1. Executive Summary

Pendle is a leading decentralized finance (DeFi) protocol specializing in yield tokenization and trading. It enables users to separate, trade, and leverage future yields from various assets without traditional lockups or liquidation risks.

Launched in 2021, it has evolved into the world's largest crypto yield trading platform, with innovations like its V2 AMM and Boros margin trading platform driving significant growth. As of August 2025, Pendle boasts an all-time high TVL of $9.4B, reflecting strong adoption amid a maturing DeFi landscape.

The protocol operates primarily on Ethereum, Arbitrum, and emerging chains like HyperEVM, addressing inefficiencies in yield management. With a market cap influenced by its PENDLE token and backed by prominent investors, Pendle is positioned to capture a substantial share of the expanding DeFi yield derivatives market, projected to contribute to the broader DeFi sector's growth. However, competition from similar yield protocols and regulatory uncertainties remain key risks.

Today’s edition of Token Metrics Research | Daily Newsletter is brought to you by Maven AGI.

Discover the measurable impacts of AI agents for customer support

How Did Papaya Slash Support Costs Without Adding Headcount?

When Papaya saw support tickets surge, they faced a tough choice: hire more agents or risk slower service. Instead, they found a third option—one that scaled their support without scaling their team.

The secret? An AI-powered support agent from Maven AGI that started resolving customer inquiries on day one.

With Maven AGI, Papaya now handles 90% of inquiries automatically - cutting costs in half while improving response times and customer satisfaction. No more rigid decision trees. No more endless manual upkeep. Just fast, accurate answers at scale.

The best part? Their human team is free to focus on the complex, high-value issues that matter most.

👉 Curious how they did it? Read the full case study to learn how Papaya transformed their customer support

Now, let’s get back to the deep dive.

2. About the Project

2.1. Vision

Pendle's vision is to liberate yield in the crypto ecosystem, establishing itself as the universal yield trading platform that bridges DeFi and traditional finance (TradFi) by enabling flexible, efficient, and leveraged yield management.

It aims to democratize access to yield trading, allowing users to trade any yield or rate, from DeFi protocols to CeFi funding rates and even TradFi benchmarks, while maximizing capital efficiency and minimizing risks.

2.2. Problem

The core problem Pendle addresses is the rigidity and inefficiency of yield generation in DeFi. Traditional yield-bearing assets often involve lockups, impermanent loss in liquidity pools, liquidation risks in leveraged positions, and unpredictable floating yields that expose users to volatility.

Additionally, funding rate risks in perpetual futures and delta-neutral strategies are underhedged, leading to potential losses, especially in a market with over $150B in open interest and $200B+ in daily volume across DeFi perpetuals.

2.3. Solution

Pendle's solution is a yield tokenization protocol that splits yield-bearing assets into Principal Tokens (PTs), representing the fixed principal redeemable at maturity, and Yield Tokens (YTs), capturing the variable future yield.

These tokens can be traded via an automated market maker (AMM) system in Pendle V2, offering spot yield trading, fixed yield earning, or leveraged long positions without lockups or liquidation risks. The recently launched Boros extends this by providing an on-chain orderbook for margin trading of yields, including funding rates from centralized exchanges.

Boros supports long/short positions on yields like BTCUSDT funding rates, converting floating exposures into fixed ones, and has been audited for security. This creates a comprehensive ecosystem for yield speculation, hedging, and structured products, integrating with major protocols like Ethena and HyperEVM.

3. Market Analysis

Pendle operates in the decentralized finance (DeFi) industry, specifically the sub-industry of yield tokenization and interest rate derivatives. This niche focuses on separating and trading future yields from underlying assets, mirroring TradFi's massive interest rate derivatives market.

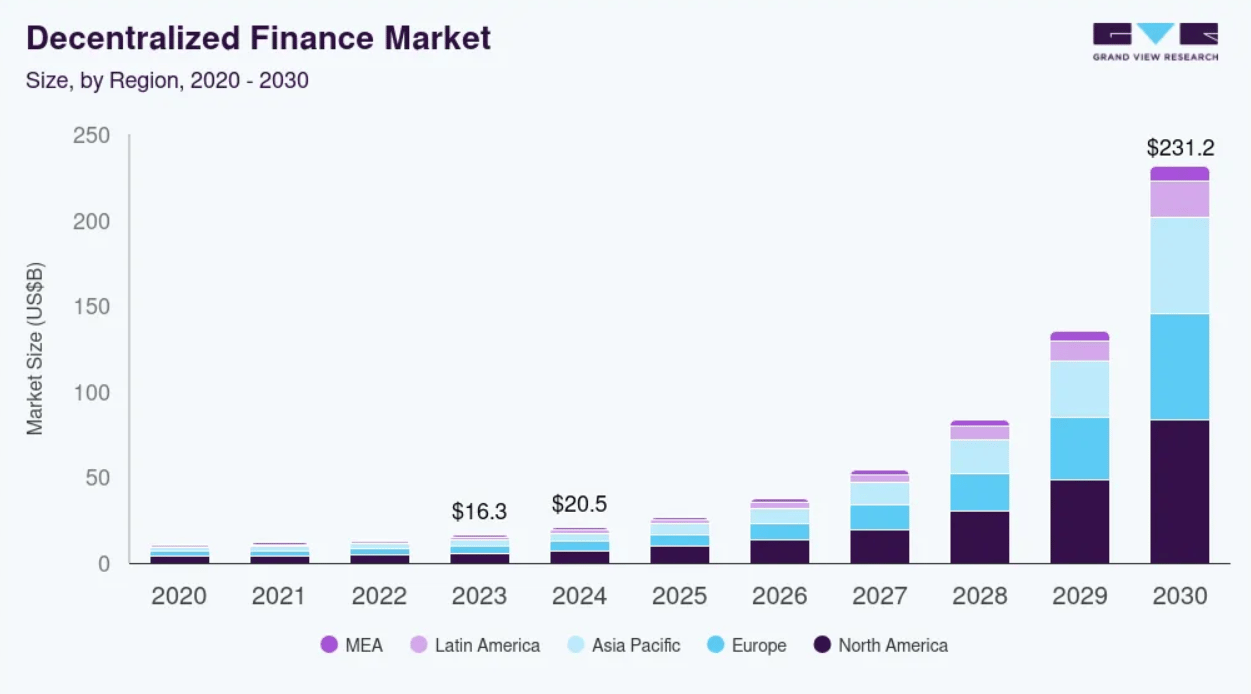

According to Grand View Research, the broader DeFi market is projected to reach $231.19B by 2030 at a CAGR of 53.7%, driven by increasing adoption of tokenized assets, yield optimization, and institutional interest.

For the yield trading/interest rate derivatives sub-sector in DeFi, growth is fueled by the need for hedging tools amid volatile funding rates and perpetual markets. Projections estimate this sub-market could expand significantly as DeFi matures, capturing a portion of TradFi's scale, with overall DeFi TVL across segments reaching new highs in 2025.

3.1. Competition

Pendle faces competition from protocols offering yield separation, fixed-rate lending, or interest rate swaps in DeFi. Below is a table of the top five competitors, highlighting similarities and differences based on their mechanisms, focus, and features.

Competitor | Similarities to Pendle | Differences from Pendle |

Tokenizes future yields into principal and yield components for trading. | Uses a bonding curve mechanism instead of Pendle's AMM; focuses more on wine-related yields and less on broad funding rates or margin trading. | |

Provides fixed-rate lending and borrowing, effectively tokenizing interest rates. | Focuses on fixed-rate debt markets rather than yield trading; uses a different AMM design without Pendle's PT/YT split or leverage options. | |

Both enhance yield generation in DeFi by optimizing returns on liquidity provision and enabling efficient capital deployment across protocols. | Convex specializes in boosting CRV rewards for Curve LP tokens through vote-escrowed locking and staking; Pendle focuses on tokenizing and trading future yields from diverse assets without relying on specific reward tokens. | |

Both aim to maximize user yields through automated tools and multi-chain support, appealing to yield farmers. | Coinwind is a yield aggregator with auto-compounding vaults across chains like BSC; Pendle emphasizes yield tokenization for speculation and hedging, without auto-compounding features. | |

Both facilitate access to diversified yields from underlying DeFi assets, with governance tokens for community involvement. | Stake DAO offers multi-strategy vaults and liquid staking derivatives; Pendle provides tradable yield components and margin trading, focusing on fixed vs. variable yield separation. |

4. Features

Yield Tokenization: Splits assets into PTs (fixed principal) and YTs (variable yield) for independent trading.

V2 Spot Trading: AMM-based trading of spot yields, fixed yields, or leveraged longs without lockups or liquidation risks, enhancing capital efficiency.

Boros Margin Trading: An on-chain orderbook for trading funding rates with long/short positions, leverage for hedging, and support for any oracle-fed yield. Includes margin requirements, liquidations, and risk parameters.

Hedging and Speculation: Converts floating yields to fixed, insulates cash-and-carry trades from volatility, and supports delta-neutral farming.

Multi-Chain Integration: Deployed on Ethereum, Arbitrum, HyperEVM, and others, with ecosystem expansions like Citadels for PT distribution.

Security and Transparency: Audited by ChainSecurity and WatchPug; fully on-chain and trustless operations.

5. Token

The PENDLE token is the native utility and governance token of the Pendle protocol. It has a total supply of 281M tokens, with a hybrid inflation model: emissions decrease by 1.1% weekly until reaching a 2% annual terminal inflation rate to sustain liquidity incentives.

As of 2025, the circulating supply is around 167M, with total supply including vested and ecosystem allocations. Distribution includes: 37% for liquidity incentives, 18% for the ecosystem fund, 22% for the team, and 15% for investors. No new tokens are introduced for products like Boros; all value accrues to PENDLE.

5.1. Utility

PENDLE's utility centers on governance and value accrual. Holders can lock PENDLE into vePENDLE (vote-escrowed) for up to 2 years to receive boosted rewards, vote on protocol parameters (e.g., emissions, fees), and direct liquidity incentives.

vePENDLE holders earn a share of protocol fees (from trading and swaps) and boosted pool yields. The token also enables participation in ecosystem airdrops and multipliers on chains like HyperEVM. As Pendle matures, PENDLE will govern upgrades, with no changes to tokenomics planned.

6. Team

Pendle was co-founded by TN Lee (CEO), who previously worked at Kyber Network and brings expertise in DeFi protocol design, and Vu Nguyen (CTO), who focuses on engineering and yield mechanics.

Key team members include Ken Chia (Head of Institutional), who has experience in institutional DeFi adoption, and Anton Buenavista (Growth Lead). The team emphasizes anonymity for some roles but has a proven track record in building scalable DeFi primitives, with engineering support from members like Long Vuong Hoang (Engineering Manager).

7. Traction

Pendle has demonstrated robust traction in 2025, with TVL hitting a new all-time high of $9.4B following maturities and expansions, up from $2.8B earlier in the year. On HyperEVM alone, Pendle achieved $533M TVL within weeks, ranking as the #3 DeFi protocol there, with over $87M in trading volume in the first five days. Daily DEX volumes are currently over $100M, and cumulative volumes are nearing $35B.

8. Investors

Pendle has raised a total of $5.34M across multiple funding rounds. The first was a $3.7M seed round in April 2021, from Mechanism Capital, The Spartan Group, Signum Capital, Lemniscap, Bitscale Capital, Origin Capital, and others. Subsequent rounds saw participation from YZi Labs and Binix Ventures. These investors provide strategic support for ecosystem growth, with no recent funding rounds announced.

9. Conclusion

Pendle stands out as a pioneering force in DeFi yield trading. Its tokenization mechanics and Boros platform unlock new efficiencies in a market ripe for innovation. Backed by strong traction, a capable team, and reputable investors, it is well-positioned to dominate the yield derivatives subsector as DeFi scales toward $231B by 2030.

While competition and market volatility pose challenges, Pendle's focus on capital-efficient, risk-minimized tools could drive widespread adoption, making it a compelling opportunity for yield-focused investors in the evolving crypto landscape.

The Cross-Chain Giant Set for 1,000%+ Gains

As crypto markets surge, one multi-chain financial protocol is being targeted for massive institutional investment before retail discovers it.

Its transaction volume is skyrocketing across all major blockchains while its price remains suppressed as retail has yet to discover it – creating a coiled spring ready to release.