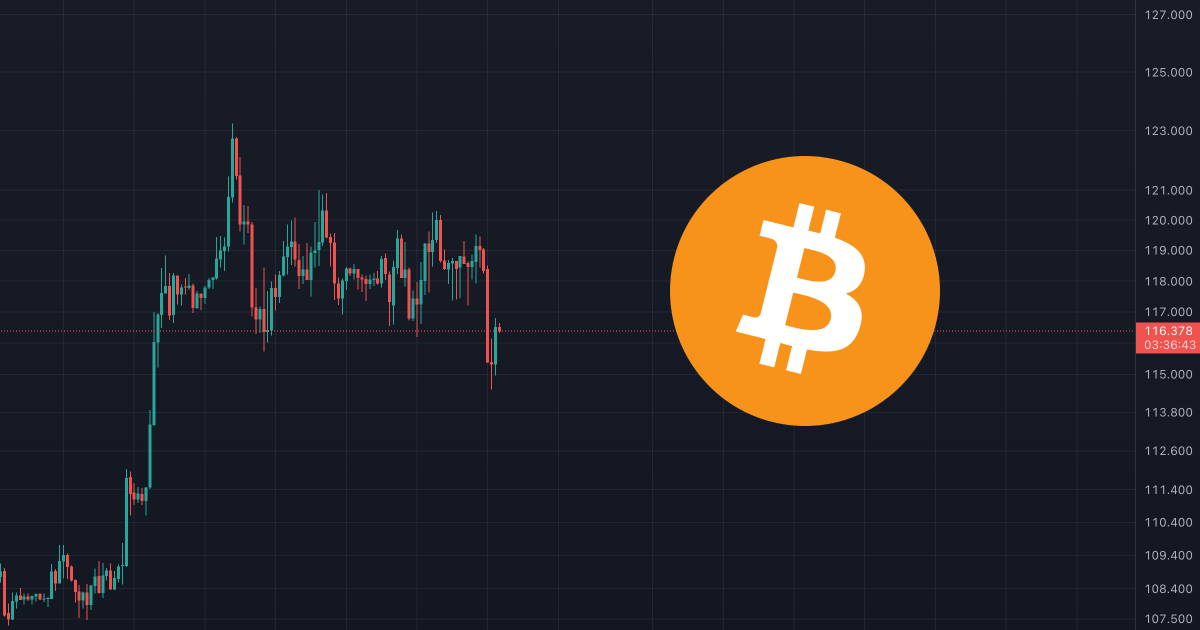

1. Bitcoin Slides to $115K Amid Broader Market Pressure

Bitcoin (BTC) experienced a notable pullback early Friday, dipping over 2.5% to hit a low of $115,170, its weakest level since July 10. This move shattered the recent consolidation range between $116,000 and $120,000, with technical indicators flashing bearish signals that could push BTC toward the $111,956 support level, a former resistance high from May. The decline wasn't isolated; the broader crypto market followed suit, with Ether (ETH), Solana (SOL), and other majors shedding 2-3%.

This crypto downturn mirrored traditional market jitters, as the Dow Jones Industrial Average stalled at a critical 45,000 resistance, echoing highs from December and January, before retreating 0.70% overnight. A potential bearish reversal in the Dow could further dampen risk appetite in crypto, especially as correlations between BTC and equities remain elevated. For investors, this underscores the need to monitor macro signals: if Dow resistance holds, expect continued pressure on BTC, but a breakout could reignite upside momentum.

On a brighter note, U.S. spot Bitcoin ETFs snapped a three-day outflow streak with $226.6M in net inflows on Thursday. Fidelity's FBTC led the pack with $106.6M, followed by VanEck's HODL at $46.4M and BlackRock's IBIT at $32.5M. Bitwise, Grayscale, and Franklin Templeton also saw positive flows, signaling renewed institutional interest despite the price dip. This comes after outflows totaling $285.3M earlier in the week, highlighting volatility in ETF sentiment. The total AUM for these products wasn't specified, but the inflow reversal could provide a floor for BTC, especially if it is sustained amid regulatory tailwinds.

2. Kaito AI Unveils Capital Launchpad

Kaito AI, a leading Web3 data provider, launched its much-anticipated Capital Launchpad. It is a decentralized crowdfunding platform designed to democratize token raises for crypto projects.

Moving away from traditional first-come-first-served (FCFS) models, the Launchpad employs a reputation-based allocation system powered by social graph mapping, sentiment analytics, and AI-driven insights to ensure fairer distribution.

Projects set their own terms (e.g., valuation, vesting), and participants earn allocations based on community merit, such as engagement and reputation scores, rather than sheer capital. The platform charges a 5% fee on funds raised to sustain operations, split evenly between stablecoins and project tokens.

This launch builds on Kaito's InfoFi (Information Finance) ecosystem, which tokenizes attention, rewards creators, and surfaces high-signal insights from fragmented crypto data. Recent improvements include the gKAITO mechanism, which filters out noise in InfoFi data flows to enhance signal quality, and integrations like the Yappers system for rewarding user-generated content. Early projects on the Launchpad include TheoriqAI (a decentralized AI agent protocol) and Espresso (a crypto initiative backed by Kaito for community merit-based fundraising).

3. OSL Group Bags $300M in Equity Funding

Hong Kong-based crypto exchange OSL Group has secured $300M (approximately HK$2.3B) in a fresh equity funding round, bolstering its balance sheet for aggressive expansion. The capital will fuel M&A activities, new business lines like payment and stablecoin services, and global growth initiatives integrating fiat, stablecoins, and major cryptos. Lead investors weren't disclosed, nor was the post-money valuation, but the raise aligns with Hong Kong's upcoming stablecoin issuance regime, set to launch in early August.

This positions OSL as a frontrunner in Asia's regulated crypto landscape, where policies are evolving to include exchange oversight, risk management, investor protections, and allowances for professional investors to trade derivatives. This funding could accelerate compliance-driven innovations for OSL, a licensed entity, potentially capturing market share as Hong Kong cements its role as a digital asset hub.

4. NFT Treasuries Emerge as a Hot Trend

The NFT space is heating up with "NFT treasuries" gaining traction, where companies hold non-fungible tokens as balance sheet assets for yield strategies and diversification.

GameSquare, a digital media firm with a $141M market cap, became the first public company to adopt this model by issuing $5M in stock for a CryptoPunk NFT, part of a $10M "NFT yield strategy" approved in July.

The firm even borrows stablecoins against the Punk, signaling sophisticated on-chain treasury management. This sparked a 72% surge in GameSquare's stock, highlighting investor appetite for blockchain-native assets.

NFT treasuries could bridge TradFi and DeFi, boosting liquidity for collections like Punks. During the revival, favor utility-driven projects but hedge against manipulation risks; regulatory clarity may catalyze further gains.

Meme of The Day