We're proud to have CoW Swap as today's lead sponsor at Token Metrics, helping us provide world-class market research and empower investors globally.

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

Project links: solstice.finance | docs.solstice.finance | @solsticefi

Hello Token Metrics readers,

Solstice Finance is positioning USX and eUSX as Solana’s next major stablecoin and yield engine. This deep dive explores how the project blends transparent collateralization, institutional infrastructure, and permissionless DeFi design to deliver sustainable on-chain yield — and whether it can become a foundational building block of Solana’s rapidly expanding economy.

1. Executive Summary

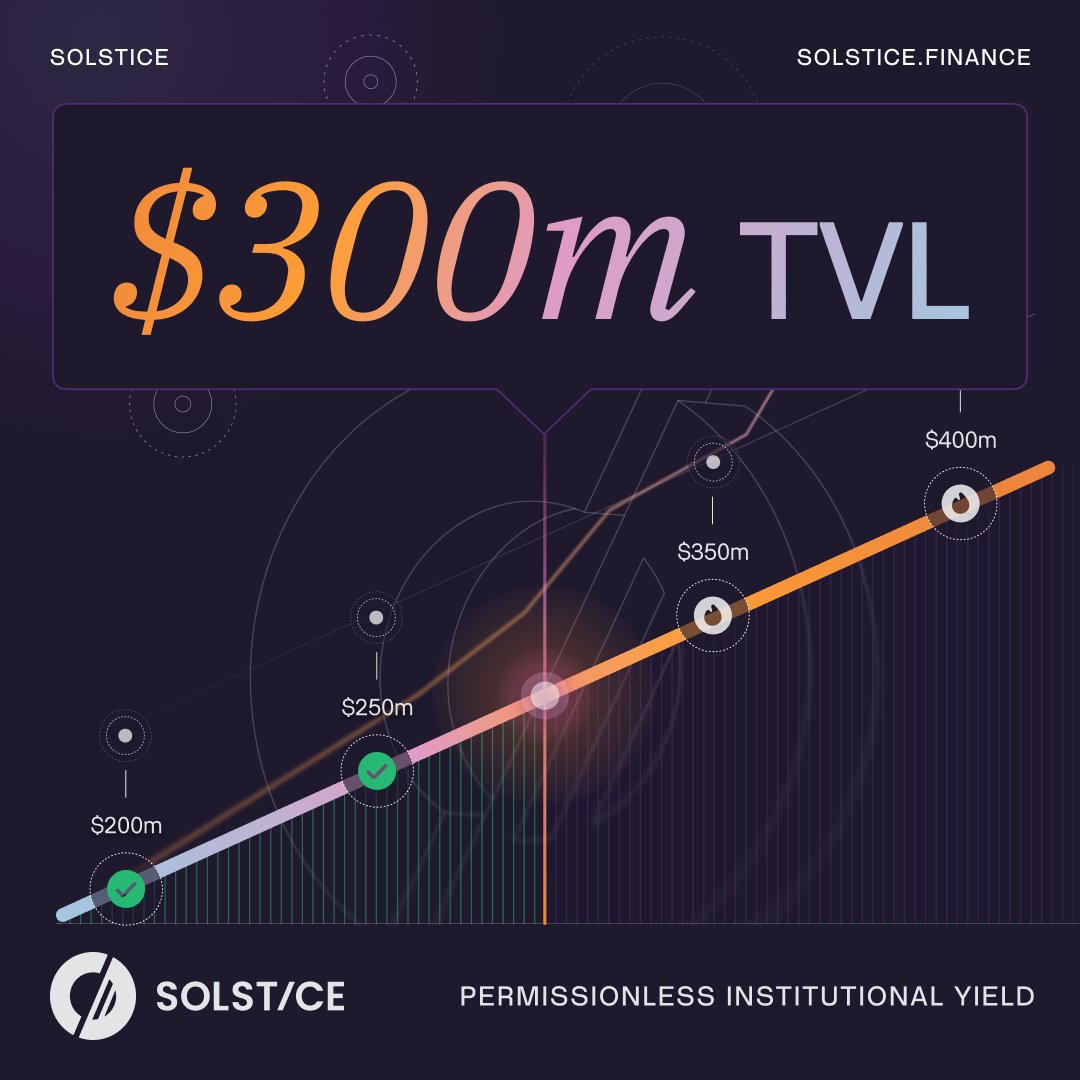

Solstice Finance introduces a Solana-native stablecoin USX and a yield-bearing vault token eUSX. USX is minted 1:1 against approved fiat-backed stables with real-time Proof of Reserves, while eUSX represents a share of the protocol’s delta-neutral strategies through the permissionless YieldVault.

- Launch TVL: $160M (Sept 30, 2025)

- Market cap: ~ $300M USX by Nov 2025

- Holders: ~24.5k Solana addresses

Solstice aims to keep stablecoin liquidity on Solana by combining transparent collateralization with accessible, institution-grade returns.

2. About the Project

2.1 Vision

Solstice Finance aims to establish a reliable, transparent, and yield-native stablecoin layer for the Solana ecosystem. The project's core vision is to give both retail users and institutions seamless access to institutional-grade strategies through simple, composable primitives. By creating a native stablecoin (USX) paired with an on-chain yield token (eUSX), Solstice seeks to transform stable assets on Solana from passive liquidity into productive, fully transparent capital.

2.2 Problem

While Solana has experienced rapid growth in stablecoin volume and user activity, a persistent challenge has been the lack of a native, yield-enabled stable asset. Historically, users relied on bridged stablecoins or off-chain yield platforms, which introduced fragmentation, bridge risk, operational complexity, and limited transparency. Yield often flowed off-chain, reducing on-chain liquidity, weakening peg stability during volatility, and limiting design space for DeFi builders. Institutions, meanwhile, lacked the necessary custody integrations and reporting standards to adopt Solana-native yield at scale.

2.3 Solution

Solstice Finance addresses these gaps with a two-token architecture designed for clarity, composability, and institutional trust:

- USX: A Solana-native, fully collateralized stablecoin minted 1:1 against approved fiat-backed stables, supported by real-time Proof of Reserves. This ensures transparent collateralization and predictable redemption mechanics.

- eUSX: A liquid receipt token minted upon depositing USX into the permissionless YieldVault. eUSX reflects a proportional share of the vault’s net asset value, appreciating over time as the underlying delta-neutral strategies generate PnL.

By combining transparent collateral management with programmatically reported performance, Solstice brings historically off-chain yield strategies directly onto Solana. Integrations with custody partners, off-exchange settlement, and institutional infrastructure further enhance its ability to handle larger flows while maintaining accessibility for everyday users. The result is a simplified, Solana-native pathway for sustainable yield that strengthens liquidity, deepens DeFi composability, and reduces the need for users to bridge away for returns.

3. Market Analysis

With Solana’s 2025 expansion in stablecoin usage, DeFi liquidity, and institutional participation, a native yield-enabled stablecoin aligns with the ecosystem’s maturing infrastructure.

3.1 Competition

| Product | Category | Key Differences |

|---|---|---|

| Ethena (USDe) | Derivatives-Backed Synthetic | Synthetic stable using basis trades; not Solana-native. |

| Superstate (USCC) | Tokenized Cash Management | Treasury-linked regulated structure. |

| Solomon (USDv) | Solana-Native Stable | Smaller scale; different collateral model. |

| Unitas | Alternative Stable Framework | Distinct design and adoption profile. |

4. Features

- Solana-native stability: USX minted with segregated collateral.

- Proof of Reserves: Real-time attestations.

- Permissionless YieldVault: eUSX as a liquid yield token.

- Delta-neutral strategies: Includes funding-rate arbitrage and hedged staking.

- Institutional integrations: Off-exchange settlement & custody partners.

- Composability: USX/eUSX integrate across Solana DeFi.

Masterworks joins us as today's featured sponsor, supporting Token Metrics in delivering high-quality analytics and actionable insights for our investment community.

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

5. Token

USX and eUSX form the core system, with a future governance token SLX planned.

5.1 Utility

- USX: Medium of exchange; mintable/redeemable 1:1 with supported stables.

- eUSX: Represents YieldVault NAV; appreciates with strategy PnL.

- SLX (planned): Governance/utility; details pending.

Minting & Redemption: Deposit stables to mint USX; deposit USX in YieldVault to mint eUSX.

5.2. Flares Program (Rewards & Airdrop Routing)

Flares are Solstice’s native, non-transferable reward points that track a user’s contribution and engagement across the USX/eUSX ecosystem and partner protocols. They are earned automatically when users interact with Solstice and its integrations and are used to route future SLX token rewards.

How Flares are earned:

- Connecting a Solana wallet and joining the Flares rewards program in the Solstice app.

- Minting or swapping into USX and depositing into the YieldVault to receive eUSX.

- Providing USX/USDC liquidity on major Solana DEXs such as Orca, Raydium, and integrated vaults like Kamino.

- Completing on-chain and off-chain quests, social tasks, and referral activities through campaigns (e.g., Galxe, Early Riser quests).

Multipliers & seasons: Flares use a points-multiplier model. Higher-impact actions (e.g., holding or depositing USX and eUSX for longer periods, or using specific partner pools) receive larger multipliers than lower-impact actions. Seasonal campaigns and partner codes (e.g., ORCA/RAYDIUM referral codes) can further boost a user’s effective multiplier, with caps to limit extreme farming.

Link to SLX airdrop: Flares are the primary scoring system for the upcoming SLX token distribution. A portion of SLX supply (publicly cited at 7.5%) is earmarked for early users who accumulate Flares before the token generation event (TGE), currently guided for December 2025. Users’ Flares balances determine their share of this airdrop, aligning protocol usage with governance and utility token ownership.

Positioning: The Flares program functions as a loyalty and bootstrapping layer for Solstice. It incentivizes deep, sticky usage of USX, eUSX, and integrated DeFi rails on Solana, while giving early participants exposure to SLX without compromising the underlying yield strategies.

6. Team

Ben Nadareski (CEO & Co-Founder): Background in crypto and traditional finance.

Tim Grant (Co-Founder & Chairman, Solstice Labs): Executive with experience across trading and investment firms.

7. Traction

- $160M launch TVL

- ~$300M USX supply by Nov 2025

- ~24.5k holders

- DEX launch: Orca Whirlpool v2 (Oct 26, 2025)

- Integrations: Raydium and major Solana aggregators

8. Investors

Solstice launched with strategic support from notable institutions in crypto trading, market making, and venture building. Backers include:

- Deus X Capital (venture builder and strategic partner; publicly committed support to $100 million in TVL at announcement)

- Galaxy Digital (strategic/backer)

- MEV Capital (strategic/backer)

- Bitcoin Suisse (strategic/backer)

- Auros (strategic/backer and market maker)

Investment amounts were undisclosed at launch. The investor set, combined with custody and settlement partners, signals an institutional posture intended to support larger, more sophisticated flows into the USX/eUSX ecosystem.

9. Conclusion

Solstice Finance provides a Solana-native, proof-of-reserve stablecoin paired with a permissionless, yield-bearing vault system. Early traction, institutional partnerships, and transparent design position USX and eUSX as emerging building blocks for payments, DeFi, and on-chain treasury management on Solana.

Disclaimer: This content is for informational purposes only and not investment advice. Digital assets are risky; conduct your own research.

A special thanks to Finance Buzz for sponsoring today’s edition of Token Metrics and helping us continue our mission to simplify crypto investing through data-driven intelligence.

Put Interest On Ice Until 2027

Pay no interest until 2027 with some of the best hand-picked credit cards this year. They are perfect for anyone looking to pay down their debt, and not add to it!

Click here to see what all of the hype is about.