Happy Monday, TM Family!

Welcome to the Token Metrics Research | Daily newsletter, where we cover key market movements, regulatory updates, and early alpha for our readers and investors.

Let's dive in!

In Today's Edition

Ethereum Poised for $12,000 Year-End Rally

Bitcoin Risks Sliding to $100,000 in September

Crypto ETFs Expand with 92 SEC Filings

Crypto Fundraising Could Break 2021's Record

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by Pacaso.

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Now let's get back to the top stories of the day.

1. Ethereum Poised for $12,000 Year-End Rally

Ethereum is showing strong bullish signals across accumulation, institutional inflows, and technical upgrades, positioning it as a top performer amid broader market rotations.

Fundstrat's Tom Lee forecasts ETH reaching $12,000 by year-end, up from its current $4,400 level, citing improved sentiment, institutional adoption, and the passage of the GENIUS Stablecoin Act as key drivers. This would require nearly tripling in value, building on ETH's $255B market cap growth since June and its role in supporting $145B in stablecoins.

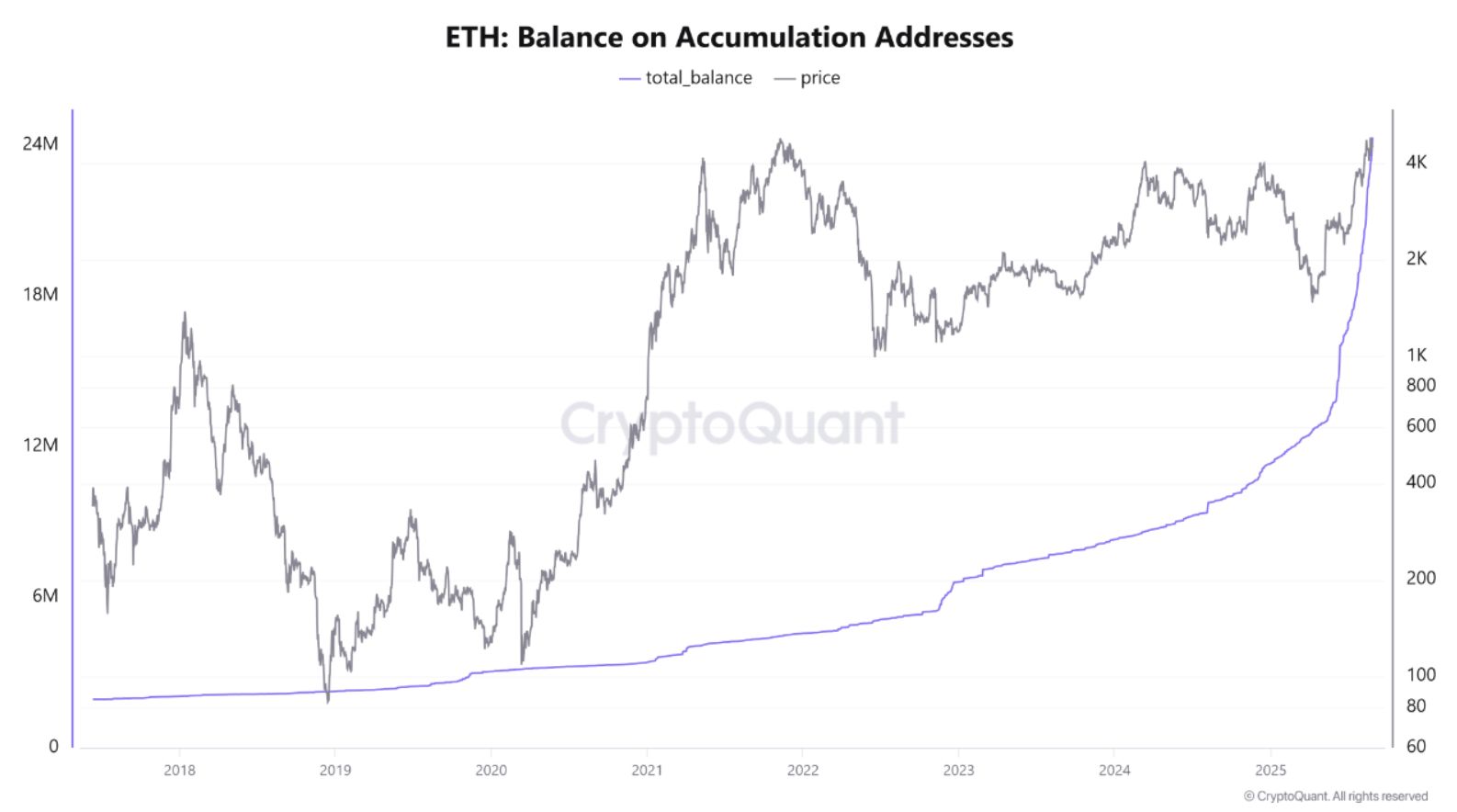

Supporting this, ETH accumulation addresses have tripled to hold 24.3M ETH, with over 90% of holders in profit, reflecting long-term confidence despite short-term volatility.

A notable Bitcoin OG whale has rotated $4B into ETH, buying 886,317 ETH in August through large transactions like 48,942 ETH for $215M in BTC.

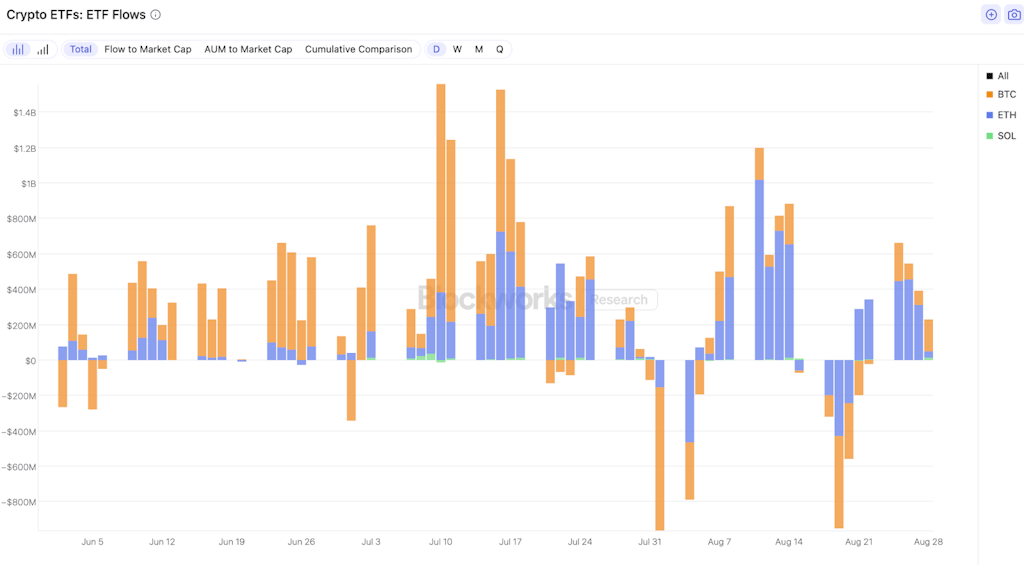

Global crypto products saw $2.48B in weekly inflows last week, with ETH funds dominating at $1.4B, outpacing Bitcoin's $748M and marking $3.95B in August ETH inflows versus BTC outflows. U.S. spot ETH ETFs alone netted $13.7B since July 2024 launches, about a quarter of BTC's $54.3B.

On the tech side, the Ethereum Foundation prioritizes interoperability via intent-based architecture, with new ERC standards like ERC-7683 for intent formats and ERC-7786 for messaging interfaces to reduce L2 fragmentation and enhance cross-chain UX within 6-12 months.

This convergence of on-chain metrics, whale activity, and ETF flows suggests ETH could decouple positively from BTC, offering asymmetric upside for DeFi and NFT exposure. Investors should monitor staking yields and L2 settlement times for confirmation, but beware of macro headwinds like delayed Fed cuts impacting risk assets.

2. Bitcoin Risks Sliding to $100,000 in September

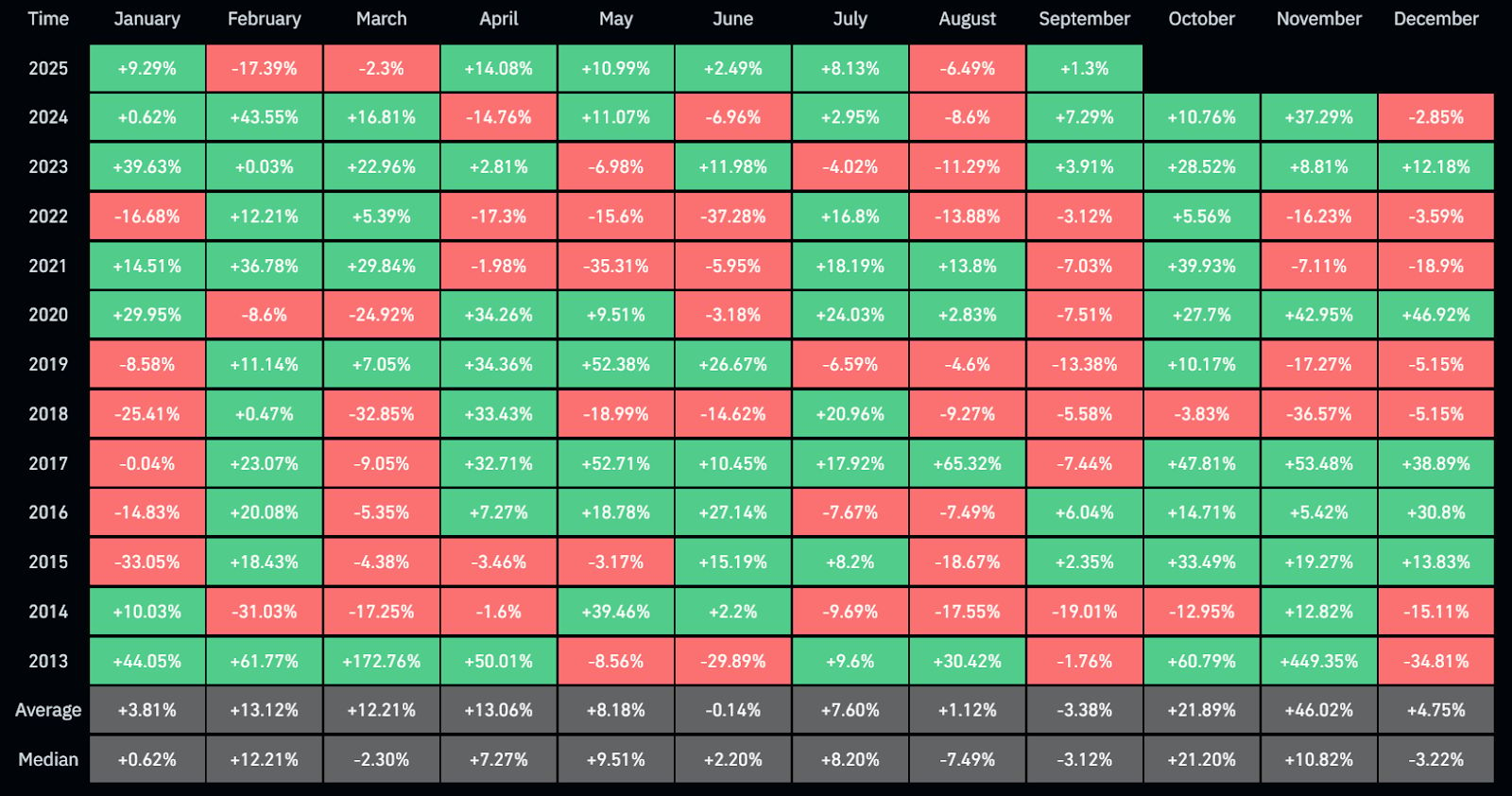

Bitcoin enters its historically weakest month with bearish momentum, risking a drop to $100,000 after August's 8% decline wiped out its summer rally from $109,500 levels.

Currently hovering around $108,000, BTC has closed lower in eight of the last 12 Septembers, averaging -3.5% to -6% returns since 2013, with median declines of 5%.

Weekend slumps pushed BTC to $107,383 and ETH to $4,385, driven by July's 2.9% core PCE inflation data tempering rate-cut expectations (87.6% odds for 25 bps in September).

This rotation to ETH (evident in $4B August ETF shifts) highlights BTC's vulnerability to equity selloffs and tight monetary policy, but Fed easing could provide a floor. Traders might hedge with options or altcoin exposure, as BTC's dominance could slip below 50% if September follows historical patterns.

This edition of the newsletter is co-presented by Morning Brew.

Business news as it should be.

Join 4M+ professionals who start their day with Morning Brew—the free newsletter that makes business news quick, clear, and actually enjoyable.

Each morning, it breaks down the biggest stories in business, tech, and finance with a touch of wit to keep things smart and interesting.

Now, let's get back to the rest of the stories.

3. Crypto ETFs Expand with 92 SEC Filings

The crypto ETF landscape is booming, with 92 filings awaiting SEC decisions, up from 72 four months ago, signaling massive institutional demand for regulated altcoin vehicles.

Solana leads with eight applications, followed by XRP's seven. Grayscale's conversions for Litecoin, Dogecoin, Avalanche, and others are also included, as are Ether staking proposals from Grayscale and 21Shares.

Notable developments include 21Shares' spot SEI ETF filing, using Coinbase custody and CF Benchmarks for NAV, with optional staking if compliant.

Sonic (ex-Fantom) approved $150M in S token issuance for a U.S. ETF push, including $50M for liquidity seeding, a $100M Nasdaq PIPE vehicle, and deflationary burns to counter inflation.

If approved, this surge could spark an alt rally, drawing trillions in TradFi capital, but SEC timelines remain uncertain amid regulatory scrutiny. For crypto natives, focus on SOL and XRP for ETF optimism, potentially boosting liquidity and reducing volatility in the long term.

4. Crypto Fundraising Could Break 2021's Record

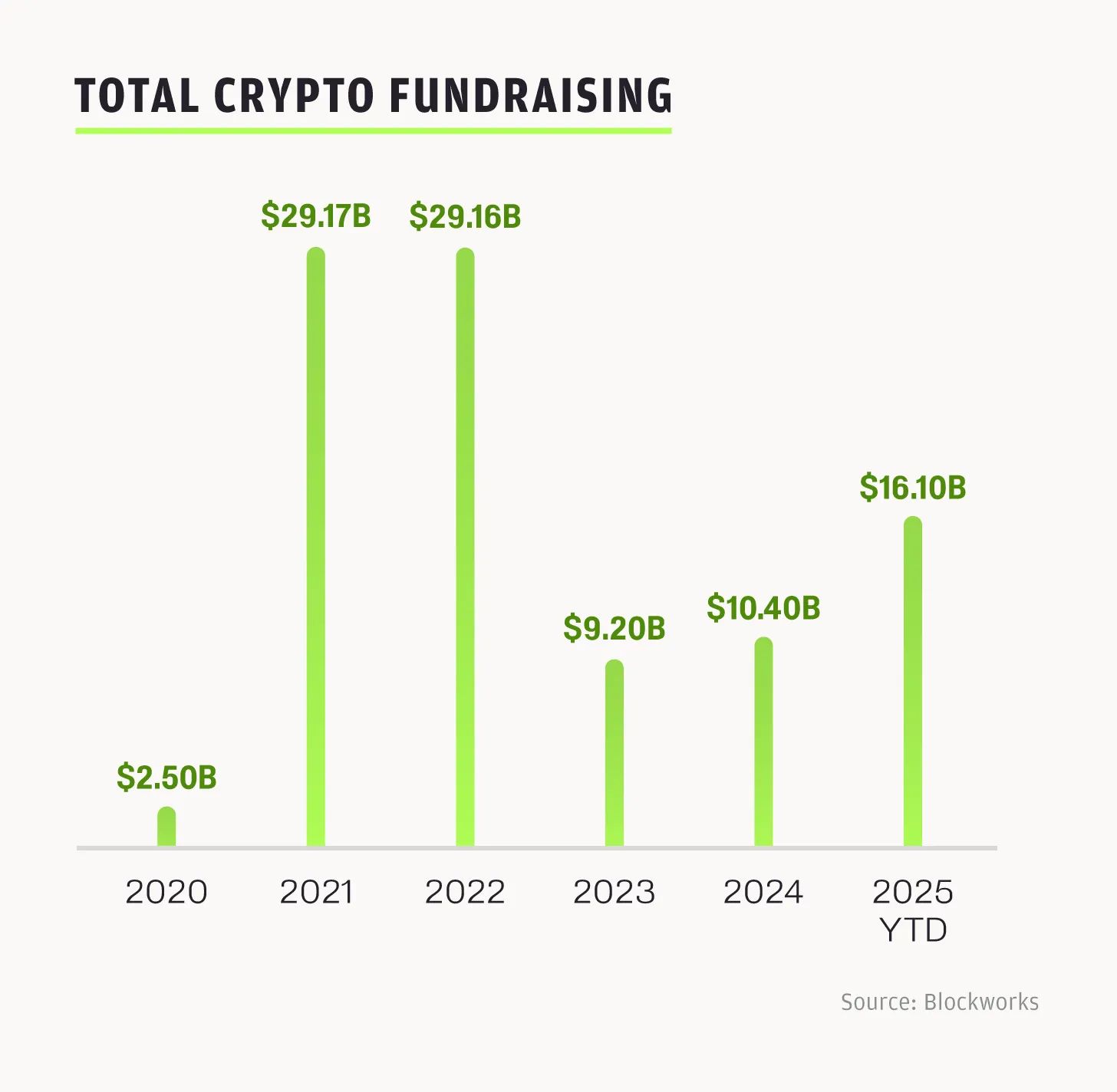

The crypto sector is shattering fundraising records. With over $16B raised YTD, it is on track to exceed 2021's $29.17B, fueled by M&A, IPOs, and stablecoin innovation.

Key deals include Rain's $58M Series B for enterprise stablecoin expansion, integrating with Visa for global payments, and leveraging MiCA/GENIUS Act clarity.

M&A hit 76 deals worth $6.23B from January-July, projecting 130 for 2025, with IPOs like Circle and Bullish attracting new capital.

Gate launched GUSD, an RWA-backed stablecoin (U.S. Treasuries) offering up to 365% APY in staking pools, with 100% reserves and appreciation potential.

Regulatory tailwinds include CFTC's FBOT registration for offshore exchanges serving U.S. traders and the Senate's potential September markup of the Responsible Financial Innovation Act, redefining investment contracts.

This maturation signals a bull cycle revival, with stablecoins and infrastructure drawing enterprise adoption. Investors should allocate to early-stage projects, but diversify amid valuation froth, as clearer regulations could unlock further value.

Meme of The Day

Helpful Links

Today’s newsletter is also powered by Stocks & Income.

Financial News Keeps You Poor. Here's Why.

The scandalous truth: Most market news is designed to inform you about what already happened, not help you profit from what's coming next.

When CNBC reports "Stock XYZ surges 287%"—you missed it.

What you actually need:

Tomorrow's IPO calendar (not yesterday's launches)

Crowdfunding deals opening this week (not closed rounds)

What real traders are positioning for (not TV talking heads)

Economic data that moves markets (before it's released)

The financial media industrial complex profits from keeping you one step behind.

Stocks & Income flips this backwards. We focus entirely on forward-looking intel that helps you get positioned before the crowd, not informed after the move.

Stop chasing trades that happened already.

Start prepping for the next one.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

That's all for today. Let's talk tomorrow.