Happy Monday, TM Family!

Welcome to the Token Metrics Research | Daily newsletter, where we cover key market movements, regulatory updates, and early alpha for our readers and investors.

Let's dive in!

In Today's Edition

Bitcoin and Hyperliquid Reach New All-Time Highs

Federal Reserve Leadership Speculation and Crypto Legislation

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by The Rundown AI.

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Now let's get back to the top stories of the day.

1. Bitcoin and Hyperliquid Reach New All-Time Highs

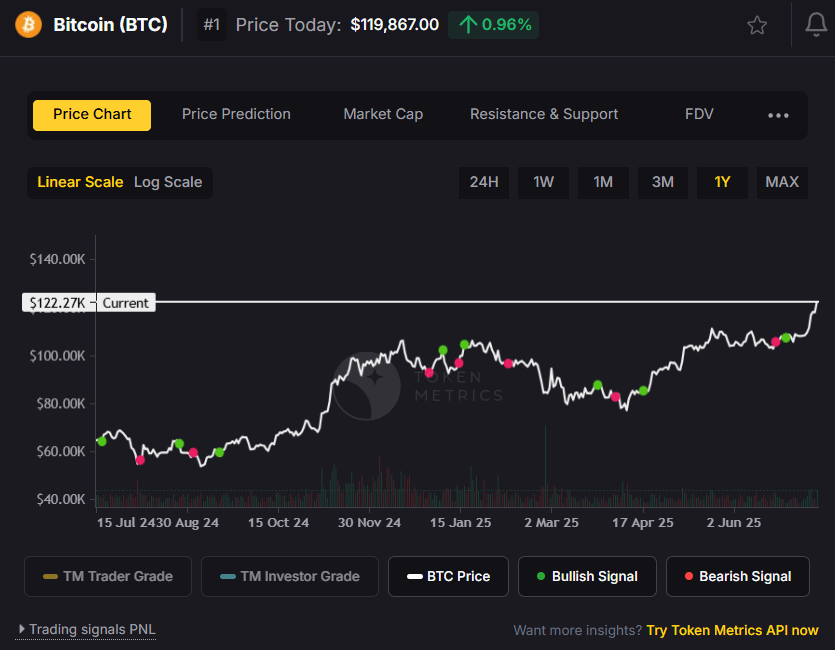

The cryptocurrency market witnessed a significant milestone today as Bitcoin surged to a new all-time high, reportedly reaching approximately $122,838 before stabilizing around $120,000. This rally aligns with growing institutional adoption and speculation about a potential shift in U.S. monetary policy, particularly as pressure mounts on Federal Reserve Chairman Jerome Powell. The anticipation of lower interest rates, which could favor risk assets like cryptocurrencies, has fueled market optimism. According to recent data, Bitcoin’s market capitalization stands at approximately $2.38T, with a circulating supply of around 19.9 million coins.

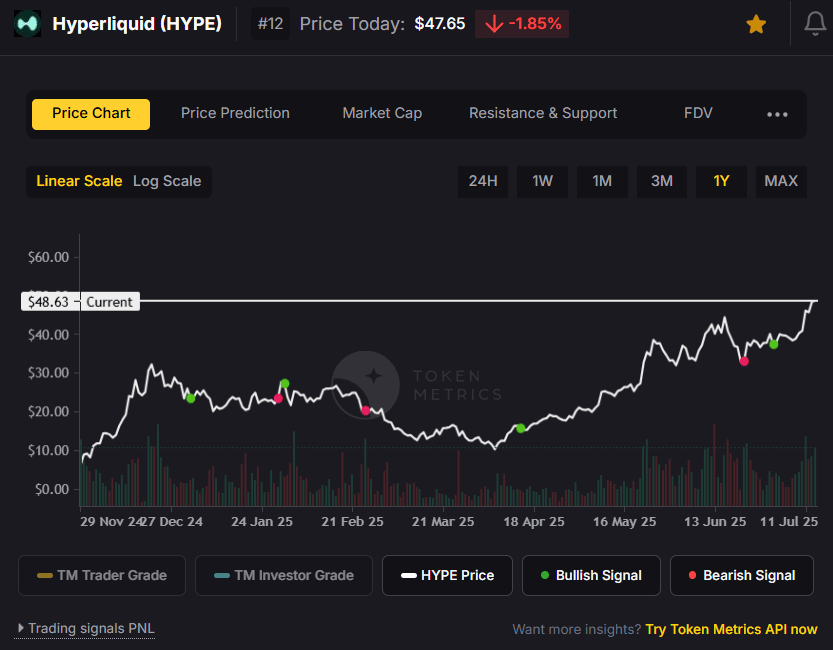

In parallel, Hyperliquid, a decentralized exchange (DEX) built on its own high-performance Layer-1 blockchain, saw its native HYPE token reach an all-time high of $49.75. Hyperliquid’s platform, known for its low-fee perpetual futures and spot trading, has gained traction due to its proprietary HyperBFT consensus mechanism, which ensures rapid transaction finality. The HYPE token’s surge reflects increasing investor interest in DeFi platforms that combine the speed of centralized exchanges with the transparency of decentralized systems.

2. Federal Reserve Leadership Speculation and Crypto Legislation

The crypto market’s bullish sentiment is partly tied to macroeconomic developments, particularly speculation about a potential regime change at the Federal Reserve. President Donald Trump has expressed dissatisfaction with Fed Chairman Jerome Powell, criticizing the central bank’s high interest rate policies. Reports suggest Trump may announce Powell’s successor as early as September 2025, with potential candidates including former Fed Governor Kevin Warsh and National Economic Council Director Kevin Hassett. A new Fed chair favoring lower interest rates could enhance the appeal of cryptocurrencies as alternative investments, as evidenced by Bitcoin’s recent rally past $120,000 amid these speculations.

Concurrently, the U.S. House of Representatives has declared the week of July 14, 2025, as “Crypto Week,” with significant legislative votes scheduled. On Wednesday, July 16, the House will vote on the Digital Asset Market Clarity Act “ (CLARITY Act), which aims to establish a comprehensive regulatory framework for digital assets, directing the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) to implement regulations (Financial Services House). On Thursday, July 17, the House will consider the Guiding and Establishing National Innovation for U.S. Stablecoins of 2025 (GENIUS Act), which mandates that liquid reserves fully back stablecoins and requires annual audits for issuers with a market cap above $50B. These legislative efforts could provide much-needed regulatory clarity, potentially fostering greater institutional adoption and market stability, though some stakeholders worry about overly restrictive regulations stifling innovation.

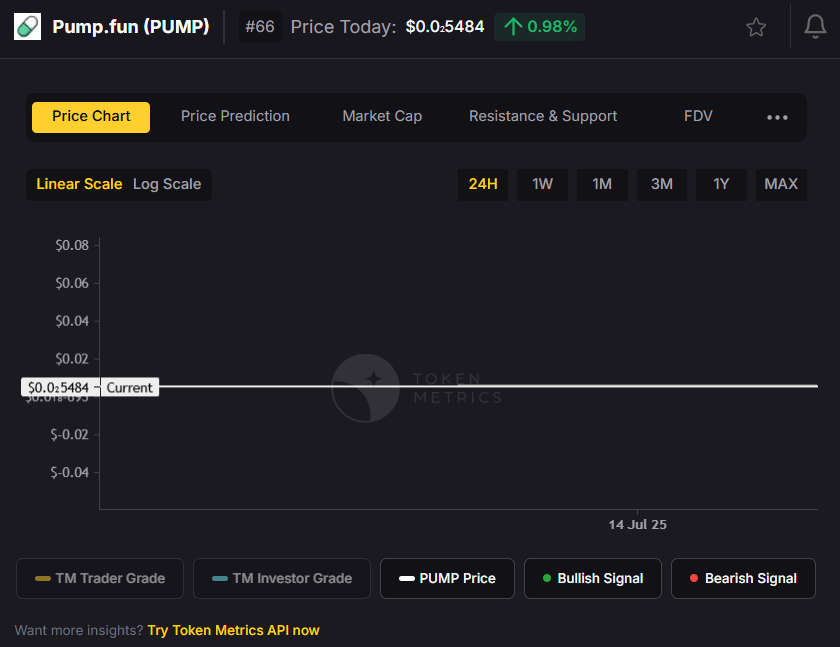

3. Pump.fun's ICO Triumph

Pump.fun, a Solana-based memecoin launchpad, made headlines by raising $600M in its Initial Coin Offering (ICO) for the PUMP token, with the public sale selling out in just 12 minutes. The platform sold 150 billion tokens at $0.004 each, reflecting strong retail and institutional demand. Some reports suggest the public sale raised $500M with 125 billion tokens, indicating possible discrepancies in reporting or confusion with a private sale of 180 billion tokens to institutional investors. Pump.fun aims to leverage these funds to build a decentralized social platform that rivals major players like Facebook and TikTok, rewarding user engagement with financial incentives.

The ICO’s rapid success highlights the vibrant demand for innovative crypto projects, though it has sparked debate. Critics have raised concerns about the tokenomics, with 20% of the 1 trillion total supply allocated to the team and 13% to early investors, prompting accusations of potential “liquidity extraction”. Despite these controversies, Pump.fun’s ambitious vision and strong community support position it as a key player in t

Meme of The Day

That's all for today, people. Let's talk tomorrow.

Your Friends at Token Metrics