Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive

Dear Crypto Enthusiasts,

This week, we took a close look at the state of the crypto markets, and the overall picture remains cautiously optimistic. While there was a noticeable correction in the last 24 hours, market sentiment continues to lean bullish, with total capitalization holding near the $4 trillion mark. Since early July, we’ve seen steady upward momentum, and Bitcoin continues to stabilize above previous highs, paving the way for altcoins to start catching up.

Key Movers and Narratives

Several tokens have been standout performers in recent days. Zora, an on-chain social platform enabling creators to tokenize posts and monetize their content, has gained significant attention. Its integration with the new Base App (a rebranded version of Coinbase Wallet) has driven rapid growth in creator activity and transaction volume. With Zora tokens directly tied to creator interactions, this project’s adoption metrics are worth monitoring as the Base App expands access beyond its current invite-only phase.

Another mover is Spark, a DeFi and lending project connected to Sky Protocol, which has experienced a sharp rise in activity and price. Sahara AI also continues to build momentum as a full-stack AI platform for blockchain, backed by notable investors including Binance and Polychain. Additionally, Moby AI — initially an AI analytics agent — has evolved into a competitor to Dexscreener with its own on-chain analytics tools, and Graphite Protocol has gained traction through its association with Bonk Fun, sharing revenue and implementing buyback strategies.

Market Themes

We’ve been closely monitoring Bitcoin and altcoin season indicators. Historically, when the market transitions from Bitcoin dominance to broader altcoin outperformance, it has often signaled a time to lock in profits. Currently, we remain in Bitcoin season, suggesting there may still be room for altcoins to gain before hitting a local peak.

DeFi & Ecosystem Highlights

In DeFi, PancakeSwap stands out as a key protocol worth revisiting. Despite generating some of the highest daily fees in the industry and achieving strong trading volumes (outpacing Uniswap in several metrics), its valuation appears comparatively modest. Similarly, Blackhole DEX on Avalanche, launched earlier this month, has seen impressive TVL growth through a community-first model that eliminates team token allocations and incentivizes user participation.

On the institutional side, Maple Finance continues its steady rise, now managing over $2 billion in TVL through its on-chain credit platform catering to institutional borrowers.

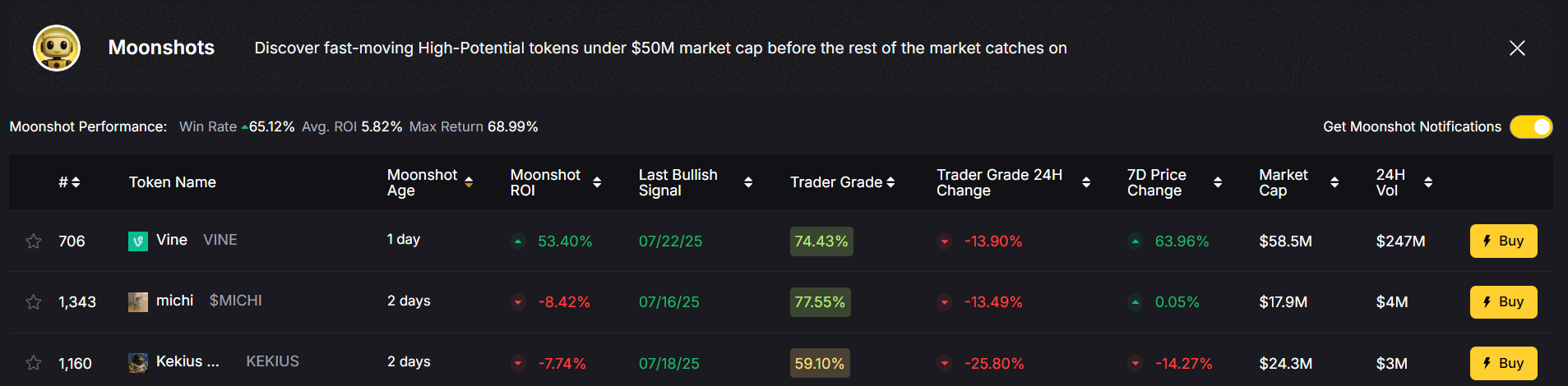

Moonshots and Risk Management

We also discussed our approach to “moonshot” tokens—low-cap, high-volatility plays that require careful risk management. Based on our analysis, these trades perform best when limited to small allocations (no more than 1% of a portfolio per position) and managed with clear exit strategies.

Other Notable Mentions

Ondo: 21 Shares recently filed for ONDO ETF product, gaining institutional attention.

Pudgy Penguins: Solidifying their role as a leading NFT collection, mirroring the cultural impact Bored Apes had in the last cycle.

Project X: A cross-chain DEX on Hyperliquid with growing TVL shortly after launch.

Swarms: An AI-agent platform that has shown recent whale accumulation, despite low current adoption levels.

Our Takeaway

The market remains in a bullish phase, but with the recent correction and ongoing Bitcoin dominance, patience and discipline remain critical. Altcoins are beginning to play catch-up, and several emerging narratives — social tokens, AI-integrated platforms, and community-led DeFi models — are gaining traction.