1. Executive Summary

BIO Protocol is a pioneering decentralized science (DeSci) platform designed to revolutionize biotechnology funding and commercialization by enabling global communities of patients, scientists, and professionals to collectively fund, build, and own tokenized biotech projects and intellectual property (IP).

Built on the foundations of predecessors like Molecule and VitaDAO, created by the same team, BIO introduces a financial layer for on-chain science, fostering bioDAOs (community-owned research networks) and creating liquid markets for scientific IP. Key features include curation via BIO token staking, rewards for milestones, and IP Tokens for fractional governance.

The protocol operates within the burgeoning DeSci niche of the broader biotechnology industry. This niche was valued at approximately $1.77T in 2025 and is projected to reach $5.71T by 2034, growing at a CAGR of 13.9%.

BIO's native token ($BIO) has a total supply of 3.32B, with utilities centered on governance, curation, and access to ecosystem perks. Backed by prominent investors like Binance Labs in its genesis round and facilitation of $33M+ in global research funding, BIO is positioned for significant upside in a market driven by AI integration, gene therapies, and personalized medicine.

Risks include regulatory hurdles and competition from established DeSci players, but opportunities in expanding bioDAOs and AI agents suggest strong growth potential. This report evaluates BIO as a high-conviction investment in the DeSci space, with a bullish outlook amid rising chronic disease prevalence and biotech innovation.

Today’s edition of Token Metrics Research | Daily Newsletter is brought to you by Crypto 101.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

Now, let’s get back to the deep dive.

2. About the Project

2.1. Vision

BIO Protocol envisions an on-chain scientific economy where decentralized communities (bioDAOs) accelerate biotechnology innovation. By tokenizing biotech projects and IP, it aims to democratize access to funding, governance, and ownership, enabling anyone, scientists, patients, or crypto users, to participate in developing life-saving therapies.

The long-term goal is to bring hundreds of new research communities and biotech assets on-chain by 2025, reshaping biotech from a centralized, slow-moving industry into a collaborative, liquid ecosystem.

2.2. Problem

Inefficiencies, including high barriers to entry for early-stage research, siloed capital flows, slow commercialization, and limited community involvement, plague traditional biotechnology funding.

Patients and scientists often lack direct stakes in outcomes, while IP remains illiquid and controlled by a few entities. This results in delayed breakthroughs for chronic diseases, high costs (e.g., R&D expenses exceeding $2B per drug), and underfunding for niche areas like longevity or rare diseases. Regulatory bottlenecks and centralized gatekeepers further exacerbate talent and capital mismatches.

2.3. Solution

BIO Protocol addresses these through a permissionless DeSci framework: communities form bioDAOs to pool resources (capital, data, labor) for R&D, with BIO token holders curating and funding promising projects via a Launchpad.

Tokenized IP (IP-Tokens) allows fractional ownership and governance, while rewards incentivize milestones like clinical trials or product launches. Built on Ethereum with AI agents for scientific tasks, it creates deep, liquid markets for biotech IP, reducing costs, speeding commercialization, and distributing value equitably.

3. Market Analysis

BIO Protocol falls within the Decentralized Science (DeSci) sub-industry, a niche at the intersection of blockchain and biotechnology focused on open, community-driven research funding and IP management.

DeSci leverages web3 tools to decentralize scientific processes, addressing inefficiencies in traditional biotech. While specific DeSci market size data is nascent, it is part of the broader global biotechnology industry.

The global biotechnology market was valued at USD 1.77T in 2025 and is projected to reach USD 5.71T by 2034, growing at a CAGR of 13.9%. This growth is driven by rising chronic disease prevalence (e.g., cancer, diabetes), advancements in gene therapies (CRISPR, mRNA), AI/ML integration in drug discovery, and demand for personalized medicine.

Key reports from Grand View Research and Precedence Research highlight factors like government initiatives (e.g., Healthy China 2030), agricultural biotech for sustainable crops, and industrial applications in bio-manufacturing. North America dominates with a 41.4% share due to R&D investments, while Asia-Pacific grows fastest at over 14.8% CAGR, fueled by healthcare infrastructure and partnerships.

3.1. Competition

DeSci is competitive, with projects focusing on tokenized funding and IP. Below is a table of the top five competitors to BIO Protocol, based on market cap, focus, and activity.

Competitor | Similarities to BIO | Differences from BIO |

VitaDAO | DeSci focus; tokenized IP/funding for longevity research; community governance via tokens. | Narrower scope (longevity only); BIO's team founded VitaDAO, but BIO expands to broader biotech with AI agents and Launchpad. |

Molecule | IP tokenization platform; enables fractional ownership of biotech IP; DeSci ecosystem builder. | More B2B/tool-oriented for IP minting; BIO integrates curation/rewards and bioDAOs for end-to-end funding/liquidity. |

AthenaDAO | BioDAO for women's health; community-driven funding and IP ownership. | Specialized in reproductive health; lacks BIO's broad curation/rewards system and AI integration. |

HairDAO | DeSci DAO for hair loss research; tokenized milestones and products. | Hyper-focused on one condition (hair loss), BIO offers multi-DAO support and a liquidity engine. |

DeSci Labs | Open science platform; data storage/sharing with blockchain; funding research via tokens. | Emphasizes data infrastructure over IP commercialization; BIO prioritizes funding/ownership with user rewards. |

4. Features

BioDAOs: Community-owned networks focusing on specific biotech areas (e.g., longevity, psychedelics). Members pool capital, data, and labor to accelerate R&D, reducing innovation costs and time to market.

Curation: BIO holders stake tokens to vote on bioDAOs for network acceptance, unlocking funding, liquidity, and acceleration services.

Bio/Acc Rewards: Incentivizes milestones like token auctions, IP launches, clinical trials, or product revenue. Rewards also go to users for data contributions or product usage (e.g., biohacking implants).

IP Tokens (IPTs): Fractional governance rights over IP; bioDAOs hold portfolios (e.g., VitaDAO's VitaRNA). Enables direct participation in research decisions and value capture.

Ignition Sales & Launchpad: Low-cap fundraises that scale with traction; V1 live since Q1 2025.

BioAgents: AI-powered scientific agents for decentralized tasks, launching Q3 2025.

5. Token

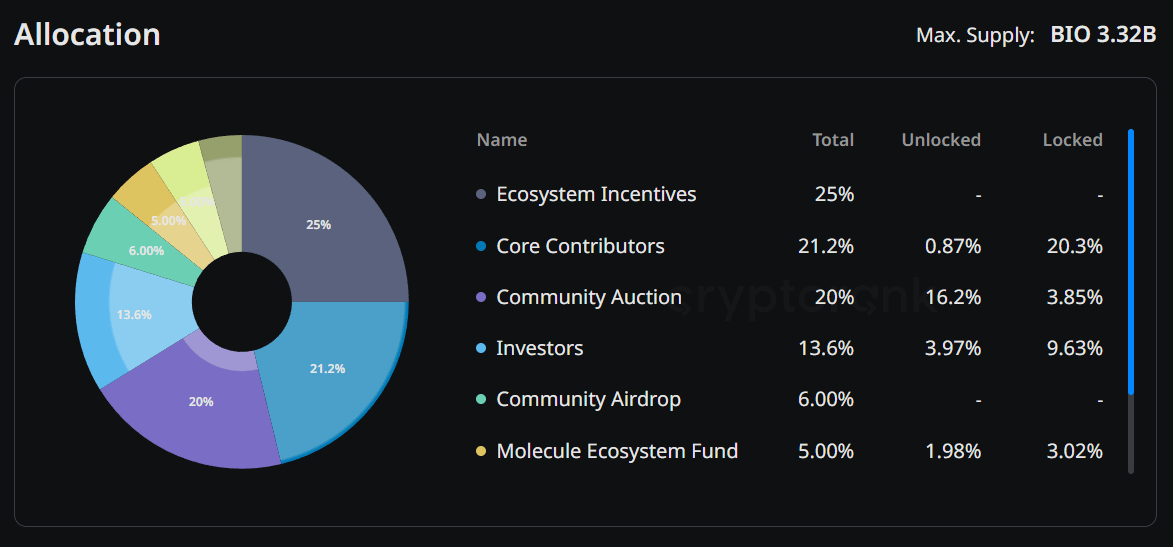

The native token is $BIO (ERC-20 on Ethereum), with a total supply of 3.32 billion (dynamic, adjustable via governance) and a circulating supply of ~1.87 billion as of mid-2025.

5.1. Utility

Governance: Vote on BIO issuance, distributions, and accelerator programs.

Curation/Signaling: Stake to support bioDAOs for funding access.

Access/Perks: Whitelists for early funding rounds; BioXP earning via staking/governance for Ignition Sales priority.

Rewards: Earn for health data contributions, trial participation, or using bioDAO products.

Ecosystem Exposure: Broad access to bioDAOs and IP, enabling diversified DeSci investment.

6. Team

BIO's team comprises DeSci pioneers with deep biotech and web3 expertise:

Paul Kohlhaas (Founder & CEO): Co-founder of Molecule and VitaDAO; ex-Consensys; focuses on tokenomics and DeSci singularity.

James Sinka (Co-Founder & Science Lead): Ex-OrangeDAO, Y Combinator; chemistry background; handles R&D and community.

Clemens Ortlepp (Co-Founder & CPO): Product lead; builds user-friendly tools for on-chain science.

Other Key Members: Jose Pinto (Legal), Nate Hindman (Growth), Ritvik Singh (AI), Aakaash Meduri (bioML). Advisors include Tyler Golato (VitaDAO) and Vincent Weisser (AI/Research).

7. Traction

BIO has achieved notable milestones since its inception:

Funding: Facilitated $34M+ in global research funding.

Metrics: BioDAO aggregate market cap >$200M; 96K+ X followers.

Key Events: First on-chain science funding (2021, U. Copenhagen); Pfizer Ventures backed VitaDAO ($4.1M, 2022); HairDAO filed first DAO patent (2023); V1 Launchpad live (Q1 2025).

User Growth: Active bioDAOs launching (e.g., longevity, women's health); $64M+ public sale (2025).

8. Investors

9. Conclusion

BIO Protocol stands out as a leader in DeSci, bridging biotech's trillion-dollar potential with web3's liquidity and community power. With a proven team, strong traction (e.g., $200M+ bioDAO caps), and utilities driving token demand, it is well-positioned for the biotech market's 13.9% CAGR growth to USD 5.71T by 2034.

Bull case: AI agents and bioDAO expansion catalyze a "scientific singularity," yielding 5-10x returns. Bear case: Regulatory risks or market downturns cap upside. Overall, BIO represents a compelling opportunity in on-chain science, recommend monitoring for further launches and integrations. (Not financial advice; do your research.)

Turn AI Into Your Income Stream

The AI economy is booming, and smart entrepreneurs are already profiting. Subscribe to Mindstream and get instant access to 200+ proven strategies to monetize AI tools like ChatGPT, Midjourney, and more. From content creation to automation services, discover actionable ways to build your AI-powered income. No coding required, just practical strategies that work.