1. Executive Summary

This week's Crypto Deep Dive focuses on Kinetiq, a leading liquid staking protocol native to the Hyperliquid blockchain. The report explores its vision to enhance staking efficiency and DeFi integration, market positioning within the growing liquid staking sector, key features like autonomous validator management, the kPoints incentive program (as no native token exists yet), team background, traction metrics including $1.6B TVL, investor activity, and future outlook for adoption in Hyperliquid's ecosystem.

Today’s edition of the Token Metrics Research | Daily Newsletter is brought to you by CoW Swap.

UN-Limited Limit Orders in DeFi

CoW Swap limit orders offer:

Unlimited order management: Limit orders on CoW Swap are completely FREE to place or cancel. Yes, really!

Unlimited order placement: Use one crypto balance to place multiple orders at once, even if you don’t have the full amount yet. That’s useful!

Unlimited order surplus: All upside captured after a price is hit goes to you and not to order takers. As it should be!

Plus everything else you know and love about CoW Swap, like gasless trading and MEV protection.

Now, let’s get back to the deep dive.

2. About the Project

2.1. Vision

Kinetiq aims to power liquid staking on Hyperliquid, enabling users to stake the native HYPE token while maintaining liquidity and capital efficiency through kHYPE. It seeks to strengthen Hyperliquid's network security, decentralization, and DeFi growth by allowing staked assets to be used across protocols like lending, AMMs, and yield strategies without sacrificing rewards.

2.2. Problem

Traditional staking on Hyperliquid requires manual validator selection, ongoing performance monitoring, reward management, and token lockups, leading to complexity, inefficiency, and limited DeFi utility for staked assets.

2.3. Solution

Kinetiq provides a non-custodial liquid staking mechanism where users deposit HYPE to instantly receive kHYPE, which accrues rewards automatically via compounded validator yields. Its StakeHub system autonomously scores and delegates stakes to top validators, ensuring optimal performance and diversification while keeping kHYPE fully liquid for DeFi activities. Withdrawals include a security delay for added protection.

3. Market Analysis

Kinetiq operates in the liquid staking derivatives (LSD) sector of DeFi, tailored explicitly to the Hyperliquid L1 blockchain. This niche allows stakers to unlock liquidity from otherwise illiquid staked assets, fueling broader DeFi composability.

The broader DeFi market, of which liquid staking is a key component, was valued at approximately $51.22B in 2025 and is projected to reach $78.49B by 2030, growing at a CAGR of 8.96%.

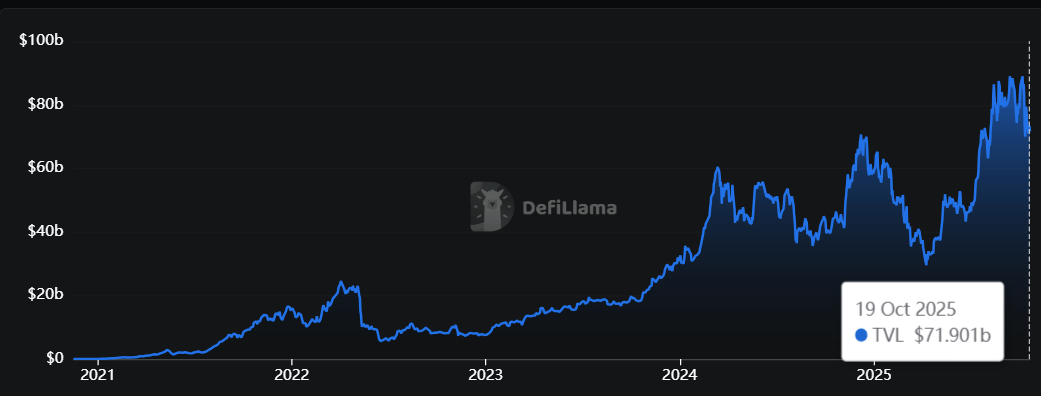

Liquid staking itself has seen explosive growth, with global TVL exceeding $71B in 2025, driven by increasing adoption on chains like Ethereum and Solana and emerging L1s like Hyperliquid.

Projections indicate continued expansion, as staking becomes integral to proof-of-stake networks, with restaking and LSD innovations potentially adding hundreds of billions in TVL by 2030, per industry reports.

3.1. Competition

Competitor | Similarities | Differences |

Staked HYPE | Offers liquid staking of HYPE for yield while maintaining liquidity; integrates with DeFi protocols. | Lacks autonomous validator scoring like Kinetiq's StakeHub; lower TVL and fewer ecosystem partnerships. |

Ventuals | Provides LSTs for HYPE, enabling DeFi composability. | Focuses on tokenized private assets and pre-IPO funding via staking vaults; more niche in venture-style applications compared to Kinetiq's broad DeFi focus. |

Hyperbeat | Liquid staking protocol for HYPE rewards and liquidity. | Emphasizes community-driven features but has limited integrations and lower adoption metrics than Kinetiq. |

Alphaticks | Enables HYPE staking with liquid tokens for DeFi use. | Smaller scale with basic staking; lacks advanced automation and security audits seen in Kinetiq. |

Others | General liquid staking on Hyperliquid. | Fragmented, smaller protocols with minimal differentiation; often lack Kinetiq's native L1 optimizations and yield maximization tools. |

4. Features

StakeHub Autonomous Validator System: Algorithmically selects, monitors, and rebalances delegations to top-performing validators based on metrics like uptime and rewards, maximizing yields and diversifying risk without user intervention.

Native L1 Integration: Built directly on Hyperliquid for efficient batch operations, direct validator communication, and seamless state synchronization, enhancing security and performance over imported solutions.

DeFi Composability for kHYPE: Users can deploy kHYPE as collateral in lending (e.g., Hyperlend), liquidity pools (e.g., Curve, Valantis), yield strategies (e.g., Pendle), or trading while still earning staking rewards.

Passive Reward Accrual: No manual claiming or rebasing needed; the kHYPE value grows automatically through an improving exchange rate from compounded validator rewards.

Multi-Layered Security: Includes emergency response systems, role-based access, multi-sig controls, and four independent audits from firms like Spearbit and Pashov Audit Group.

5. Token

Kinetiq does not currently have a native token; instead, it issues kHYPE as a liquid staking derivative for HYPE. kHYPE has no fixed supply cap, as it is minted 1:1 upon staking HYPE and burned upon redemption. Distribution is user-driven via staking, with value accrual tied to Hyperliquid network rewards. No explicit allocation metrics are available, but kHYPE circulates freely in DeFi.

Instead of a token, Kinetiq runs the kPoints program to incentivize participation. Launched on July 15, 2025, it distributes 800,000 kPoints weekly based on Tuesday snapshots, with allocations occurring on Thursdays.

Points are earned through activities like holding/staking kHYPE, providing liquidity in partnered vaults, and engaging in DeFi integrations. The purpose is to reward active users, bootstrap liquidity, and drive protocol adoption, with speculation around a future airdrop or token launch. The final distribution occurred on October 16, 2025, marking the program's end.

This edition of the newsletter is co-presented by AltIndex.

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Now, let's continue with the deep dive.

6. Team

Kinetiq's team consists of 13 pseudonymous contributors with extensive experience in crypto, particularly in DeFi and blockchain development. Key figures include co-founder Omnia, who focuses on liquidity solutions and has a background in early-stage protocol building on high-performance chains.

The team has been active in the Hyperliquid ecosystem since its inception, emphasizing native integrations and security. While specific resumes are not public, their work on StakeHub and L1-optimized staking demonstrates expertise in validator management, smart contracts, and DeFi composability.

7. Traction

Kinetiq has achieved significant adoption on Hyperliquid, with a TVL of $1.6B, representing an 88.9% market share of HYPE LSTs. On-chain metrics include annualized fees of $38.79M and revenue of $2.83M, with treasury holdings of $210,888.

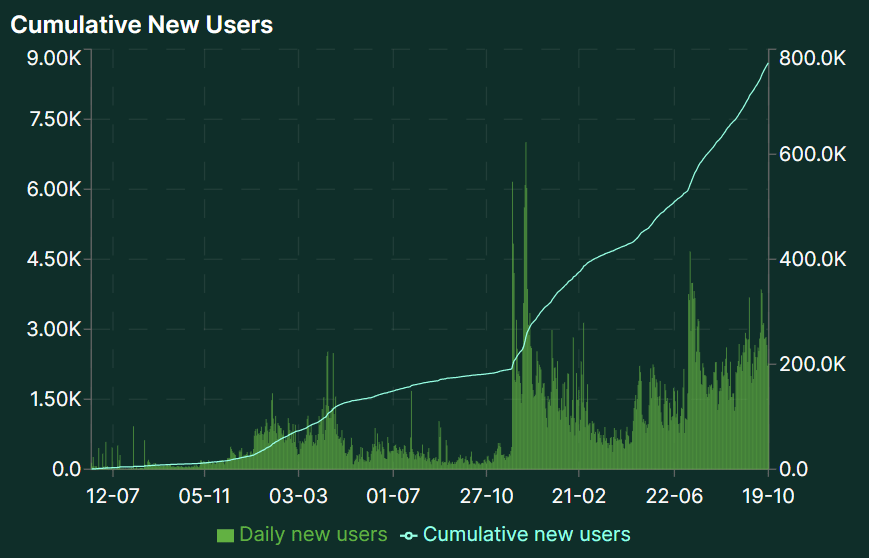

Hyperliquid's overall expansion to over 773,000 addresses in 2025 implies user growth, with Kinetiq's integrations driving DeFi TVL inflows.

Adoption highlights include partnerships with protocols like Veda, Pendle, and Hyperlend, and rapid TVL growth from $458M in mid-July 2025 to over $2.1B recently, fueled by yield hunters and the kPoints program.

8. Investors

No traditional VC funding rounds have been disclosed for Kinetiq, suggesting a bootstrapped or community-driven model. However, institutional adoption is evident through entities like Hyperion DeFi, which has deposited over 1.5 million HYPE (valued at ~$70M as of recent purchases) into Kinetiq's iHYPE product for isolated staking pools.

This occurred in phases, including a $5M addition in July 2025. Other ecosystem players like Pier Two have collaborated on co-branded validators, indicating strategic backing without formal equity investments.

9. Conclusion

Kinetiq stands out as a robust, native solution for liquid staking on Hyperliquid, with strong metrics like dominant market share and high TVL signaling solid fundamentals.

To assess the project, readers should evaluate on-chain activity (e.g., via DeFiLlama), security audits, and DeFi integrations, while monitoring for a potential token launch post-kPoints.

The future outlook is positive, with Hyperliquid's growth potentially driving Kinetiq's TVL beyond $3 billion by 2026 amid broader LSD sector expansion. Risks like network congestion or competitive LST launches warrant caution. Investors may find opportunities in farming yields or anticipating ecosystem airdrops.

Today’s newsletter is also powered by 1440 Media.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

That's all for today. Let's talk tomorrow.